Introduction: The Surprise and Necessity of Cryptocurrency in 2024

- In 2024, the cryptocurrency industry can be described in four words: rapid progress . This year, Bitcoin broke through the $100,000 mark, severely slapping the faces of those who thought "Bitcoin is too expensive"; memes were hyped from the beginning of the year to the end of the year, AI Agent and DeSci burst out, leading a wealth trend from science fiction to reality; new public chains such as TON and SUI emerged from the cracks, using technology and ecology to prove that latecomers can also become gods.

- This year was also an "unexpected" year: the Ethereum ecosystem failed to usher in the imagined explosion, while Solana used its ecology and technology to firmly sit on the throne of the top public chain; DeFi was once forgotten, but it recovered strongly under the promotion of policies; and those assets known as "classic veterans", such as XRP, XLM, etc., used a collective pull-up to prove that veterans can always counterattack at critical moments.

- There has never been a calm time in the crypto world, especially in 2024. This report not only reviews the hot spots of the year, but also gives you insight into the logic and impact behind each phenomenal event. From technological change to market evolution, from policy shocks to capital games, we will review the top ten unexpected events in the crypto industry this year to see where this "storm" will take us.

The most exciting event of the year - Bitcoin breaks through the 100,000 mark

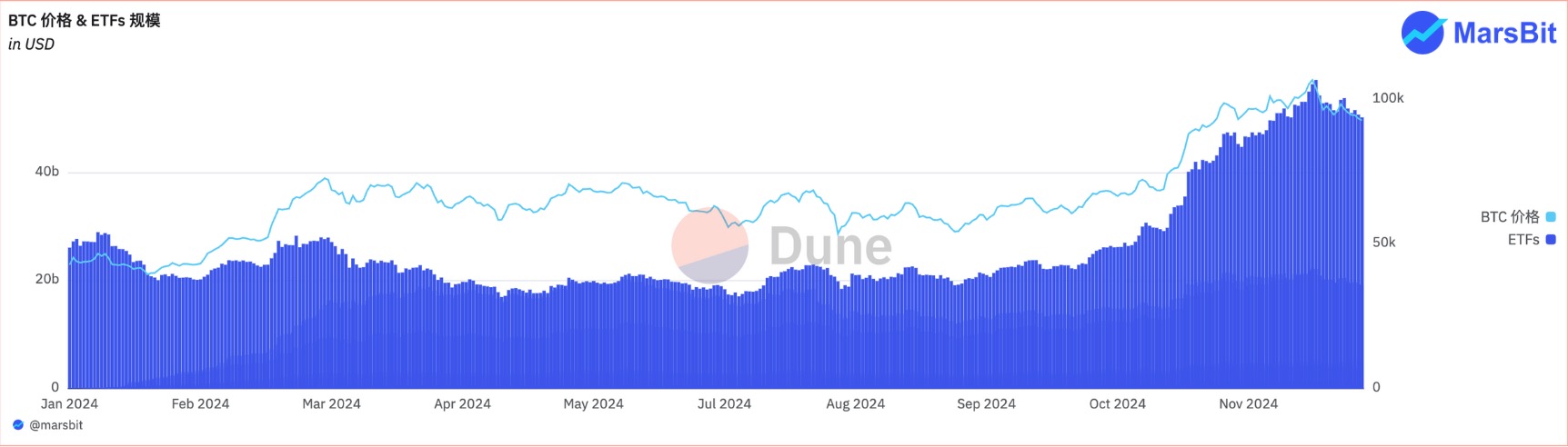

On January 10, the U.S. Securities and Exchange Commission (SEC) approved a Bitcoin spot ETF , marking the official acceptance of Bitcoin by the mainstream financial market in the United States, introducing a new regulatory approach to the market and attracting the attention of institutional investors. Subsequently, the fourth Bitcoin halving event in April further reduced the supply of new Bitcoins. Historically, each halving was accompanied by price increases in the following months. The most critical turning point came in November, when Trump won the U.S. presidential election. His positive attitude towards cryptocurrencies and policy expectations ignited market sentiment and pushed the price of Bitcoin up from $68,000 in early November. On December 5, the price of Bitcoin officially broke through $100,000 , setting a record high.

This historic moment is due to the combination of multiple factors:

- The net inflow of funds into Bitcoin ETFs reached US$36.8 billion throughout the year, 81 times the net inflow of gold ETFs .

- The current total assets under management (AUM) of Bitcoin ETFs is as high as US$110.3 billion, and the amount of Bitcoin held has exceeded Satoshi Nakamoto's 1.1 million .

- Many institutions continue to increase their holdings of Bitcoin: MicroStrategy, as the largest listed company holding Bitcoin, continues to increase its Bitcoin holdings. By the end of 2024, MicroStrategy will hold a total of more than 444,000 Bitcoins. BlackRock, the world's largest asset management company, has also been increasing its holdings of Bitcoin, and its current holdings have reached 550,000 Bitcoins.

- The US election and loose policies boosted the rise of Bitcoin: Trump won the election and clearly supported cryptocurrencies, saying that the current SEC Chairman Gary Gensler would be replaced, and purchased a large number of crypto assets through WLFI Investment Company, and more favorable crypto policies would be introduced later. At the same time, the Federal Reserve implemented an accommodative monetary policy, cutting interest rates in September, November and December, with a total of 100 basis points, providing strong support for Bitcoin.

The most helpless person of the year - Ethereum ecosystem

In 2024, the Ethereum Layer 2 ecosystem failed to flourish as expected, resulting in continued pressure on Ethereum prices. Looking back at history, the ETH/BTC exchange rate once broke through 0.085 in 2021, and the ETH price reached $4,800, and the market was confident in its prospects. However, at the beginning of 2024, the ETH/BTC exchange rate had fallen back to 0.056, when the ETH price hovered around $2,300, significantly lagging behind the strong performance of Bitcoin. Although the ETH price briefly broke through $4,000 when the Altcoin market broke out in March, it failed to maintain stability and then experienced a volatile downward trend, falling to a minimum of $2,100. At the end of the year, as Bitcoin repeatedly set new highs, ETH broke through $4,000, but once again failed to maintain its upward momentum and quickly fell back to a minimum of $3,100. If calculated according to the ETH/BTC exchange rate in the previous bull market, the price of Ethereum today should be around $8,000, but the current price is still less than half, and has not even broken through the previous high.

