Bit (BTC) reached an all-time high on December 17, but has since fallen below $100,000. Key indicators such as ADX and cautious whale activity suggest a weakening downtrend.

As BTC approaches important resistance and support levels, the price direction in the coming days could be significantly impacted.

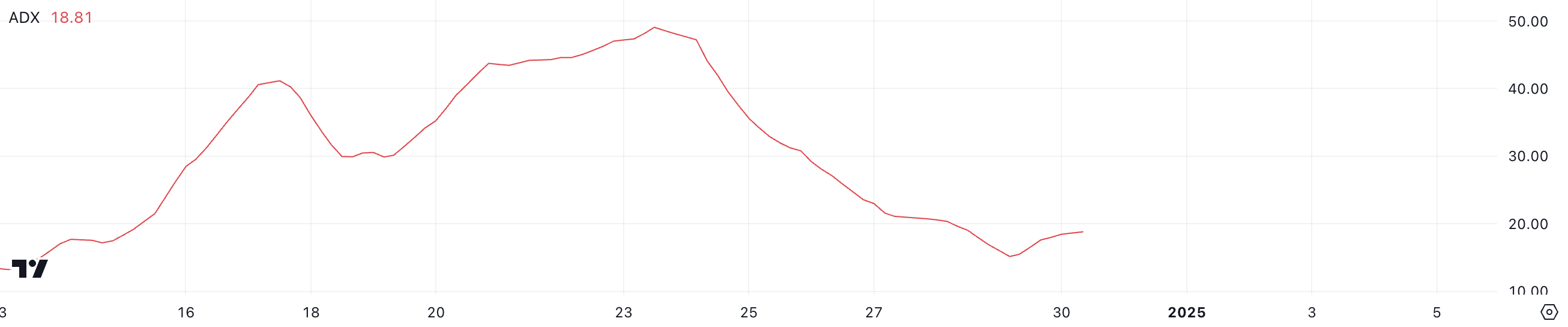

BTC ADX Suggests Weakening Downtrend

BTC's ADX is currently at 18.81, down sharply from nearly 50 a week ago. This decline emphasizes that the intensity of the ongoing Bit (BTC) downtrend has significantly weakened.

The rapid decrease in ADX suggests that the momentum driving Bit (BTC)'s recent price movements is fading, and the market is in a state of reduced directionality.

The Average Directional Index (ADX) measures the strength of a trend on a scale of 0 to 100. Values above 25 indicate a strong trend, while values below 20 suggest a weak or non-existent trend. With BTC's ADX currently at 18.81, this low reading implies that the current downtrend is losing momentum.

As a result, Bit (BTC) may enter a short-term correction characterized by reduced volatility and sideways price movements.

