The cryptocurrency market saw a significant surge in the fourth quarter of 2024 [1], according to the FTSE/Grayscale Crypto Industry Index Series, reflecting the market's positive reaction to the US election results. The competition in the smart contract platform crypto sector remains fierce. As the leader in this category, Ethereum's performance was outpaced by the second-largest market cap, Solana[2], while investor focus is also gradually shifting towards other Layer 1 networks, such as Sui and The Open Network (TON) which is deeply integrated with the Telegram messaging platform.

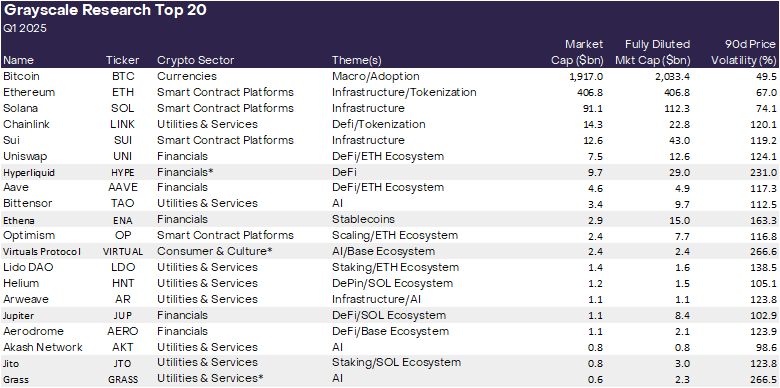

We have updated the Top 20 asset list in Grayscale Research. The Top 20 represents a diversified set of assets that we believe have high potential in the various crypto sectors over the next quarter. New additions for this quarter include HYPE, ENA, VIRTUAL, JUP, JTO, and GRASS. Please note that all assets in our Top 20 list have high price volatility and should be considered high-risk assets.

The Grayscale Crypto Sectors framework provides a comprehensive approach to understanding the investable digital asset landscape and the underlying technological relationships. Collaborating with FTSE Russell, we have developed the FTSE/Grayscale Crypto Industry Index Series to measure and monitor crypto asset categories (see Chart 1). Grayscale Research applies this crypto industry index in our ongoing analysis of the digital asset market.