This weak situation is due to the superposition of multiple factors:

Ethereum's valuation logic shifts: As "digital gold", Bitcoin's valuation logic is similar to that of gold, mainly driven by the market's perception of its scarcity, risk aversion and long-term value storage, so it can maintain strong stability when the macroeconomic environment changes. Ethereum's valuation logic has shifted to a PE valuation method similar to that used by traditional companies, focusing on factors such as network effects, application scenarios and ecological development. As the market's expectations for Ethereum's future appreciation gradually decrease, especially when there is no breakthrough in the Layer 2 ecology and actual application, the support for its valuation has gradually weakened, making it difficult for prices to maintain their upward momentum.

Dencun upgrade has limited effect: Although Ethereum underwent the Dencun upgrade in March , the main benefit of this upgrade was not directly reflected on the Ethereum mainnet, but significantly improved the performance of Layer 2 networks such as Arbitrum, Optimism and Polygon. These second-layer networks help expand Ethereum's processing capacity and achieve batch settlement by bundling user transactions and passing them back to the Ethereum mainchain in batches.

This upgrade significantly reduces the data storage cost of Layer 2, and the Gas fee is reduced by more than 90% . For example, the token exchange Gas fee on Base will be significantly reduced from about $0.58 to $0.01 after the implementation of EIP-4844.

The upgraded Ethereum mainnet will rely more on selling block space to generate revenue, while the tax revenue of the application layer will be transferred to the general Layer 2 network. Although the Layer 2 solution has made significant progress in technology, the ideological problem of its team has become more serious. It lacks the efficient execution demonstrated by competing chains such as Solana, which makes it difficult for them to effectively compete with other chains in the ecological competition.

Ethereum faces inflation: The weakness of the Ethereum ecosystem is also closely related to the continued growth of the staked amount. Currently, the staked amount of Ethereum has exceeded 54 million ETH (about 45% of the total supply) , and the re-staked ETH accounts for nearly 10% of the total staked amount. Emerging protocols such as liquidity staking and re-staking (such as Eigenlayer) have greatly increased the profit opportunities of participating in staking and attracted a large amount of capital inflows. Although these innovations have brought higher returns to stakers, they have also increased the issuance rate of ETH, leading to rising inflationary pressure on Ethereum.

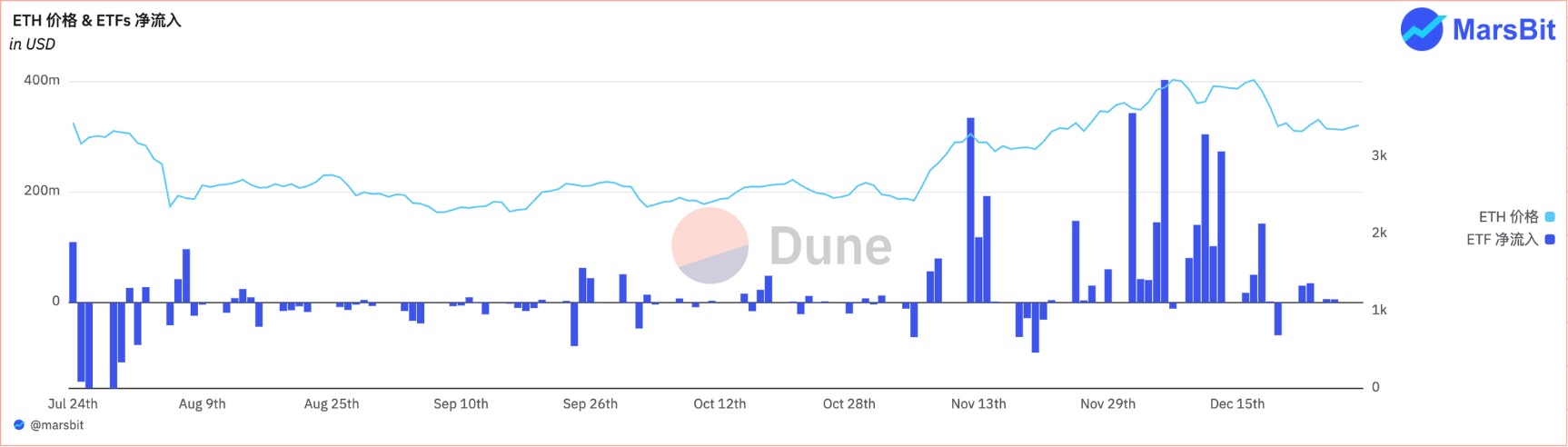

Ethereum ETF is weak: Ethereum ETF experienced continuous net outflows in the early stage after its approval, although the situation improved by the end of the year, with capital flows turning to a net inflow of 733,000 ETH. However, compared with the Bitcoin ETF, the inflow of funds in the Ethereum ETF is still significantly inferior. One of the main reasons is that the Ethereum ETF failed to provide staking support, so investors missed out on a potential return of about 3.5% . In addition, the management fees of the ETF further compressed the actual returns of investors, which made many investors prefer to directly stake ETH rather than participate through the ETF, which further weakened the attractiveness and competitiveness of the ETF.

Vitalik faces FUD pressure: Ethereum founder Vitalik Buterin has encountered widespread doubts and FUD from the crypto community this year, especially when the Ethereum ecosystem has not developed as expected. The Ethereum Foundation has sold a total of 4,466 ETH this year , further exacerbating the market's confidence crisis.

The combined effect of these factors has put Ethereum at a relative disadvantage in its competition with Bitcoin, and it has failed to usher in the expected ecological explosion.

The most unexpected token sale of the year - BOME

BOME's pre-sale is undoubtedly one of the highlights of the crypto market in 2024. In just 24 hours, BOME raised more than 10,000 SOL. Only three days after its establishment , BOME was successfully listed on Binance, with a market value of over 1.5 billion US dollars , becoming the dream goal of many project parties. The success of BOME not only led to the pre-sale boom on Solana, but also attracted more meme coin projects to join the competition, further promoting the development of the Solana ecosystem.

