Written by: BitpushNews

After the harsh winter of 2022, the cryptocurrency industry has been reborn in 2024.

Even without the grand slogan of Donald Trump's "Crypto Capital of the Earth", 2024 is destined to be a landmark in the history of cryptocurrency development, as it is integrating into the mainstream financial system at an unprecedented pace.

Patrick Kirby, policy advisor of the Crypto Innovation Council, said at an industry conference in 2024: "The approval of spot Bitcoin ETFs and Ethereum ETFs is undoubtedly an important turning point in the industry's development. Looking back on the journey of cryptocurrencies, we cannot help but be amazed at the speed of their development."

Accompanied by Bitcoin breaking $100,000 and a series of key regulatory developments and election results, cryptocurrencies will undoubtedly play a more important role on the future political and economic stage. The BitPush editorial team will take you through some of the key developments in the crypto field over the past 12 months.

Mainstream Embracing Cryptocurrencies

The pace of cryptocurrencies moving towards the mainstream is becoming more and more firm, and the most notable evidence is that traditional financial giants are opening their arms to embrace this emerging asset class - the medium is the much-favored investment tool: exchange-traded funds (ETFs).

ETFs, which trade on exchanges like stocks, cleverly build a bridge that allows investors to participate in the growth of the cryptocurrency market without having to hold digital assets directly.

In January 2024, the U.S. Securities and Exchange Commission (SEC) historically approved the listing of 11 spot Bitcoin ETFs, ushering in a new era of cryptocurrency investment in the U.S.

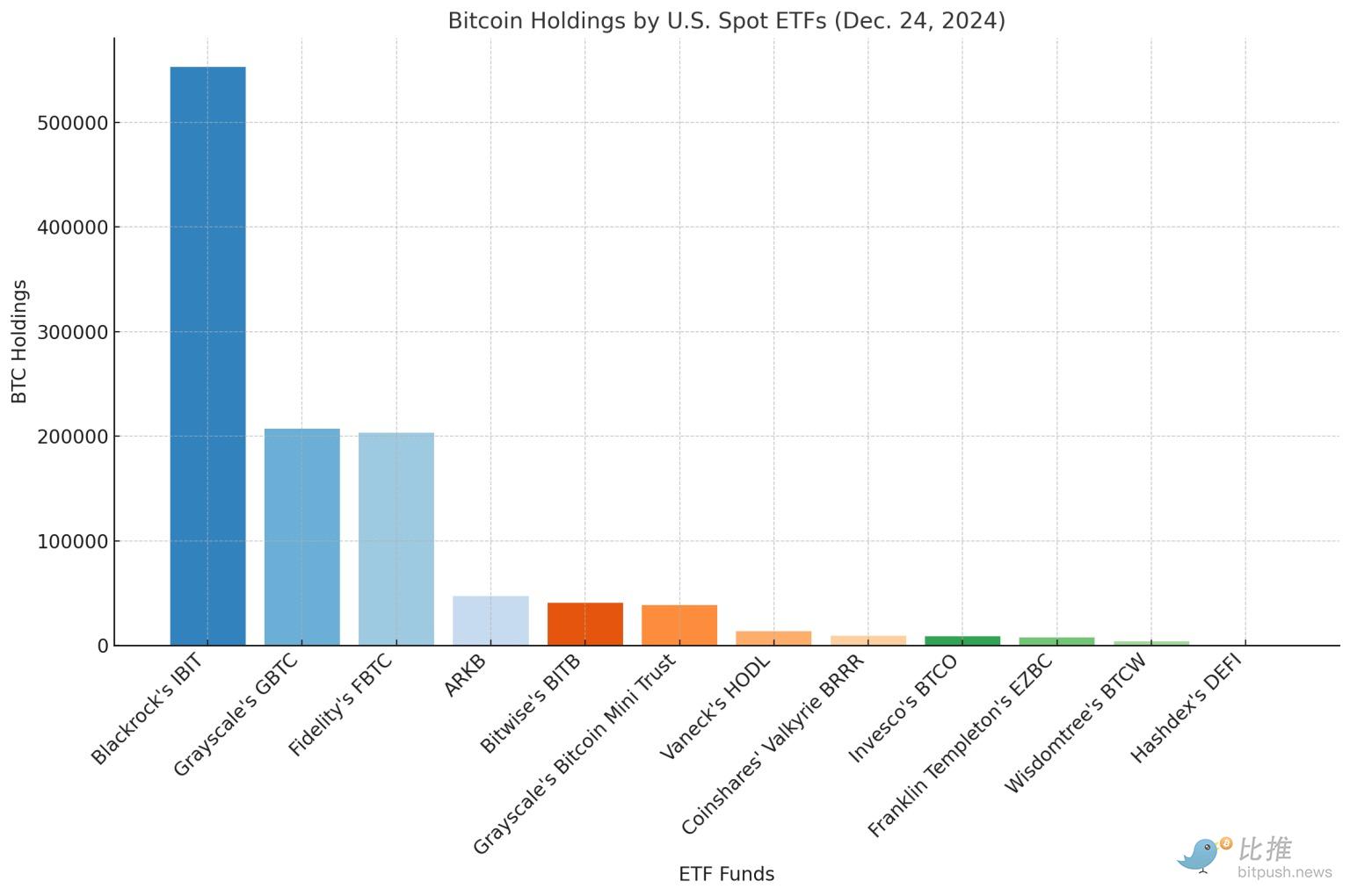

According to statistics from Bitcoin.com, as of December 24, the holdings of U.S. spot Bitcoin ETFs have exceeded 1.13 million BTC in less than a year, demonstrating their strong ability to attract funds.