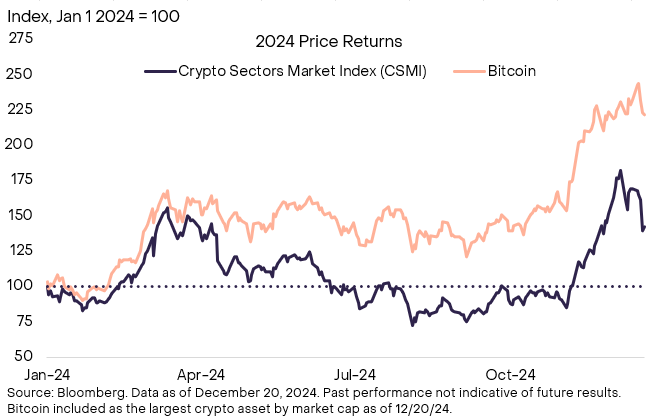

Chart 1: Our crypto industry index delivered positive returns in 2024

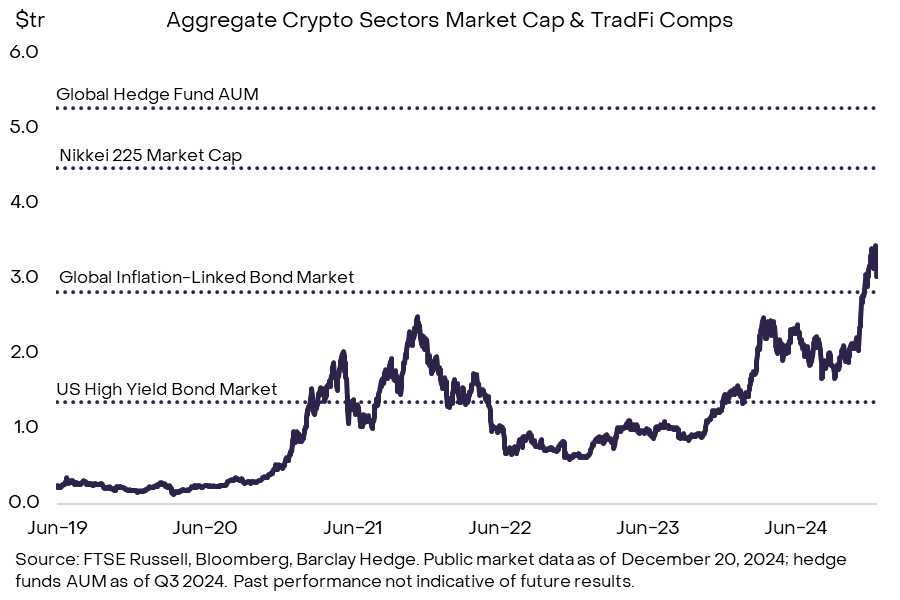

In the fourth quarter of 2024, cryptocurrency valuations surged significantly, primarily driven by the market's positive feedback on the US election results. According to our Comprehensive Crypto Market Index (CSMI), the total market capitalization of the industry grew from $1 trillion to $3 trillion [3] this quarter. Chart 2 compares the crypto market capitalization to various traditional public and private market asset classes. For example, the current size of the digital asset industry is roughly equivalent to the global inflation-linked bond market, about twice the size of the US high-yield bond market, but still significantly smaller than the global hedge fund industry or the Japanese stock market.

Chart 2: Crypto market capitalization increased by $1 trillion in Q4 2024

Due to the rise in valuations, many new tokens have met the inclusion criteria of our crypto industry framework (a minimum market cap of $100 million for most assets). In this quarter's index series rebalance, we added 63 new tokens, bringing the total to 283. The Consumer & Culture Crypto Sector saw the most new token additions, reflecting the continued strong performance of meme coins and various assets related to gaming and social media. The most significant new addition by market cap in this crypto industry framework is Mantle, an Ethereum Layer 2 protocol that now meets our minimum liquidity requirements (see our index inclusion criteria for more details).

Competition in Smart Contract Platforms

The smart contract platform crypto sector may be the most fiercely competitive segment of the digital asset industry. While 2024 was a landmark year for the sector's leader, Ethereum, which received approval to launch a spot exchange-traded product (ETP) in the US and completed a major upgrade, its token Ether still underperformed some of its competitors, including the second-largest in this category, Solana[4]. Investors are also turning their attention to other Layer 1 networks, such as the high-performance Sui, and TON, which is integrated with the Telegram messaging platform.

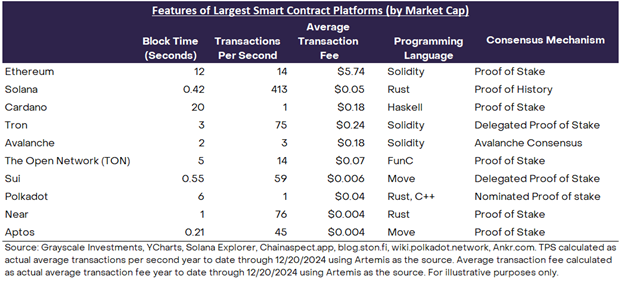

In the process of building infrastructure for application developers, the designers of smart contract blockchains must balance multiple trade-offs. These trade-offs impact the three elements of the "Blockchain Trilemma": network scalability, network security, and network decentralization. For example, prioritizing scalability often means high transaction throughput and low fees (like Solana), while prioritizing decentralization and security may result in lower transaction throughput and higher fees (like Ethereum). The specific design choices lead to significant differences in block times, transaction throughput, and average transaction fees across platforms (see Chart 3).

Chart 3: Different smart contract platforms have distinct technical characteristics

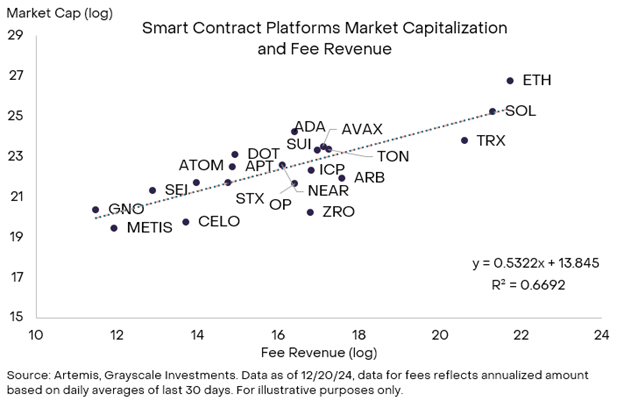

Regardless of a platform's design trade-offs and network strengths and weaknesses, one way smart contract platforms empower themselves is through their ability to generate network fee revenue. As we've discussed in previous articles, fee revenue can be seen as a primary driver of token value accumulation in this sector, although metrics like Total Value Locked (TVL) are also worth considering (see "The Battle for Value in Smart Contract Platforms"). As shown in Chart 4, there is a statistical relationship between smart contract platforms' fee revenue and their market capitalization. The stronger a network's ability to generate fee revenue, the more likely it is to channel value back to the network through token burning or staking rewards. This quarter, the smart contract platforms in Grayscale Research's Top 20 list include ETH, SOL, SUI, and OP.

