Author: Jessy, Jinse Finance

As the regulation of virtual currencies in the United States becomes clearer, DeFi has also become one of the main themes of this bull market.

At present, the DeFi under US regulation that people are talking about is more about the RWA (Real-World Assets) on-chain, stablecoins, and PayFi, etc. These practices are generally built on Ethereum and its Layer 2, or some high-performance new public chains. The relationship between all this and Bitcoin seems to be only the wrapped Bitcoin, participating in on-chain financial activities.

In order to change the embarrassing situation where only wrapped Bitcoin could participate in on-chain finance, BTCFi emerged, the so-called BTCFi is a financial service platform and protocol built around Bitcoin and its ecosystem, combining decentralized finance technology, allowing the financial function of Bitcoin to be expanded.

Specifically, this allows Bitcoin itself to participate in on-chain financial activities, and the originally barren Bitcoin smart contract functionality has been enhanced. There are also centralized exchanges, over-collateralized stablecoins, and re-staking and other more complex DeFi protocols on the Bitcoin ecosystem. In addition to BTC itself, some BTC ecosystem-related assets, such as Ordinals, Runes, and RGB++, have also participated in DeFi-related activities.

According to DeFiLlama data, the current total TVL of BTC is $6.545 billion, while the total TVL of Solana is $8.297 billion and the total TVL of Ethereum is $68.31 billion. It can be seen that BTCFi is currently a blue ocean with relatively high development potential.

Currently, projects like Babylon have emerged in the BTCFi space, which mainly introduce Bitcoin staking protocols, allowing users to stake Bitcoin to another PoS blockchain and earn rewards without using third-party custody, bridge solutions or wrapping services. Besides, what other projects are worth paying attention to?

Overall Development of BTCFi

According to DeFiLlama data, the total TVL of the representative BTCFi project Babylon has exceeded $5 billion. Lending and re-staking protocols are the two core components of the BTCFi ecosystem, occupying the largest market share.

BTCFi Protocol TVL Ranking (Data as of December 24, 2024)

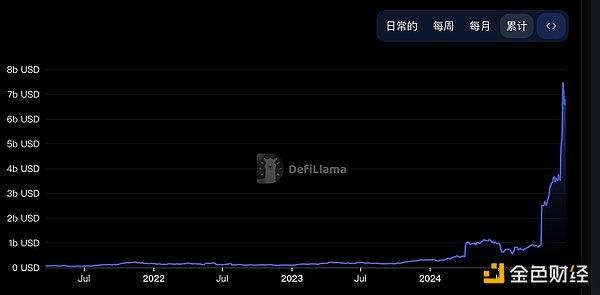

According to DeFiLlama's forecast, the BTCFi market size will grow to around $1.2 trillion by 2030. This year has been a year of rapid development for the BTC ecosystem. The overall TVL of BTC increased from $300 million at the beginning of 2024 to $6.5 billion at the end of 2024, an increase of more than 20 times.

In the BTCFi track, lending protocols are one of the most important applications. Traditionally, Bitcoin as a digital asset has not participated in the lending market. However, BTCFi protocols allow Bitcoin to be used as collateral for decentralized lending. Typical projects include Liquidium and Shell Finance.

Then there are stablecoin protocols. The stablecoin protocols in BTCFi use Bitcoin and its derivative assets (such as Ordinals and Rune) as collateral to issue stablecoins pegged to the price of Bitcoin. In stablecoins, there are projects like the Bitcoin-pegged stablecoin of Shell Finance and the Bitcoin-collateralized stablecoin of Babylon.

The re-staking mechanism is also an innovation in the current BTCFi ecosystem. This year, these projects have also achieved considerable success in terms of locked-in volume. There are quite a few re-staking protocols in the BTCFi ecosystem. Users can re-stake the Bitcoin or other cryptocurrencies they have already staked to obtain additional rewards, such as BounceBit and the Lombard Protocol in the Babylon ecosystem.

Introduction to Top BTCFi Projects

Babylon

When it comes to BTCFi, Babylon is definitely a project that cannot be ignored. It is the industry's first project to introduce Bitcoin's own standard Staking. Its essence is a staking, security, and liquidity protocol.

