Source: Research Report Review

The sky is still dark, but the skyline of Manhattan, New York, is already lit up by countless lights. The traders on Wall Street have come to the office as early as usual, but the atmosphere today is noticeably different. On the big screen, in addition to the familiar Dow Jones Index and Nasdaq Index, the price trend of Bit is jumping in real-time. This "alternative asset" once sneered at by the Wall Street elite has now become a trading target they must watch every day.

1. Trump's Crypto Bull Market and the New Wave of Funds

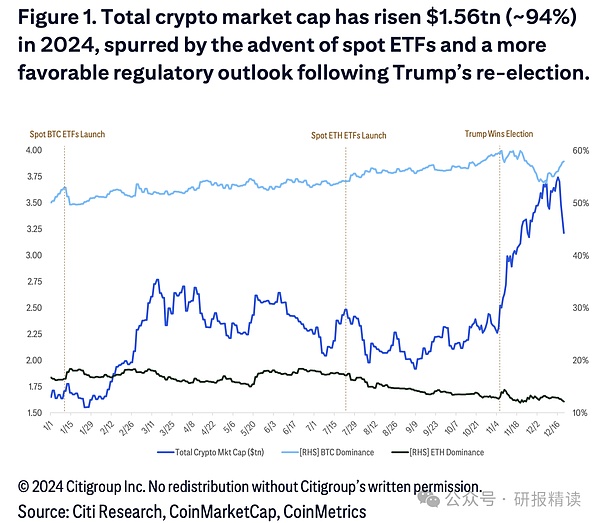

"This is the most significant change in capital flow I've seen in my 25-year career," said James Carlton, head of Morgan Stanley's digital asset division, pointing to the data screen in front of him in his Fifth Avenue office. The screen shows that in just two months since Trump's victory in the November 2024 election, more than $80 billion in institutional funds have flowed into the Crypto currency market.

The morning Bit price broke through the $100,000 mark, the entire Wall Street was boiling. But what really caught the market's attention was not the price itself, but the fundamental change in the underlying capital structure.

"In the past, the bull market was mainly driven by retail investors, but this time it's completely different," analyzed Sarah Mitchell, a senior investment strategist at BlackRock. "Now we're seeing pension funds, university endowment funds, family offices, and even sovereign wealth funds building positions. These are the 'smart money' that have never touched Crypto currencies before."

The specific data is staggering:

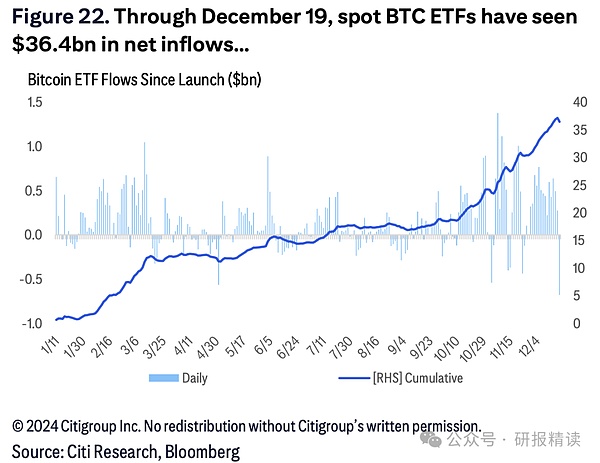

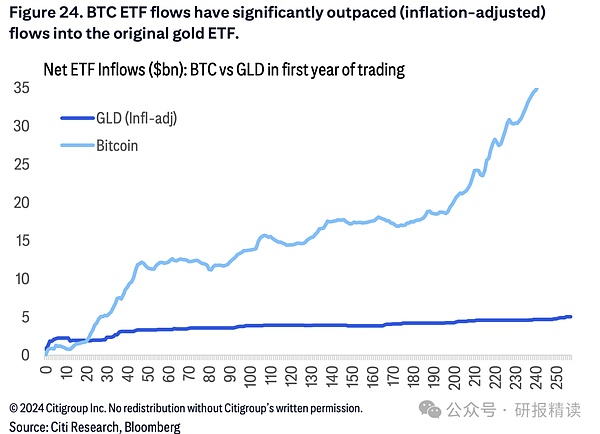

BlackRock's IBIT Bit ETF raised over $5 billion in its first month of launch, breaking the ETF issuance history record

