Author: Aquarius

Background

The Bit market has grown rapidly and has become an important force in the digital economy, even competing with traditional financial networks. According to Coinbase's research, the total trading volume of Bits in 2023 exceeded $108 trillion. After excluding "unnatural" transactions (such as bot-driven or automated transactions), the actual trading volume is about $23 trillion. This adjusted data reflects an organic year-over-year growth rate of Bits of 17%, highlighting the increasingly important role of Bits in retail and institutional finance. The following charts provide a visual insight into the current landscape and growth trajectory of Bits in the major Blockchain ecosystems.

This chart shows the overall market capitalization trend of the top 20 Blockchains from 2020 to 2025. Ethereum stands out in particular, with a market capitalization exceeding $100 billion at its peak, dominating the entire Blockchain ecosystem. Such a high market capitalization is closely related to Ethereum's role as the primary platform for DeFi and Bit issuance, which allows it to maintain a strong position even in market fluctuations. Other Blockchains (such as BSC, Tron, and Solana) have relatively lower market capitalizations but are showing stable performance. Particularly, Tron and BSC are exhibiting a stable growth trend, highlighting their role as alternative platforms for Bits and DeFi, especially in regions and use cases where transaction cost and speed are critical.

It is worth noting that the market capitalization of emerging platforms like Arbitrum, Sui, and Optimism is gradually increasing, indicating an increasing adoption rate. This growth trajectory suggests that as these ecosystems continue to mature, they may challenge the existing leaders in the future by meeting specific needs or providing competitive transaction efficiency.

This chart provides a more detailed view of the Bit market capitalization trends of the top 20 Blockchains. Ethereum leads with over $8 billion in Bit market capitalization, reflecting its important role as the custodian platform for major Bits such as USDT, USDC, and DAI. Ethereum's large-scale market capitalization supports its position as a Bit hub, with demand primarily coming from DeFi applications and institutional users seeking compliant Bits. However, Tron is a significant competitor, with a Bit market capitalization of around $4 billion. Tron's appeal lies in its low transaction fees and fast processing speed, making it popular in high-frequency transaction scenarios, such as remittances and cross-border payments.

Other Chains (such as BSC, Terra Classic, and Solana) have relatively smaller Bit market capitalizations, but play a critical role in diversifying the Bit ecosystem. For example, BSC's Bit market capitalization is around $2 billion, attracting DeFi projects and retail users seeking lower fees than Ethereum. Smaller Blockchains (such as Algorand and Stellar) are positioned as niche platforms for Bits, typically targeting specific use cases like cross-border payments and micro-transactions.

Ethereum: The Solid Leader

Ethereum is often seen as the cornerstone of Decentralized Finance (DeFi) and remains the dominant Chain for Bit activity, with a Bit market capitalization exceeding $8 billion. Several factors have enabled Ethereum to maintain its leadership position in the Bit ecosystem:

Mature and Interconnected DeFi Ecosystem: Ethereum's large and mature DeFi ecosystem, including well-known protocols like Uniswap, Compound, and Aave, is highly dependent on Bit liquidity in their operations. Bits are crucial for liquidity pools, lending, and yield farming, making Ethereum an indispensable platform for users seeking comprehensive DeFi services.

Institutional and Regulatory Trust: Bits on Ethereum (particularly USDC and DAI) have gained regulatory recognition and institutional trust. As more institutions enter the crypto space, Ethereum's reputation as a secure and decentralized network makes it an ideal choice for compliant, institutional-grade Bits. Circle's USDC and MakerDAO's DAI are the primary native Bits on Ethereum, serving as pillars of trust within the ecosystem.

Diversified Bits and Use Cases: Ethereum hosts a wide range of Bits, including fiat-backed Bits like USDT and USDC, as well as algorithmic and decentralized Bits like DAI. This diversity allows Ethereum users to choose the Bit that best suits their risk tolerance, regulatory requirements, and preferences. For example, DAI's unique appeal as a non-directly fiat-pegged Bit aligns with Ethereum's community's decentralization values.

