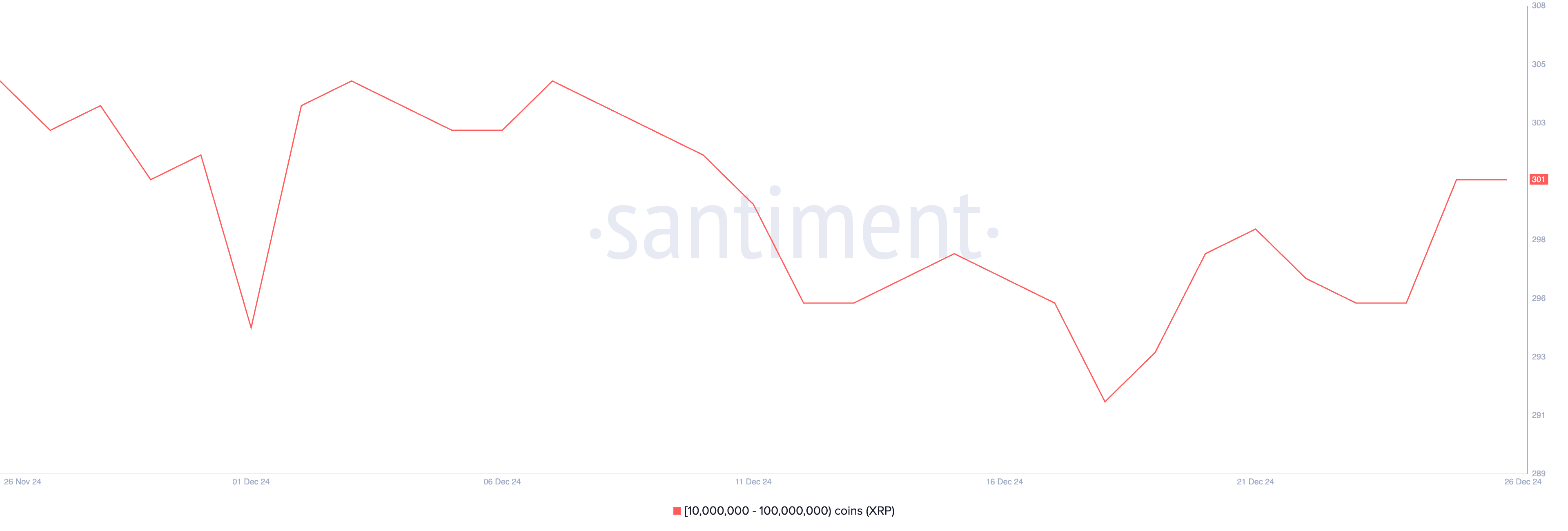

The price of XRP has been in correction over the past 7 days. After the historic rise in November and December, it reached its highest level in 6 years. Whale activity has stabilized. The number of wallets holding between 10 million and 100 million XRP recovered to 301 after hitting a low of 292 on December 18.

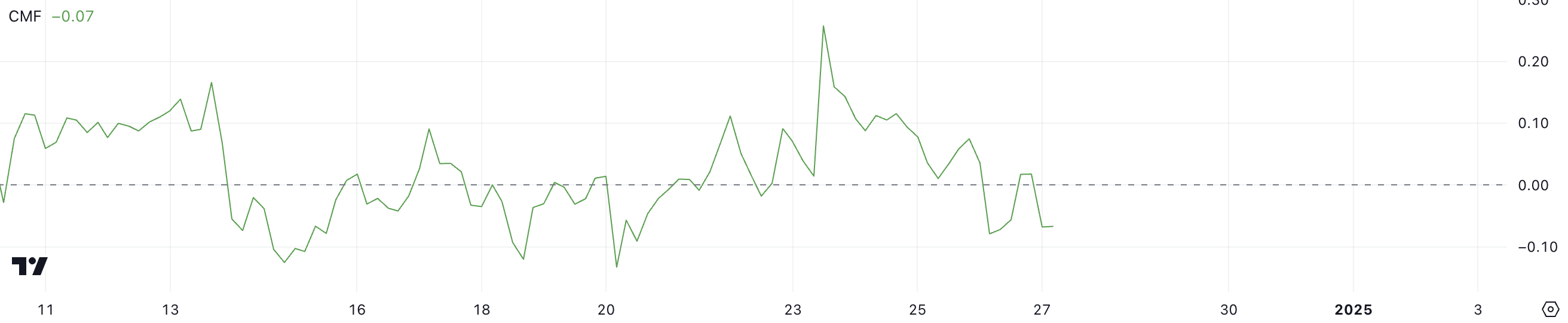

Meanwhile, the Chaikin Money Flow (CMF) for XRP has turned slightly negative at -0.07. This reflects a slight selling pressure after a brief positive turn. With XRP hovering around key support levels, market indicators are showing a mixed short-term outlook. Both bullish and bearish scenarios are possible.

XRP Whales Accumulating Again

The number of 'XRP whales' holding between 10 million and 100 million tokens stabilized at 301 on December 24, up from 296 on December 18, which was the lowest level recorded.

The stabilization suggests a temporary pause in whale activity after a volatile period. These major participants may be positioning themselves in preparation for future market developments.

Tracking whale activity is important, as these large holders can influence price trends due to their trading volume. The recovery and stabilization of whale numbers may indicate renewed confidence among major investors, which could provide short-term support for the XRP price.

If whales continue to hold or accumulate, it could create a positive sentiment. Conversely, a decrease in holdings could signal caution or selling pressure, potentially impacting the XRP price.

XRP CMF Turns Negative After Brief Positive Stint

The Chaikin Money Flow (CMF) for XRP has dropped to -0.07, down from 0.02 reached yesterday. It had spiked to a notable peak of 0.26 on December 23, surging from 2.13 to 2.26 in a matter of hours.

The changes in CMF highlight the shifts in the market's buying and selling pressure levels over the past few days.

CMF measures the inflow and outflow of funds into the asset. Positive values indicate buying pressure, while negative values suggest selling pressure. The XRP CMF at -0.07 implies that selling pressure is slightly dominant over buying pressure. In the short term, this could mean that the price may face upward resistance if buying activity does not strengthen.

However, the relatively weak negative value suggests that the selling pressure is not yet overwhelming. This may indicate a period of correction rather than a sharp decline.

XRP Price Prediction: Retesting the $2.13 Support Level

The XRP price has recently tested and held the $2.13 support level, leading to a slight price bounce. While the token has not entered a clear uptrend, additional upward momentum could test the $2.33 resistance.

If the trend strengthens, XRP could aim for higher targets at $2.53 or even $2.64, which would represent key levels for potential sustained upside.

However, the whale activity and Chaikin Money Flow (CMF) suggest a lack of clear market direction.

If the $2.13 support level is not held again, XRP could decline to $1.96 or even $1.89.