It's the end of another year, and it's time to summarize and look forward.

As a top research institution in the industry, Messari released its annual report " The Crypto Theses 2025 " as scheduled last week, which comprehensively describes and predicts the development history of the crypto industry in 2024 and the trends in 2025.

There are some highlights in the report, such as the prediction that BTC will mature as a global asset next year, and Meme, as a speculative outlet, will continue to attract users.

The report has two main parts. It starts with the “Cryptocurrency State”, which includes shorter articles on the state of the crypto market in 2024, and the “Sector Research”, which reviews the narratives and forward-looking theories of the major sectors.

However, considering that the original report is 190 pages long and reading it in its entirety is time-consuming and laborious, we have extracted and summarized the key contents of the original report, and presented the most important viewpoints, especially the forecasts and outlooks in each section.

Macro environment: Breaking pessimistic expectations and providing strong support for encryption

Key Developments

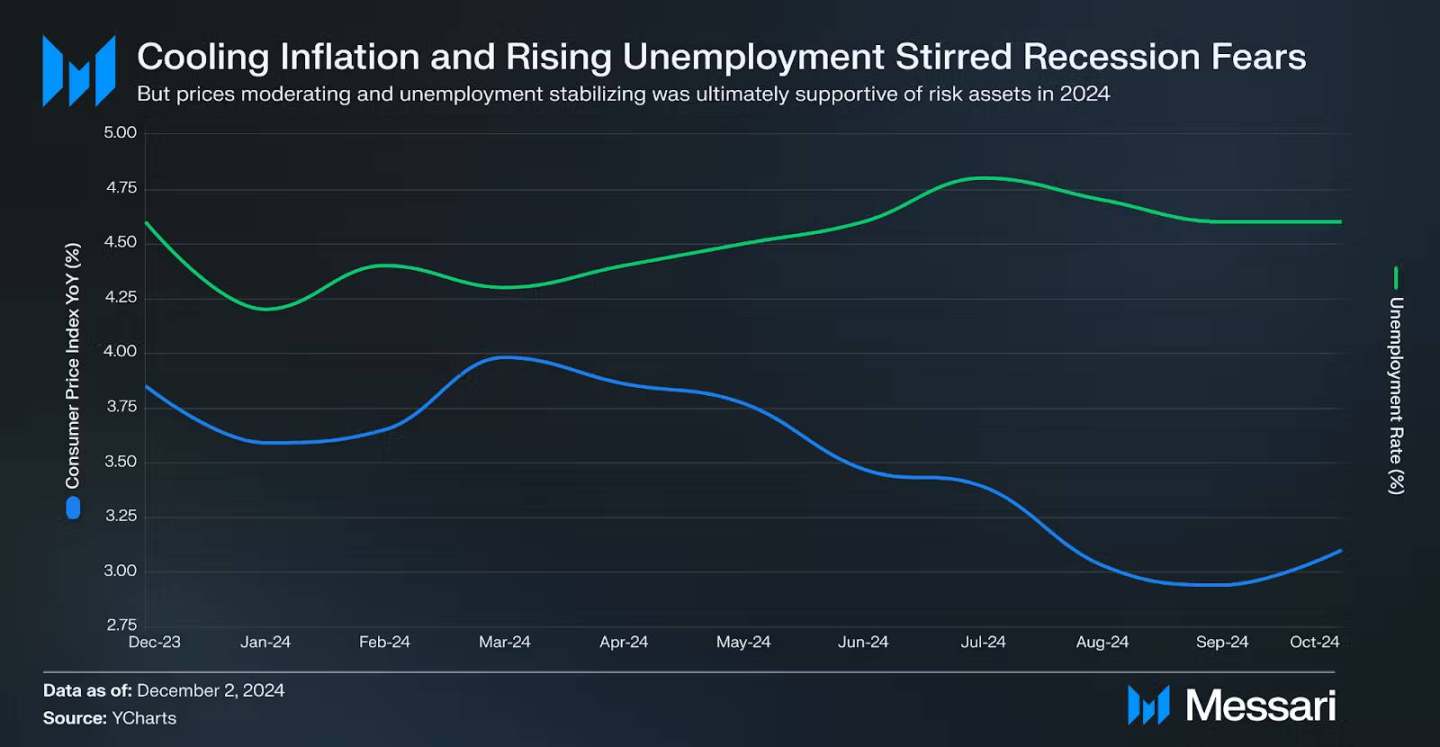

The economic trend in 2024 broke most pessimistic expectations, and the US economy showed unexpected resilience. The Federal Reserve was able to implement a 50 and 25 basis point interest rate cut in September and November, respectively, achieving a relatively smooth policy shift.

The S&P 500 index rose by about 27% throughout the year, ranking in the top 20% of historical performance, fully reflecting the market's confidence in a soft landing of the economy. It is worth noting that, except for the short-term fluctuations caused by the unwinding of the yen carry trade and geopolitics, the market as a whole maintained a steady upward trend.

The unique landscape of the crypto market

The crypto market faces a double challenge in 2024. On the one hand, it needs to deal with various risk factors in traditional markets, and on the other hand, it needs to overcome industry-specific challenges, including selling pressure from the German government, Mt Gox's token distribution, and Tether's investigation. The market experienced an 8-month consolidation period before the election became a breakthrough catalyst.

Predictions for 2025

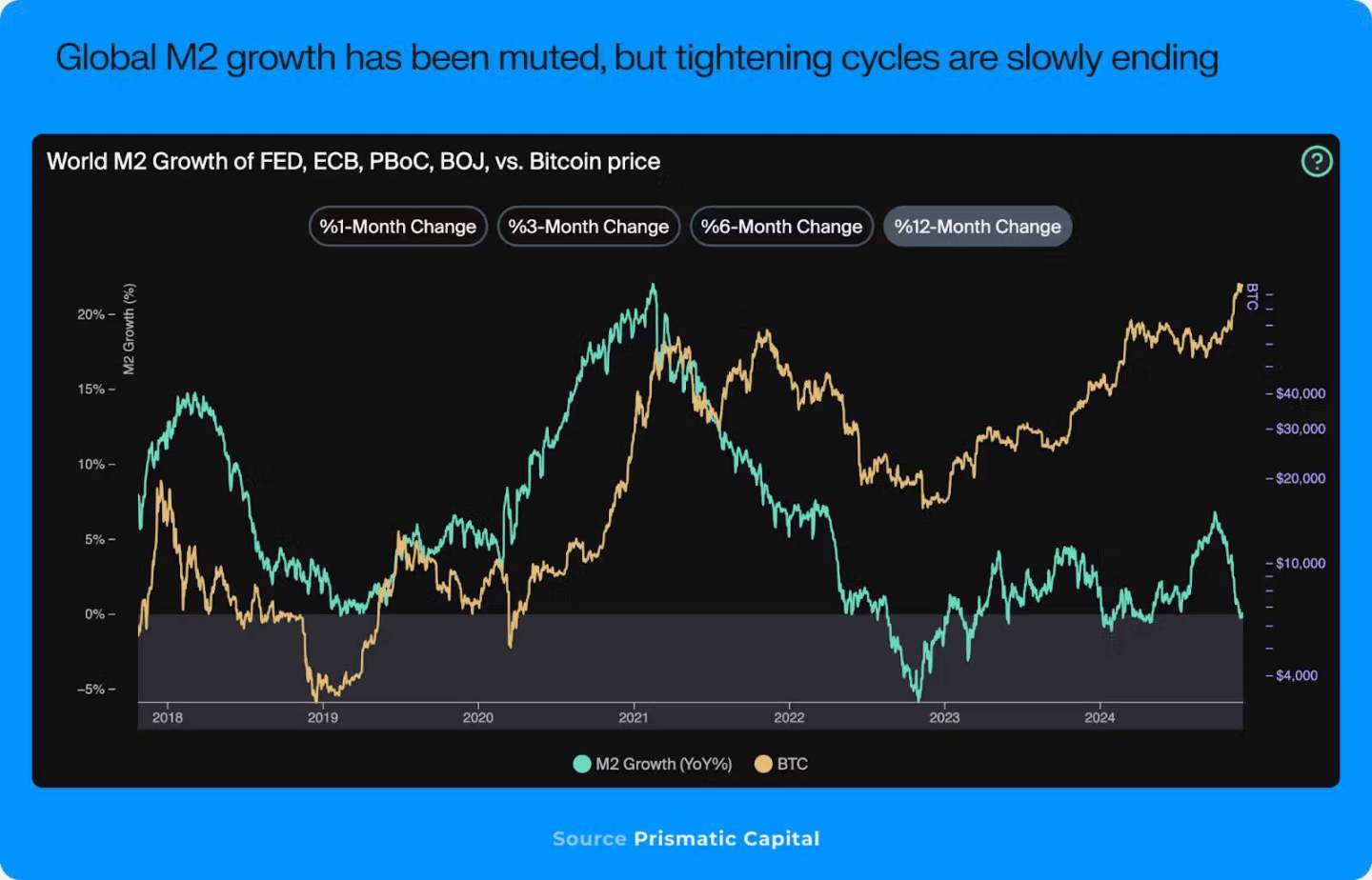

The macro environment is expected to provide strong support for crypto assets. Specifically:

- The Federal Reserve has begun to relax its tightening policy since 2022, but has not yet entered a substantial easing phase. This gradual policy adjustment is expected to provide stable support to the market;

- After the election, the volatility of various assets has dropped significantly. According to historical experience, low volatility often breeds lower volatility. This environment is particularly conducive to the development of crypto assets such as Bitcoin and Ethereum.