Layer 2 Solutions to Address Scalability: Ethereum faces scalability challenges, with high Gas fees limiting small-user participation in DeFi. However, Layer 2 solutions like Arbitrum, Optimism, and zk-Rollups are significantly reducing transaction costs and increasing throughput, allowing Ethereum to maintain its leadership in Bit use cases without sacrificing decentralization.

As Ethereum continues to develop its Layer 2 ecosystem and fully transition to Ethereum 2.0, its dominant position in the Bit market is expected to persist. With the regulatory landscape around Bits becoming clearer, institutional adoption is likely to grow, potentially leading to the launch of more fiat-backed and compliant Bits on Ethereum. Additionally, Ethereum's DeFi ecosystem may continue to innovate, developing new Bit use cases, including synthetic assets, cross-Chain Bits, and more complex yield-generating products.

Solana: A High-Performance Ethereum Alternative

Solana is often viewed as a high-performance alternative to Ethereum, known for its fast transaction speeds and low fees. While Solana's Bit market capitalization is significantly smaller than Ethereum's, it has successfully attracted a loyal user base and is gaining popularity among retail users and developers seeking low-cost solutions.

High-Speed, Low-Cost Transactions: Solana's unique Proof of History (PoH) consensus mechanism supports high throughput and low latency, enabling the network to process thousands of transactions per second at extremely low fees. This makes Solana an ideal choice for applications requiring frequent transactions, such as micro-payments and retail Bit transfers. As a result, Bits like USDC and USDT are often used for daily payments and fast intra-ecosystem transfers on Solana.

Integration with Payments and Gaming Applications: Solana is positioned as an ideal platform for industries like gaming and payments, which have high demands for fast and cheap transactions. Its user-friendly development tools and support for high-performance applications have made it a preferred platform for developers building decentralized applications (dApps), many of which integrate Bits. For example, the blockchain game Star Atlas and the music streaming service Audius are leveraging Solana's speed and stability, using Bits as in-game currency and tipping tools, respectively.

Network Stability Concerns: While Solana's high performance is a significant advantage, it has also faced issues with network outages and stability. These downtime incidents have led some users to question its reliability, particularly in high-value transactions or institutional use cases. Solana's network resilience is still evolving, and it needs to address these technical challenges to gain full trust in the Bit and DeFi markets.

Collaboration with USDC and Cross-Chain Solutions: Solana's partnership with USDC issuer Circle is a key factor in driving the adoption of stablecoins on the platform. The availability of USDC on Solana provides users with a reliable USD-backed stablecoin, enhancing the appeal of Solana. Additionally, Solana is exploring cross-chain solutions, which will allow assets to flow seamlessly between Solana and Ethereum, providing users with more flexibility and expanding its influence in the stablecoin market.

Key Conditions for Stablecoin Growth

As stablecoins continue to gain traction in the cryptocurrency and financial markets, certain ecosystem characteristics and environments are more conducive to the adoption and growth of stablecoins. These environments not only have technical advantages but also strategically cater to the needs of retail users and institutional investors. The following are the specific features of blockchain ecosystems most likely to experience a stablecoin boom, as well as the latest data and trends observed in the market.1. Low Transaction Fees

Stablecoin transactions are typically frequent and require low latency, especially in scenarios where users rely on stablecoins for everyday transactions, cross-border payments, and remittances. Ecosystems with low transaction fees and high scalability are more attractive, as they can facilitate economically efficient transactions without network congestion. In a 2023 survey of stablecoin users, over 60% of respondents cited transaction cost as the primary factor in choosing a blockchain platform. Ethereum's average transaction fees often exceed $10 during periods of network congestion, while networks like Tron and BSC have average transaction fees below $0.10. This has attracted a significant amount of USDT to migrate from Ethereum to Tron, with Tron capturing around 30% of the USDT supply, primarily due to its low fees, which are particularly attractive in regions with high demand for cross-border remittances. Additionally, the Binance Smart Chain (BSC) continues to attract retail users to its DeFi ecosystem due to transaction fees being significantly lower than Ethereum. Blockchain environments that provide low-cost and highly scalable solutions, such as Polygon's Ethereum Layer 2 and Solana, are also well-suited for stablecoin growth. Solana can process up to 65,000 transactions per second and has relatively low average fees, particularly in payment and gaming applications, where its stablecoin adoption is gradually increasing.2. Robust DeFi Ecosystem with Diverse Use Cases

