Cryptocurrency in 2025: Future Outlook After the 2024 Milestones

As we enter 2025, the Altcoin market has undergone significant transformation and development in 2024. From the strong growth of BTC to the rise of Altcoins, the entire industry landscape is rapidly evolving. Let's delve into the key trends of 2024 and the potential directions for 2025.

Key Trends in 2024: BTC and Altcoins

Price Surge Driven by the BTC Halving

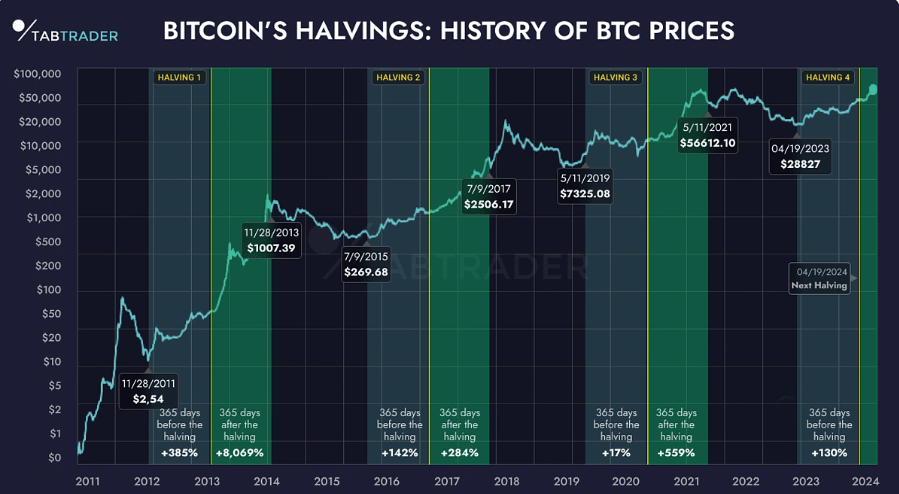

In 2024, the BTC halving event once again became a significant market catalyst, driving a remarkable 146% surge in the price of BTC. This event occurs approximately every four years, halving the reward for miners verifying transactions. This reduction in new BTC supply typically triggers significant market volatility due to increased scarcity.

Looking back, BTC's price has experienced significant growth after each halving event. For example, after the 2016 halving, BTC rose from $650 to $20,000 in just over a year. Similarly, after the 2020 halving, BTC surged from around $8,000 to its 2021 peak of $69,000.

