Master Talks About Hot Topics:

On the eve of Christmas, the sound of the bell has not yet sounded, but the chill has already penetrated the market. The festive atmosphere seems unable to alleviate the gloom in the market, with the US stock market closed and liquidity declining. Some are worried that the market sentiment will dominate and lead to deeper declines, choosing to leave early to avoid this "Christmas disaster".

The master believes that we still need to first look at the performance of the Asia-Europe market tomorrow. If they can remain stable, even if the US market is closed, it may not cause any major turmoil. But if the Asia market weakens first and the European market follows with a transmission of panic sentiment, Christmas may turn into a "warehouse-cutting festival". At such times, the flow of funds becomes particularly important.

In addition, some fans have recently asked the master about the situation where BTC is falling but Altcoins and Ethereum are actually rising against the trend. Is the Altcoin season coming? My answer is still the same old view: the Altcoin season will definitely come, but it will not start in a panic. BTC is falling sharply, but the funds are going to buy Altcoins for hedging? Isn't that a bit too far from reality?

The real Altcoin season is often accompanied by BTC consolidation or small gains, with a high market sentiment and a spreading money-making effect. The current market environment is more of a "false climax" in small fluctuations, not enough to kick off the Altcoin season.

Even if Altcoin prices rise temporarily during the Christmas period, it is mostly an emotional rebound and does not represent the start of a trend.

Back to the protagonist BTC, according to historical patterns, the current fluctuations and corrections are expected to end in about two weeks. It is more likely to break below the previous $90,600 liquidation long wick, and may even explore the $85,000 area.

But this is not the end of this bull market, but rather the accumulation of strength for the next round of uptrend. The master personally expects a new round of uptrend to emerge in mid-January next year.

In addition, Ethereum has performed more steadily than BTC in this downturn, and is unlikely to fall below the $3,000-$3,100 range. The probability of Ethereum outperforming BTC is increasing, and it is more like a touchstone of market confidence at this stage. And those Altcoins that have fallen ahead of time may be potential candidates in the subsequent market.

Speaking of which, Christmas is a day to expect miracles, but in the investment market, miracles have always belonged to those who have made good plans. In a market dominated by emotions, rationality is a scarce mentality. May this Christmas, our positions be as stable as green pines in the snow, and not wither like fallen leaves in the cold wind.

Master Looks at the Trend:

BTC is currently consolidating in the 94K range, with the adjustment cycle prolonged. Due to the hawkish rate cut expectations and the appearance of arbitrage selling, BTC has continued to adjust and decline. At the same time, the buying power of the US market has weakened, further leading to the formation of a premium.

Resistance Levels:

First Resistance: 95500

Second Resistance: 97800

Support Levels:

First Support: 92600

Second Support: 90800

Suggestions for Today:

Currently in the resistance area after the Double Botto formation, it may continue to maintain a range-bound oscillation trend before the trend reversal occurs. If it breaks through 95K and forms a trend breakthrough, you can look for entry opportunities in the retracement area.

If the bottom can be raised, there may be a short-term uptrend, but you need to be cautious about the potential for further adjustments brought by the resistance area.

92.6K is the high point area of the previous uptrend, and is also the current key support level. Usually, if it falls below the starting point of the previous uptrend, the probability of a downward trend will increase significantly. Currently, 92.6K is a key support area, and if this level can be maintained, the possibility of short-term rebound can be maintained.

Since the trend reversal has not yet occurred, the possibility of further decline cannot be ruled out. When the long positions reach the profit target, they should be closed in time to accumulate profits.

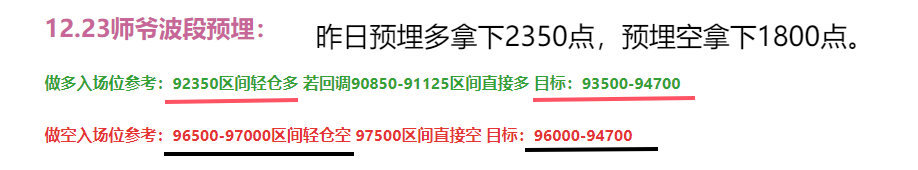

12.24 Master's Swing Trading Suggestions:

Long Entry: 92600 with light position, or directly long at the 90800 area on dips, Target: 94800-95500

Short Entry: 95500-96000 area with light position, Target: 94000-92600

The content of this article is exclusively planned and published by Master Chen (public account: Coin God Master Chen). Master Chen is the same name across all platforms. If you want to learn more about real-time investment strategies, unwinding, spot, short, medium and long-term contract trading methods, operation skills and K-line knowledge, you can join Master Chen's learning and exchange group, which has already opened a free experience group for fans and community live broadcasts and other high-quality experience projects!

Warm Reminder: The only public account (the above image) that writes this article is Master Chen. All other advertisements at the end of the article and in the comments are not related to the author! Please be careful to distinguish the true and false, thank you for reading.