Source: Kaiko Research; Compiled by Deng Tong, Jinse Finance

I. The Road to $100,000 for BTC

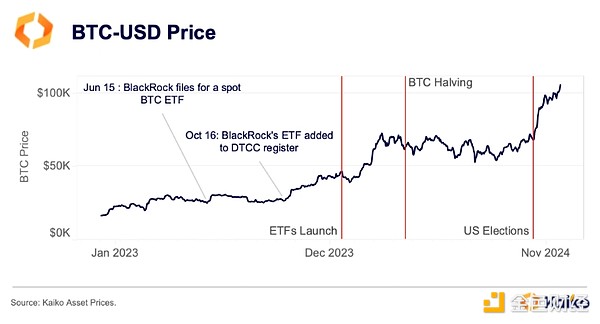

2024 was a successful year for Bitcoin. With the launch of spot BTC exchange-traded funds in January, the market gradually matured, and the fourth halving was also smoothly carried out.

Even a few billion-dollar liquidations and sell-offs could not stop BTC's success this year. The BTC price in US dollars has risen nearly 140% so far this year, with a larger increase compared to other fiat currencies (some of which experienced significant devaluation in 2019).

II. US Election Fuels Bullish Bets

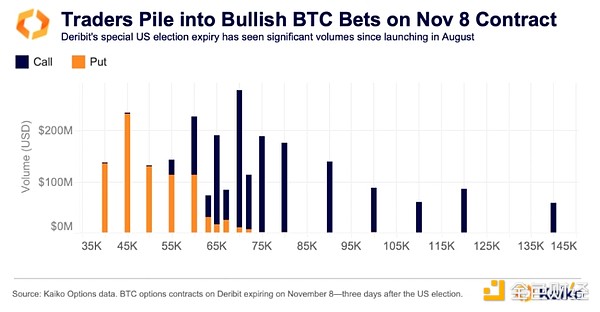

The 2024 US presidential election is of great significance for cryptocurrencies. Bitcoin or digital assets have never received so much attention on the world stage - at least not with such positive attention.

President Trump expressed support for gradual regulation and open dialogue with the industry in the summer. Shortly after an attempt was made on his life, he even appeared at the Bitcoin Nashville conference. Most of the crypto community rallied around the Republican candidate and the eventual Democratic nominee Kamala Harris, starting to take some positive steps on cryptocurrencies.

Before the November 5th election, there was a "Trump trade" market sentiment for Bitcoin. A special election contract on Deribit attracted billions of dollars in trading volume and open interest before the election, and traders betting on a historic high soon after the election showed a significant bullish bias. They were right, as by November BTC had exceeded $75,000.

The overall Senate vote and the final vote outcome were widely seen as favorable for cryptocurrencies. As a result, BTC led the post-election rally in crypto assets, breaking through $80,000 by November 11th.

As we've shown above, the increasingly bullish sentiment continued from November through the rest of the year, with Bitcoin currently reaching a new all-time high above $107,000.

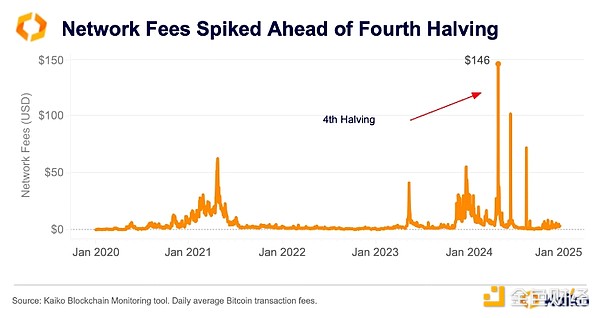

III. Soaring Fees Before Bitcoin's Fourth Halving

The fourth Bitcoin halving occurred on April 19th this year. On Saturday, the average Bitcoin transaction fee spiked to a record high of $146. This was significantly higher than Ethereum's $3 average fee that day.

The historic surge in Bitcoin network fees may be one of the most important developments in the fourth quarter. While there were warning signs, it still came as a surprise to many market participants.