- The most important thing is the fundamental improvement of the regulatory environment. Even a relatively neutral regulatory attitude will bring significant improvement compared with the strict control of the past four years. This change is expected to eliminate the main concerns of institutional investors entering the market and bring more incremental funds to the market;

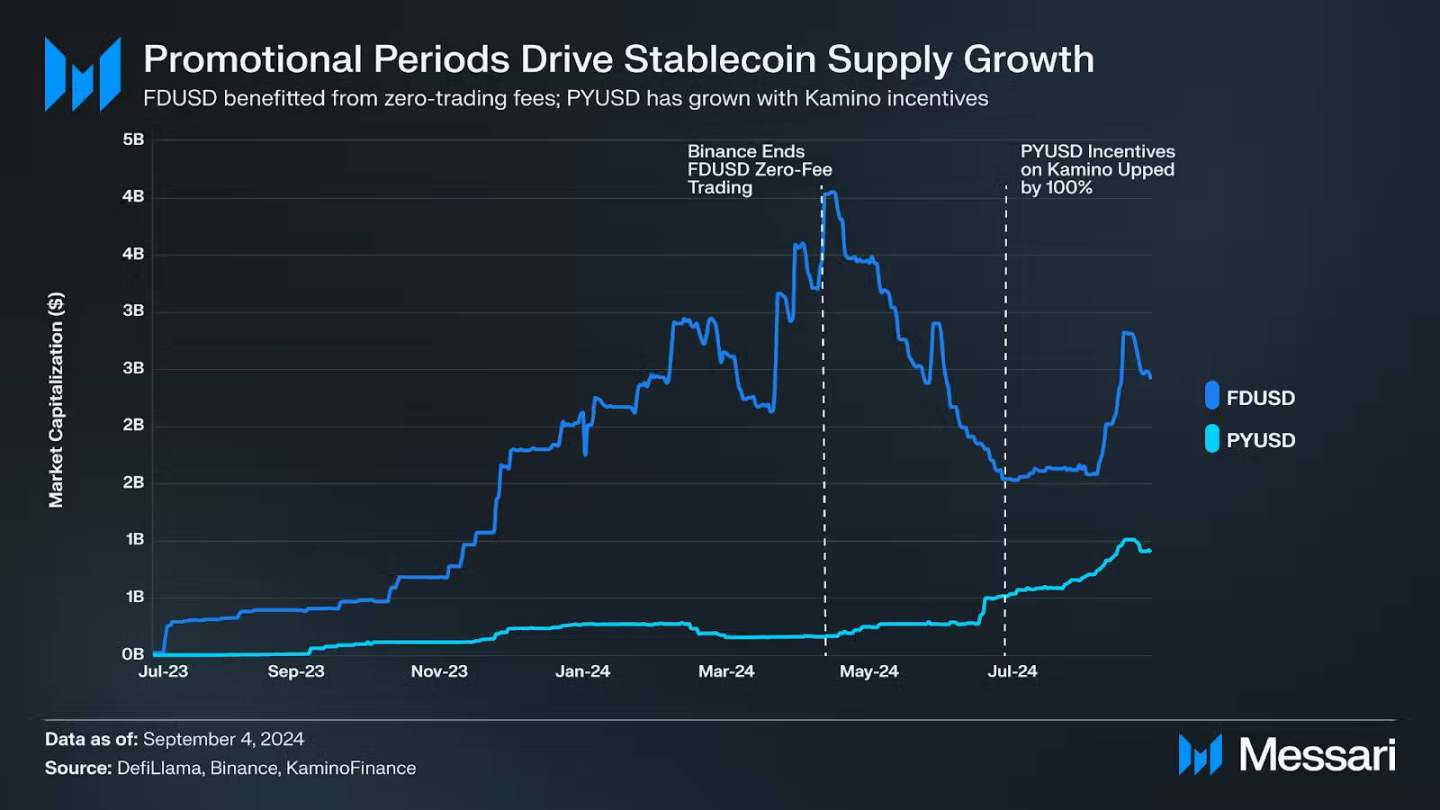

- The field of stablecoins may become a breakthrough. The bipartisan open attitude towards stablecoin regulation has created favorable conditions for the advancement of relevant legislation in 2025;

Institutional funds: full entry

Dramatic changes in the market

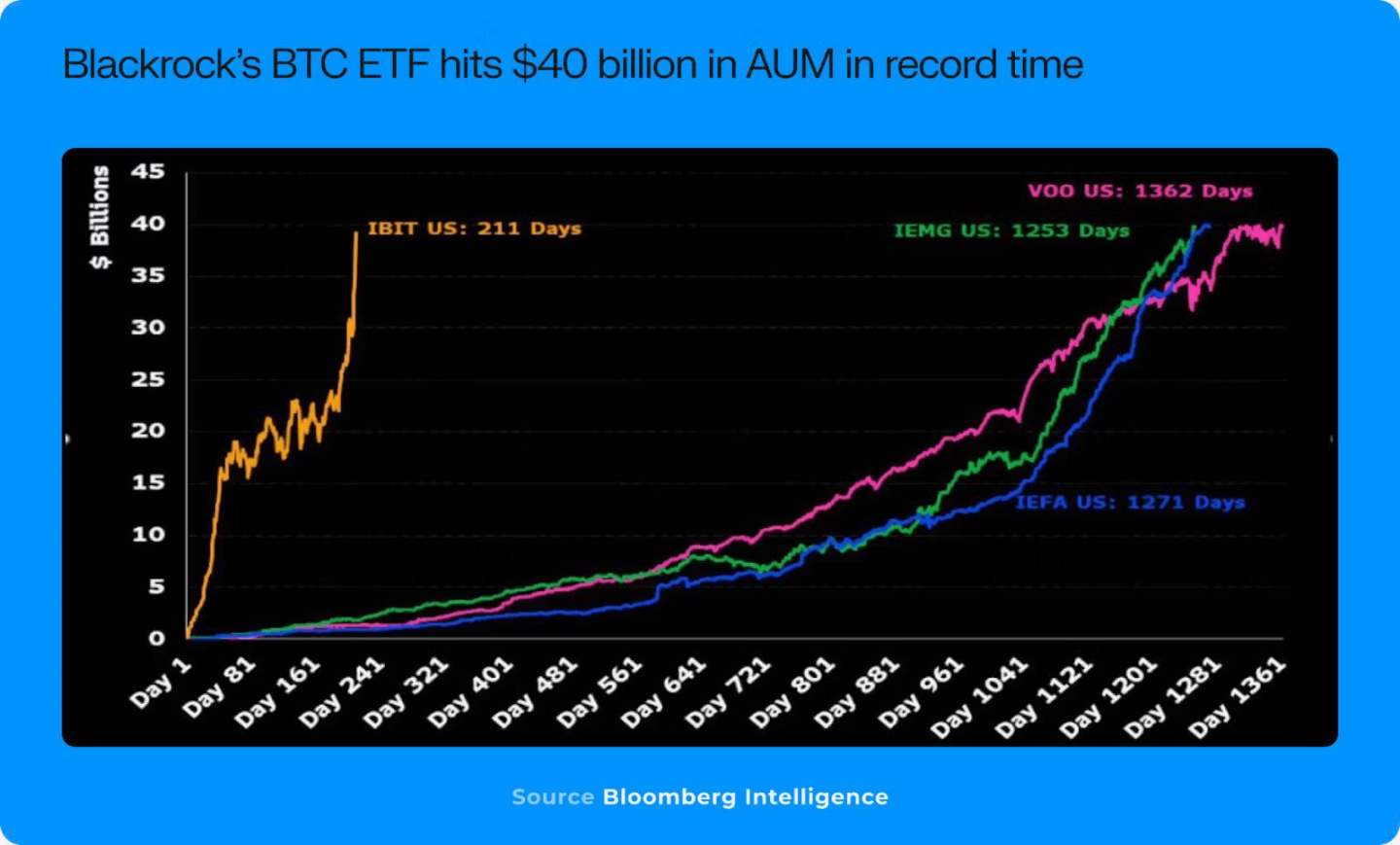

- In 2024, the entry of institutional funds is no longer an empty talk. The approval of Bitcoin and Ethereum ETFs marks the official recognition of the crypto asset class, providing a more convenient access channel for institutional and retail investors;

- BlackRock’s IBIT set records: the first ETF to reach $3 billion in AUM within 30 days of launch, and surpassed $40 billion in about 200 days. This shows the strong demand for crypto derivatives from institutions;

Diversification of institutional involvement

- Institutional participation goes far beyond ETF investment. Traditional financial institutions are making arrangements in multiple areas: significant progress has been made in asset issuance, tokenization, stablecoins, and research;

- Institutions such as Sky (formerly MakerDAO) and BlackRock have launched on-chain money market funds. Ondo Finance’s USDY (Tokenized Treasury Bond Fund) has an asset size of approximately US$440 million;

Fintech Integration

- PayPal launched its stablecoin PYUSD on Solana in May, and Agora, backed by Nick Van Eck, also launched a stablecoin AUSD on multiple chains. The asset is backed by Van Eck (asset management company) and custodied by State Street;

Predictions for 2025

- The depth and breadth of institutional participation is expected to expand further. As BlackRock continues to position digital assets as a non-correlated asset class worthy of a small allocation, steady inflows into ETFs are likely to continue. More importantly, institutions are looking for innovation opportunities in multiple verticals to reduce costs, increase transparency, or speed up payment efficiency;

- It is particularly noteworthy that traditional financial giants such as JPMorgan and Goldman Sachs are accelerating their layout. They are not only expanding their own blockchain platforms, but also exploring a wider range of product offerings;

- This trend suggests that institutions are no longer viewing crypto as just an investment asset, but are beginning to take its potential as financial infrastructure seriously;

