The price of Crypto.com PENGU has risen more than 9% in the last 24 hours, and trading volume has increased by 150%, reaching $907 million. PENGU, the second largest Solana meme coin after BONK, has seen its market capitalization rise to $2 billion, attracting significant attention.

Despite the recent surge in RSI and the bullish momentum reflected in the DMI, the trend strength remains weak, indicating cautious optimism among traders. The altcoin is approaching a crucial resistance level of $0.043, and if the current momentum persists or reverses, the possibility of further upside or a sharp correction exists.

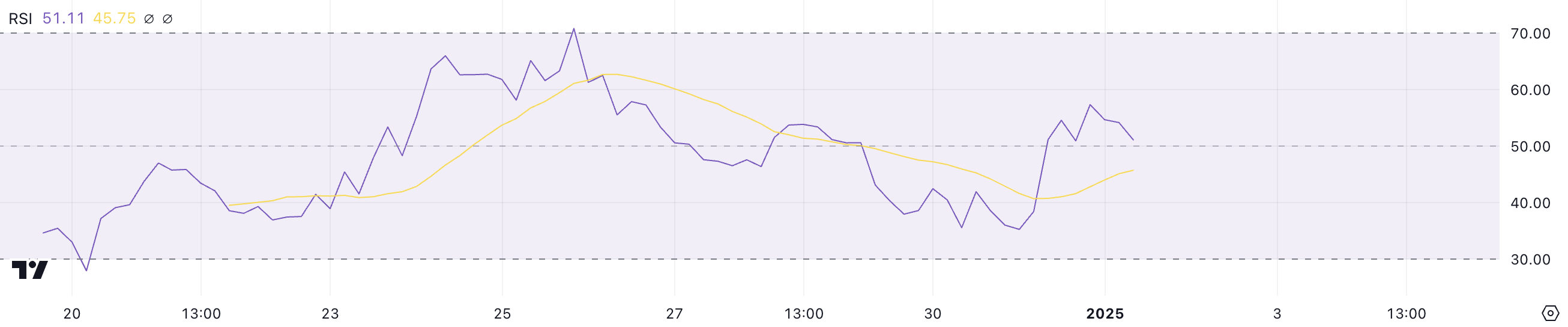

PENGU RSI Surges... Remains in Neutral Territory

The Relative Strength Index (RSI) of PENGU is currently at 51, slightly down from 57 yesterday. This is the result of a rapid surge from 35 in a single day. This movement suggests that buying pressure has somewhat decreased, but the RSI remains in the neutral zone.

The sharp rise from oversold levels implies a recent recovery phase, but the stabilization around 51 suggests that the market is in a state of temporary pause as traders assess the next direction of the PENGU price.

The RSI is a momentum indicator that measures the strength and speed of price movements on a scale of 0 to 100. Values above 70 indicate overbought conditions and often suggest the possibility of price corrections, while values below 30 indicate oversold conditions and the potential for price recovery.

With PENGU's RSI currently at 51, this indicator does not reflect a strong upward or downward trend, but rather reflects the market's uncertainty. In the short term, this neutral RSI suggests that PENGU's price may consolidate unless a clear change in buying or selling pressure pushes the momentum in a definitive direction.

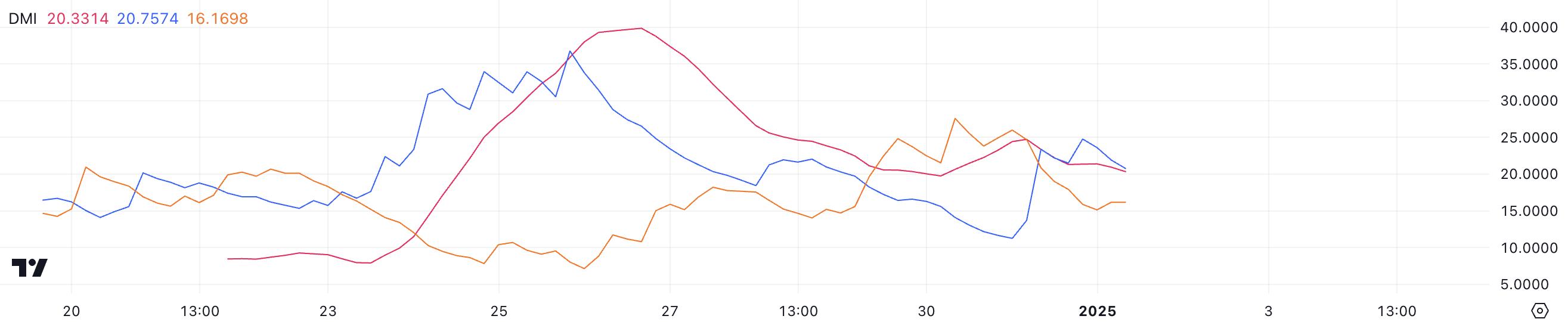

PENGU Trend Strength Lacking

PENGU's DMI chart shows that the ADX has decreased slightly to 20.3 from the previous day's record of 25, indicating a weakening of the trend strength. This decline in ADX suggests that the market is entering a phase of reduced directionality, despite the recent momentum.

The chart, with +DI at 20.7 and -DI at 16.1, reflects a bullish bias. The buying pressure is stronger than the selling pressure, but the strength is minimal.

The Average Directional Index (ADX) measures the strength of a trend from 0 to 100, regardless of the direction. Values above 25 indicate a strong trend, while values below 20, like PENGU's current 20.3, suggest a weak or absent trend. While the slightly higher +DI indicates a persistent bullish momentum, the decline in ADX suggests a lack of strong underlying strength behind the movement.

In the short term, PENGU's price may experience limited volatility unless the ADX rises again to confirm a strong trend or the directional indicators show a decisive change in buying or selling pressure.

PENGU Price Prediction: Reaching $0.05 in January?

PENGU's price has risen more than 9% in the last 24 hours, reaching a market capitalization of $2 billion. This has made it one of the largest Solana memecoins, driven by strong momentum. If this upward trend continues to strengthen, PENGU's price is likely to test the $0.043 resistance level soon.

Breaking above this level could open the door for further upside. With targets at $0.045 and $0.05, PENGU may approach or even exceed its previous all-time high and potentially regain its market capitalization lead over BONK.

However, if the trend reverses and a downward trajectory is established, PENGU's price could experience a sharp correction. The closest strong support level is at $0.025, a crucial level that must be maintained to prevent further downside.