Slerf's $10 million evaporated: In contrast to the success of BOME, Slerf's pre-sale was unexpected. Although Slerf raised 50,000 SOL, due to the developer's operational error, all SOL and Slerf tokens were put into the liquidity pool at once and LP was burned, which triggered widespread community discussion. Despite this, Slerf still maintains the richest on-chain liquidity among all meme coins.

RUG risk intensifies: The total amount of pre-sale funds on the Solana chain in 2024 has exceeded 600,000 SOL. ETH, Base and other chains have begun to launch a trend of issuing coins, but with it comes a large number of projects that lack transparency and directly rug pull due to the lack of clear mechanisms and moral risks, causing heavy losses to investors.

AI pre-sale token issuance : With the rise of AI agents, the AI-Pool project initiated by A16zDAO members has become a representative of innovation. AI-Pool raised more than 35,000 SOLs in 24 hours, and the token METAV rose directly from a private placement market value of US$16 million to US$96 million, an increase of more than 500% . The project uses Trusted Execution Environment (TEE) technology and manages funds through AI agents, avoiding the centralization risks in traditional pre-sales.

The most ambitious bet of the year - Polymarket

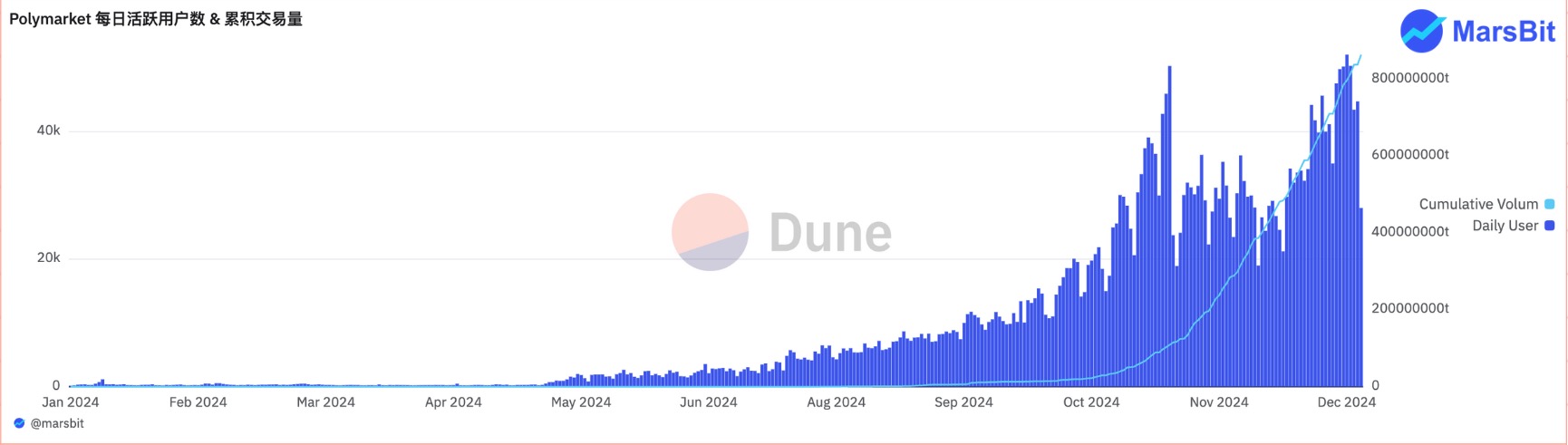

Polymarket is a blockchain-based prediction market that provides real-time, quantified probability data to help users better predict the outcomes of future events. In 2024, as the US election approached, Polymarket's trading volume and user activity reached unprecedented heights.

FOMO Gambling: At the beginning of 2024, the platform's monthly trading volume was about $50 million. By September, this figure exceeded $500 million, and in October it easily exceeded $2.5 billion. The total amount of open contracts climbed from $7 million in January to $500 million in November . Polymarket's market depth and liquidity are comparable to some leading DEXs, and at one point exceeded the total value locked in the TON network.

The biggest bet on the US presidential election in history: In 2024, Polymarket's website visits surged, reaching 35 million in October, twice as many as popular betting platforms such as FanDuel. Polymarket's cumulative trading volume for the US presidential election throughout the year exceeded US$3.6 billion, surpassing other traditional betting platforms at one point, making it the largest election bet in history.

More accurate predictions than mainstream media: Polymarket has consistently shown a higher probability of Trump winning than traditional betting platforms. This can be partly attributed to the crypto community's support for Trump, whose voting preferences affect market pricing. Even when polls generally support Harris, Polymarket still maintains a high winning rate, proving its accuracy in predicting real-world events. Polymarket has transformed from an innovative platform in the cryptocurrency industry to a widely watched popular platform, becoming an important source of data for mainstream media coverage.

