Author: 1912212.eth, Foresight News

The cryptocurrency market has seen huge volatility this month. After breaking through the $100,000 mark for the first time on December 5, it experienced a dramatic pullback from December 9 to 10. Since then, the market has slowly oscillated upwards, just as investors were expecting to break through $110,000, hawkish comments from Fed Chair Powell delivered a heavy blow to the heated market, leading to a bloody correction in the market, with some now nearly halving from their monthly highs.

Crypto investors' panic sentiment has spread, with anxiety and unease pervading the community.

Countless investors are asking: Has the bull market really ended? What will the future market performance be like? Although the market is unpredictable, what catalysts will there be in January? Why is the January performance worth looking forward to?

I. Trump to be Inaugurated as President on January 20

After Trump's successful presidential election in early November, the market has seen a month-long consecutive rally. Trump has shown a crypto-friendly stance, and his nominees for various departments are also largely pro-crypto market figures, while the much-criticized SEC chair is also about to step down, which has led the market to generally hold an optimistic view of the future of the crypto market.

The latest data shows that the proportion and number of the incoming new Congress members who are pro-crypto are significantly ahead of the previous Congress.

According to the latest Reuters report, Michael Rosen, Chief Investment Officer of Angeles Investments, said that Trump's inauguration ceremony may also bring some surprises to the market, and he is expected to issue at least 25 executive orders on his first day in office, covering a range of issues from immigration to energy and cryptocurrency policy.

The market is closely watching Trump's future moves on the crypto market. If he can implement the promises he made during the campaign, the crypto market may usher in its golden age.

II. FTX to Begin Debt Repayment

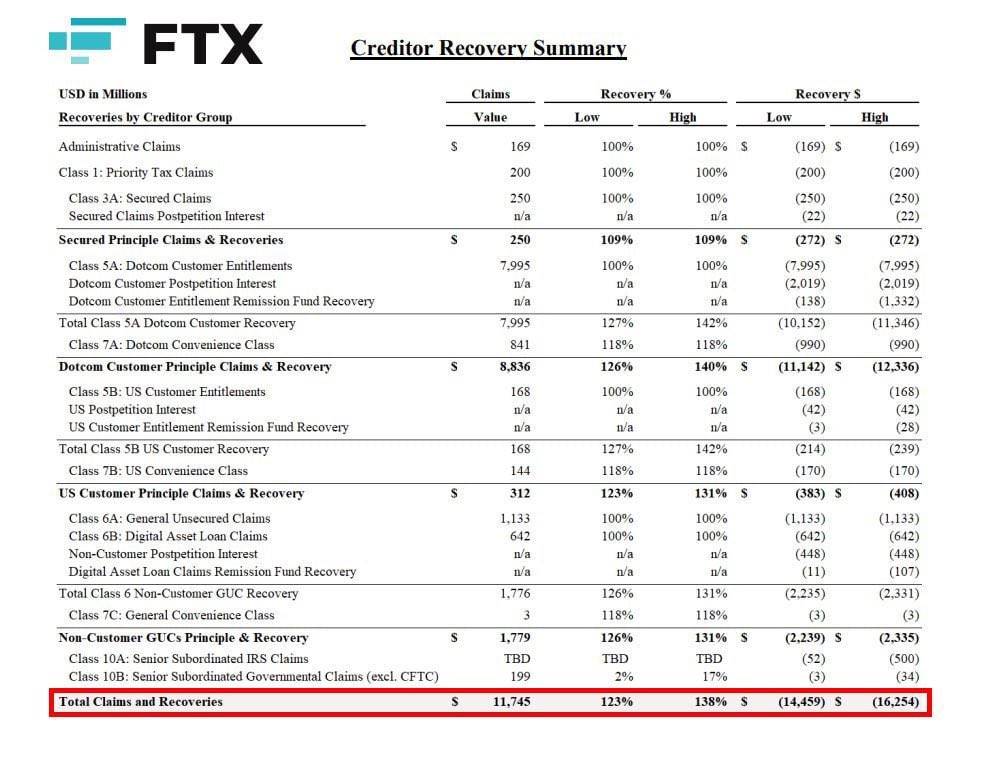

On December 17, FTX and its affiliated debtors announced that the court-approved Chapter 11 reorganization plan will officially take effect on January 3, 2025.

The first round of distribution will be launched within 60 days after the effective date, targeting only the approved creditors in the Convenience Classes. FTX has reached agreements with crypto custodian BitGo and trading platform Kraken to provide asset distribution services for retail and institutional clients.

According to data disclosed by HODL15Capital, the first round of debt repayment distribution by FTX on January 3 will include $16 billion in cash.

Some of the tokens previously held by FTX/Alameda, such as /, have basically been sold off.

Creditors will receive compensation in cash rather than tokens, indirectly reducing the selling pressure in the market and increasing the probability of the compensation funds flowing back into crypto, thereby boosting the market sentiment.

III. BTC Generally Rises in the Lunar New Year Month

As early as the beginning of February 2024, Markus Thielen, founder and research director of 10X Research, stated that often rises by 11% around the Lunar New Year. Over the past 9 years, traders who bought 3 days before the Lunar New Year and sold it 10 days after the Lunar New Year would have achieved decent returns.

February 10 is the Spring Festival of 2024, and rose from $43,000 on February 5 to around $53,000 on February 15, and then continued to rise, reaching a stage high of $72,000 on March 15.

The Spring Festivals of 2021, 2022 and 2024 all fell in early February, while the 2023 Spring Festival occurred in late January. The chart clearly shows that the uptrend in the Lunar New Year month was over 10%, with the highest reaching a staggering 43.55%.

The 2025 Spring Festival will be on January 29, earlier than in previous years.

The market often has a self-fulfilling prophecy, such as the "October rally", and the market performance during the Lunar New Year is worth looking forward to.