A strong DeFi ecosystem not only attracts stablecoin liquidity but also provides utility beyond simple transactions. In an environment with lending, yield generation, and other applications, stablecoins serve as a stable medium of exchange and collateral for various DeFi products. Ethereum hosts over 70% of global DeFi applications, with stablecoins accounting for nearly 50% of Ethereum's DeFi protocol total value locked (TVL). This widespread use of stablecoins is a core reason for Ethereum's continued leadership in stablecoin adoption, despite its higher fees. As of Q2 2024, Ethereum's DeFi TVL is around $40 billion, with a significant portion comprising stablecoins (such as USDC, USDT, and DAI). The Binance Smart Chain (BSC) also has an active DeFi ecosystem, with platforms like PancakeSwap and Venus extensively using stablecoins as the basis for liquidity pools and lending markets. In 2023, BSC's DeFi TVL exceeded $5 billion, with stablecoins accounting for around 40% of the liquidity pools. This utility and accessibility of the ecosystem further encourage stablecoin adoption.3. Interoperability

As the crypto space moves towards a multi-chain ecosystem, interoperability has become an important factor for stablecoin adoption. Stablecoins need to flow seamlessly across different blockchains to meet user demands for transacting or holding assets across multiple chains. Ecosystems that can facilitate the easy transfer of stablecoins across chains will benefit from increased adoption. According to a 2023 Chainalysis report, cross-chain stablecoin transfers account for about 25% of all stablecoin transactions. Solutions like the Cosmos Inter-Blockchain Communication (IBC) protocol, which supports the free flow of stablecoins across different chains within the Cosmos ecosystem, drive broader liquidity and use cases. Cosmos and Polkadot are two major ecosystems focused on interoperability. Cosmos's IBC protocol allows the blockchains within its network to interact seamlessly, enabling the easy transfer of stablecoins across chains, which has promoted their adoption within specific ecosystems, such as Terra's UST (before its collapse) and other stablecoin assets issued on Cosmos chains. Polkadot's parachain structure provides similar interoperability, a feature that helps drive stablecoin adoption across DeFi and specialized applications. Projects like USDC have also prioritized multi-chain deployment, currently supporting Ethereum, Solana, BSC, and Avalanche. By achieving cross-chain compatibility, these ecosystems can enhance the utility of stablecoins and promote broader adoption.4. Support for Regulatory Compliance and Institutional Needs

As global regulatory scrutiny of stablecoins intensifies, compliance has become a key factor in stablecoin adoption. Blockchain ecosystems that support compliance requirements (such as KYC and AML regulations) may see stronger adoption among institutional users and compliant stablecoin issuers. In 2023, around 30% of stablecoin inflows on Ethereum were related to institutional trading, largely due to the regulatory compliance capabilities of Ethereum stablecoins (such as USDC). In contrast, chains with a more lenient regulatory structure (like Tron) primarily serve retail users and remittance-based use cases. Algorand and Ethereum have positioned themselves as regulatory-friendly ecosystems. Algorand supports compliant stablecoins (like USDC) and has established partnerships with regulated financial institutions to ensure compliance. Ethereum, through Circle's USDC and MakerDAO's DAI, provides compliant stablecoin options, making it a preferred platform for stablecoin issuance with significant institutional interest. As the regulatory landscape around stablecoins becomes clearer, blockchains that prioritize compliance may attract more institutional participation. For example, Avalanche's customizable subnet feature allows institutions to build regulated environments, a characteristic that may appeal to stablecoin issuers required to follow specific compliance standards.5. Geographical and Regional Demand for Low-Cost Remittances