Meme: The heat will continue

2024 Market Landscape

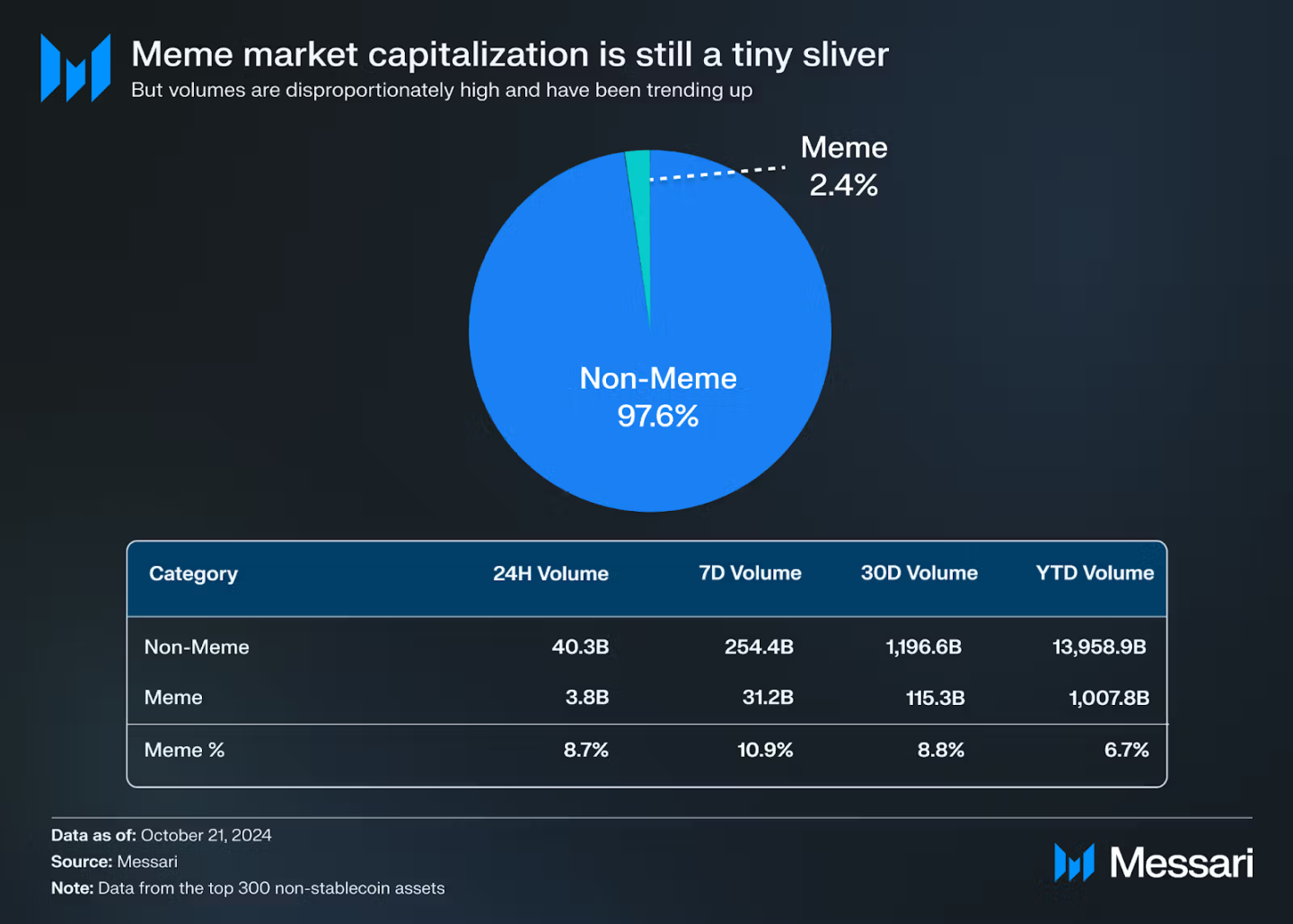

- Although Meme coin only accounts for 3% of the top 300 cryptocurrencies (excluding stablecoins) in terms of market capitalization, its trading volume continues to account for 6-7% of the market share, and has even climbed to 11% recently;

- The first quarter’s rally was led by politically themed meme coins like Jeo Boden, and then TikTok meme coins like Moodeng and Chill Guy, and AI agent concepts like Truth Terminal’s GOAT, continued to drive the momentum;

Market drivers

The memecoin boom is not just due to trends or user-friendly interfaces, but also due to two key conditions:

- Excess capital: As the overall crypto market appreciates, many traders have accumulated a lot of funds, but lack of quality investment opportunities;

- Sufficient block space: High-throughput networks such as Solana and Base provide a low-cost, efficient transaction environment;

This environment is particularly evident on Solana. The strong market performance in late 2023 and early 2024 has enabled Solana users to accumulate a large amount of capital.

The evolution of trading infrastructure

- User-friendly trading platforms have significantly boosted the popularity of memecoins. Applications such as Pump.fun, Moonshot, and Telegram bots have simplified the process for retail traders;

- Moonshot, in particular, bypasses traditional cryptocurrency deposit channels by supporting USDC payments on ApplePay, PayPal, or Solana, and its intuitive interface and simple registration process have attracted a large number of new retail investors;

Predictions for 2025

It is predicted that in 2025, memecoin is expected to continue to grow, mainly due to several key factors:

- Infrastructure support: High-throughput chains such as Solana, Base, Injective, Sei, and TON provide ample block space, allowing memecoin transactions without incurring high fees;

- User experience optimization: Applications such as Moonshot and Pump.fun continue to lower the entry barrier and simplify the trading process, which is expected to attract more retail participants;

- Macroeconomic fit: Memecoin’s attributes as a speculative outlet, similar to gambling, may continue to attract users seeking entertainment and profit in the current macroeconomic environment;

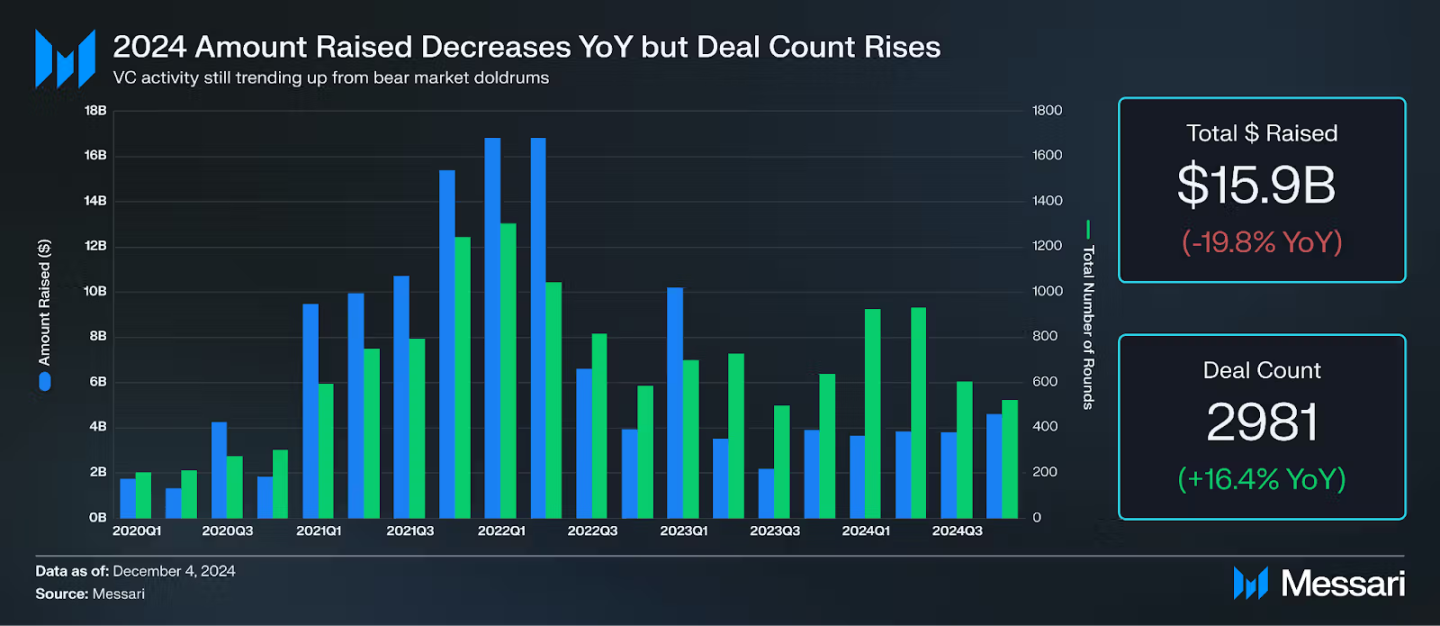

Financing landscape: AI leads emerging investment themes

Market Overview

- Crypto project financing is on an upward trend compared to 2023. Although the total financing of startup projects and protocols has decreased by about 20% year-on-year (mainly affected by the outliers in the first quarter of 2023), the market has still seen a number of large financings;

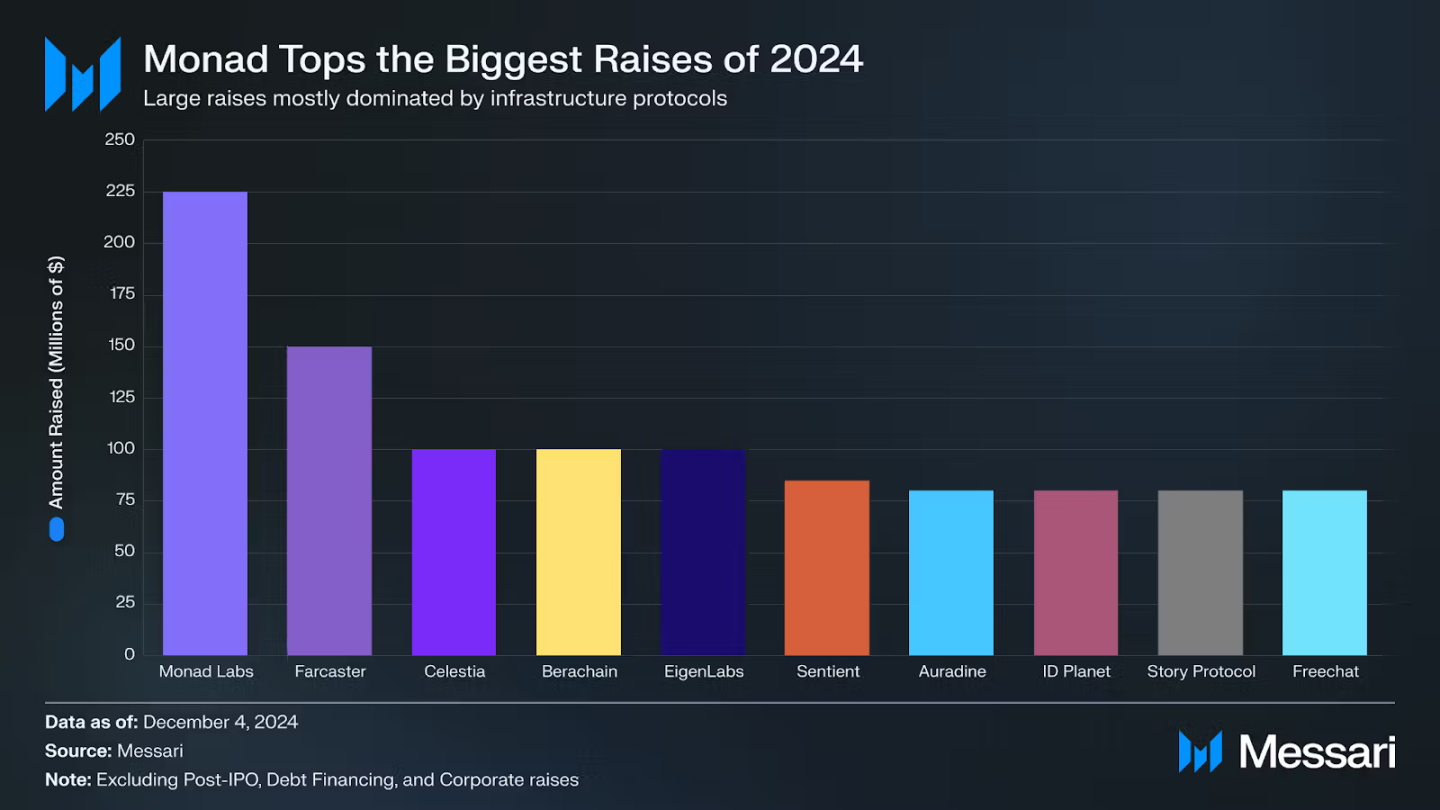

Important financing cases

- Monad Labs: raised $225 million in April, showing that infrastructure and L1 projects are still the key investment areas for VCs;