The main innovation lies in the introduction of Bitcoin's own standard Staking, through technical upgrades of Bitcoin improvement proposals, such as Schnorr signatures, Taproot upgrades, and Tapscript updates, to improve the efficiency and privacy of Staking transactions, allowing Bitcoin holders to lock their BTC assets on the Bitcoin mainnet in a self-custodial manner through scripted contracts, and output "secure consensus services" on many BTC layer2s, thereby obtaining rich rewards from other extended services.

Currently, the TVL exceeds $5 billion, and it has a rich ecosystem. According to public information, its ecosystem projects cover 7 categories, including Layer2, DeFi, liquidity staking, wallets and custodians, Cosmos, finality providers, and Rollup infrastructure, with a total of 91 projects, including many well-known projects such as BisonLabs and BSquared Network in the Layer2 field, Kina Finance and LayerBank in the DeFi field, and Bedrock, Chakra, and Lombard in the liquidity staking field. These projects have formed a huge ecosystem around Babylon, promoting the diversified development of the Bitcoin ecosystem.

Shell Finance

It is the first decentralized lending and stablecoin protocol built on the Bitcoin layer. Its goal is to provide decentralized lending and stablecoin protocols for the Bitcoin ecosystem, allowing Bitcoin and related asset holders to manage their assets and obtain liquidity more flexibly.

One of its core functions is the lending service, where users can use Bitcoin, Ordinals NFTs, BRC-20, Runes, and other Bitcoin ecosystem assets as collateral to borrow a synthetic asset called BTCX, without the need for third-party trust, through a unique peer-to-protocol lending mechanism, and Shell Finance acts as the counterparty to the borrower. Unlike traditional lending protocols, Shell Finance charges a one-time loan fee from the borrower instead of continuously charging interest through a floating rate, realizing interest-free instant lending and providing a unique earning opportunity for Ordinals holders.

The second core function is stablecoin issuance. Shell Finance is the first decentralized stablecoin protocol on the BTC mainnet. Users can obtain stablecoins by collateralizing the aforementioned Bitcoin ecosystem assets. The launch of this stablecoin has improved the liquidity of BTC layer1 assets and laid the foundation for the development of BTCFi. In the future, it will also expand to Bitcoin Fractal and other UTXO model networks to further expand its use cases.

Technically, it adopts Discreet Log Contracts (DLC) technology and PSBT technology. The former, proposed by Tad Gredryja, a co-creator of the Bitcoin Lightning Network, can make the contract execution process more private, secure, and fully automated, such as automatically liquidating when the collateral asset value falls below the critical point to repay the loan.

On December 4, 2024, the Shell Finance mainnet was launched.

Liquidium

It is a Bitcoin blockchain-based ordinal lending platform that allows users to borrow and lend native Bitcoin using native ordinals as collateral, eliminating the need for intermediaries or custodians.

The product supports multiple collateral types, not only supporting Bitcoin Ordinals as collateral, but also plans to support BRC-20 tokens and other assets, providing users with more choices and further expanding the application scenarios of Bitcoin assets.

Technically, it is based on the Bitcoin network, and all lending operations are directly on the Bitcoin first-layer network. The project token LIQUIDIUM was launched on July 22, 2024, which is the first governance token of the Ordinal token standard on Bitcoin. The token aims to decentralize the Liquidium protocol and promote community participation in its governance.

BitSmiley

The project has three main components. The first is the over-collateralized stablecoin protocol bitUSD, which is pegged to DAI, where users can mint bitUSD stablecoins by over-collateralizing native BTC in the bitSmiley Treasury.

The second is the native decentralized lending protocol bitLending, which adopts a peer-to-peer atomic swap technology to achieve transaction matching, and also introduces an insurance system to optimize the shortcomings of the traditional lending liquidation process.

The third is the innovative derivative protocol Credit Default Swaps (CDS), which is essentially a risk transfer tool. On the BitSmiley platform, one party (usually the party concerned about the risk of debt default) pays a certain fee to another party (the party willing to take on the risk to obtain a certain return) on a regular basis, similar to an insurance premium. If the agreed underlying debt (such as the debt situation arising from related Bitcoin ecosystem asset lending, etc.) defaults, the party bearing the risk will have to compensate the party paying the fee according to the agreement, in order to manage and hedge the risk of debt default. In operation, it integrates NFT slicing of CDS, using aggregated bidding to improve market efficiency and fairness.