In regions with limited financial inclusion or high banking fees, stablecoins provide a viable alternative for everyday transactions and cross-border remittances. Ecosystems that can meet these market needs through low fees, high accessibility, and integration with payment providers have an advantage in stablecoin adoption. According to the World Bank's 2023 report, global remittance flows have exceeded $700 billion, with stablecoins occupying an increasingly larger share of cross-border transactions in countries with limited financial infrastructure. Blockchain environments that offer low transaction fees and fast processing capabilities have the potential to capture a portion of this remittance market. Tron is widely popular in regions like Asia, Africa, and Latin America, and its low fees make it an ideal choice for cross-border remittances. Tron's network processes a significant volume of stablecoin transactions, particularly USDT, which has been widely adopted in these regions as a tool for overseas remittances without the need for traditional banking services. Tron's average transaction fees remain below $0.10, making it an ideal platform for remittance-based stablecoin use.The BSC (Binance Smart Chain) is also suitable for the remittance market due to its low fees and strong presence in Asia. In these regions, the Binance exchange ecosystem has established trust. In addition, chains like Celo are targeting emerging markets by focusing on mobile financial services to promote the use of stablecoins by the unbanked or underbanked population.

6. High Scalability

Layer 2 solutions provide an effective way for blockchains to solve high transaction fees while maintaining security and decentralization. Blockchains that integrate Layer 2 scaling solutions can support larger volumes of stablecoin transactions at lower costs, attracting users who were excluded due to the high costs of the Layer 1 network.

Ethereum-based Layer 2 protocols (such as Arbitrum and Optimism) have surpassed $5 billion in total value locked (TVL) by mid-2024. Stablecoins have a significant presence in various DeFi applications and payments on these platforms. Layer 2 solutions have reduced transaction costs by over 90%, making them highly attractive to stablecoin users.

Polygon is a leading Layer 2 scaling solution, driving significant growth in stablecoins by providing Ethereum's security with lower fees. Platforms like Aave and Uniswap have deployed on Polygon to leverage the lower costs. At the same time, the usage of USDC and DAI on Polygon has increased significantly. Similarly, the cost-effectiveness of Arbitrum and Optimism has attracted DeFi protocols that rely on stablecoins.

As more chains adopt Layer 2 scaling solutions, the adoption of stablecoins in these environments may increase, allowing users to access stablecoin functionality at lower costs.

Potential Challengers

With the growing global demand for stablecoins, emerging blockchain ecosystems like TON (The Open Network) and Sui are showing significant potential for stablecoin adoption due to their unique infrastructure, target user groups, and growth strategies. While mature blockchains like Ethereum, Tron, and BSC currently dominate stablecoin activity, TON and Sui are injecting differentiated competitiveness into the stablecoin market through innovative approaches. We will analyze the potential of TON and Sui in driving stablecoin growth, compare them to the current leaders, and explore the financial implications of the increasing stablecoin activity in these ecosystems.

TON: Leveraging the Telegram Network to Drive Retail-Oriented Stablecoin Adoption

TON was initially developed by Telegram and later handed over to the open-source community, and has now evolved into a high-performance blockchain. TON's market capitalization is currently around $5 billion, relatively small compared to Ethereum's $200 billion and BSC's $35 billion. However, TON's potential lies in its unique integration with Telegram. Telegram has over 700 million monthly active users globally, providing TON with a ready-made user base, making it a significant contender for stablecoin adoption, especially in markets where Telegram is widely used for communication and peer-to-peer transactions.

Key Features Driving Stablecoin Adoption

Seamless Integration with Telegram: The direct integration of TON with Telegram can make its network-based stablecoins highly accessible to Telegram users, enabling seamless peer-to-peer transfers and payments. This setup is particularly advantageous in countries with limited banking infrastructure but widespread Telegram usage, such as Russia, Ukraine, Turkey, and parts of the Middle East and Southeast Asia.

