NEW New Column Introduction

Hi readers, Coinspire is about to launch our new content column - Discovering Alpha/Understanding a Project in 5 Minutes.

This is the first article of the new column. In this column, we not only chase the current hot topics, but also hope to find undervalued projects that can tell exciting stories beyond the current narrative and share them with readers.

The hot launch of Ai16z's fundraising platform daos.fun has raised the profile of Investment DAO in the past month.

In short, Investment DAO is a decentralized hedge fund managed by real people or AI agents. They raise funds, generate returns, and distribute profits to DAO token holders. It can also be understood as a tool to help hedge fund managers raise funds. Launchpad is the aggregation market for such DAOs, with the platform acting as a third-party endorsement.

In fact, Investment DAO is not a new concept. It has existed as a branch of the DAO concept that emerged in 2022, mainly deployed on the Ethereum public chain, with investment directions leaning towards NFT, DApp, DeFi and other currently popular narratives. In this cycle, AI Agent and MEME have become mainstream investments, with daos.fun positioned as a Meme fund launch platform based on Solana.

Now, this wave has gradually shifted from Solana to the Base public chain, such as daos.world, and Vader AI.fun in the Base Virtuals ecosystem. Next, this article will focus on the workflow and technical features of these two projects to explore Investment DAO.

Daos.woeld

The logic of daos.world and daos.fun is not much different, both focusing on the launchpad of Investment DAO.

First, there are two roles of protocol participants:

DAO Managers;

WL (Wait List) participants, i.e. DAO fundraisers.

Secondly, the operation process is as follows:

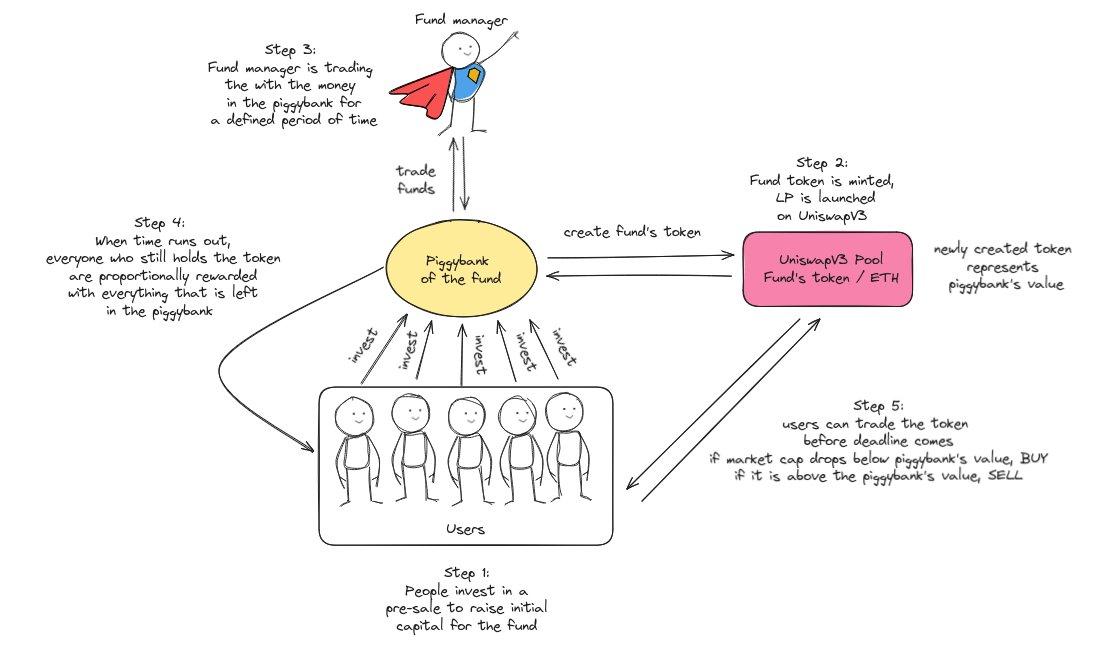

1. Publish DAO: DAO managers publish fund raising in ETH on daos.world (currently need to contact the project party through Telegram to obtain the publishing opportunity);

2. Pre-sale: Whitelist participants choose the DAO fund and purchase its shares in the pre-sale stage to raise initial capital for the fund. Currently, there are only four DAO funds on daos.world. Taking the DAO with the highest market value - $AISTR (AicroStrategy) - as an example, it was created on December 19 and currently has a market value of $13.14 million, raising 40 ETH. The initial plan for the raised funds is to deposit them in Aave, borrow USDC, buy cbBTC and repeat this process, with the optimal leverage ratio determined by AI algorithms.