Currently, its token SMILE has been listed on multiple exchanges such as Bybit, Gate.io, Bitget, and Matcha.

Chakra

A Bitcoin re-staking protocol, with the following technical innovations: The first is self-custody staking, through time-locked scripts, Bitcoin holders can stake their assets without transferring them out of their own wallets, avoiding third-party risks, following the "not your keys, not your coins" principle, and ensuring asset security. The second is the use of zero-knowledge proof technology, specifically using Stark to implement the proof system. The Bitcoin staking event is verified off-chain through zero-knowledge proof to access on-chain information, without the need to connect to the Bitcoin network and without the need for a trusted setup, which enhances security compared to Snark.

By integrating decentralized Bitcoin liquidity, Chakra provides a more secure and smooth settlement experience. Users can easily one-click stake Bitcoin and participate in more liquidity mining opportunities, including the LST/LRT projects in the Babylon ecosystem, through Chakra's advanced settlement network.

Solv Protocol

A Bitcoin staking protocol, the core highlight of which is to cooperate with leading protocols in various ecosystems to provide diverse yield scenarios.

The project's SolvBTC is the first BTC product that allows self-generated yields. By staking, it creates a safe base yield for the Bitcoin that is originally idle in the user's wallet. SolvBTC captures staking rewards from the BTC Layer2, restaking rewards, and DeFi yields from the ETH Layer2, and seamlessly integrates with various protocols at the application layer, providing Bitcoin holders with rich yield opportunities, with yields generated through staking, restaking, and trading strategy rewards.

We can understand it as a unified Bitcoin liquidity matrix, aiming to unify the decentralized trillion-dollar Bitcoin liquidity through SolvBTC. It is equivalent to a Bitcoin asset yield aggregator, no matter BTCB, FBTC, MBTC... different on-chain BTC assets can be minted into SolvBTC, simplifying the user's asset management experience.

This also integrates the liquidity opportunities of different Bitcoin assets, with one SolvBTC traversing the chain to form a unified asset pool, bringing more diversified yield opportunities for holders.

Bedrock

Bedrock is a multi-asset liquidity re-staking protocol.

In the BTCFi area, it uses the uniBTC supported by Babylon for re-staking, and in the Babylon War, Bedrock performed outstandingly, successfully grabbing 297.8 BTC of staking quota, accounting for nearly 30% of Babylon's initial total staking amount.

Users of this product can stake their wBTC on the ETH chain to Babylon, and after staking their wBTC, they will receive a 1:1 certificate - uniBTC, and users' uniBTC can be redeemed for wBTC at any time. Babylon provides core technical support in the middle. Users who stake wBTC and hold uniBTC can receive Bedrock and Babylon points. By cooperating with uniBTC and Babylon, Bedrock provides liquidity staking services to support Babylon's PoS chain. By minting uniBTC, it ensures the stability and security of the Babylon chain, and further expands Bedrock's products to the BTC chain.

Bouncebit

Committed to creating a yield infrastructure for Bitcoin, providing institutional-grade yield products, re-staking application scenarios, and CeDeFi services, its specific business includes:

Bouncebit Protocol: Users deposit BTC and other assets and can receive the corresponding Liquid Custody Token, with the assets managed on the Binance platform through a multi-party computed secure custody account and mirroring mechanism, generating yields to be returned to users.

Bouncebit Chain: A Layer1 blockchain compatible with the Ethereum Virtual Machine and using a proof-of-stake delegation consensus mechanism, where users can delegate tokens to validator nodes for staking and use the staking proof in the on-chain DApps.

Share Security Client: Its logic is consistent with Eigenlayer, allowing the security of the Bouncebit Chain to be rented out to provide support for applications such as Bridges, Oracles, and Sidechains.

Bouncebit will be launched in early 2024, with a total of $7.98 million in funding. In May 2024, its native token BB will be listed on Binance.

Lorenzo protocol

A modular Bitcoin L2 infrastructure based on Babylon, aimed at providing a Bitcoin liquidity finance layer.

Through Babylon's Bitcoin staking and timestamping protocols, it lays the foundation for scalable and high-performance Bitcoin application layers, enhancing Bitcoin's scalability and enabling the execution of smart contracts.