Fidelity's digital asset division reported that more than 60% of institutional clients have started to include Crypto currencies in their asset allocation

Six of the world's top ten sovereign wealth funds have started allocating Bit, with a total allocation of over $20 billion

"The most interesting thing is the source of the funds," pointed out Tom Zhang, head of the digital asset trading department at Goldman Sachs. "According to our statistics, nearly 70% of the funds come from the traditional market, and these are truly incremental funds."

The policy orientation of the Trump administration has also injected a strong tonic into the market. The new Treasury Secretary's proposal for a "digital US dollar reserve" and the support for allocating part of national reserves to Bit have given the market hope for the official recognition of Crypto currencies.

"This reminds me of the historic moment in 1971 when the US dollar was decoupled from the gold standard," said renowned economist Professor Robert Williams. "At the time, few people realized how that decision would transform the global financial system. Today, we may be standing at another similar historical turning point."

However, behind the market's exuberance, there are also rational voices. Senior investment advisor Linda Chen warned, "Yes, the influx of institutional funds has made the market more mature, but that doesn't mean the risks have disappeared. On the contrary, we need a more professional risk management system."

2. The Crypto Regulatory Spring Breeze Blows in the US

December 18, 2024, Capitol Hill, Washington, D.C.

"The purpose of regulation is not to set limits, but to provide guidance," said the firm voice of the new SEC chairman candidate Paul Atkins echoing in the conference hall. The lawmakers below nodded frequently, a stark contrast to the hearing after the FTX incident at the end of 2022. The US regulatory environment at the end of 2024 is undergoing a profound transformation.

The turning point began in September 2024. The Treasury Department announced the establishment of the Office of Financial Innovation and appointed a distinctive leader. Sarah Mitchell, a tech finance expert who has been working in Silicon Valley for 15 years, said, "We're not here to be the 'police,' but to be the 'guides' of innovation."

On October 15, the SEC issued a landmark digital asset classification guide. This 108-page document brought unprecedented clarity to the market. A week later, the CFTC also released supporting policies, and the two major regulators reached a high degree of consensus in the digital asset field for the first time.

On November 1, the "regulatory sandbox" program was officially launched. This two-year pilot project provided a valuable experimental field for innovative companies. Of the first 25 selected companies, 18 had completed their compliance transformation by the end of the year.

Investor protection measures were fully rolled out after Thanksgiving. From December 1, all licensed exchanges must complete three safeguards:

Purchase insurance of no less than 5% of the total custodial assets

Implement cold and hot wallet separation storage

Publish monthly reserve proof audited by the Big Four accounting firms

The response from the states has also been very rapid. In the fourth quarter of 2024, the battlefield shifted to the local level:

Texas passed the "Digital Asset Innovation Act" on October 26, attracting 87 Crypto companies to register that month. The energy district in Houston overnight became the "Crypto Valley". By December, the number of companies settled exceeded 200.

On November 8, Miami completed its first Bit tax payment, and the mayor immediately announced: "By 2029, every American city will plan its digital currency future."

On December 5, the Digital Asset Association released the industry's first self-regulatory framework, which was recognized by the federal regulatory agencies. This 76-page document covers various aspects from trading rules to risk control.

International cooperation is also accelerating. On December 12, the US Treasury Department signed a "Digital Asset Regulatory Cooperation Memorandum" with seven major economic entities including the EU, Japan, and Singapore, promising to establish a unified cross-border regulatory framework by 2025.

"The changes in these three months have exceeded the total of the past three years," said Professor Emily White of Harvard University at the annual FinTech Forum on December 20.

"In the last quarter of 2024, we finally saw the arrival of the 'infrastructure era' of the digital asset market," said a senior lawyer with a vivid analogy. "It's like paving highways in the wilderness, once the road is built, the cars can run fast and steady."