Ethereum ETFs have also performed impressively, attracting $14.28 billion in inflows, accounting for 2.93% of Ethereum's market capitalization, becoming a highlight in the cryptocurrency investment field this year.

The thriving development of ETFs clearly demonstrates the increasing acceptance of cryptocurrencies by mainstream institutions. As Sumit Roy, senior analyst at ETF.com, predicted, "One can imagine that in the future, spot Bitcoin ETFs could even account for 10%, 20%, or even a higher proportion of Bitcoin's market capitalization."

Memecoin Breakthrough and Wealth Effect

The wealth effect and cultural output of Memecoins once again affirm the powerful force of "entertainment first" in the Internet age. Amidst the wave of institutionalization and professionalization of cryptocurrencies, Memecoins are an undeniable trend.

According to Artemis data, Meme coins were the third largest profit narrative in 2024, with an average annual return of 201%, far exceeding the market's average return of 128%.

For example, Fartcoin's valuation quickly soared to $836 million after its launch in October; the Patriot token, which was born out of Trump's re-election, even skyrocketed 626% in just one week, with a market capitalization exceeding $73 million, and its community even spent a huge sum to build a 22-foot-tall bronze statue of Trump to celebrate this "victory". The power of Memecoins is evident.

The technical support behind the Memecoin craze is Solana, which, with its high performance and low cost advantages, has attracted 89% of new Memecoin projects to take root here, becoming the true "Memecoin soil".

Cryptocurrencies Influencing "Politics"

The 2024 presidential election will transform the status of cryptocurrencies from a niche movement to a powerful participant in American politics.

According to data compiled by blockchain analytics platform Breadcrumbs and FOX Business, the cryptocurrency industry set a record of $238 million in campaign contributions this election season.

Some campaign ads did not mention cryptocurrencies, and some advocacy groups criticized this, with Public Citizen author Ray Claypool stating: "This tidal wave of money is a naked attempt by for-profit enterprises to prioritize their private economic interests over the public interest."

Crypto User Numbers Soar to Historic Highs

According to data from Token Terminal, the number of cryptocurrency holders reached 19.7 million as of early December. The industry has also attracted more diverse types of investors.

A Coinbase research report found that cryptocurrency holders' voting patterns are not uniform, nor are they always the stereotypical "tech people in hoodies". The study found that 18% of cryptocurrency holders are stay-at-home moms, 10% are small business owners, and 41% listen to country music.

Legislative Progress

A cryptocurrency legislation bill that had been in the works for nearly a year was passed in the U.S. House of Representatives in May, marking a critical step for the U.S. in regulating the digital asset space. This bill, called the 21st Century Financial Innovation and Technology Act (FIT21), was passed with a rare bipartisan approach. In the increasingly polarized U.S. political landscape, 71 Democratic representatives and more than 200 Republican representatives voted in favor, fully demonstrating the importance of this bill. Patrick Kirby of the Crypto Innovation Council said the passage of this market structure bill is "an important turning point in the industry's development."

The FIT21 Act aims to provide clearer regulatory guidance for cryptocurrency companies, clarifying which digital assets should be classified as securities and which as commodities, thereby ending the "tug-of-war" between the SEC and CFTC in cryptocurrency regulation and clearing obstacles for industry development.

The bill has now been submitted to the Senate for review, and some analysts believe the Senate may introduce more forward-looking legislation based on this, to better address the challenges posed by the rapidly evolving digital asset market, such as the regulation of stablecoins.

U.S. States Prepare to Embrace Cryptocurrencies

As previously reported by BitPush, Ohio State Representative Derek Merrin has proposed a bill to establish a Bitcoin reserve in the state treasury and authorize the state government to invest in Bitcoin. Ohio is not an isolated case. Pennsylvania and Texas have also passed similar bills, indicating that some U.S. state governments are actively exploring the possibility of incorporating cryptocurrencies into their fiscal strategies.

Texas State Representative Giovanni Capriglione bluntly stated that inflation is "the biggest enemy of our investments", and he believes that establishing a strategic Bitcoin reserve would be a "win-win" for the state government. This view is also shared by some other legislators. The scarcity of Bitcoin gives it certain anti-inflationary properties, which is an important reason why some legislators support incorporating it into state fiscal reserves.

Although there are still many challenges ahead, the trend of mainstream adoption is irreversible. We have reason to expect that in the not-too-distant future, cryptocurrencies will play an increasingly important role in the global economy and politics.