Author: Brayden Lindrea, CoinTelegraph; Translator: Tong Deng, Jinse Finance

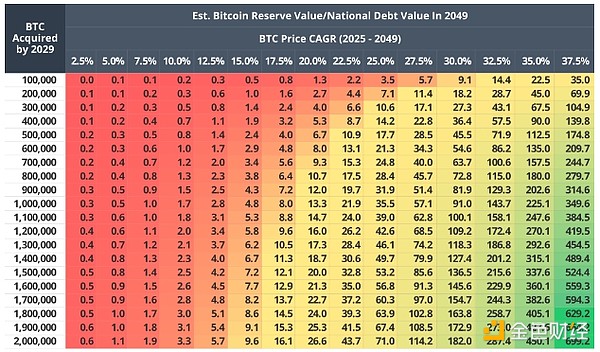

If the US establishes a 1 million Bitcoin reserve as proposed by Senator Cynthia Lummis, the US could reduce its national debt by 35% over the next 24 years.

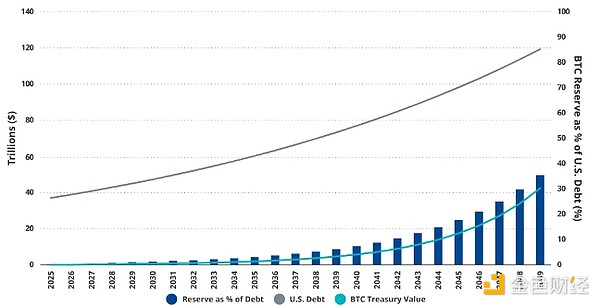

VanEck estimates that by 2049, Bitcoin's compound annual growth rate (CAGR) will reach 25%, reaching $42.3 million, while the US national debt's CAGR will reach 5%, increasing from $37 trillion at the beginning of 2025 to $119.3 trillion.

"By 2049, this reserve could account for 35% of the national debt, offsetting about $42 trillion in debt," said Matthew Sigel, Head of Digital Asset Research, and Nathan Frankovitz, Investment Analyst at VanEck, in a report on December 20.

US national debt is expected to increase with the growth of Bitcoin reserves from 2025 to 2049. Source: VanEck

The "optimistic" forecast assumes a 25% CAGR for Bitcoin starting from a price point of $20,000 in 2025. Bitcoin's current trading price is $95,360, needing to more than double to reach the starting point indicated by VanEck.

A Bitcoin price of $42.3 million would mean it accounts for around 18% of global financial assets - far higher than its current 0.22% share of the $900 trillion market.

Estimated CAGR of 25% for US national debt, Bitcoin reserve holdings, and Bitcoin value. Source: VanEck

The idea of a Bitcoin reserve was proposed by the new Trump administration, driving Bitcoin's price above six figures, but Senator Lummis' bill has not yet been reviewed by the Senate or House.

Strike founder and CEO Jack Mallers claimed earlier this month that Trump might issue an executive order designating Bitcoin as a reserve asset on his first day in office.

According to the Lummis bill, the US could repurpose the 198,100 Bitcoin it holds from asset seizures, and the remaining 801,900 Bitcoin could be financed through an emergency support facility, selling a portion of its $455 billion gold reserve for Bitcoin, or a combination - all without printing money or taxpayer funds, VanEck noted.

Sigel and Frankovitz said that Bitcoin's adoption at the state, institutional, and corporate levels in the US will also boost the CAGR estimates for Bitcoin and Ethereum ETF issuers.

Sigel explained in a December 21 X post that the BRICS (Brazil, Russia, India, China, and South Africa) alliance of nation-states could also impact Bitcoin's price and make it increasingly used as a currency.

"Bitcoin is likely to be widely used as a settlement currency for global trade for those nations seeking to avoid exponential US dollar sanctions," they pointed out.