Ordinals founder Casey Rodamor announced plans to launch Runes, a protocol that would make it easier to issue fungible tokens on Bitcoin. However, given the impact of Ordinals on transaction fees, users may have already anticipated the fee increase, but the historic surge still surprised many.

Ordinals allow node operators to inscribe data and images onto newly created Bitcoin blocks. These so-called "inscriptions" are similar to Non-Fungible Tokens (NFTs), increasing the demand for Bitcoin block space and raising the fees earned by BTC miners.

The launch of Runes is also expected to increase demand for block space in a similar way, affecting fees.

IV. BlackRock Surpasses Grayscale

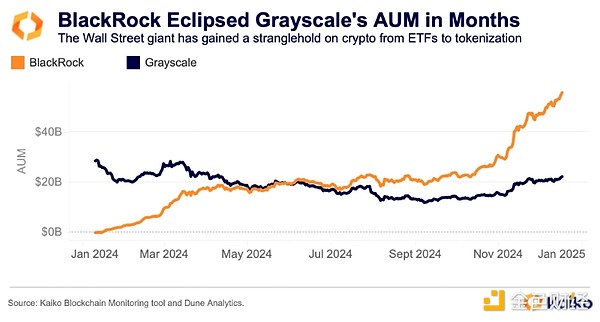

BTC ETFs broke various records this year, with the total assets under management of 11 funds exceeding $100 billion.

BlackRock is the big winner, demonstrating major institutions' interest in Bitcoin and digital assets. Its spot BTC ETF has over $55 billion in assets under management, surpassing Grayscale's GBTC within a few months. GBTC, launched by digital asset manager Grayscale in 2013, was largely a crypto-first product, and its massive premium/discount to net asset value meant limited institutional buy-in. Therefore, after the ETF launches this year, it was quickly surpassed by BlackRock.

After the company decided to maintain fees at 1.5%, GBTC has been losing assets for most of the year. In the US ETF space, companies are accustomed to low fees, so most Wall Street firms prefer BlackRock and Fidelity over GBTC.

V. The ETH/BTC Ratio Declines

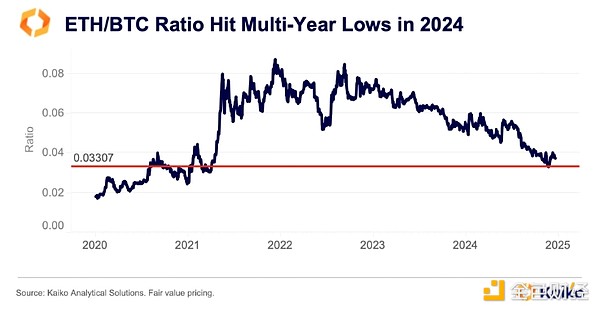

The ETH/BTC ratio has continued to decline since the Merge and showed no signs of slowing down in 2024. The ratio compares the performance of the two assets, and it declines when Ethereum underperforms Bitcoin.

Other factors contributing to the decline include the rise of Solana, as users migrated to the cheaper network during speculative activity spikes in March and the fourth quarter this year. Meme tokens (which we'll discuss later) were behind many of the speculations and drove Solana DEX trading volumes to sometimes exceed Ethereum's at times this year.

The ratio fell to 0.033 in November, the lowest level since March 2021. What's behind the underperformance? Since the Merge, ETH has faced significant regulatory pressure, as staking in the US has come under close scrutiny, angering the SEC.

VI. A Slow Start: The Launch of ETH ETFs

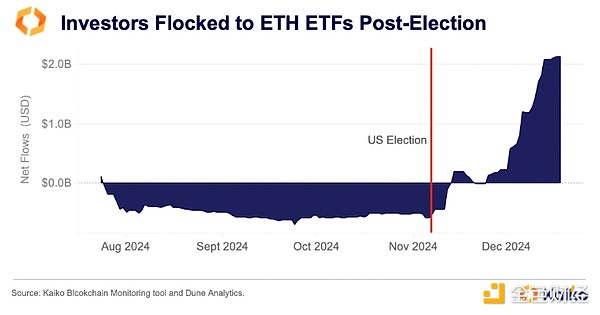

ETH ETFs have had a slow start since their launch in July. Similar to the BTC ETF launch, Grayscale's fund once again put pressure on the market, as the digital asset manager maintained fees at 2%.