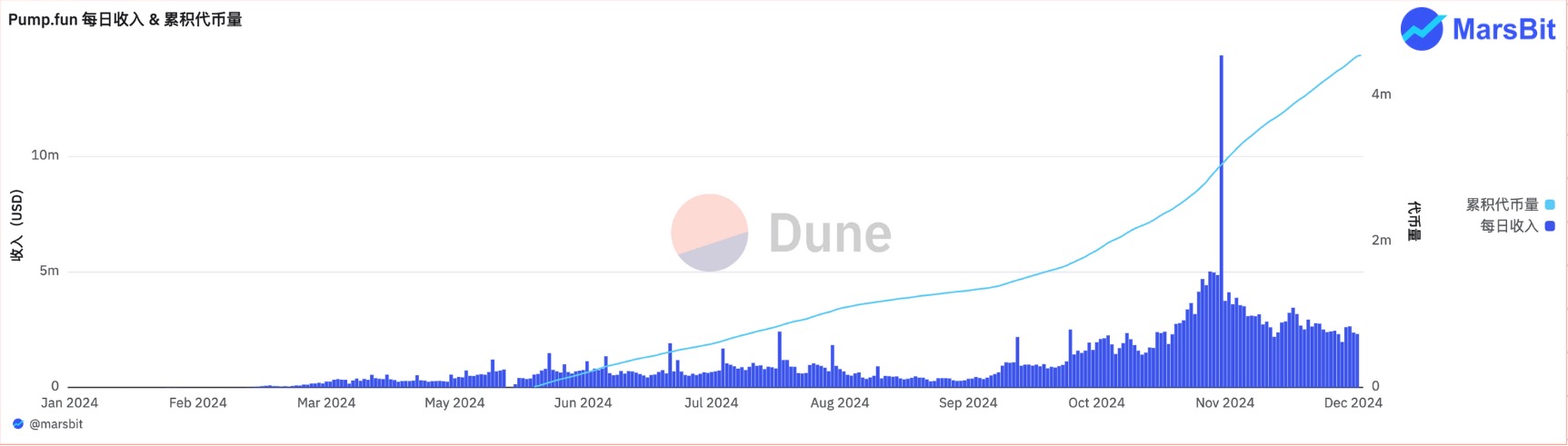

The most profitable app of the year - PumpFun

PumpFun is a meme coin issuance and trading platform based on the Solana chain. It has quickly emerged in the crypto community through its innovative token issuance mechanism and unique market operation method. The core feature of the platform lies in its fair issuance principle. The platform does not conduct pre-sales or team allocations, and uses the joint curve pricing model to achieve automatic dynamic adjustment of token prices and issuance.

The fastest growing platform in crypto history : PumpFun has performed amazingly since its launch in January 2024. PumpFun has issued more than 5.2 million tokens , accounting for 70% of the Solana chain meme coin issuance , and has accumulated more than $200 million in revenue . Its daily revenue peaked at $14 million , surpassing Uniswap at one point and becoming the fourth largest protocol in the blockchain protocol.

A new stage for social celebrities and cultural memes: PumpFun has become a new distribution platform for social celebrities, Internet memes and cultural symbols. The meme culture on social media such as TikTok is converted into tokens through PumpFun, which not only becomes a tool for expressing personal brands, but also a way to raise funds and publish political and life attitudes, such as PNUT and Chillguy. Many celebrities choose to issue tokens to interact with fans and promote personal ideas and opinions.

This trend has transformed PumpFun from a simple hype platform into a cultural phenomenon. Meme coins are no longer just a speculative tool, but have become a new social language.

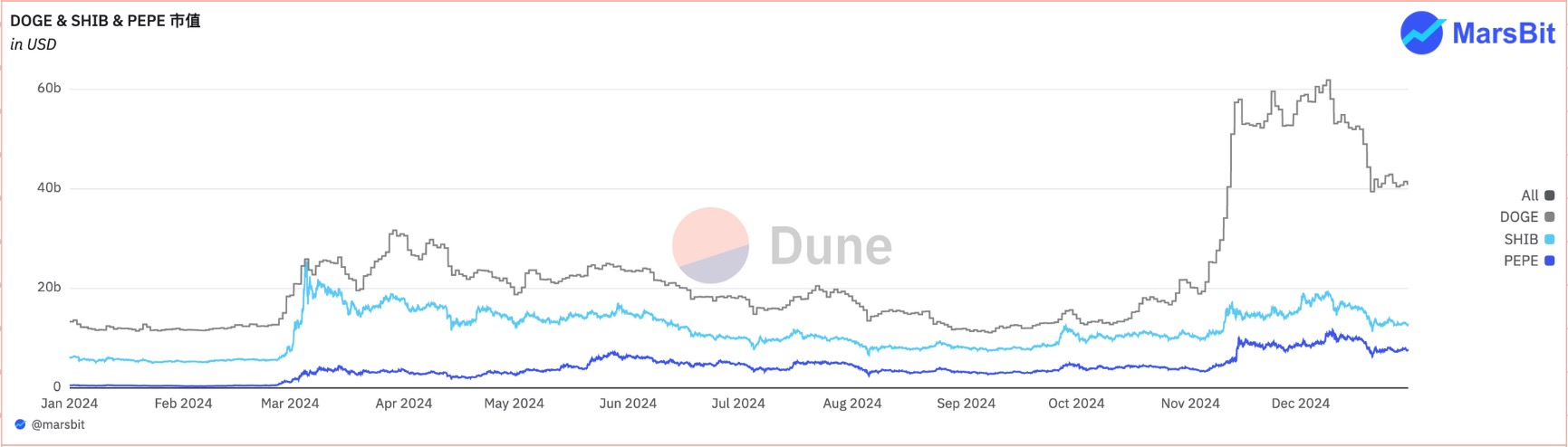

The hottest track of the year——MEME

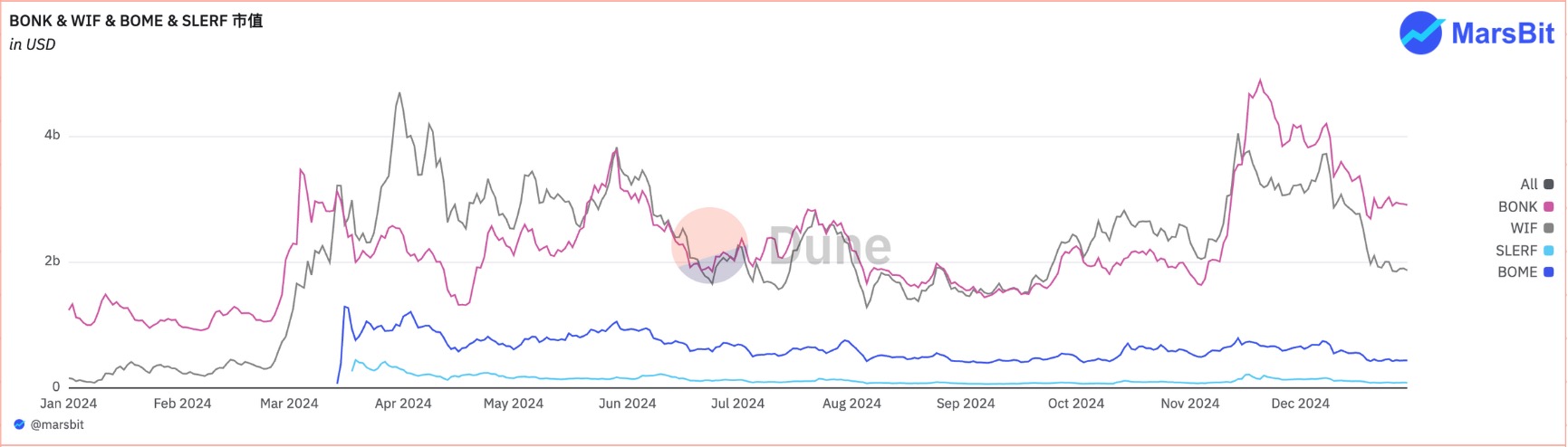

Meme has undoubtedly become the hottest track of the year in the cryptocurrency industry in 2024. The total market value of the meme coin market has exceeded US$105 billion, setting a historical high .