Chart 4: All smart contract platforms are competing for fee revenue

Grayscale Research Top 20

Each quarter, the Grayscale Research team analyzes hundreds of digital assets to support the rebalancing process for the FTSE/Grayscale Crypto Industry Index Series. From this process, Grayscale Research selects a Top 20 asset list within the crypto industry. The Top 20 represents a diversified set of assets that we believe have high potential in the next quarter (see Chart 5). Our research methodology considers multiple factors, including network growth/adoption, timing of potential catalysts, fundamental sustainability, token valuations, token inflation, and potential tail risks.

This quarter, we are focused on tokens that can touch at least one of three core market themes: (1) the US election and its potential impact on industry regulation, particularly in areas like decentralized finance (DeFi) and staking; (2) continued breakthroughs in decentralized AI technology and the use of AI agents on blockchains; and (3) growth in the Solana ecosystem. Based on these themes, we have added the following six assets to the Top 20 list for Q1 2025:

- Hyperliquid (HYPE): Hyperliquid is a Layer 1 blockchain designed to support on-chain financial applications. Its main application is a decentralized exchange (DEX) focused on perpetual contracts, with a fully on-chain order book.

- Ethena (ENA): The Ethena protocol has launched a new stablecoin called USDe, primarily supported by long positions in BTC and ETH, along with short positions in perpetual contracts to hedge [5]. Specifically, the protocol holds long positions in Bitcoin and Ethereum, while simultaneously taking short positions in similar asset perpetual contracts. Staking rewards come from the spread between spot and futures prices.

- Virtuals Protocol (VIRTUAL): Virtuals Protocol is a platform for creating AI agents on the Ethereum Layer 2 network Base. These AI agents are designed to autonomously execute tasks, simulating human decision-making processes. The platform allows for the creation and co-ownership of tokenized AI agents that can interact with their environment and other users.

- Jupiter (JUP): Jupiter is the leading DEX aggregator on Solana, with a top TVL among all applications on the network. As more retail traders enter the crypto market through Solana, and speculation around meme coins and AI agent tokens on Solana intensifies, we believe Jupiter is poised to benefit from this increasingly active market environment.

- Jito (JTO): Jito is a liquid staking protocol on Solana. Over the past year, Jito's adoption has increased significantly, and its financial performance has been among the best in the crypto space, with projected fee revenue exceeding $550 million in 2024.

- Grass (GRASS): Grass is a decentralized data network that rewards users with a Chrome extension for sharing their unused internet bandwidth. This bandwidth is used to crawl web data, which is then sold to AI companies and developers for training machine learning models, essentially monetizing web data crawling and compensating users [6].

Figure 5: This quarter's updates to the Top 20 cover DeFi applications, AI agents, and the Solana ecosystem.

Note: Highlighted backgrounds indicate assets added in the new quarter (Q1 2025). Assets marked with an asterisk (*) are not included in the corresponding crypto industry index track. Source: Artemis, Grayscale Investments. Data as of December 20, 2024. For illustrative purposes only, assets may change. Grayscale, its affiliates, and clients may hold the digital assets discussed herein. All assets in the Top 20 list have high price volatility and should be considered high-risk assets.

In addition to the new themes mentioned above, we remain optimistic about the other themes from previous quarters, such as Ethereum scaling solutions, asset tokenization, and decentralized physical infrastructure (DePIN). To reflect these themes, we continue to retain protocols that have returned to the Top 20, such as Optimism, Chainlink, and Helium, which correspond to the aforementioned themes.

This quarter, we have removed the following assets from the Top 20: TON, Near, Stacks, Maker (Sky), UMA Protocol, and Celo. Grayscale Research still recognizes the value of these projects and believes they continue to hold important positions in the crypto ecosystem. However, we believe the new Top 20 list may offer more attractive risk-adjusted returns in the coming quarter.

Investing in crypto assets carries certain risks, some of which are unique to this asset class, including smart contract vulnerabilities and regulatory uncertainty. Additionally, all assets in the Top 20 list have high volatility and should be considered high-risk, and may not be suitable for all investors. Given the risk considerations for this asset class, any investment in digital assets should be made at the portfolio level and aligned with the investor's financial objectives.

Index Definition: The FTSE/Grayscale Digital Assets Index (CSMI) measures the price return of digital assets listed on major global exchanges.

[1] The crypto industry total market index rose 58% this quarter as of December 20, 2024. Source: FTSE, Grayscale Investments.

[2] FTSE, Grayscale Investments, as of December 20, 2024.

[3] Source: FTSE Russell, data as of December 20, 2024.

[4] As of December 20, 2024.

[5] USDe's collateral may also include other liquid stablecoins.

[6] Bitget