- Story Protocol: Completed $80 million in Series B financing, led by a16z, dedicated to transforming intellectual property into programmable assets;

- Sentient: Received $85 million in financing, led by Thiel's Founders Fund, focusing on open AGI development platform;

- Farcaster and Freechat: raised US$150 million and US$80 million respectively, indicating that the social field continues to attract capital attention;

The rise of AI and DePIN

- The total amount of AI project financing increased by about 100% year-on-year, and the number of financing rounds increased by 138%;

- The total amount of DePIN project financing increased by about 300% year-on-year, and the number of financing rounds increased by 197%;

AI rounds are particularly popular in accelerator programs such as CSX and Beacon. Investors are showing strong interest in the intersection of crypto and AI.

Emerging investment themes

In addition to AI and DePIN, there are several funding trends worth noting in 2024:

- The decentralized science space began to gain traction, with projects such as BIO Protocol and AMINOChain receiving funding;

- VCs in the Asia-Pacific region are more inclined to invest in gaming protocols, especially projects launched on the TON blockchain;

- The funding share of NFT and Metaverse projects has dropped significantly compared to 2021 and 2022;

- Experimentation continues in the social space, with projects such as Farcaster, DeSo and BlueSky receiving funding despite limited past success;

Encrypt users and increase new evidence

Market size breakthrough

- According to a16z's report, the number of monthly active addresses of cryptocurrency has reached a record high of 220 million, with a growth trend similar to early Internet adoption. Although this number may contain duplicate counts (because many users use multiple wallets), after screening, it is estimated that there are still 30-60 million real monthly active users;

Key use cases for user growth in 2024

- The breakthrough of Phantom Wallet has made it the most popular wallet in the Solana ecosystem, and it once ranked in the top ten in the iOS App Store, surpassing WhatsApp and Instagram.

- Stablecoin adoption in emerging markets: Sub-Saharan Africa, Latin America, and Eastern Europe are beginning to bypass the traditional banking system and adopt stablecoins directly; platforms such as Yellow Card, Bitso, and Kuna are driving adoption by providing services such as stablecoin exchange and payment APIs;

- The explosion of Telegram Mini-Apps: Notcoin has more than 2.5 million holders, Hamster Kombat attracts 200 million users, 35 million YouTube subscribers;

- Polymarket’s actual application: It grew rapidly during the election, with nearly 1 million new accounts, and once became the second most downloaded iOS news app;

- Base and Hyperliquid drive CEX users to the blockchain: Base L2 provides a free Coinbase to Base transfer channel, and Hyperliquid provides perpetual contract traders with a high-performance trading experience similar to CEX;

Predictions for 2025

- The crypto ecosystem is no longer just preparing for mass adoption, it’s already happening;

- User growth is shifting from a sudden, noisy entry model to a model of natural discovery and sustained growth through various applications. Meme coins, consumer applications (such as Phantom and Telegram), prediction market platforms, and growing on-chain utility will continue to bring compound growth;

- The next critical step is to make blockchain navigation more retail-friendly, which will be greatly improved by new innovations like chain abstraction and aggregation frontends;

Bitcoin: This year is great, next year will be more mature

Key developments in 2024

Price and Institutional Adoption

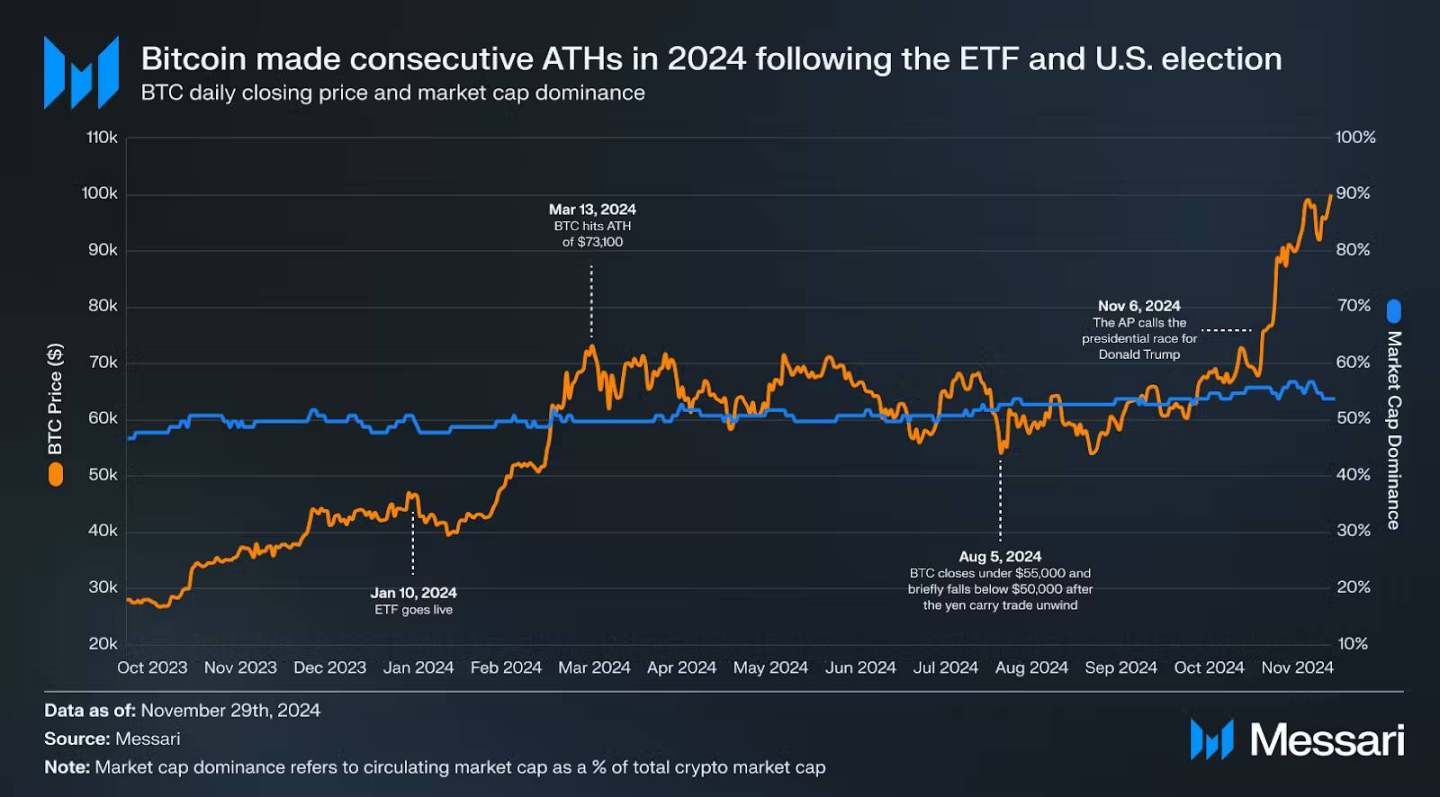

- Starting at $40,000, it hit a new high of $75,000 in Q1 after the ETF was approved, and broke through the important $100,000 mark after Trump won the election;

- Bitcoin market capitalization dominance rose to about 55%;

- ETF issuers hold more than 1.1 million bitcoins, of which BlackRock and Grayscale hold 45% and 19% respectively;

- After the ETF was approved, there was only a single month of net outflow in April. BlackRock's IBIT continued to be the largest net buyer, with about $8 billion in inflows in November alone;