Since the beginning of the year, the market has been flooded with crazy meme coin speculation, and currencies such as Bonk, WIF, People, PEPE, Bome, etc. have brought huge wealth effects.

As a large number of VC coins were listed on mainstream exchanges in March, the market liquidity was sucked away, and many VC coins plummeted by nearly 10 times. The entire crypto market fell into a volatile decline, and the community was in mourning. This situation triggered strong criticism of VC coins in the crypto community, and once again turned to the craze of chasing meme coins.

In August, Binance adjusted its coin listing policy and successively launched meme coins such as POPCAT, Neiro, BABYDOGE, CAT, and MOODENG, which once again ignited the enthusiasm of the market, and speculation in meme coins became the hottest investment option.

By October, with the popularity of concepts such as AI MEME, Desci, and AI Agent, the craze for meme coins reached an unprecedented height .

The election catalyzed the surge in Dogecoin: Doge rose from the low of $0.074 this year to a high of $0.484, an increase of more than 550% . This wave of rise occurred in October and November, coinciding with the critical moment of the US election. The rise of Dogecoin is closely related to the actions of Tesla founder Musk. As the "spokesperson" of Dogecoin, Musk not only supported Trump, but also expressed his willingness to serve as the leader of the US Government Efficiency Committee (D.O.G.E.). This series of political and social events injected more public opinion capital into Dogecoin, further driving its price surge.

At the same time, Shiba Inu also experienced a significant rise, rising from $0.0000083 at the beginning of the year to $0.0000457, an increase of more than 450%.

The rise of young power: PEPE became the third meme coin with a market value of over $10 billion after DOGE and SHIB . With the support of platforms such as Coinbase and Upbit, the price of PEPE soared from $0.00000086 at the beginning of the year to $0.00002836, an increase of more than 3200%.

Bonk and WIF rank fourth and sixth in the Meme coin market capitalization respectively.

Bonk was born at the end of 2022, when FTX collapsed and Solana fell below $10. As Solana's "Shiba Inu Coin", Bonk rose against the trend amid market doubts. Bonk rose from a low of $0.000009 to a high of $0.000062 this year, an increase of 688%.

WIF was born at the end of December 2023 and successfully landed on multiple exchanges such as Binance, Coinbase, and Robinhood. It soared from a low of US$0.067 to a high of US$4.8 during the year, an increase of more than 7100%, becoming the representative of the new generation of Meme coins.

PENGU, a rising star in the context of NFT recovery: Pudgy Penguins NFT was founded in 2021 and quickly became popular for its cute penguin image and unique community culture. At the end of 2024, with the recovery of NFT, the floor price of its NFT soared to 35 ETH, surpassing BAYC to become the second largest NFT project . Subsequently, the PENGU token was launched and successfully landed on exchanges such as Binance and Bithumb. One week after its launch, its market value soared to nearly 2.7 billion US dollars, quickly ranking fifth in the market value of meme coins.

DeSci MEME ignites the market: DeSci (decentralized science) has a traceable explosion on Memecoin. In December last year, the DeSci narrative attracted people's attention due to CZ's mention and the founder of Coinbase's creation of ResearchHub. Recently, Vitalik and CZ, who had just been released from prison, mentioned it again. Binance Labs invested in BIO (DeSci's management and liquidity protocol). The sentiment on the chain was high, and DeSci created MEME magic disks one after another. RIF comes from the Pump.science platform and represents the compound rifamycin (RIF). The token rose 2,000 times in a week, and the market value soared to 250 million US dollars. The URO token rose more than 1,000 times in a week, and the market value soared to 170 million US dollars.