3. Stablecoins Accelerate Development as a Bridge between the US Dollar and Crypto currencies

In the Crypto currency market, US dollar stablecoins are a class of digital assets pegged 1:1 to the US dollar, maintaining price stability through fiat currency reserves, over-collateralized Crypto assets, or algorithmic mechanisms. They are essentially the "digital US dollar" in the Crypto world, becoming an important bridge connecting the fiat US dollar and Crypto currencies. This unique positioning allows stablecoins to maintain the convenience and programmability of Crypto currencies, while avoiding the violent fluctuations of assets like Bit, making them an important infrastructure for the digital economy.

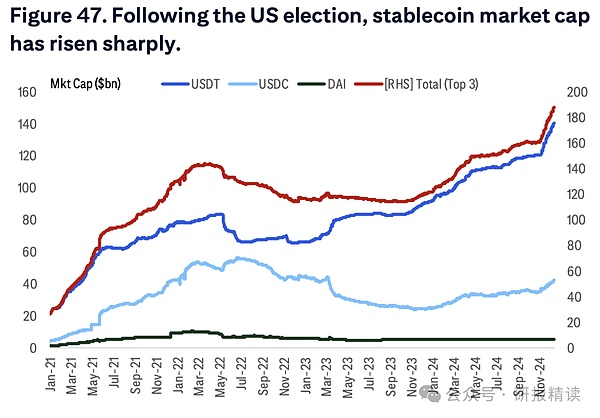

In the fourth quarter of 2024, the stablecoin market saw a transformative development. After Trump's victory, the total market value of stablecoins broke through the $200 billion mark for the first time, an increase of 13% from the previous month. Among them, USDT, USDC, and BUSD occupy a dominant position, with a combined market value of over $180 billion, providing sufficient liquidity for digital payments.

The market landscape is undergoing profound changes. The market share of the traditional leader Tether (USDT) has declined from more than 50% at the beginning of the year to 45%, while innovative stablecoins are rapidly emerging. Ethena Labs, supported by BlackRock, has launched a new stablecoin, and Ripple has released its first RLUSD, demonstrating the confidence of institutional participants in this field. These new products often adopt more transparent reserve management and stricter compliance standards, driving the entire industry towards maturity.

The expansion of the payment scenario is particularly remarkable. According to Goldman Sachs data, the transaction volume settled with stablecoins reached $10.8 trillion in 2023. Visa has collaborated with Coinbase to enable real-time account recharging, while Mastercard has partnered with Mercuryo to launch a euro crypto debit card that supports self-custodial wallets, making digital payments more integrated into daily life.

In the cross-border payment field, the cooperation between Circle and Thunes has unleashed the potential of USDC. "Stablecoins are reshaping the global payment system," said the CEO of Circle, "particularly in terms of efficiency and cost-effectiveness." This trend has been recognized by traditional payment giants, with Stripe restarting crypto payment support and acquiring the stablecoin platform Bridge, marking a re-embrace of digital assets by the payment industry.

The regulatory attitude is also turning positive. According to a JPMorgan research report, with the new US government in office, a clearer stablecoin regulatory framework is expected to be introduced. Meanwhile, countries like Singapore and Japan have begun to promote stablecoin-related legislation, injecting institutional confidence into the market.

"We are witnessing the reconstruction of the payment infrastructure," the JPMorgan analyst pointed out, "Stablecoins are transforming from a simple cryptocurrency transaction medium to an essential component of the global payment system."

4. Traditional Financial Giants Accelerate the Embrace of Cryptocurrencies

As the cryptocurrency market matures, global financial giants are embracing the digital asset space at an unprecedented pace. Traditional financial institutions represented by BlackRock, Visa, Mastercard, and Stripe are reshaping the application scenarios of crypto assets through product innovation and strategic cooperation.