Use Cases: If stablecoins like USDT or USDC are widely adopted on TON, users can send stablecoins with a single click within the Telegram app. This integration could make stablecoins on TON as easy to use as Venmo or WeChat Pay, providing a low-barrier entry point for users unfamiliar with blockchain.

Low Fees and High Scalability: TON's sharded architecture supports processing high transaction volumes at low cost, making it attractive for stablecoin transactions. TON's estimated average transaction fee is below $0.01, rivaling the cost-efficiency of Tron and BSC. This economic viability could drive the adoption of daily transactions and micro-payments, especially for cost-sensitive users. TON's high scalability ensures that it does not experience significant speed declines or fee increases as traffic grows, which is crucial for high-frequency transaction scenarios like remittances and retail purchases involving stablecoins.

Embedded Custody Options and User-Friendly Interfaces: TON provides both custodial and non-custodial wallet options to cater to different user types. The embedded Telegram custodial wallet simplifies the user experience for mainstream users, while the non-custodial wallets serve crypto-savvy users who prioritize security and asset ownership. This dual approach can increase adoption among diverse user groups, including retail users and more experienced crypto asset holders.

If TON successfully attracts stablecoins or launches its own ecosystem stablecoin, it may capture a significant share of the retail and remittance markets. Given Telegram's widespread influence, TON has the potential to onboard millions of new stablecoin users in the emerging markets where Telegram is popular.

If TON can capture 1-2% of the current global stablecoin market (estimated at $120 billion), it would bring $1.2 billion to $2.4 billion in ecosystem-wide stablecoin market value growth. This additional activity could increase TON's own market capitalization from $5 billion to $6-7 billion, positioning it as one of the top platforms for stablecoin transactions.

With a base of 700 million active Telegram users, even a 5% stablecoin adoption rate would bring 35 million users to TON, a significant increase compared to the existing stablecoin adoption on other chains. This user base would not only drive stablecoin transactions but also increase the demand for other TON services, fueling the growth of the ecosystem.

TON's Value Proposition in Use Cases

The deep integration of TON with Telegram has significantly boosted stablecoin activity. This vast, ready-made user base provides TON with an audience reach that other blockchain ecosystems cannot match. As of May 2024, the Tether (USDT) supply on the TON blockchain has surged from $100 million to $1.2 billion, indicating the growing user adoption within the Telegram ecosystem.

Telegram's prevalence in regions like Russia, Southeast Asia, and the Middle East, where traditional banking infrastructure is often lacking, provides a practical alternative for TON-based stablecoins for peer-to-peer payments and remittances. If Telegram natively integrates stablecoins, users can seamlessly send funds, as convenient as Venmo or WeChat Pay but with global coverage. This convenience could accelerate mainstream stablecoin adoption in underbanked areas.

TON's sharded architecture allows it to achieve high scalability while maintaining low transaction fees, with typical costs below $0.01 per transaction. This cost-effectiveness is crucial for micro-transactions and high-frequency retail use cases. For example, stablecoins on TON could be used for tipping in Telegram communities, paying for digital content, or small business transactions. Additionally, the low cost of TON transactions makes it a strong contender in the global remittance market, especially in emerging economies. According to World Bank data, global remittance flows are expected to exceed $700 billion in 2023, with stablecoins playing an increasingly important role in these cross-border payments. The integration of TON with Telegram can simplify the remittance process and reduce fees to a fraction of traditional banking methods, becoming an ideal alternative for millions of users worldwide.