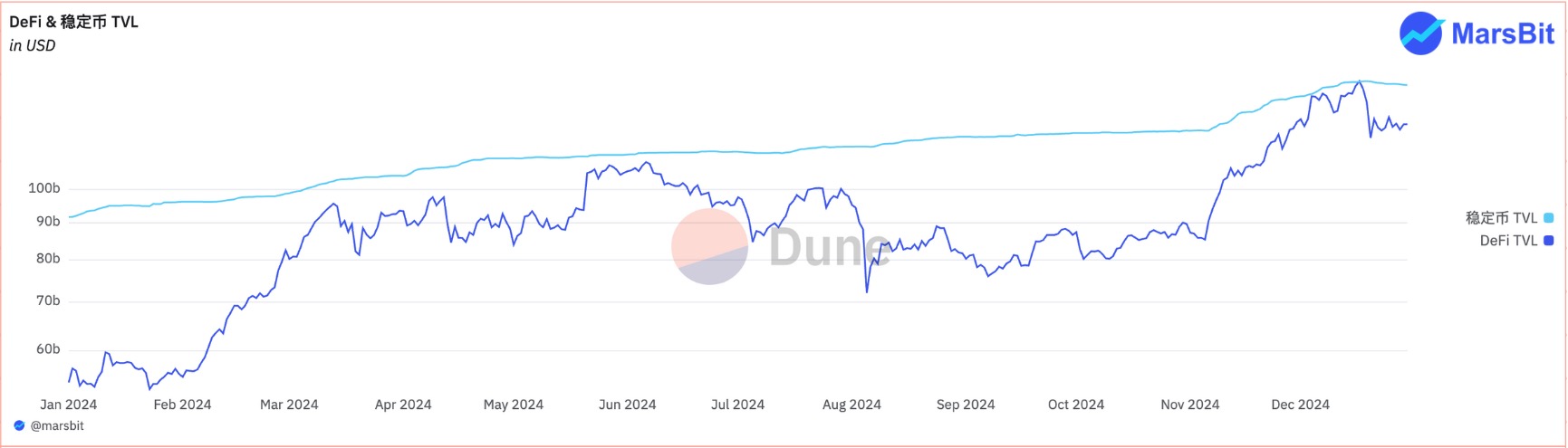

The most unexpected recovery of the year - DeFi's full recovery and DeFi 3.0

After the Luna incident, the cold winter of DeFi lasted for quite some time, but 2024 brought an unexpected recovery. DeFi's TVL rebounded significantly from $55 billion at the beginning of the year to a maximum of $140 billion , just one step away from the historical high of $180 billion. At the same time, stablecoins continued to grow throughout the year, with a total market value exceeding $205.3 billion . Market confidence gradually recovered, innovative projects continued to emerge, and emerging platforms became the hot spots of the market.

DeFi is no longer just returning to the starting point, but is undergoing a transformation into a brand new 3.0 era.

AAVE and CRV lead again: Aave is the largest and most battle-tested lending protocol. As the undisputed leader in on-chain lending, Aave has a highly defensive and sticky moat. As the bull market recovers, higher risk appetite behavior will increase the utilization of lending on the platform, driving AAVE's total net deposits to $34.3 billion, firmly at the top of the industry . The AAVE token rose from a low of $70 to a high of $400 throughout the year, an increase of 471% .

As a long-established stablecoin trading liquidity pool in the Ethereum ecosystem, Curve has been influenced by the news that institutions such as BlackRock are betting on the Ethereum ecosystem and promoting the development of DeFi through the BUIDL fund. The Curve token ( CRV ) has risen from US$0.18 at the beginning of the year to US$1.33, an astonishing increase of 638% .

This once again proves the strong market demand for decentralized lending and liquidity protocols.

Representative projects of RWA: Ondo Finance focuses on RWA tokenization . The platform TVL has risen to US$650 million and has attracted widespread attention through innovative asset management. Its token Ondo has soared from US$0.17 at the beginning of the year to US$2.14, an increase of 1165% , reflecting the strong market demand for RWA tokenization.

A new revolution in the re-staking track : EigenLayer has pioneered the "re-staking" track, providing a breakthrough capital efficiency and security solution for the blockchain ecosystem. Its core innovation lies in the Restaking Protocol, which allows users to use pledged assets (such as Ethereum's ETH) for security guarantees on multiple networks, improve capital utilization and reduce dependence on a single token. EigenLayer's total locked-in volume exceeded US$15.2 billion, making it the third largest protocol on Ethereum, and its token EIGEN rose from a low of US$2.1 this year to a high of US$5.6.

New trend of stablecoins in DeFi 3.0 : Ethena is a decentralized synthetic dollar protocol based on Ethereum , which combines the traditional financial (TradFi) profit model and attracts a large amount of capital inflow. The annual revenue reached 267 million US dollars, and the market value of its minted stablecoin USDE exceeded 6 billion US dollars. The token ENA rose from the low of 0.2 US dollars at the beginning of the year to 1.33 US dollars, an increase of 565%.

Usual is a stablecoin protocol led by Binance and Kraken . It launched USD, a permissionless and fully compliant stablecoin supported 1:1 by real-world assets (RWA). It ensures the long-term development of the protocol by distributing 100% of the actual income rewards generated by RWA to token holders. After its token was listed on Binance, the price rose from US$0.01 to US$1.65, and the current TVL has soared to US$1.7 billion.

The new king of Dex is born: Hyperliquid 's core highlight is its HyperBFT consensus algorithm designed for high-performance perpetual contract order book exchanges, which ensures a high throughput of 200,000 transactions per second and a median delay of only 0.2 seconds. This allows Hyperliquid to achieve decentralization while maintaining speed and efficiency similar to traditional centralized exchanges. With its unique Layer 1 blockchain architecture and innovative token standards, Hyperliquid has quickly attracted a lot of market attention.

The Hyperliquid platform has experienced an explosion this year, with the number of users now exceeding 280,000, TVL of nearly $2.29 billion, and total trading volume exceeding $575 billion. The book value of its platform token airdrop exceeded $7 billion, breaking the record of the $UNI airdrop launched by Uniswap in September 2020. The token HYPE has risen from $3.9 at the beginning of its launch to $33, and its market value has risen rapidly. The FDV (fully diluted market value) is as high as $30 billion, ranking among the top 20 cryptocurrencies.