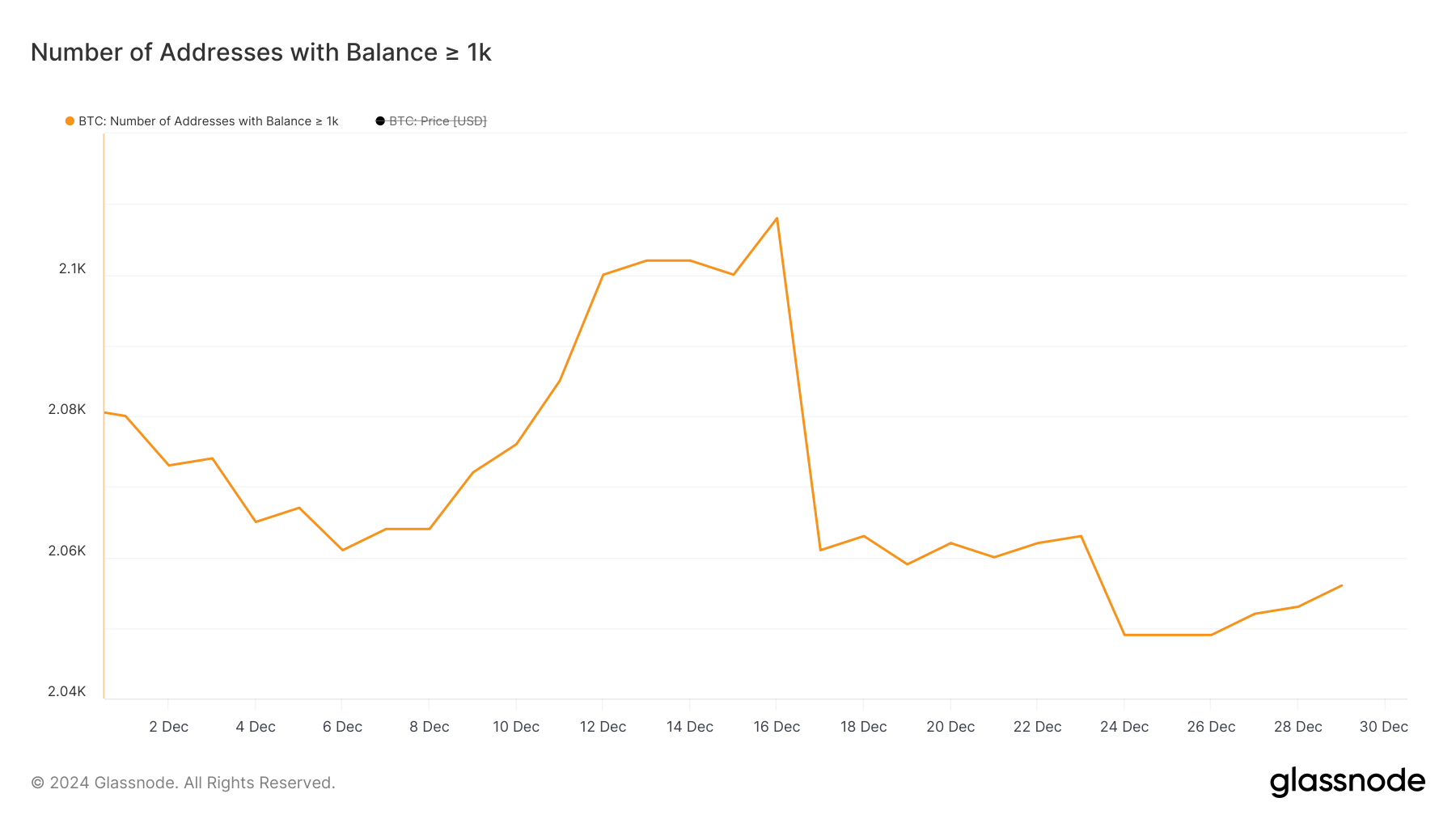

Bit (BTC) Whales Begin Accumulating Again

The number of Bit (BTC) addresses holding at least 1,000 BTC decreased significantly from 2,108 on December 16 to 2,061 on December 17. This decline highlights notable selling or redistribution of holdings among large-scale investors.

This metric remained stable until December 24, when it further decreased to 2,049. Changes in this whale activity can have a significant impact on Bit (BTC), as these addresses represent entities capable of executing large-scale transactions and thus exerting substantial influence on price movements.

Tracking the so-called Bit (BTC) whales is crucial, as their trading behavior often serves as a leading indicator for broader market trends. Whale accumulation signals confidence in Bit (BTC)'s potential price appreciation, while large-scale selling may indicate caution or profit-taking, potentially triggering market declines.

After the sharp decrease in whale numbers, this metric has now started to increase slightly, reaching 2,056. While the increase is not happening at a rapid pace, it suggests a cautious restoration of confidence among major holders. This gradual accumulation may point to a stabilization of Bit (BTC) prices in the short term.

Bit (BTC) Price Prediction: Below $90,000 or Back to $100,000?

The Bit (BTC) price is currently approaching the critical resistance level of $94,200. If this level is breached, the uptrend could strengthen, potentially leading to tests of $98,700 and $102,500.

Despite the upside potential, Bit (BTC)'s EMA (Exponential Moving Average) lines still indicate a bearish configuration, with the short-term EMA below the long-term EMA.

This configuration reflects the market's persistent bearish sentiment. If the downtrend regains strength, Bit (BTC) could retest the $90,700 support level. If this support fails to hold, the next downside target could be $88,089.