Source: Jinse Finance, Binance, Bio Protocol official website, whitepaper, Twitter Compiled by: Jinse Finance

On December 23, 2024, Binance announced the launch of the 63rd project on Binance Launchpool - Bio Protocol (BIO), a decentralized science (DeSci) management and liquidity protocol.

Users can deposit BNB and FDUSD into the BIO reward pool on the Launchpool website after 8:00 AM (UTC+8) on December 24, 2024 to earn BIO. The BIO event will last for 10 days.

New Coin Listing

Binance will list Bio Protocol (BIO) at 6:00 PM (UTC+8) on January 3, 2025, and open trading markets for BIO/USDT, BIO/BNB, BIO/FDUSD, and BIO/TRY, with the seed label trading rules applied.

I.LaunchpoolDetails

Token Name: Bio Protocol (BIO)

Total Initial Token Supply: 3,320,000,000 BIO

Maximum Token Supply: 3,320,000,000 BIO (can be increased through network governance)

Initial Circulating Supply on Binance Listing: 1,296,529,168 BIO (39.05% of the total initial supply)

Launchpool Total: 99,600,000 BIO (3% of the total initial supply)

Token Contract and Network: Ethereum, 0xcb1592591996765Ec0eFc1f92599A19767ee5ffA

Restriction: KYC required

Individual Hourly Reward Cap:

BNB Pool: 35,275 BIO

FDUSD Pool: 6,225 BIO

Reward Pools:

BNB Pool: Total Reward 84,660,000 BIO (85%)

FDUSD Pool: Total Reward 14,940,000 BIO (15%)

Event Duration: 8:00 AM (UTC+8) on December 24, 2024 to 8:00 AM (UTC+8) on January 3, 2025