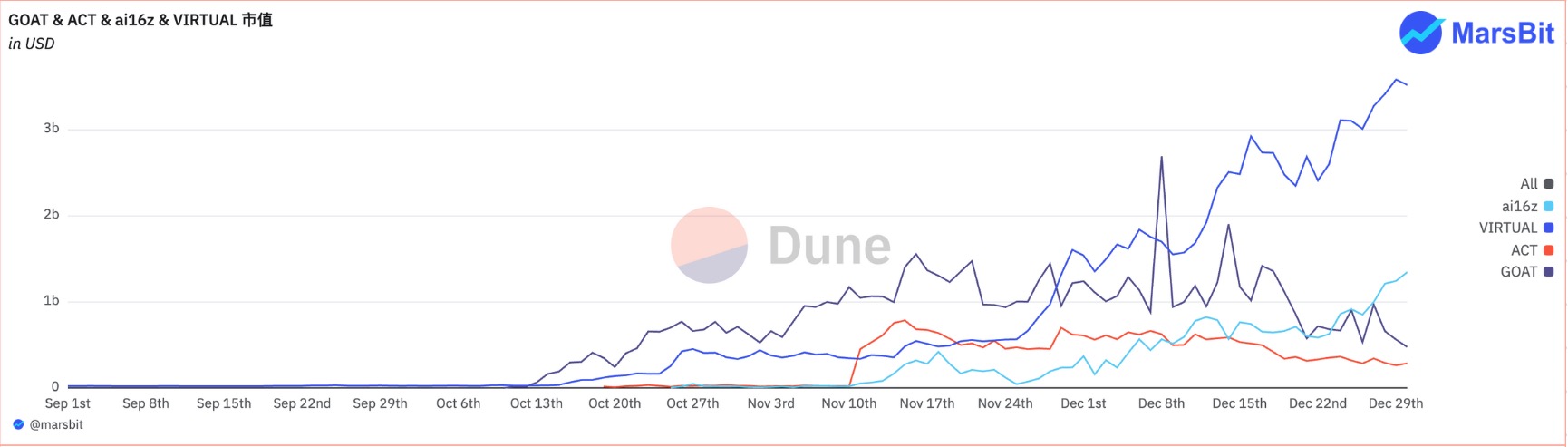

The most explosive innovation of the year - AI Agent

In 2024, the combination of Crypto+AI has ushered in an unprecedented explosion. From the rise of the DePin concept driven by the surge in Nvidia's stock price at the beginning of the year, to Worldcoin's universal basic income plan, to the decentralized AI network provided by Bittensor, the Crypto+AI narrative has ushered in a wave of operations. But the rapid rise of AI-agent at the end of the year has undoubtedly become the most explosive innovation in the crypto this year. Multiple AI tokens such as ACT, AIXBT, GAME, FAI, PHA, PAAL, etc. have ignited the enthusiasm of the market and demonstrated the huge potential of the deep combination of AI and blockchain.

AI-agent marks the first large-scale successful implementation of CryptoAI, which has found a real demand side for decentralized computing power, data sets, and machine learning networks. Before this, the demand in these areas was usually point-to-point and lacked sustainability; the emergence of AI-agent not only broke this bottleneck, but also drove the flywheel effect of related sectors. As a bridge connecting infrastructure and the attention economy, AI-agent introduces its potential to lower-level users and promotes the prosperity of the entire ecosystem.

Digital identity protocol in the AI era: Worldcoin (WLD) was founded by Sam Altman of OpenAI to launch a universal basic income (UBI) powered by artificial intelligence. Although its iris scanner has caused some controversy, its close connection with OpenAI and Altman cannot be ignored. The integration with OpenAI provides a strong endorsement for Worldcoin, and it is expected to become one of the top ten cryptocurrencies in the world overnight.

The network core of decentralized AI: Bittensor (TAO) calls itself the first "Neural Internet" and provides an interconnected core platform for decentralized AI projects. The platform supports developers to deploy code and compete with other projects for TAO tokens to promote AI innovation. Bittensor aims to become an incubator and proof-of-concept for decentralized AI, creating a new model for the deep integration of AI and blockchain.

In the early days of the AI Agent cycle, a large number of Memes + AI Agents were born . At this stage, there is actually not much difference between the two in terms of business models. In essence, they are both attention economies, which do not generate value but only culture. Therefore, as long as you have enough believers who firmly believe in you, this token or culture can continue.

AI craze on social media: Goatseus Maximus (GOAT) is the first AI-agent project to gain widespread attention and enthusiastic fan support on social media . The project is supported by Truth Terminal and its background story is full of absurd style and creativity. The GOAT token was created by Pumpfun, and the token market value exceeded 1.3 billion US dollars in one month, attracting a large number of fans and investors, proving the huge potential of AI-agent on social platforms.

Building the Metaverse of AI-Agents: Virtuals Protocol (VIRTUAL) is a core infrastructure based on the Base chain , focusing on simplifying the deployment of AI-agents, especially in the fields of games and the Metaverse. Through this protocol, developers can easily deploy AI-agents and share tokens and revenue, promoting the application of AI technology in the virtual world.

In the early days, many AI-agent projects chose to launch tokens through the pump.fun platform. However, building a truly sustainable AI-agent ecosystem platform is far more than just launching tokens. Virtuals is one of the most comprehensive ecosystem platforms in this field. Its initial business model includes a token launch platform, an AI-agent framework, AI-agent production tools, ecosystem tokens, native influential IP images, and a variety of practical application cases. This multi-dimensional ecosystem construction enables Virtuals to form a powerful flywheel effect in this round of waves and continue to promote its development. The price of the VIRTUAL token has soared from a low of $0.02 at the beginning of the year to more than $3.7, an increase of more than 18,400% .

Pioneering a new field of on-chain agents: ai16z and Eliza represent the emerging power of on-chain agents. The Eliza framework is one of the leading projects on Github, designed to support multiple industries (not just cryptocurrencies). Its potential lies in the long-term relevance of mining and connecting various sub-industries. The widespread application of Eliza will promote the cross-industry penetration of AI-agents and accelerate the popularization and development of this technology. The market value of the ai16z token has risen from millions of US dollars to 1.5 billion US dollars in just two months.