However, after the outflows from Grayscale's ETHE decreased, the new funds started seeing inflows towards the end of 2024. Inflows have significantly increased since the US election in November, and traders have also flocked to CME's ETH futures. This reflects similar activity seen when traders executed arbitrage trades on BTC futures in May and June.

Increasing open interest in ETH futures, along with a changing regulatory outlook, has reversed the trend for ETH ETFs, with net flows turning positive in late November and December. Net flows since launch have now exceeded $2 billion, including over $3 billion outflows from ETHE.

ETH will be one of the biggest winners from the power shift in Washington, D.C. While it lagged behind Bitcoin this year, the regulatory changes brought about by the US government transition will greatly benefit the second-largest asset by market cap. Clarity on ETH's classification as a commodity or security, as well as staking, are likely to be two key drivers of growth next year.

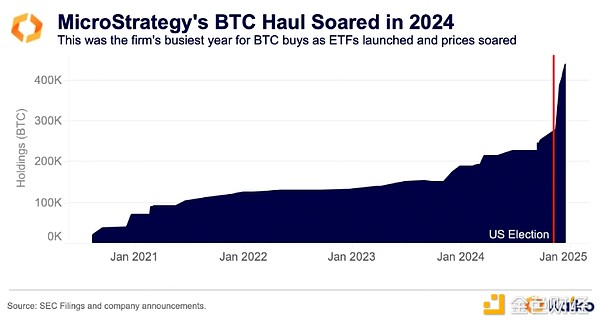

VII. MicroStrategy, the Trendsetter, Bought More BTC Than Ever

In terms of BTC purchases, MicroStrategy has had its busiest year yet. The business software company has already transformed from its core business in many ways this year. Chairman and former CEO Michael Saylor even referred to his company as the world's first "Bitcoin treasury company" in the Q3 earnings report in November.

Since January, MicroStrategy has purchased over 249,850 bitcoins, with the pace of purchases accelerating since the US election, nearly doubling its holdings in the past month. The company has issued multiple convertible bonds to fund its acquisitions, which has raised concerns among some market participants that a price crash could adversely impact the company, potentially forcing it to sell.

The current strategy is proving effective. The rapid rise in BTC prices and the bullish market sentiment have caused MSTR's value to soar to an all-time high. This is the first time MSTR has reached a new high in 24 years since the bursting of the internet bubble in March 2000.

While MicroStrategy is a pioneer in corporate Bitcoin purchases, some Republican lawmakers want the U.S. government to follow suit. Senator Cynthia Lummis has pledged to establish a strategic Bitcoin reserve if Donald Trump wins the U.S. presidential election.

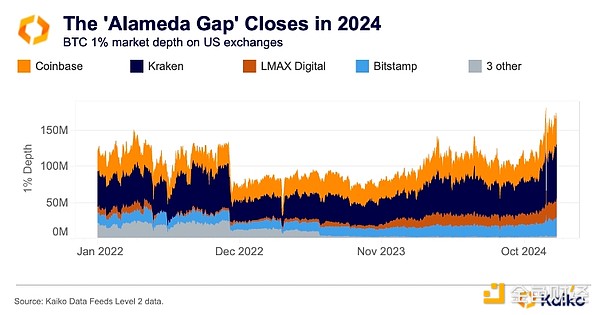

8. The Alameda Gap has narrowed after the ETF listing

This year, the crypto market has finally made the FTX collapse a thing of the past. The liquidity gap (or Alameda Gap) left by the collapse of FTX and its sister company Alameda Research has narrowed this year.