The project has an innovative token system, including liquidity principal tokens (LPT, such as stBTC) and yield accumulation tokens (YAT). stBTC is 1:1 pegged to the staked BTC, unifying the BTC liquidity of different ecosystems, and holders can redeem the principal after the staking ends; YAT has its own restaking plan with a start and end time, can be traded and transferred before maturity, and holders can receive PoS chain rewards, and YATs of the same staking plan can also be exchanged, with their value coming from accumulated yields and speculation on future yields.

The project supports various staking methods, such as circular and leveraged staking. Circular staking utilizes external DEX partnerships to allow users to stake BTC, borrow more BTC, and increase staking rewards; leveraged staking simplifies the process by providing internal liquidity, allowing users to apply maximum leverage with a single click, improving capital efficiency and optimizing staking yields.

Current Problems in BTCFi

The projects in this track are not few, and the total TVL has also experienced explosive growth in 2024, but the BTCFi track itself has not yet really triggered a wave in the industry.

Currently, the development of this track still faces quite a few problems, the most core of which is that the Bitcoin community itself often fails to reach a consensus on some technical upgrades and innovative solutions, which leads to the difficulty in promoting Bitcoin ecosystem-related projects.

At the technical level, there are also significant challenges, first of all the lack of block expansion scalability of Bitcoin itself, which cannot achieve automated financial transactions and complex business logic like Ethereum. Moreover, the interoperability between Bitcoin and other blockchains is limited, and most solutions rely on centralized institutions to achieve cross-chain interaction.

In addition, the transaction fees of BTCFi projects are also relatively high, which greatly increases the cost of participants, such as the high transaction fees exposed in the staking process of Babylon, including the FOMO effect leading to soaring miner fees, as well as the high fees for unlocking and withdrawing after staking.

Insufficient liquidity is also a common problem in this track. On the one hand, the liquidity risk of Wrapped BTC versions still exists, as in the Babylon protocol, the liquidity of the Wrapped BTC provided by the participating nodes is not fully matched with the aggregated native BTC, and it relies on the credibility of each aggregation platform to maintain. On the other hand, the liquidity provision methods for Bitcoin staking and lending activities are relatively single, mainly relying on capital lending, and a diversified and efficient liquidity provision mechanism like the traditional financial market has not yet been formed.

It is in this context that the total locked value of BTCFi projects is still relatively small compared to mainstream public chains like Ethereum, and the market acceptance and participation is not high, facing great challenges in development and promotion.

Looking to the Future

Currently, exchanges such as Binance and OKX have cooperated with Babylon, Chakra, Bedrock, B², Solv Protocol and other projects to carry out a series of pre-staking, farming and other activities, and users can obtain very high returns by participating, which is also a very convenient way for ordinary users to participate in BTCFi.

Looking at the projects mentioned above, it can be seen that the current BTCFi ecosystem, in addition to BTC itself, already has a rich variety of asset types participating in BTCFI. For example, first-layer assets based on BTC such as Ordinals and Runes; second-layer assets based on the BTC network such as rgb++ and Taproot Asset; wrap/stake assets such as WBTC on the ETH chain and various certificates representing staked BTC such as LST or LRT. These assets have expanded the liquidity of BTCFi and made the scenarios of BTCFi more and more abundant.

Looking to the future, as technology develops, Layer2 technology will continue to evolve and improve, and solutions such as Rollups will become more mature, bringing a significant increase in Bitcoin's transaction processing capability.

With the emergence of reliable cross-chain bridges, the safe and efficient transfer and interaction of assets between Bitcoin and other blockchain networks will be enabled. Bitcoin will be able to participate more widely in DeFi applications on different chains.

With the help of solutions such as rsk, avm, and bitvm, the smart contract functionality of Bitcoin will be enhanced, enabling more complex financial business logic and applications.

The progress of these technologies will provide stronger technical support for decentralized financial services in the Bitcoin ecosystem, realizing more flexible staking, lending, derivative trading, and other financial products.

With the revival of DeFi, we may see the connection between BTCFi and traditional finance becoming closer, as the application of stablecoins in the BTCFi ecosystem will continue to expand, providing more efficient and low-cost solutions for cross-border payments and international trade. For example, the usdi stablecoin supported by rgb++, with its 1:1 US dollar peg and AML/KYC compliance requirements, has become an important tool in the international payment field and is expected to be widely deployed in global cross-border e-commerce and international settlement scenarios in the future, which will drive the widespread application of Bitcoin in the global financial system.