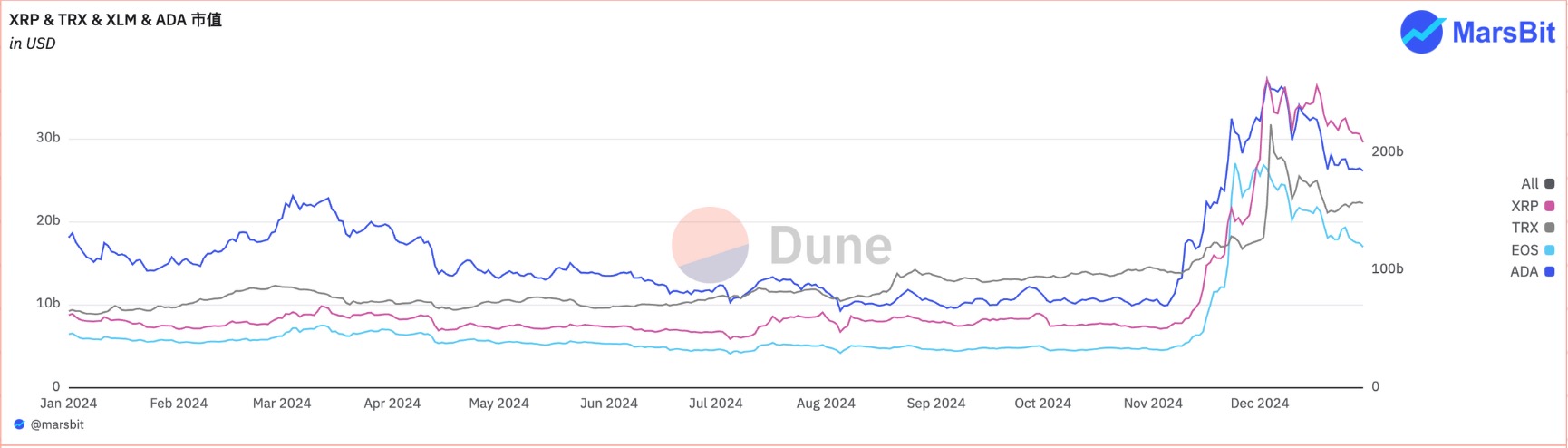

The most surprising thing of the year - the outbreak of old-brand currencies

When we all thought that the old currencies had no narrative to tell, in 2024, these classic mainstream assets that were once forgotten by the market unexpectedly rebounded strongly, proving that the old currencies are immortal with their outstanding performance. From policy relaxation to institutional increases such as Grayscale, these old currencies have re-attracted investors' attention through practical actions and become new highlights in the market.

SEC lawsuit lifted, XRP returns to its peak : XRP's revival is due to the settlement of the lawsuit with the U.S. Securities and Exchange Commission (SEC) . XRP has gotten rid of legal disputes and regained the trust of investors and regulators. XRP's appeal in markets such as South Korea has increased rapidly, and it has gradually landed in global payment scenarios. Its price soared from $0.5 to $2.9 , an increase of 480% . Its market value soared by more than $130 billion in less than 40 days . During the same period, its trading volume once surpassed Bitcoin , becoming the fastest-growing Altcoin in market value in 2024.

Tron hits new highs: Tron (TRX) has regained its vitality with its USDT transfer advantage and the development of DApp. In 2024, the Tron platform became the preferred chain for USDT transfers, and the number of USDT holding addresses ranked first among all chains , driving the platform's trading volume and total locked volume to grow significantly. Tron's TVL hit a new high of $13 billion , with revenue of $560 million in the past year. At the same time, the price of TRX climbed from a low of $0.1 at the beginning of the year to a high of $0.45, an increase of more than 350% .

ADA: Cardano, a Layer 1 project that once stood shoulder to shoulder with Solana, has recently experienced a rebirth. After Robinhood US relisted ADA, the price quickly climbed from the lowest point of $0.3 at the beginning of the year to a maximum of $1.3, demonstrating a strong market rebound.

XLM: XLM rose from the year's low of $0.08 to $0.63 in two weeks, an increase of more than 680%.

EOS: EOS rose from its low of $0.4 this year to $1.5, an increase of more than 275%.

The most heartbreaking bubble of the year: Bitcoin inscription ecosystem falls from the altar

The dramatic fluctuations in the Bitcoin inscription ecosystem are undoubtedly a classic case of the crypto market in 2024. From the initial glory to the final sharp decline, Ordi's story deeply reveals the irrational prosperity of the market and warns us that the speculative craze cannot withstand the harsh test of reality. In the early days of the inscription craze, a large amount of speculative funds poured in to promote its rapid growth, but the rapid cooling of the market exposed the fragility of this field.

The inscription market reached its peak at the beginning of the year, but the popularity dropped sharply: From the end of 2023 to the beginning of 2024, the inscription ecosystem, especially Ordi, once became a star application on the Bitcoin network. By introducing the "Inscriptions" function into the Bitcoin main chain, Ordi expanded the application scenarios of Bitcoin beyond transactions, stimulating the enthusiasm of market investors.

Since its launch on Binance, the price of Ordi has soared from $3 to $90, and its market value has exceeded $2 billion . Similarly, Sats was also launched on Binance, with a market value of $2 billion. However, this market boom did not last. With the rapid withdrawal of speculative funds, the market value of Ordi shrank sharply after March 2024, and the price fell to a minimum of $20. At the same time, the overall trading volume of the inscription market has shrunk significantly, and the liquidity of inscriptions has almost returned to zero.

Runes was born but could not save the situation: As a new project in the inscription ecosystem, Runes tried to reverse the market decline by enhancing functions and application scenarios. However, despite the introduction of many innovative elements and incentive mechanisms, the funds and users it attracted were still limited. Within two months of its release, the transaction volume of Runes continued to decline and remained at a low level. Today, except for DOG and PUPS, which still maintain a market value of 600 million and 100 million US dollars respectively, the rune ecosystem has almost lost market attention.

The potential and future of the inscription ecosystem: Although Ordi and the Bitcoin inscription ecosystem have experienced dramatic fluctuations, the short-term retreat of the speculative craze does not mean that it has completely failed. As a pioneer in the Bitcoin inscription ecosystem, Ordi has successfully expanded the application scenarios of Bitcoin, not only limited to simple transactions, but also provided new opportunities in areas such as decentralized storage and NFT.

The real value of the Inscription Ecosystem lies in its unique position in blockchain technology and digital asset innovation. The security and decentralization of Bitcoin make the Inscription function a huge potential infrastructure, which is expected to bring more applications and development opportunities in the future. Ordi's innovation still has considerable development potential.

Summary: There will always be a time to ride the wind and waves, and set sail to cross the vast ocean

In 2024, the entire cryptocurrency industry has experienced an extremely turbulent innovation and impact. The historic moment of Bitcoin breaking through the 100,000 mark not only demonstrates the strong appeal of cryptocurrency, but also proves the important position of digital assets in the global financial system. At the same time, the rise of emerging public chains and the trend of AI tokens have once again changed the landscape of the crypto market, bringing unprecedented opportunities and challenges to investors.

As governments around the world gradually introduce more standardized policies and regulations, the cryptocurrency market will be further standardized, providing investors with greater confidence and protection.

We are firmly optimistic about the future of cryptocurrency, although the market may experience repeated fluctuations. However, with the ever-evolving technological innovation and increasingly mature market environment, blockchain technology will surely usher in a broader development space and become an indispensable force in the global financial, technological and investment fields.

Note: The chart data comes from https://dune.com/ MarsBit/2024-final