Approval of BTC and ETH ETFs

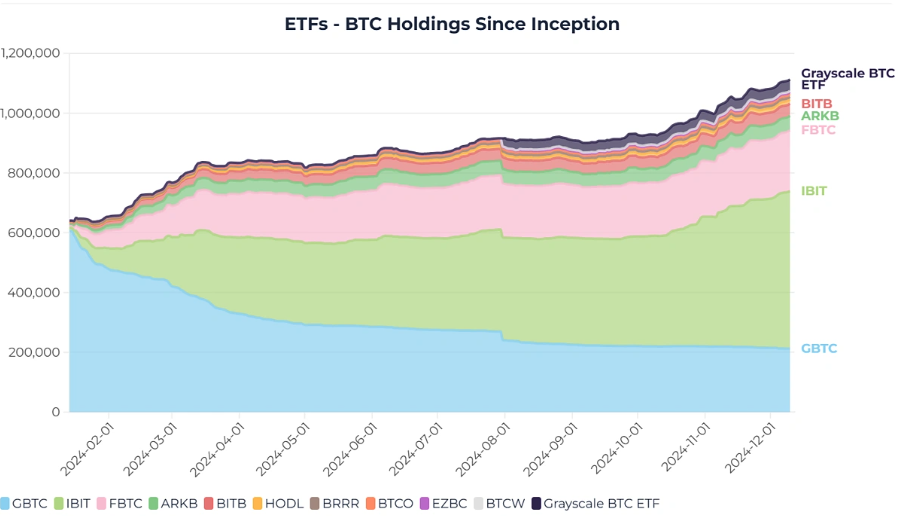

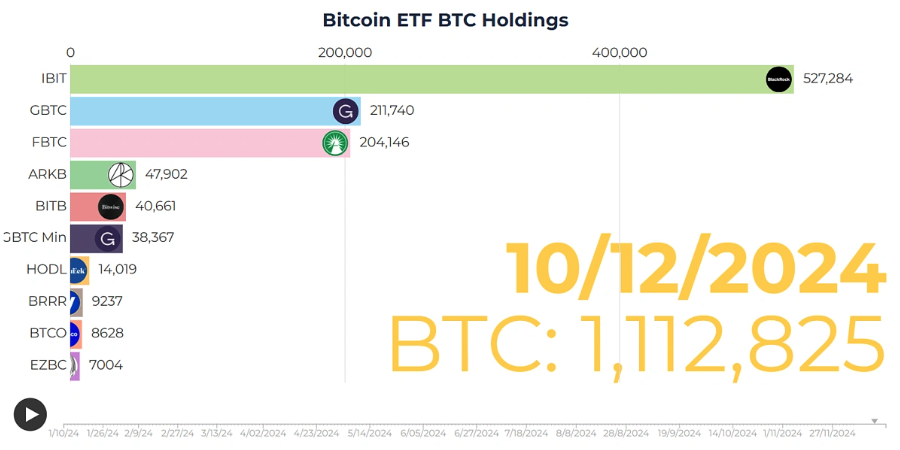

In 2024, the approval of BTC and ETH ETFs became a turning point for the Altcoin market, significantly driving institutional adoption. The long-awaited approval by the U.S. Securities and Exchange Commission (SEC) finally gave the green light for spot BTC ETFs, providing a regulated and accessible way for traditional investors to gain exposure to BTC. This approval brought a significant influx of institutional capital, leading to a notable rise in BTC's price following the announcement.

Similarly, the approval of the ETH ETF elevated ETH's status as a serious investment asset. The SEC's approval of the spot ETH ETF paved the way for traditional financial participants to include ETH in their investment portfolios, solidifying ETH's position as the second-largest Altcoin.

The latest data shows that in the U.S. market, institutional investors now hold around 20% of the shares in BTC-based ETFs.

- BlackRock's iShares BTC Trust ETF (IBIT) leads in institutional BTC holdings, with over 71,000 BTC, although its institutional adoption rate is relatively low at 18.38%.

- Grayscale's GBTC is close behind, with institutions holding 44,707.89 BTC, accounting for 20.25% of its shareholders.

- Fidelity's FBTC ranks third, holding 44,623.23 BTC, with an institutional holding rate of 24.14%.

ARK 21Shares' ARKB has the highest institutional adoption rate, with asset management firms holding 32.8% of its shares, equivalent to 17,166 BTC. At the other end, Grayscale's Bitcoin Mini Trust has the lowest institutional participation at 1.52%. The CoinShares Valkyrie ETF (BRRRR) has the smallest institutional holdings, with only 451.26 BTC.

Leaked information indicates that BlackRock, the world's largest asset manager, is in negotiations to acquire a stake in a major BTC spot ETF holder.

The precedents set by these ETF approvals have paved the way for other Altcoin ETF applications. Currently, the SEC is reviewing over 10 ETF applications, covering assets such as Solana (SOL), XRP, and others. This suggests that institutional interest in a broader range of digital assets may expand, and these developments are expected to drive further adoption and price growth in the overall Altcoin market.

Trump's Victory in the Presidential Election

Donald Trump's victory in the 2024 election has proven to be a game-changing event for the Altcoin market. Trump's supportive stance on Altcoins, as well as his public discussion of the possibility of using BTC as a tool to repay U.S. debt, have significantly boosted market confidence. This bold vision aligns with his broader pro-business and deregulatory policy agenda, instilling a sense of optimism among traders and institutional investors.

Following his election victory, the price of BTC broke through the $100,000 milestone. Investors expect the Trump administration to adopt Altcoin-friendly policies, further driving adoption and fostering innovation in the blockchain space. His victory has also sparked discussions about the potential to integrate Altcoins into a broader economic framework, creating a favorable environment for the development of digital assets.

Key Events to Watch in 2025

BTC as a Global Economic Policy Tool

One of the most notable developments is the discussion around using BTC as a tool for the U.S. to repay its debt. This bold idea, initially proposed during CZ's campaign, is gaining traction and attracting global attention. Trump has also expressed support for the establishment of a strategic BTC reserve, similar to the current gold reserves held by the Federal Reserve. This reserve could serve as an alternative asset to address sovereign debt challenges, demonstrating BTC's potential as a legitimate reserve asset.

The U.S. sovereign debt crisis, driven by record-high borrowing and persistent fiscal imbalances, has prompted policymakers to explore unconventional solutions. Proponents argue that holding BTC as a reserve can hedge against inflation, diversify national financial instruments, and facilitate debt repayment without devaluing the U.S. dollar.