II. Bio Protocol (BIO) Introduction

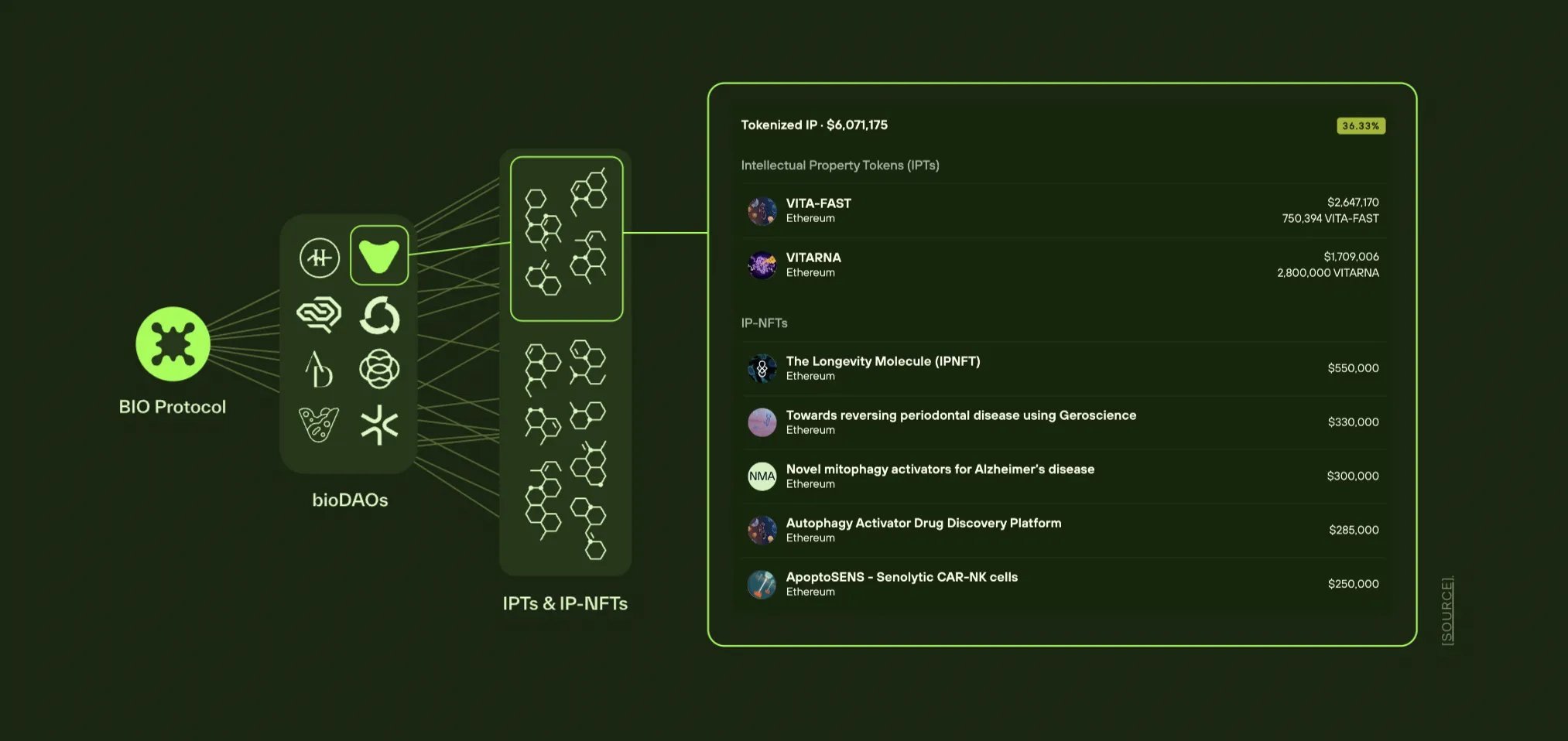

BIO is a decentralized science (DeSci) management and liquidity protocol. Its mission is to enable the global patient, scientist, and biotech professional community to collectively fund, build, and own tokenized biotech projects and intellectual property (IP), thereby accelerating the development of biotechnology.

The team behind BIO has helped create Molecule (a tokenization platform for early-stage biomedical projects) and VitaDAO (the largest longevity science decentralized community). Building on these successes, BIO aims to catalyze the on-chain science economy through decentralized funding, incentives, and liquidity.

The protocol aims to catalyze the on-chain economy of the science community (bioDAO) and create deep, liquid, and efficient markets for the scientific IP developed by bioDAOs.

Core advantages of BioDAO compared to traditional scientific models:

Capital Efficiency: Concentrate resources to reduce innovation costs

Flexible Work Modes: Allow part-time experts to contribute

Shared Intellectual Property: Incentivize contributions through IP

Open Access: Eliminate barriers to scientific funding and decision-making

Diversified Portfolio: Bundle multiple biotech projects to reduce risk

III. Token Economics

BIO Token

BIO is the native governance token of the BIO protocol. Holders can use BIO tokens to:

• Support specific bioDAOs (project screening and management);

• Vote on future BIO token issuance or distribution;

• Implement accelerator programs to drive network development.

BIO tokens provide the following benefits to holders:

• Governance rights within the bioDAO network;

• Participation in early-stage bioDAO funding rounds;

• Economic rewards for contributing health data and participating in clinical trials;

• Priority access to new health products funded by bioDAOs.

BIO tokens are issued by the Bio.xyz Association, a non-profit organization responsible for the legal custody of the BIO infrastructure and treasury.

• BIO Token Contract Address: 0xcb1592591996765Ec0eFc1f92599A19767ee5ffA

• vBIO (Locked BIO) Token Contract Address: 0x0d2ADB4Af57cdac02d553e7601456739857D2eF4

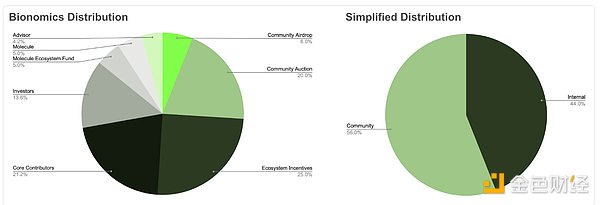

Initial Distribution

Total Supply: 3,320,000,000

BIO Token Status: Non-transferable

Maximum Supply: Uncapped, to be determined by BIO governance.

New BIO can be minted for future protocol or network growth. This requires deploying a new token contract to replace the current BIO token.

Token Allocation (Community 56% in total):

-Community Airdrop (6%): 199,200,000 BIO

-Community Auction (20%): 664,000,000 BIO

-Ecosystem Incentives (25%): 830,000,000 BIO

-Molecule Ecosystem Fund (5%): 166,000,000 BIO

Other Allocations:

-Core Contributors (21.2%): 703,840,000 BIO

-Investors (13.6%): 451,520,000 BIO

-Molecule (5%): 166,000,000 BIO

-Advisors (4.2%): 139,440,000 BIO

$BIO token holders can vote to fund specific research IP assets, reward BioDAO minting of IP tokens, or support community and infrastructure initiatives for the DeSci DAO. Through IP monetization, including IP licensing, IP-NFTs, and data contribution services, they can generate revenue, which is then reinvested into the BioDAO to fund more and better research projects, driving the value of the $BIO token.