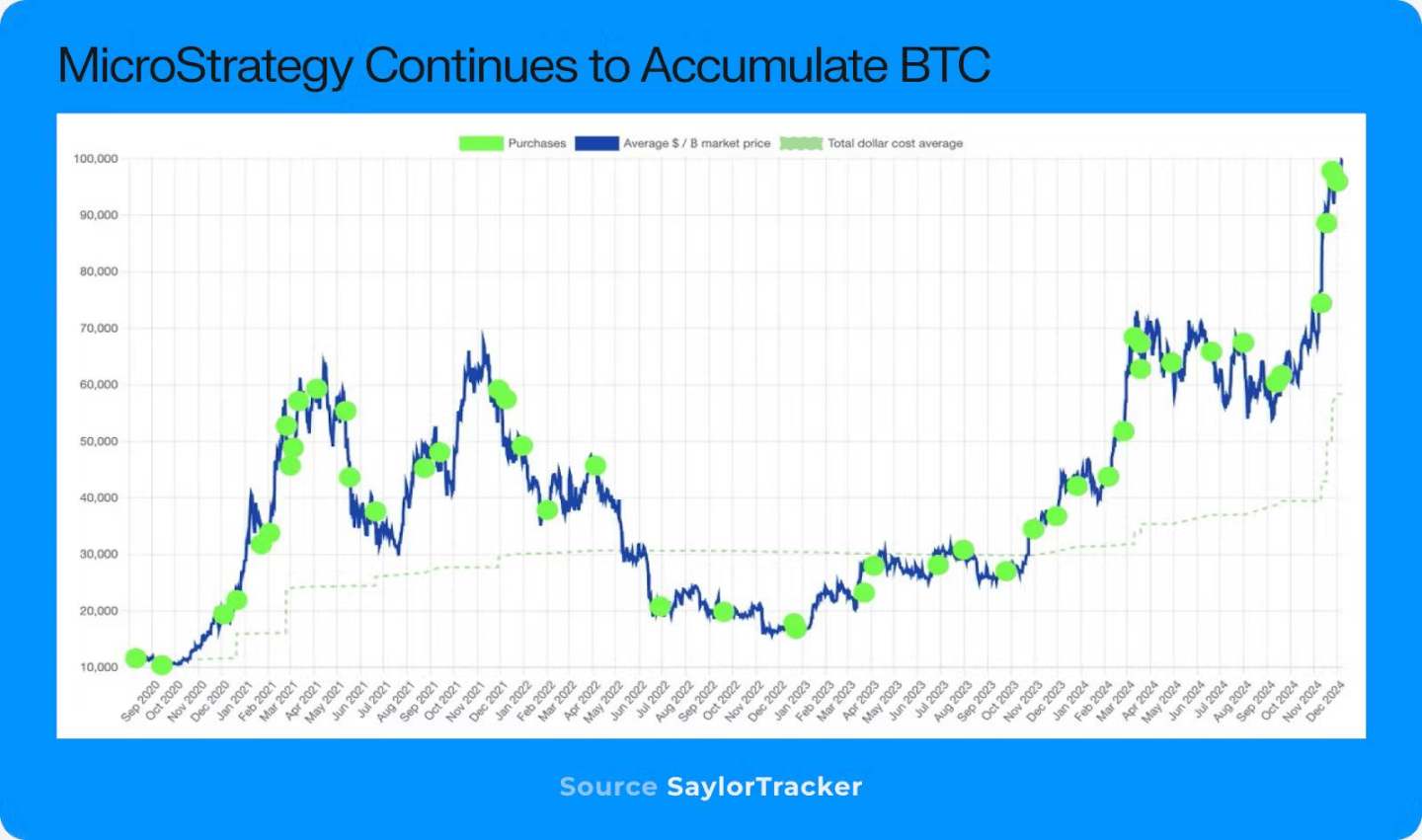

- MicroStrategy continues to make large purchases, with the latest purchase of $2.1 billion worth of Bitcoin between December 2 and 8, and currently holds about 420,000 Bitcoins, second only to Binance, Satoshi Nakamoto, and ETF issuers;

- Michael Saylor and MicroStrategy (MSTR) continue to invest regularly, and their BTC-centric strategy has inspired other public companies such as Marathon Digital Holdings (MARA), Riot Platforms, and Semler Scientific to begin accumulating BTC reserves;

- 2024 is also a year of BTC decline, and the number of natural sellers of Bitcoin will decrease over time;

Network Innovation

The Rise of Ordinals and Runes

- Ordinals brings NFT functionality to Bitcoin, and Runes is launched as a new token standard, similar to Ethereum ERC-20;

- The valuation of some Runes projects has reached nine figures, showing the market's recognition of the expansion of the Bitcoin ecosystem;

Bitcoin Programmability Breakthrough and Staking Innovation

- The emergence of BitVM has brought the possibility of arbitrary computing to Bitcoin, and more than 40 Layer-2 projects have been launched on the testnet or mainnet;

- CORE, Bitlayer, Rootstock, and Merlin Chain lead in TVL;

- Babylon was launched in Q3 as the first Bitcoin staking protocol, and the first round of 1,000 BTC staking limit reached within 6 blocks;

- Liquid staking tokens such as Lombard’s LBTC are beginning to emerge;

Predictions for 2025

- Bitcoin ETF inflows have greatly exceeded expectations, and institutions are likely to slowly become the main driver of daily BTC price movements over time;

- ETFs can buy spot Bitcoin without the use of leverage. Smoother and more consistent spot inflows from institutions should reduce reflexive, leverage-driven volatility, helping Bitcoin mature as an asset;

- The approval of a Bitcoin ETF could put BTC in the early to mid-stage of becoming the world’s leading store of value. In November, Bitcoin surpassed silver to become the world’s eighth most valuable asset, driven in part by ETF inflows throughout the year. Year-end trends suggest that ETF inflows will continue to increase in 2025, especially as Grayscale’s GBTC turns to positive net flows;

- In terms of regulation, the new Trump administration has shown a positive attitude towards cryptocurrencies and Bitcoin, making promises related to Bitcoin during the campaign. Although Bitcoin quickly repriced after Trump's victory, ultimately the government needs to deliver on some of their claims;

- While we predict a low probability of this happening, a federal strategic Bitcoin reserve would be particularly influential. The market seems to be treating the Trump administration with cautious optimism, and if the president can achieve some of the higher probability action items, it may build enough goodwill to maintain Bitcoin optimism moving forward;

- The impact of clear and proactive cryptocurrency reform becomes a major issue for all branches of government after the 2024 election, and we believe that cryptocurrency is on the verge of bipartisan support. The impact is significant and will help eliminate the regulatory overhang on Bitcoin for the foreseeable future;

- On Runes and Ordinals, we think the dust has largely settled and the opportunities are attractive by 2025;

- Magic Eden is a driving force in improving Bitcoin UI/UX, and if the Bitcoin ecosystem takes off, we expect them to be the clear winner;

- Bitcoin programmability and BTC staking are still in their infancy, and early TVL growth is not enough to indicate actual demand; consumers largely favor the performance capabilities of networks such as Solana and Base, and if this trend continues, Bitcoin builders will face an uphill battle;

Ethereum: Identity Crisis and Future Opportunities

2024 Performance Overview

Ethereum has experienced an extraordinary year. As the "second brother" in the crypto market, it not only competes with Bitcoin for the hard currency narrative, but also has to deal with challenges from new public chains such as Solana. Main performance:

- Significant underperformance relative to other major crypto assets, especially Bitcoin and Solana;

- The Layer-2 ecosystem continues to grow, but mainnet activity has declined significantly; ETH has experienced sustained inflation for the first time, rather than the expected deflation;

- Initial inflows of funds were limited after the ETF was approved, but have only recently begun to accelerate;

- L2 expansion capacity increased by 15 times, with cumulative throughput reaching approximately 200 TPS;

- The rapid growth of Base has triggered discussions about “The future of Ethereum is Coinbase”, but the decentralized L2 ecosystem has damaged user experience and developer experience;

Key Outlook for 2025

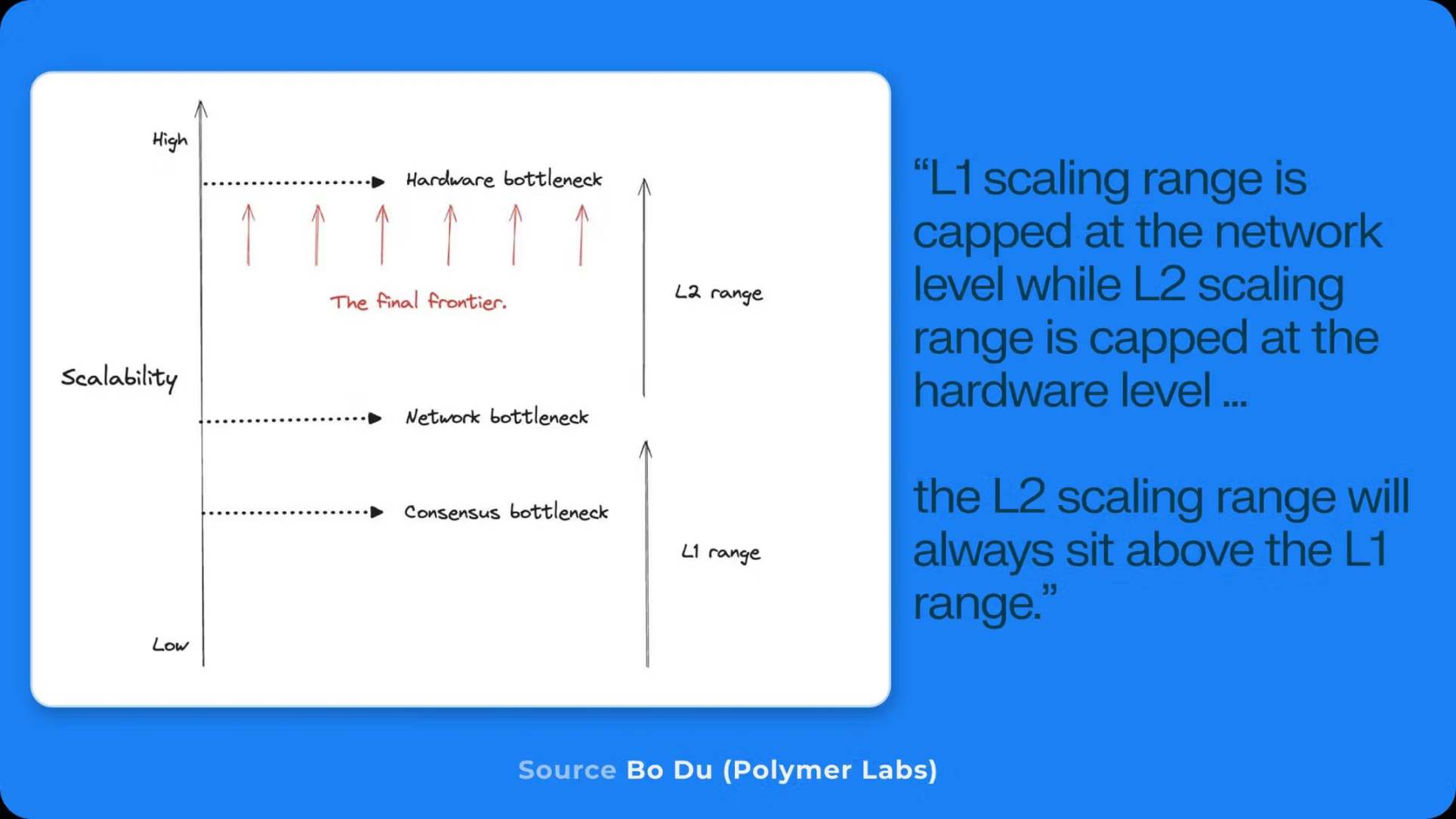

L2 is better than L1

- Layer-2 design allows for a more flexible execution environment, which is superior to native Layer-1; high-throughput L2 (such as MegaETH) has a theoretical capacity far exceeding fast L1;

- Application chains can achieve better trade-offs, such as transaction priority customization;