Driven by price increases and growing market share, Bitcoin's 1% market depth this year has exceeded the pre-FTX level of about $120 million. The recovery of Kraken, Coinbase, and LMAX Digital has been most notable. Interestingly, the Bitcoin market depth of the institution-centric LMAX reached a record $27 million this week, briefly surpassing Bitstamp to become the third largest liquid Bitcoin market.

9. Meme Token Frenzy

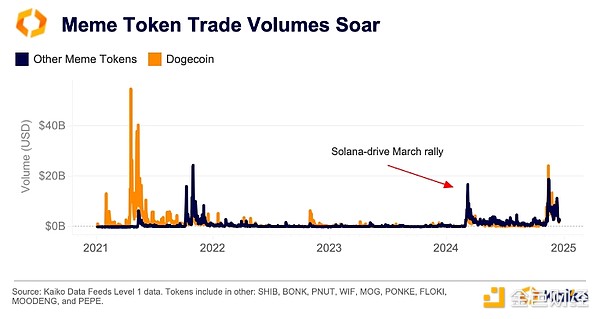

As mentioned above, meme tokens have experienced exponential surges at different times this year. In particular, tokens on Solana have seen significant growth due to the launch of Pump dot fun, a protocol for launching meme tokens that allows anyone to issue tokens and build liquidity from scratch through word-of-mouth and participation.

However, familiar assets have largely dominated trading volumes on centralized exchanges. Similar to the rally before 2021, Dogecoin has again gained favor with traders - also due to the post-election bullish sentiment. Dogecoin rose after the incoming president, Donald Trump, revealed plans to establish a "Department of Government Efficiency" (D.O.G.E.) led by Elon Musk and Vivek Ramaswamy.

One of the new tokens launched on Solana this year is PNUT, which has captured people's imagination, inspired by Peanut the Squirrel (a New York pet influencer), whose untimely passing has led to widespread online support (and token issuance).

One trader even turned a $16 PNUT investment into a realized profit of $3 million. PNUT is currently traded on several major centralized exchanges, including Binance, Crypto.com, and OKX.

10. Regulatory Changes Reshape the Stablecoin Market

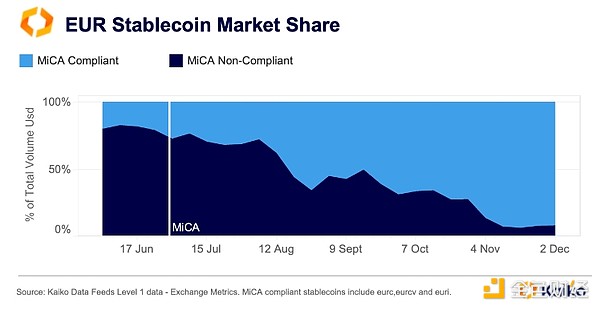

Since June, regulation in Europe has been reshaping the stablecoin market. The landmark European Union's Markets in Crypto-Assets (MiCA) regulation has triggered a wave of major exchange stablecoin delistings and product supply adjustments.

Throughout 2024, the trading volume of the Euro against cryptocurrencies will remain above last year's average, indicating growing demand. Three months after the MiCA enactment, the Euro-backed stablecoin market has undergone a significant transformation, driven by the rise of MiCA-compliant alternatives. By November 2024, MiCA-compliant Euro stablecoins (including Circle's EURC, Société Générale's EURCV, and Banking Circle's EURI) have captured a record 91% market share.

After listing EURI in late August, Binance has become a major player in the Euro stablecoin market, on par with Coinbase. Nevertheless, Coinbase remains the largest market, accounting for 47% of the share, driven by Circle's EURC.

Conclusion

This year has been crucial for establishing digital assets as a viable asset for Wall Street investors. Time will tell if the industry can sustain growth in the coming months and years, but this rebound feels different.

The 2024 rebound is built on the arrival of established companies with risk frameworks (currently including BTC and ETH). With regulatory changes and market structure shifts, next year's rally is expected to go beyond Bitcoin and expand to other assets.