In the payment field, Visa was the first to provide real-time account recharging functionality for US and European users through its strategic partnership with Coinbase. This innovation significantly improves the efficiency of fund flow - traditional ACH transfers take 3-5 business days, SEPA transfers take 2-3 business days, while Visa's solution achieves instant settlement, helping users seize market opportunities more flexibly. According to Coinspeaker data, in just one week after the US midterm elections, the crypto market saw a net inflow of $2.2 billion, and the annual inflow has already exceeded $33 billion in 2024.

Mastercard has partnered with Mercuryo to launch a euro crypto debit card that supports self-custodial wallets, allowing users to directly use cryptocurrencies to consume at over 100 million Mastercard merchants worldwide. This innovative solution has addressed the "liquidity" problem of cryptocurrencies and lowered the user threshold. The global transaction volume using cryptocurrencies for payments has reached $10.8 billion in 2023, demonstrating the enormous market potential.

Payment giant Stripe has restarted its crypto payment business after a 6-year hiatus and spent $1.1 billion to acquire the stablecoin platform Bridge, demonstrating its confidence in the future of crypto payments. The new feature supports enterprises to accept USDC payments from more than 150 countries, with a single transaction limit of $10,000 and a monthly limit of $100,000.

"This is not just simple product innovation," a Citibank analyst pointed out, "Traditional financial institutions are building an ecosystem that deeply integrates crypto assets with the existing financial system. They no longer see cryptocurrencies as a threat, but as an opportunity to expand their business boundaries."

This transformation has received a positive market response. Since Trump's election, nearly $10 billion has flowed into US Bitcoin ETFs, driving the total assets of related products to around $113 billion. ETF products issued by institutions like BlackRock have performed particularly well, demonstrating investors' trust in well-known financial institutions.

"We are at a turning point," JPMorgan said in its latest research report, "The entry of traditional financial institutions not only brings capital and credibility, but more importantly, it brings professional risk management systems and mature operational experience, which are crucial for the long-term healthy development of the entire industry."

5. How to Rationally Incorporate Cryptocurrencies into Asset Allocation Strategies

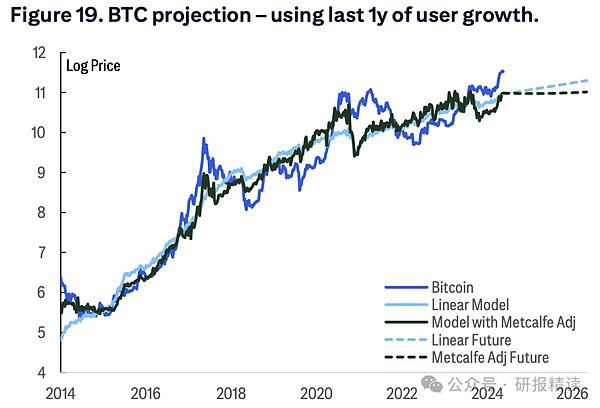

Bit's long-term investment performance is remarkable. Data shows that Bit's annualized return rate reaches 75.6%, not only significantly outperforming the 11.6% of the S&P 500 index, but also surpassing the 73.5% of the technology stock leader NVIDIA. This remarkable excess return has made it a focus of investor attention.

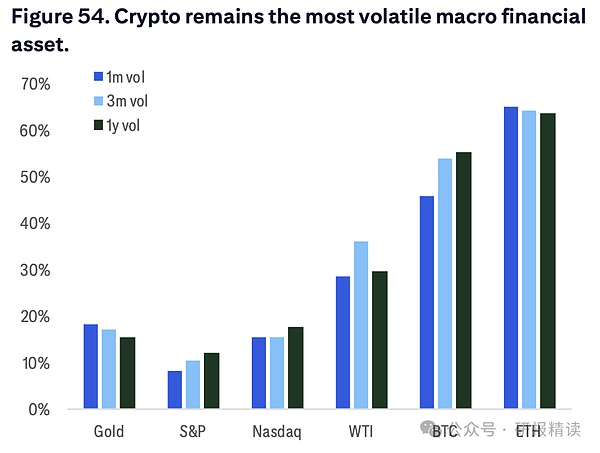

However, high returns come with significant volatility risks. Bit's annualized volatility is as high as 57.9%, far exceeding the 11.6% of the S&P 500. Since its inception in 2009, the Bit market has experienced multiple sharp corrections of 70% to 80%. This violent fluctuation reminds investors that while pursuing high returns, they must pay full attention to risk management.