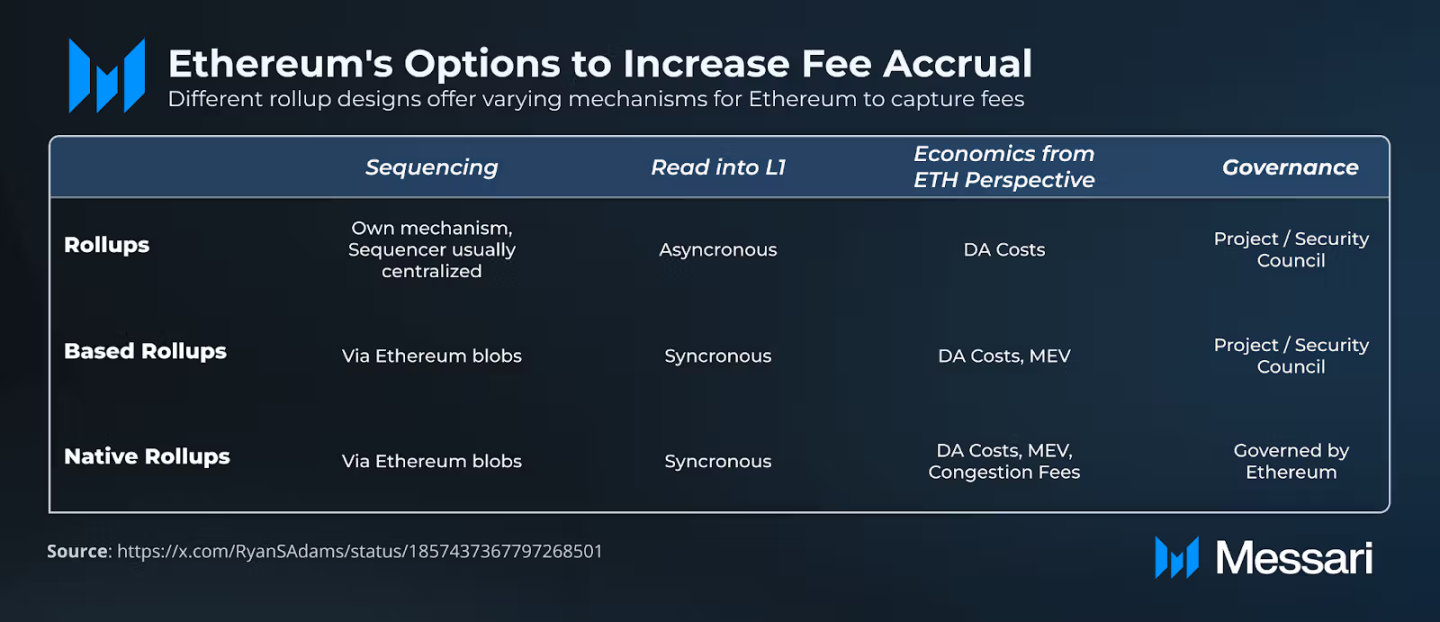

2 possible models for increasing value capture

Ethereum faces two value capture paths:

Cost is not important route

- Current expenses are mainly derived from speculative activities, and their sustainability is questionable;

- Token valuation should be based on “security needs” rather than fees; the largest applications create the highest security needs and drive the value of native assets;

Enhanced fee capture route

- Native rollup can improve the value capture of the mainnet and increase data availability costs;

- Expanding the base layer to compete with the normal EVM Layer-2;

New opportunities for the entire ecosystem

- A super rollup, an interconnected based-rollup network, or high fee burning could all be paths to success;

- Regaining crypto-native speculative market share will drive institutional interest;

- The decentralized nature of the ecosystem makes it possible for any participant to facilitate this transition;