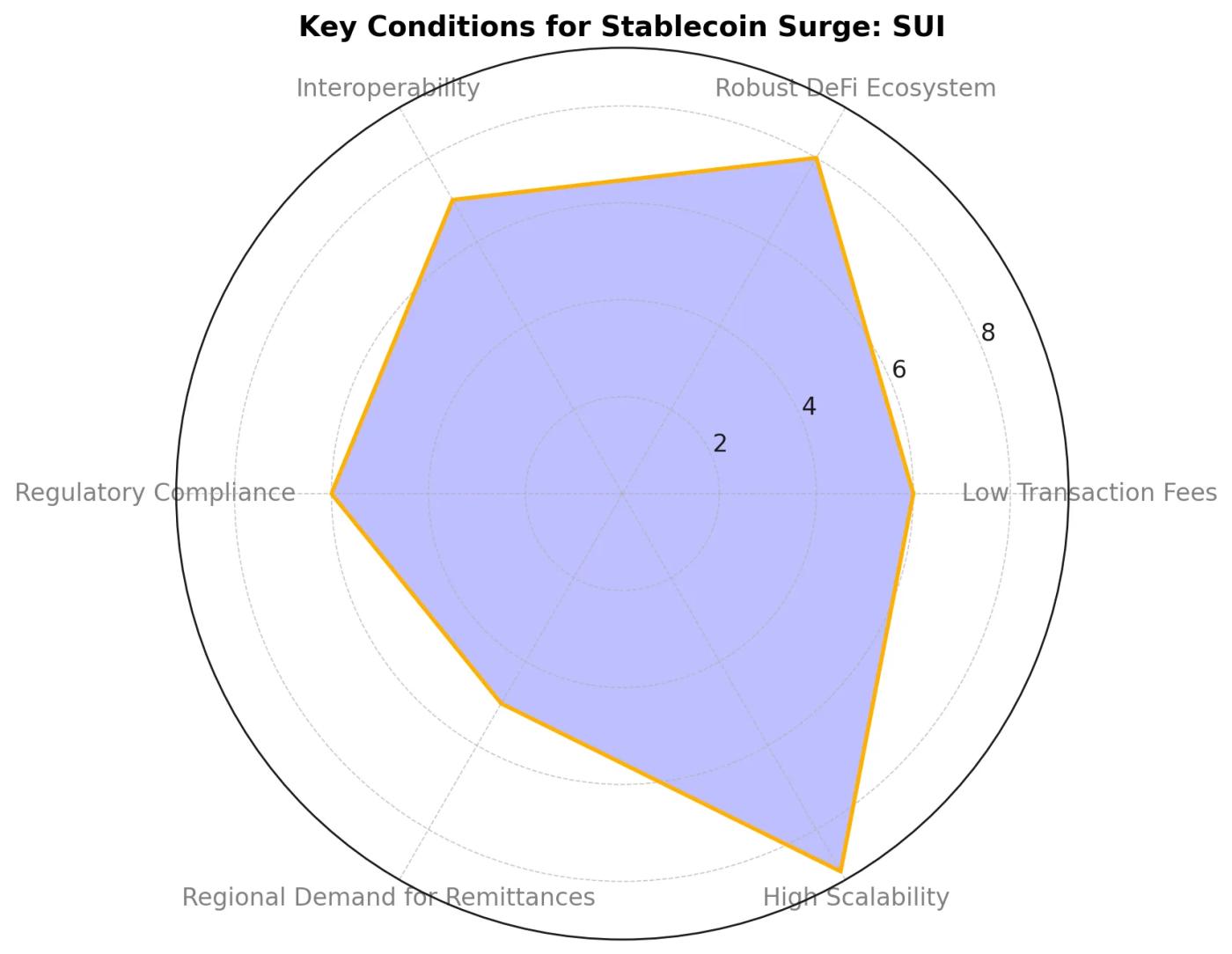

Sui: A High-Performance Blockchain Focused on DeFi and Institutional Use Cases

Sui, developed by Mysten Labs, is a relatively new blockchain with a current market capitalization of around $800 million. Despite being in the early stages, Sui's high-performance capabilities and focus on DeFi make it a strong candidate for stablecoin adoption. Compared to Ethereum and BSC, Sui's market value is relatively small, but its specialized technology and appeal to institutions give it promising growth prospects in the stablecoin and DeFi domains.