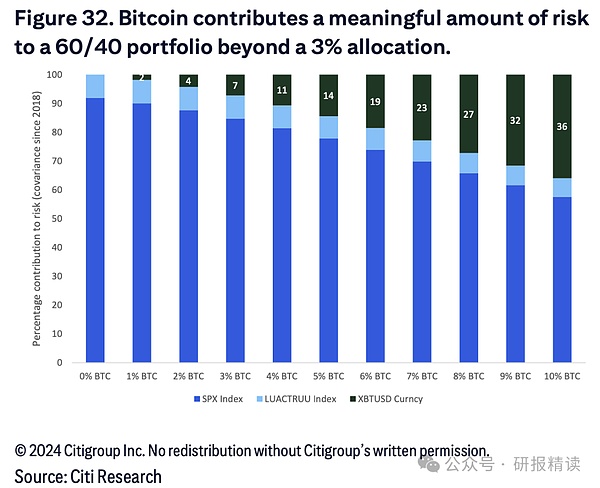

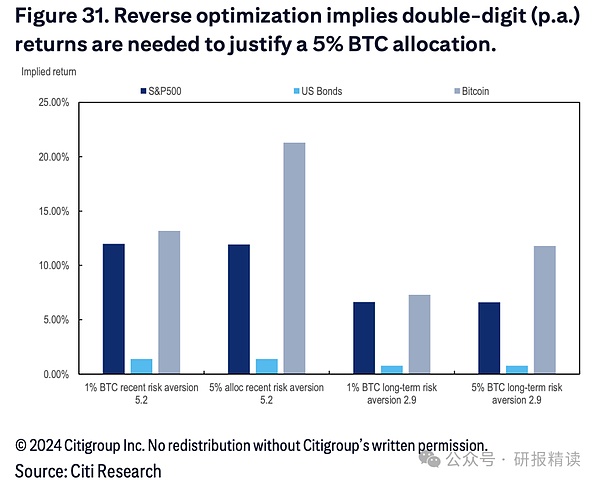

Faced with this risk-return characteristic, the BlackRock Investment Research Institute has provided practical allocation recommendations for institutional investors. The research shows that allocating 1% to 2% of Bit in a traditional 60/40 stock-bond portfolio is a "reasonable range", which can capture investment opportunities while effectively controlling risks. If the allocation exceeds 2%, the overall risk level of the investment portfolio will increase significantly - for example, a 5% Bit allocation will cause the risk contribution to rise from 0% to over 10%, and a 10% allocation will lead to a volatility contribution of up to 36%.

The launch of Bit ETFs has provided a more convenient channel for institutional investors to allocate. Since Trump's election victory, nearly $10 billion has flowed into US Bit ETFs, with the total asset size reaching around $113 billion. ETF products not only offer higher liquidity and lower operational thresholds, but also provide a standardized tool for introducing Bit exposure into traditional investment portfolios.

More notably, traditional pension funds have begun to cautiously experiment with Bit investments. The Australian pension giant AMP has first allocated about 0.5% of its total pension assets (about $17.2 million) to Bit futures through its dynamic asset allocation plan. AMP's Chief Investment Officer Anna Shelley pointed out that this decision reflects the "structural changes" in the digital asset industry, especially as mainstream asset management institutions have launched ETF products, the acceptance of crypto assets by institutional investors has significantly improved.

"We are witnessing the evolution of investment philosophy," the JPMorgan analyst said, "Crypto assets are transforming from speculative tools to important options for asset allocation. But the key to success is to maintain prudence and restraint, and treat it as a complementary element in a larger investment portfolio."

"Investors need to establish a dynamic risk management framework," JPMorgan emphasized, "While enjoying the diversification benefits brought by crypto assets, risk control must always be the top priority. The determination of the allocation ratio must be based on the investor's risk tolerance and investment objectives, rather than simply pursuing short-term returns."