Since LINK in 17 and PYTH in 23, the market finally has a new oracle project that is about to launch its token, led by Ethereum veteran developer Jakub, with investment support from Coinbase and Kraken, and as the sole on-chain pricing partner of Babylon.

After 3 years, how is the potential of RedStone? This article will review it, and the following is the thread.

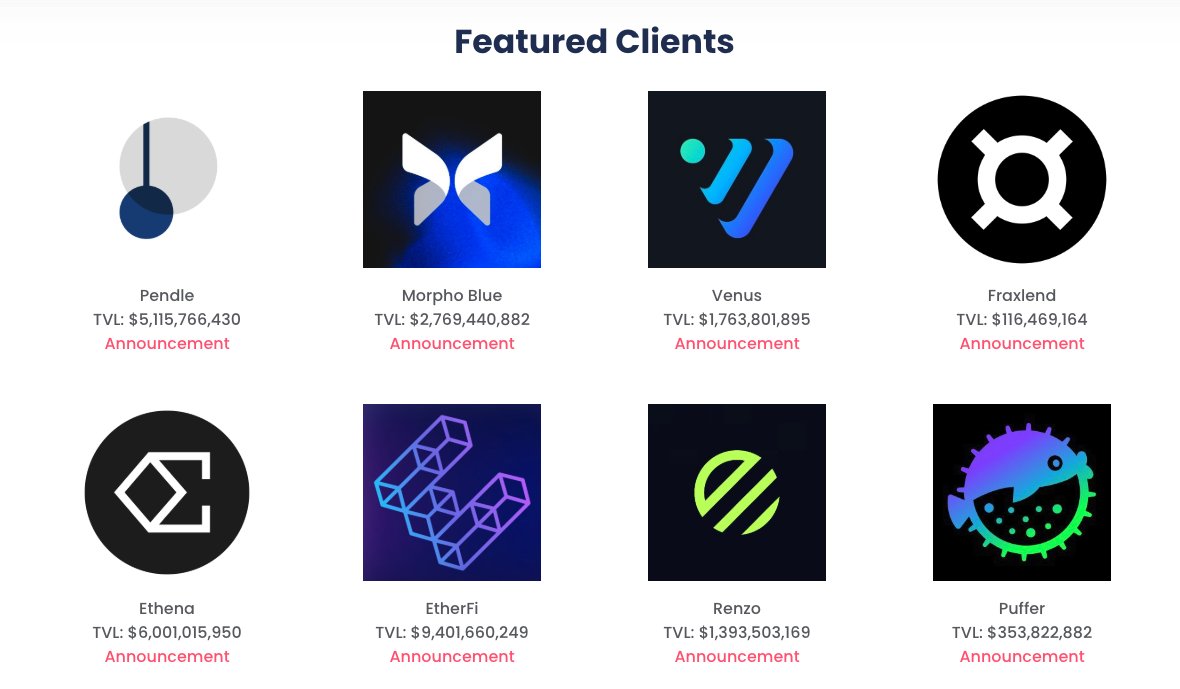

RedStone is a cross-chain oracle using Arweave technology, and is the fastest growing project in the same track this year. It mainly focuses on liquidity staking LST, reStaking, and on-chain pricing and support for the Bitcoin ecosystem BTCFi. Projects like EigenLayer, EtherFi, Renzo, and Puffer are its strategic partners, and RedStone currently occupies 90% of the reStaking market share.

In simple terms, any on-chain contract that requires off-chain data, such as weather, stocks, election results, etc., needs the price feed support from oracles, which play the role of data carriers and verify the authenticity of the data.

If a project wants to obtain data, they need to pay the corresponding tokens or money to get the oracle's price feed, which provides income and token buyback incentives for the oracle project.

Recently, the relatively hot Babylon in the Bitcoin ecosystem needs to create its own Layer1 mainnet, and the mainnet requires continuous price feed service from external sources, so that the DeFi, lending or prediction projects on the mainnet can have a reference price source. Therefore, RedStone became the first oracle project to provide price feed for a mainnet in the Bitcoin ecosystem, enabling Babylon to successfully launch its Bitcoin staking mainnet.

Currently, in addition to supporting ReStaking and BTCFi, RedStone is also building price feed oracles for Monad and Berachain, which will be available for use after the mainnets of these two public chains are launched.

The team will soon launch on Sui to support price feed for the Move-based infrastructure, and may also expand to public chains like Solana and Aptos.

In terms of the team, RedStone was founded by Ethereum veteran developer Jakub, who was previously the CTO of the Ethereum non-profit project Alice, which had been running for 4 years since 16. Its major investors include Coinbase, 1kx, Kraken, The Graph (GRT token), and Arweave (AR).

In terms of market capitalization estimation, according to information from VC peers, the token is expected to be launched in early 25, and the team has submitted listing applications to exchanges. The latest valuation is around hundreds of millions of dollars, and referring to the competitor Pyth that launched in 23, the expected opening market cap is over $2 billion.

Coinbase, Kraken, Upbit or Bithumb have relatively certain opportunities for the initial listing.

Looking at the team's moves in the past half year, as the long-standing leader Chainlink has been leading the oracle track for years, RedStone has mainly focused on emerging tracks, such as being the first to support BTCFi, and promptly cooperating with various Move public chains and reStaking protocols. Considering the upcoming token launch and the future market rhythm, with policy relaxation and the return of DeFi, RedStone has great market potential.