Key features driving stablecoin adoption

Advanced consensus protocol supporting high throughput and low latency: Sui uses the Narwhal and Tusk consensus protocol, enabling high transaction speed and low latency. This design provides high transactions per second (TPS) capability, making Sui an ideal platform for DeFi applications (such as lending, borrowing or complex trading scenarios) that require high transaction speed and reliability. Low latency also benefits stablecoin users who need instant settlement.

Use cases: High-frequency trading is an important component of DeFi, and stablecoins are crucial for rapid collateral swaps and liquidity provision. Sui's high throughput may attract institutional-grade DeFi protocols reliant on stablecoins, positioning it as a competitor to Ethereum in high-value DeFi transactions.

DeFi-centric ecosystem attracting institutional users: Sui is actively positioning itself as a DeFi-focused blockchain, with early applications focused on lending, decentralized exchanges (DEXs) and asset management. As stablecoins are critical for DeFi applications, Sui's focus on building a strong DeFi foundation may drive demand for stablecoins as collateral, liquidity pools or exchange mediums.

Institutional interest: Sui's programmable infrastructure allows for customized compliance solutions, which may attract institutions seeking a secure, compliance-friendly environment for stablecoin transactions. This capability may facilitate partnerships with regulated stablecoin issuers, enhancing credibility and drawing institutional interest.

Security and flexibility from the Move programming language: Sui uses the Move programming language, designed for security and asset protection. Move's resource-oriented programming model minimizes the risk of errors, ensuring a secure transaction environment, which is appealing to both retail and institutional users. The enhanced security may make Sui a secure environment for high-value stablecoin transactions and complex DeFi protocols.

If Sui can capture 0.5-1% of the Ethereum-driven DeFi market (valued at around $40 billion) for stablecoins, it would bring an additional $200 million to $400 million in stablecoin market value growth to the Sui ecosystem. Given Sui's current $800 million market cap, such a surge in activity could potentially double its valuation to over $1 billion. Meanwhile, Sui's architecture and compliance potential may attract institutional users who prioritize a stable and secure digital asset environment. If Sui becomes the preferred chain for institutional DeFi, it could see significant capital inflows, establishing its core position in DeFi alongside Ethereum and BSC.

Sui's value proposition in use cases

The use of the Move programming language enhances Sui's ecosystem, providing a secure environment for developers to build robust financial applications. Move's resource-oriented programming model reduces the risk of errors, ensuring the secure handling of digital assets in smart contracts. This makes Sui particularly attractive for institution-grade stablecoin use cases focused on security and compliance. For example, programmable stablecoins deployed on Sui could support highly secure lending and borrowing protocols, enforcing collateral and repayment through algorithmic rules. This feature may attract large financial institutions seeking to integrate stablecoins into their operations.

For instance, in November 2024, Sui established a strategic partnership with the digital assets division of global investment firm Franklin Templeton, Franklin Templeton Digital Assets. This collaboration aims to support developers within the Sui ecosystem and leverage the Sui blockchain protocol to deploy innovative technologies. Franklin Templeton's involvement highlights Sui's potential to drive institutional growth.

Sui's compliance-centric infrastructure makes it a viable platform for cross-border trade, where stablecoins can be used for real-time settlement of international transactions and enforcing trade terms through smart contracts. This institutional appeal and flexibility position Sui to compete with Ethereum in high-value stablecoin use cases.

Disclaimer: This article is for general information purposes only and does not constitute investment advice, a recommendation or any solicitation to buy or sell any securities. The content of this article should not be relied upon for any investment decision, nor should it be used as accounting, legal, tax or other advice. You should consult your own advisors on any legal, business, tax or other matters. The views expressed herein are solely those of the author and do not necessarily reflect the views of Aquarius or its affiliates. These views may change at any time and are subject to update.

Reference

https://defillama.com/stablecoins

https://www.chainalysis.com/blog/stablecoins-most-popular-asset/