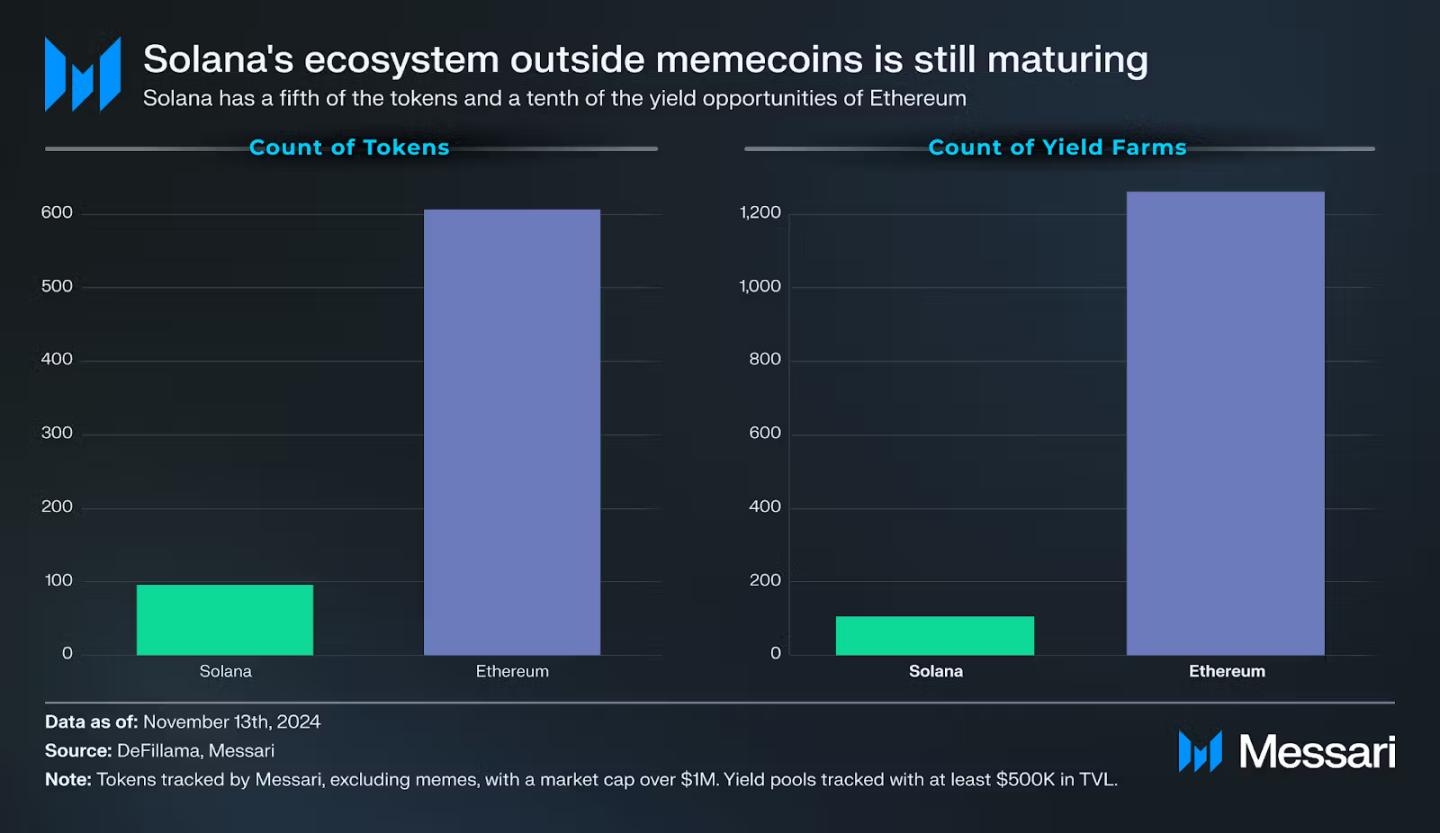

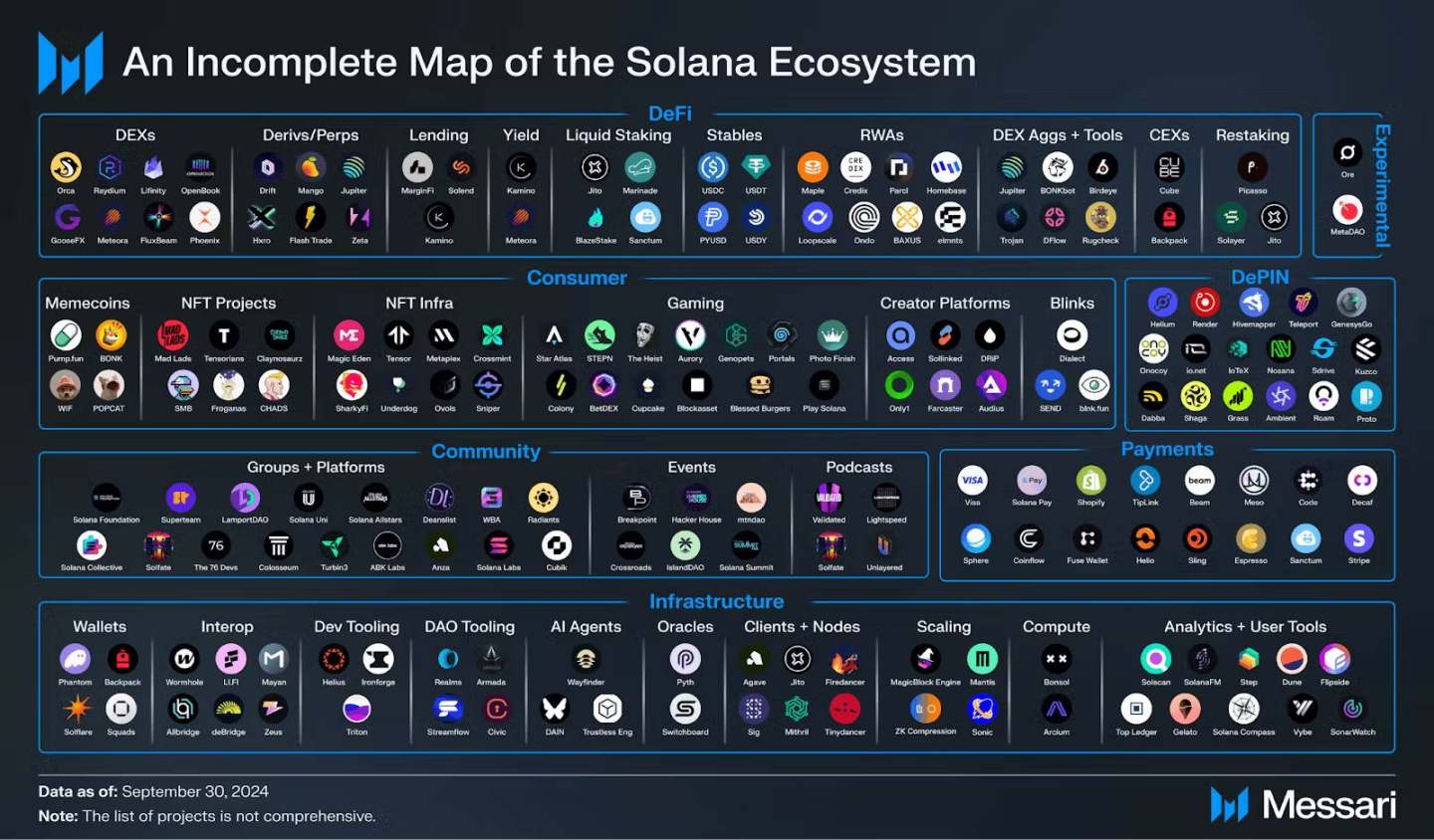

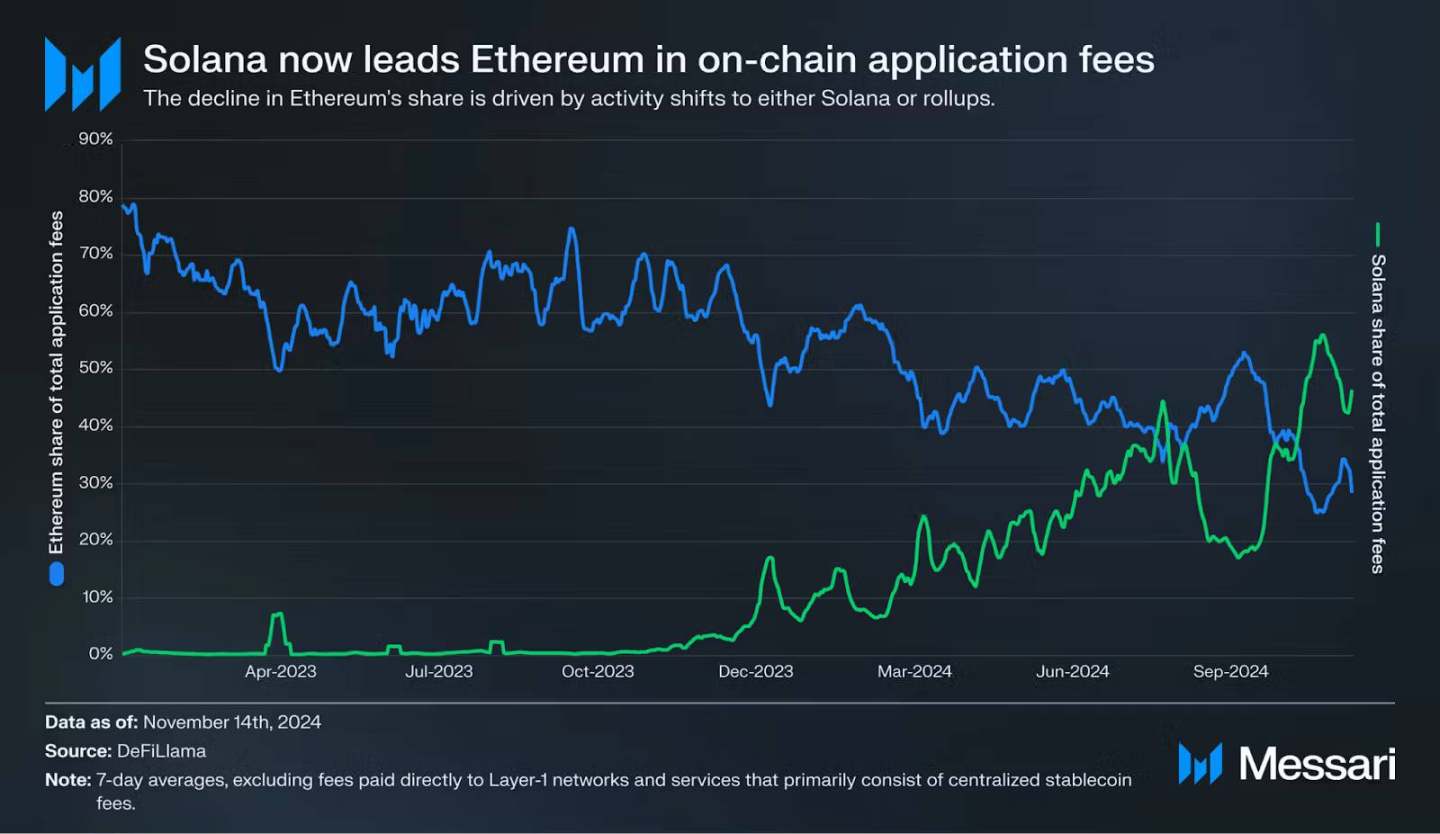

Solana: From a follower to a mainstream ecosystem

Key performance in 2024

Solana has gone from “recovery after the FTX crash” to a definitive breakthrough. Key achievements:

- From the "two-horse competition" of Bitcoin and Ethereum to a "three-horse race";

- The network stability has been significantly improved, with only one 5-hour outage throughout the year; the total DeFi locked volume (TVL) has increased from $1.5 billion to more than $9 billion; the issuance of stablecoins has increased from $1.8 billion to nearly $5 billion;

- Positioning itself as a place for speculation, especially through Memecoin trading. The seamless user experience of the ecosystem wallet, as well as platforms such as Pump.fun and Moonshot, make it easier than ever to issue and trade tokens;

- This flurry of on-chain activity even pushed Solana’s on-chain fees to occasionally surpass Ethereum, highlighting the network’s accelerating momentum and retail appeal;

Key Outlook for 2025

Ecosystem expansion

- Looking forward to applications beyond speculation: We are particularly excited about MetaDAO’s prediction markets, and the emerging Solana L2 ecosystem will be worth watching to see if they can effectively compete with their counterparts on Ethereum;

- AI Trend Pioneering: ai16z, has become one of the most trending repositories in all areas of Github. The Solana ecosystem not only embraces artificial AI x Crypto, but also leads this trend;

Traditional financial interest

- With the ETF trend, investors may seek to invest in “tech stocks” in the field, and Solana will become the fastest horse;

- It seems inevitable that a spot Solana ETF will go live in the next year or two, creating the perfect storm for an explosive second phase in the Solana story;

Intensified competition

- A new batch of Layer 1 blockchains (such as Monad, Berachain, and Sonic) are expected to emerge next year;

- Resurgent DeFi, AI agents, and consumer applications led by platforms like Base and numerous L2 upstarts;

Other L1+ Infrastructure Outlook 2025

Note: Due to space limitations, we will focus on interpreting the 2025 forecast outlook from this chapter onwards. The 2024 summary can be found in the original report, which also integrates more information from public and objective data.

- Next year we will see the release of Monad and Sonic as two general-purpose, high-throughput, “holistic” L1s;

- Both projects have accumulated a large amount of capital ($225 million for Monad and about $250 million for Sonic’s FTM tokens) to attract developers and developers;

- Berachain is one of the most interesting experiments in L1, with over 270 projects committed to supporting the network after raising $142 million in Series A and B funding, and a huge amount of interest from developers and application teams;

- Celestia’s Lazybridging proposal and Avail’s Nexus ZK proof validation layer have the potential to build meaningful network effects for modular L1 in the second half of 2025;

- Unichain, if successful, could spark a wave of protocols that eschew L1 and build application- or domain-specific L2s to increase value accrual and generate more revenue for token holders.

- Alternative VMs (primarily Solana and Move VM) will continue to gain traction;

- Avalanche9000, combined with Avalanche’s BD strength in both the institutional and gaming sectors, is set to have another strong year;

- In 2025, the future of Cosmos remains uncertain;

- Initia will be launched as L1, supporting 5 to 10 application-specific, interoperable L2 solutions. This strategic setup makes it possible for Initia to lead the next wave of application chain progress;

- In the interoperability track, pay attention to Across, Espresso, and Omni Network;

- In the ZK track, pay attention to Polygon's Agglayer. In 2025, it is expected that almost all infrastructure protocols will adopt ZK technology;

- The line between applications and infrastructure is becoming increasingly blurred, and modular projects such as Celestia, EigenDA, Avail, etc. may benefit from this;

DeFi Outlook 2025

- Base and Solana - Valuable Real Estate: We continue to see promise in Solana and Base DEX’s growing share relative to DEX’s on other chains;

- Vertical integration and composability: Protocols such as Hyperliquid and Uniswap have moved towards owning their own infrastructure in order to configure network characteristics to benefit their applications;

- Prediction Markets: We predict that trading volumes may decline compared to previous election-driven trading months. To win, other protocols must be able to provide relevant markets that bettors can consistently speculate on while incentivizing market makers;

- RWA: As interest rates fall, tokenized treasuries are expected to face resistance; idle on-chain funds may gain more favor, and the focus may shift from purely importing traditional financial assets to exporting on-chain opportunities. Even if macroeconomic conditions change, RWA has the potential to maintain growth and diversify on-chain assets;

- Points Play: We expect points to remain core to protocols that aim to bootstrap user adoption through token distribution, powering marketplaces and yield trading protocols. As we head into 2025, protocols are likely to refine their points programs while nurturing communities of early adopters;

- Yield trading protocols such as Pendle are expected to grow further, driven by new opportunities in yield farming and the speculative appeal of points-based incentives.

