After the pullback before Christmas, Bitcoin (BTC) finally saw a rebound, with the price breaking through the $98,000 mark, bringing a "green Christmas gift" to global Bitcoin bulls.

On December 24, as Wall Street opened, the price of Bitcoin, driven by strong spot buying, broke through the psychological barrier of $98,000, reaching a high of $99,487.

TradingView data shows that Bitcoin hit a new high of $98,020, refreshing its recent trading record. With Bitcoin's price rising by more than $5,000, the Christmas gathering discussions in the market have heated up again, and investors are starting to focus on the future trend.

Behind this rebound, the strong spot buying in the market played a decisive role. The well-known X account Exitpump expressed optimism about this trend, believing that Bitcoin could see a "Christmas rebound". He said: "BTC spot buyers are pouring in, LFG!" and accompanied it with a chart showing exchange order data, further verifying the current buying pressure in the market.

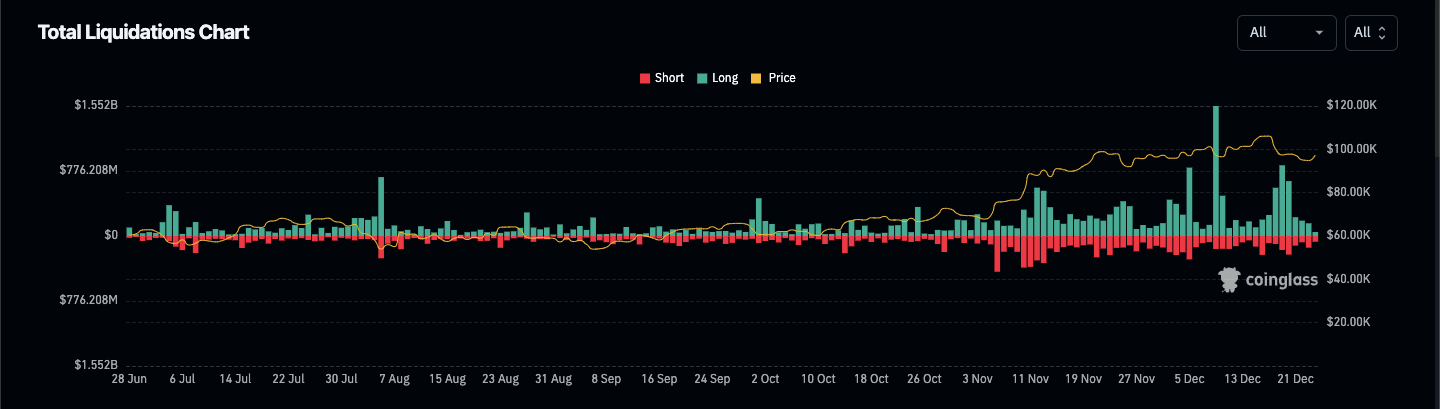

According to the latest data from CoinGlass, in the past 24 hours, the amount of BTC shorts that were forcibly liquidated was close to $40 million, and the total liquidation amount in the crypto market exceeded $150 million. This large-scale liquidation phenomenon also means that the bearish sentiment in the market is gradually subsiding, and more investors are starting to turn to a bullish sentiment.

Technical Analysis: The Next Key Resistance Level is at $98,500

From a technical perspective, after breaking through $98,000, Bitcoin is facing a key resistance level. We have already broken through the first VWAP resistance level (green arrow). If we can break through the $98,500 key resistance, Bitcoin is expected to break through the historical high and continue to rise.

The chart also shows that the Coinbase premium has rebounded, reflecting the gradually increasing buying pressure during the US trading session. With the rebound in premium, the market's optimistic sentiment is also accumulating, further supporting the upward momentum.

Analyst Perspective: Cautiously Optimistic, Need to Watch for Potential Risks

Although the overall market sentiment is leaning towards optimism, some analysts have also raised cautionary voices. The well-known trader Rekt Capital pointed out in his latest X report that although Bitcoin has shown signs of rebound, the changes in support levels still need to be closely watched. He said: "Yesterday, Bitcoin rebounded but the price almost fell to a new low. Today, Bitcoin rebounded again and returned to the original support level. Overall, as long as the lost support level becomes a new resistance level, there may still be further downside risks."

He further added that if Bitcoin can regain the previously lost support levels, that would be a significant bullish signal, and the market may see further upside.

Market Outlook: Potential for a Breakthrough Uptrend

Despite certain downside risks, in the current market environment, Bitcoin's rebound seems to be accumulating more upward momentum. If Bitcoin can break through the $98,500 resistance level and stabilize above this price level, the market may see a strong uptrend. With the intensification of short liquidations and the continued buying in the spot market, Bitcoin is expected to see a breakthrough uptrend in early 2024.

In the coming days, the market will continue to focus on whether Bitcoin can break through this key technical level. If successful, the breakthrough of the historical high may be imminent, and the investment sentiment in the market will also be further heated up.