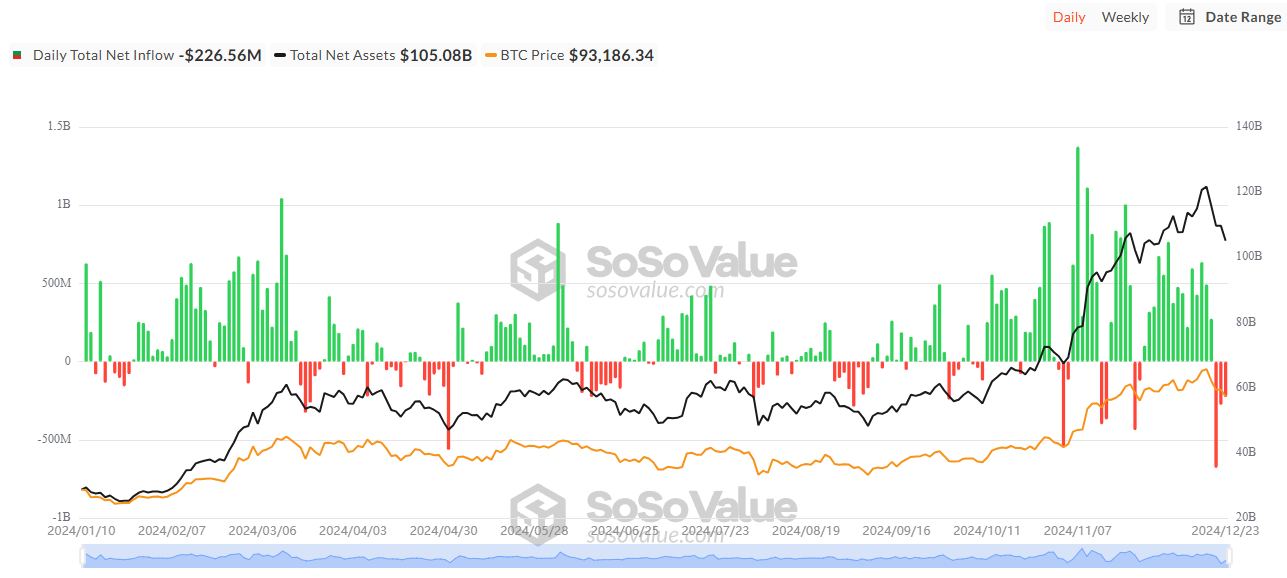

Bitcoin ETFs in the US recorded outflows for 3 consecutive days ahead of Christmas. These ETFs also set a single-day outflow record, temporarily weakening the upward momentum of Bitcoin.

Meanwhile, the US Ethereum ETF showed positive inflows, signaling a positive trend.

Bitcoin ETFs See 3 Consecutive Days of Net Outflows

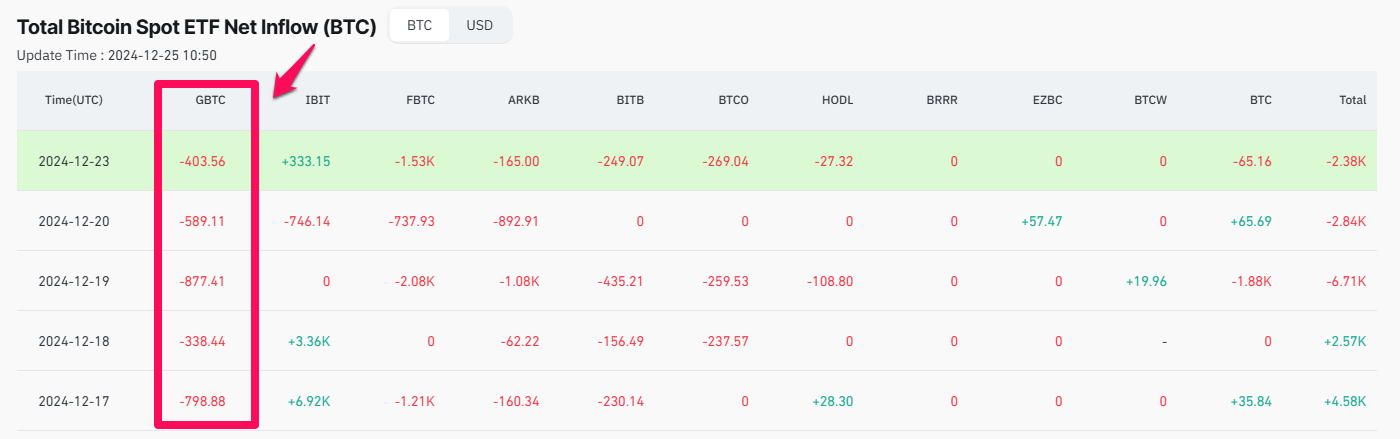

According to data from SoSoValue, Bitcoin ETFs experienced around $1.2 billion in outflows over the past 3 trading days. Particularly on December 19, there was an outflow of $680 million, the highest single-day outflow since the approval of Bitcoin ETFs.

"These large outflows raise questions about whether this is simply profit-taking or a structural shift in capital. At the moment, profit-taking seems the most likely, but it's worth watching to see how market sentiment and institutional moves play out," investor Antonio Zennaro commented.

Previously, Bitcoin ETFs had recorded 15 consecutive days of net inflows, increasing their total net assets from $100 billion to $121 billion. However, the recent 3 days of outflows have reduced the total net assets to $105 billion.

According to data from Coinglass, Grayscale's GBTC sold 1,870 BTC over the past 3 trading days, contributing significantly to the outflows, far exceeding the buying activity of BlackRock's IBIT during the same period.

Despite the 3-day negative net inflows, investor optimism for BTC remains strong. In December, Bitcoin ETFs surpassed gold ETFs in assets under management (AUM), indicating increased institutional and retail investor confidence in digital assets.

Interestingly, while funds were flowing out of Bitcoin ETFs, Ethereum ETFs saw inflows during the trading session on December 23. While Bitcoin ETFs experienced $226 million in outflows, Ethereum ETFs recorded over $130 million in inflows. Additionally, BlackRock's Ethereum ETF currently holds over 1 million ETH.

Many investors believe this could signal positive momentum for Ethereum and altcoins, especially after Ethereum's price declined from around $4,100 to nearly $3,100 in December.

"BlackRock's Ethereum ETF currently holds over 1 million ETH. This data, combined with the fact that ETH is still consolidating below its all-time high, is a signal of an altcoin season we haven't seen before," investor Dan Gambardello commented.