AI X Crypto Outlook 2025

Bittensor and Dynamic TAO: A new AI coin casino

- Each existing subnet (and future subnets) will have their own tokens, and they will essentially be tied to Bittensor’s native TAO tokens;

- The AI war is a war for talent, and Bittensor has a unique angle to attract talent -- the subnet shows early signs of producing high-quality research;

- Don’t be surprised if next year Bittensor unexpectedly becomes the epicenter of cutting-edge AI research in the cryptocurrency space;

- Bittensor is not just a speculative “AI coin casino” but a platform that has the ability to attract serious AI developers;

Decentralized model training: a stumbling block and a pivot

- Rather than trying to compete with giants like OpenAI and Google by training large-scale base models, decentralized networks will likely shift their focus to fine-tuning smaller specialized models;

- More experiments are expected next year in the field of small and specialized models. These models may be designed to perform specific tasks;

Artificial Intelligence Agents and Meme Coins: An Ongoing Experiment

- Most AI agents would probably prefer to be on-chain;

- Growing token valuations can fund continued development of AI Agent and boost social media engagement;

- We believe that talent density will continue to increase as more engineers focus on it;

- As AI agents KOLs actively compete for attention on social media, this category will win over “static” meme coins;

- As the open vs. closed discussion around AI continues, we expect cryptocurrencies to take up an increasing portion of the conversation;

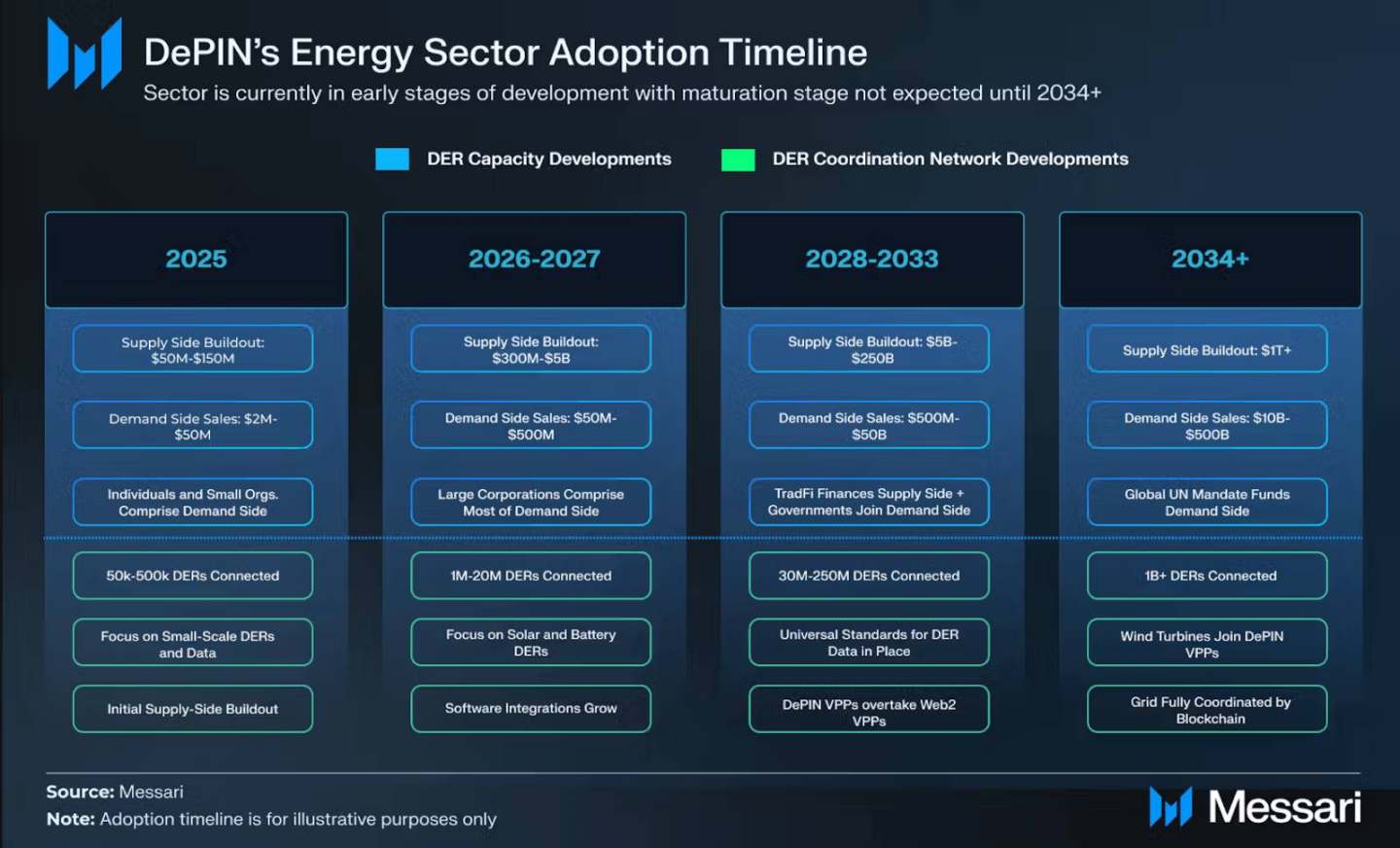

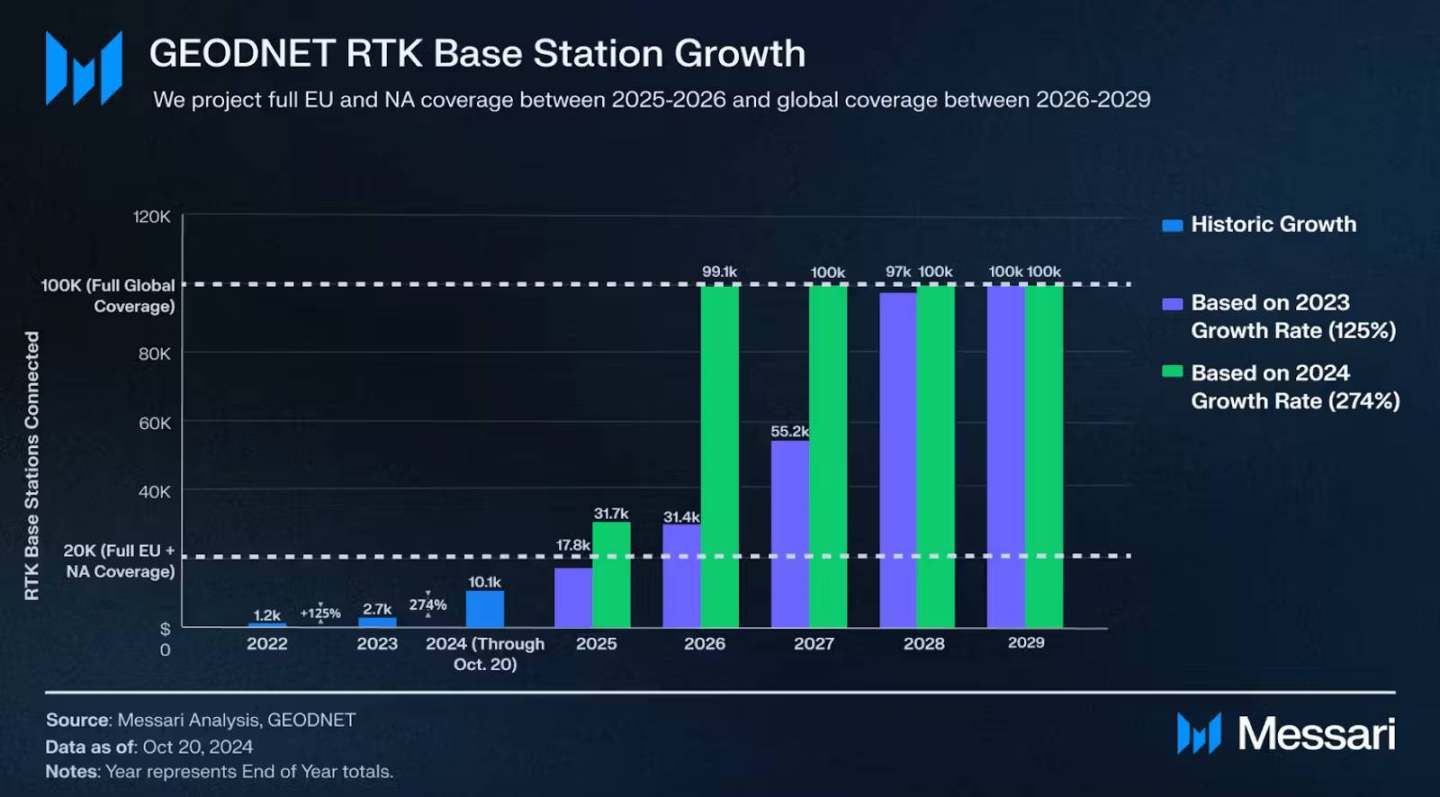

DePIN Outlook 2025

- By 2025, we expect Energy DePIN to have built $50-150 million in supply-side infrastructure while generating up to $50 million in demand-side sales;

- As Helium Mobile prepares for further growth and DAWN is set to launch its mainnet in 2025, the wireless sector will solidify its position as a breakthrough use case in DePIN;

- Revenue Forecast: The industry is expected to achieve revenues of 8 to sub-9 figures by 2025;

- RTK networks such as GEODNET are expected to expand the supply side, providing 90%-100% coverage of high-value areas in the EU and North America by the end of 2025. In addition, annual revenues could grow to more than $10 million;

- The weather collection network vertical is expected to see significant progress in 2025;

- It is expected that integration and partnerships between Energy and Mobility DePIN will further enhance grid integration and energy harvesting data from EV batteries;

- In 2025, file storage DePIN is expected to generate revenues of $15-50 million across the sub-industry;

- Driven by the success of projects such as Grass, data collection DePINs will increase in 2025;

Outlook for consumer applications in 2025

- Playing airdrops will continue to be the main way to attract players to the game. The "paid airdrop" strategy may become the new standard in 2025;

- Mobile applications will be the defining trend in 2025;

- In 2025, we expect Solana to continue to account for the largest share of Memecoin transaction activity;

- Ordinals are expected to be a category that continues to gain traction. Upcoming catalysts such as potential CEX listings, airdrop-driven wealth effects, and growing popularity in Asian markets will enable continued growth and broader appeal throughout the year;

CeFi Outlook 2025

- As the bull run continues and funding rates continue to rise, Ethena’s supply will likely continue to expand;

- Yield-bearing stablecoins probably won’t take a significant share from Tether anytime soon;

- With Trump’s pick for Secretary of Commerce, Howard Lutnick, managing Tether’s assets, there is a possibility that the U.S. will completely change its hostile stance toward Tether;

- The real innovation will likely happen behind the scenes at orchestration companies like Bridge. Stablecoin APIs, such as those provided by Yellow Card, will empower small businesses to accept stablecoins as a form of payment globally;

- On the exchange side, we will continue to see a convergence of on-chain and off-chain services. Coinbase and Kraken want to get as many people as possible on board their L2s by 2025, and will likely offer incentives to do so;

- The new government will allow exchanges to be more lenient with the assets they choose to list. This trend could reach fever pitch in 2025 as Binance, Bybit, and Coinbase compete to list the most popular crypto assets.