The US stock market last night rose across the board, driven by the strong performance of large-cap stocks and tech stocks. Data shows that the Dow Jones Industrial Average rose 0.91%, the Nasdaq and S&P 500 indices rose 1.35% and 1.1% respectively, shaking off the negative impact of weaker-than-expected US consumer confidence data and the Federal Reserve's slower pace of rate cuts.

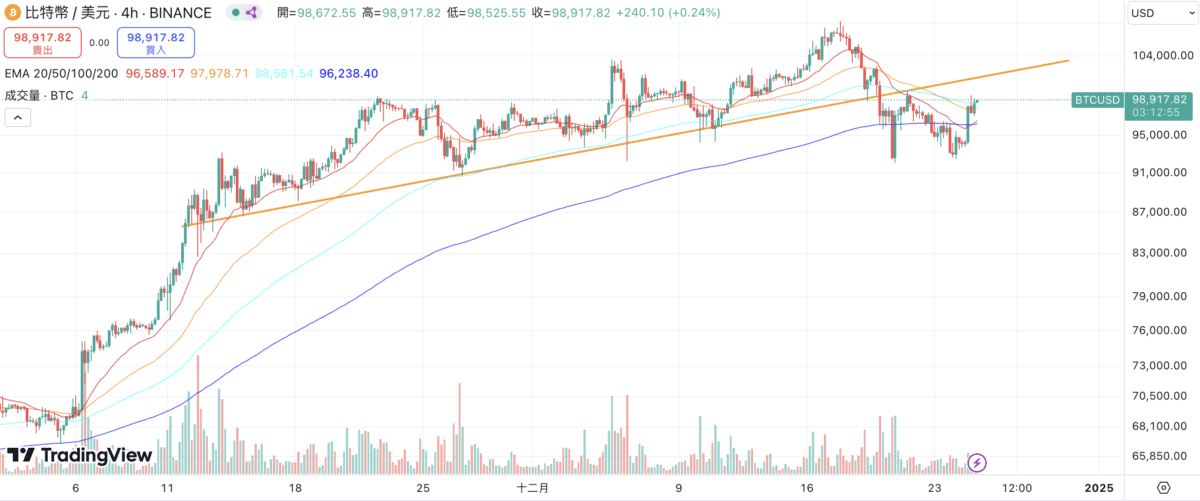

At the same time, Bitcoin suddenly turned from a shaky trend to a strong rebound from 8pm in the evening, rising more than 4% in four hours, reaching a high of $99,480 this morning.

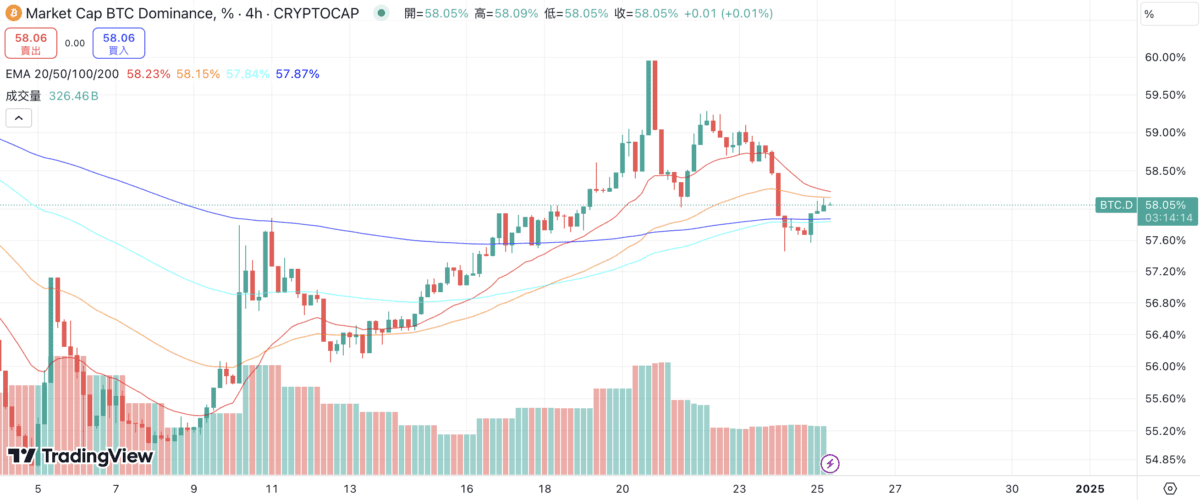

It is worth noting that this upward trend in sync with traditional finance is often mainly reflected in Bit rather than other Altcoins, as can be seen from the changes in Bit's market share, this rebound is mainly driven by Bit, while the upward momentum of other Altcoins is not as strong as the previous day.

However, it should be emphasized that it is currently the Christmas season, and the overall market liquidity will be weaker than usual, so investors still need to be cautious in controlling the risk of violent fluctuations.

(This article is reprinted with permission from GT Radar)

About GT Radar

GT Radar focuses on building a long-term, stable-growth quantitative investment portfolio, with over 10 years of stock and cryptocurrency quantitative trading experience. The trading system integrates over 150 strategies, aiming to provide high adaptability and flexibility to ensure the most stable way to profit from the market.