Here is the English translation:At the national level, after El Salvador took the lead, countries like Tonga, Paraguay, and Panama are also considering adopting Bitcoin as legal tender. Motivated by economic opportunities, financial inclusion, and remittance efficiency, these countries aim to leverage the potential of cryptocurrencies to modernize their financial systems and attract global investment.

Additionally, CZ, the founder of Binance, stated that it is inevitable for China to establish a strategic Bitcoin reserve. He pointed out that although China's attitude towards cryptocurrency policy has been volatile, its decision-making capability in this field remains swift and decisive. CZ emphasized that if other countries start to build Bitcoin reserves, China may follow suit to maintain its position in global financial competition.

Major companies like Amazon and Microsoft have also received shareholder proposals to allocate a portion of their corporate reserves to Bitcoin. Although Microsoft shareholders rejected the proposal to include Bitcoin on the balance sheet based on the board's recommendation, the participation in such discussions indicates that large enterprises are shifting towards potential Bitcoin use cases, paving the way for broader adoption in the future.

Approval of Other Cryptocurrency ETFs

Following the successful launches of Bitcoin and Ethereum ETFs, 2025 may become a turning point for the approval of other cryptocurrency ETFs, including Solana (SOL) and XRP. Although the U.S. Securities and Exchange Commission (SEC) previously rejected the Solana ETF application, it is currently reviewing over 10 related filings, indicating a continued market interest in expanding crypto investment options.

This ongoing review creates an optimistic space, and with market maturity and regulatory clarity, the approval of these ETFs may become a reality, enhancing market liquidity and boosting investor confidence.

Widespread Adoption of Real-World Assets (RWA)

In 2025, the tokenization trend of Real-World Assets (RWA) is expected to accelerate further, fundamentally transforming the interaction between traditional finance and blockchain technology. Assets such as real estate, commodities, and even art are gradually being converted into blockchain-based tokens, enabling fractional ownership and broader accessibility.

According to CoinGecko data, tokenization may unlock trillions of dollars in previously illiquid assets, allowing them to be traded within the crypto ecosystem. This shift bridges the gap between traditional and digital finance, not only providing investors with new diversification options but also driving innovation across various industries.

The End of the Mining Halving Cycle

Historically, the post-halving Bitcoin cycles have often triggered prolonged price increases, lasting approximately one year (around 365 days). This trend suggests that the first quarter of 2025 will be influenced by the remaining effects of the 2024 halving event, fostering optimistic sentiment and driving price appreciation. The halving event will reduce miner rewards, leading to supply constraints and increased demand, creating a favorable environment for Bitcoin's growth. This effect is expected to persist at least until April 2025, presenting ample opportunities for investors and traders.

Predictions for 2025: What Will Happen in the Crypto Market?

Bitcoin Outlook

Driven by the momentum in 2024 and the upcoming critical events in 2025, the growth trajectory of Bitcoin looks promising. Through a logarithmic analysis of the Bitcoin monthly chart, it can be observed that it is operating within an ascending channel. Currently, Bitcoin is approaching a key pivot point within this channel, similar to past bull market cycles.

Optimistic forecasts suggest that Bitcoin could reach the upper bound of the ascending channel, reflecting a potential 154% value increase. This scenario aligns with historical post-halving trends, and if realized, Bitcoin could reach $250,000, further solidifying its leading position in the crypto market.

Crypto Market Capitalization Forecast

The total crypto market capitalization exhibits strong bullish momentum, operating within an ascending wedge pattern. Historically, bull market rallies often target the upper boundary of this structure. Currently, the estimated upper boundary is $3.4 trillion, representing a potential 270% growth.

Forecast for Total Crypto Market Capitalization Excluding the Top 10 Coins

Meanwhile, the total market capitalization excluding the top 10 Altcoins has formed a classic "cup and handle" pattern. It is currently testing the $370 billion resistance level. A breakout above this key level could trigger a 317% rally, targeting $1.6 trillion, signaling the start of a strong Altcoin season.

Conclusion

The crypto market is poised for significant growth in 2025, driven by milestones in 2024 such as the Bitcoin halving rally, ETF approvals, and Trump's supportive crypto policies. With the potential integration of Bitcoin's economic framework, widespread Altcoin adoption, and the tokenization of real-world assets, the market is expected to witness innovation and expansion. Despite regulatory challenges, the outlook remains optimistic, with Bitcoin projected to reach new highs and the entire crypto ecosystem reshaping the traditional financial system.