Background: Cryptocurrencies are hot, can exchange-traded tokens rise?

Recently, Bitcoin's market share has dropped from 60% to 55%, indicating that the altcoin season has begun. The recent hot spots are endless: led by the AI Agent, Virtuals Protocol has reached a market capitalization of up to $300 million; the ai16z in the Solana ecosystem has also exceeded $1 billion in market capitalization, and the Hyperliquid ecosystem token HYPE has surged by more than 10 times. In terms of products, the open interest on exchanges has repeatedly hit new highs, exceeding $4.3 billion. Even the NFT sector, which was almost forgotten by the market, has seen some action, with Magic Eden and Pudgy Penguins launching tokens, driving the rise of many blue-chip ETH/SOL NFT projects.

From the above brief review of the hot spots in various sectors, it is not difficult to find that they are all centered around the blockchain. So, have the tokens within the centralized exchanges been forgotten by the market?

In fact, not at all. There is another narrative that cannot be ignored in this bull market cycle: the election of Trump.

Trump's election means that cryptocurrencies have officially entered the public eye. The improvement of regulations and the relaxation of supervision are conducive to the inflow of external capital into the crypto market, as evidenced by the continuous net inflow of funds into BTC and ETH spot ETFs. The Trump family's crypto project, World Liberty Financial, has also taken the lead, crazily buying DeFi-related tokens such as ETH, CBBTC, AAVE, LINK, ENA, and ONDO within a month.

So, how did the prices of these tokens perform after being purchased by World Liberty Financial? What do these tokens have in common? And what other concept tokens are there? Let's take a look together with the WOO X Research.

Purchase Record Summary

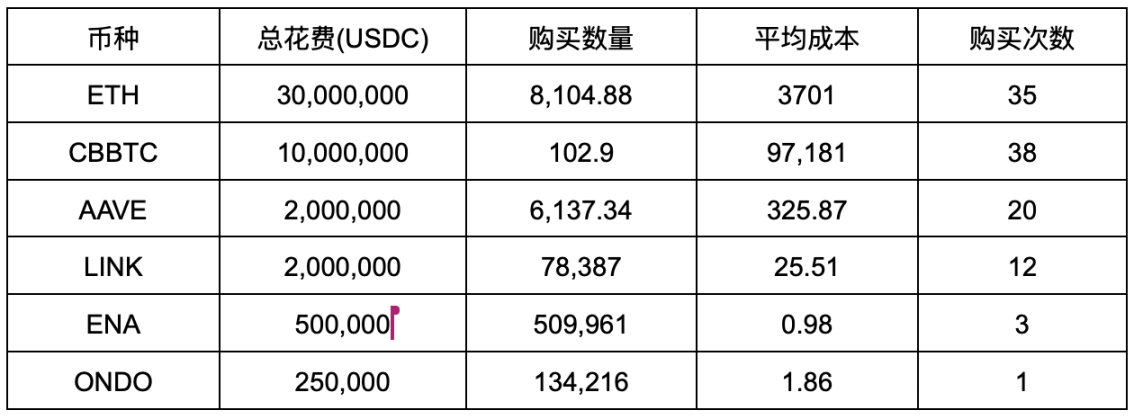

The above table summarizes the cryptocurrencies purchased by World Liberty Financial since November 30th, with a total investment of $447.5 million. As of the writing, all the tokens held by World Liberty Financial are in a state of floating profit.

Interestingly, traditional institutions have traditionally shown more interest in Bitcoin than Ethereum, but in their investment portfolio, World Liberty Financial's holdings of ETH are much larger than Bitcoin, perhaps indicating that they are more optimistic about Ethereum's future price trend compared to Bitcoin.

- AAVE is the leading lending protocol in the market, with the highest TVL among all protocols, reaching a historical high of nearly $40 billion. The token price has also risen by 35% in seven days. In addition, World Liberty Financial's community has voted to cooperate with AAVE, which is currently in the TEMP CHECK stage in the AaveDAO. If the proposal is passed, it will bring new users and more real yield to AAVE.

- LINK is an established oracle project. On November 14th, World Liberty Financial also announced that it will adopt Chainlink as the standard for on-chain data and cross-chain connections, as a secure way to bring DeFi into the next stage of mass adoption.

- The development of ENA is closely related to the current bull market. Since the yield of USDe comes from spot-futures arbitrage, the higher the Ethereum funding rate, the more ENA can benefit. Recently, the TVL has also exceeded $6 billion, a historical high. They have also recently collaborated with BlackRock to launch the RWA stablecoin USDtb, the yield of which comes from government bonds, which has alleviated the market's concerns about the protocol entering a death spiral due to negative funding rates.

- ONDO is the current leader in the RWA track. After BlackRock announced the BUIDL fund, Ondo Finance invested more than $95 million in it, making it the largest holder. In terms of compliance, orthodoxy, capital size, and market favor, ONDO is the best choice in the current RWA track.

In addition to the above-mentioned holdings, it is worth mentioning COW. When World Liberty Financial purchased the above tokens, they only used the Cow Protocol, so it is also considered a "Trump concept token".

What coins might they buy next?

After understanding the investment trajectory of World Liberty Financial, we can speculate on the targets they might focus on next.

First, from their portfolio allocation, the best option would be tokens that have a cooperative relationship with World Liberty Financial, such as AAVE m3. Then, they would prefer tokens with "clear business models" and "stable actual yields". AAVE, LINK, ENA, and ONDO all have clear product positioning, large ecosystem users, and actual revenue models. This indicates that they will not blindly pursue "novel" or "pure concept" tokens, but are more inclined to invest in protocols that can bring long-term value.

LDO: Since World Liberty Financial's holdings of ETH are much higher than BTC, it is clear that they are very optimistic about Ethereum's long-term potential. With the maturity of the Ethereum staking mechanism, and the possible introduction of Ethereum staking yields into ETFs, the leading protocol LIDO becomes the current top choice.

It is the largest liquid staking protocol in the Ethereum ecosystem, with a TVL of $37 billion, accounting for 30% of the entire Ethereum staking market.

Pendle: It mainly focuses on the yield splitting market, allowing users to trade future yield rights. As Ethereum staking yields and the yields of protocols like USDe continue to rise, the demand for yield trading markets is increasing, making Pendle a highly focused project in this bull market. Recently, Pendle's TVL has exceeded $5 billion and it has established cooperative relationships with many mainstream DeFi protocols.

UNI: Uniswap is the origin of the DeFi Summer, and is currently the most widely used decentralized exchange, the leader in this track. Recently, they have also launched Unichain, but the market response has been lukewarm, though this does not diminish users' reliance on Uniswap's products.

Conclusion: Blue-chip projects = President's coin trading projects

Regarding World Liberty Financial's aggressive coin trading, Nansen analyst Nicolai Søndergaard told Bloomberg: "World Liberty Financial's purchase of tokens may be to gain more trust, or to drive the development of their own projects by attracting attention to these assets. Because if these assets perform well, World Liberty Financial may also benefit."

World Liberty Financial's active deployment in blue-chip projects not only has boosted the market's confidence in mainstream DeFi protocols, but also injected more institutional capital into the crypto market. This capital flow has further stabilized the market and propelled the mainstream projects towards higher market capitalization and development potential.