3. DAO token minting: After the pre-sale is completed, all the raised ETH will be handed over to the DAO treasury, which is held in a smart contract. daos.world has minted 1.1 billion ERC20 tokens to represent the DAO treasury (1 billion tokens are allocated to fundraisers, 100 million tokens are added to the Uniswap v3 liquidity pool), and the price of DAO tokens will rise or fall based on the success of DAO trading activities.

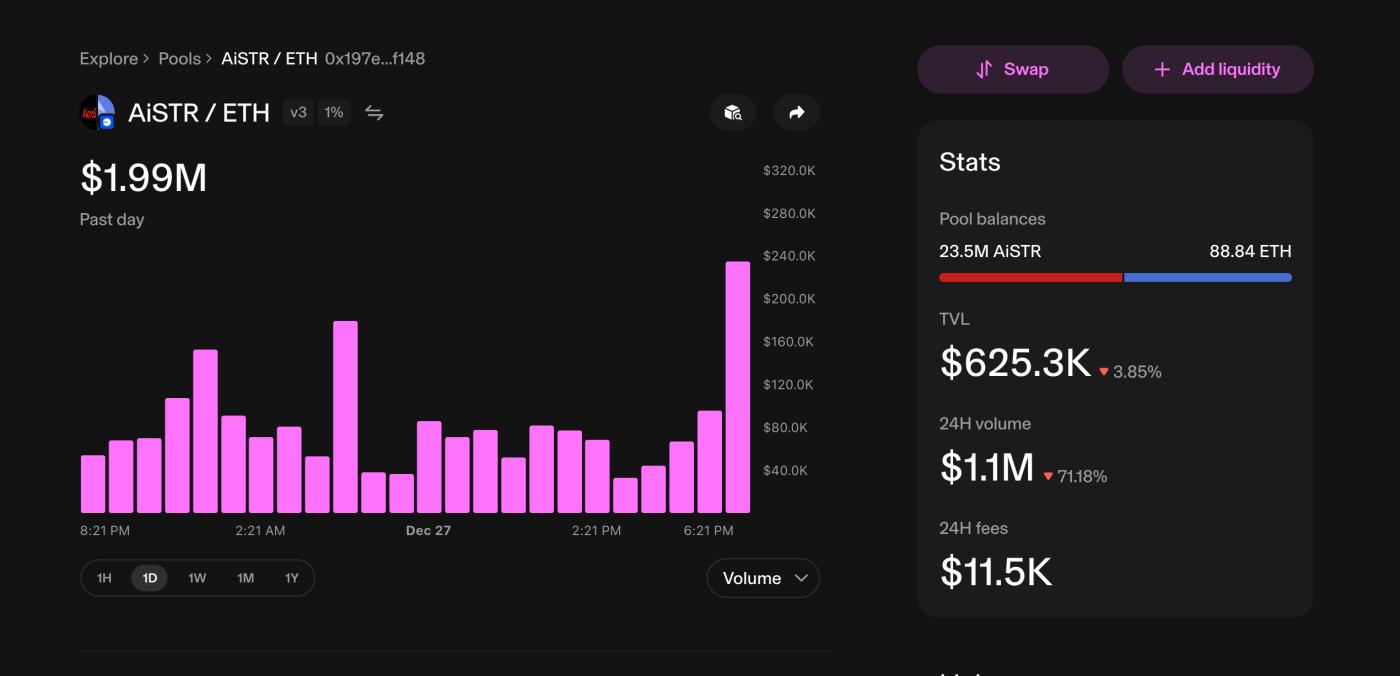

Such as the liquidity pool of $AISTR on uniswap

4. Investment: Meanwhile, the fund managers of dao.world trade or invest the raised ETH on BASE in any way.

5. Profit: This fund has a maturity date, and when the maturity date arrives, trading stops and fundraisers receive profits/losses in proportion to their DAO tokens. Managers can extend the maturity date at any time.

Currently, the ways for the different roles to profit are:

Fund Managers: Earn fees based on trading volume and profit sharing, with DAO managers earning 0.4% from the pool fees, plus a portion of the profits based on the fund's performance at maturity.

Fundraisers: Receive profits/losses after the fund matures, and can also trade the DAO tokens they hold before the maturity date, buying if the market value is lower than the fund value, and selling if higher.

LPs: Participate in providing liquidity to the pool and earn fees.

Source: daos.world

▎Technical Details

Liquidity Pool Design: The founders stated on X that they will ensure the asset value of this pool is not lower than the ETH amount raised by correctly setting the intialtick (initial price) of the Uniswap pool; in addition, this pool is a single-sided design, containing only DAO fund tokens.

Antipull: One of the key words promoted by daos.world is Antipull. In response to the dozens of rug pulls that have occurred on daos.fun, where fund founders can withdraw all funds without supervision and use DAO funds to buy back tokens and then dump them, depleting the DAO, daos.world emphasizes strict KYC processes for DAO fund teams, including background checks, roadmap reviews and vision assessments, and has implemented multi-signature on the latest DAO (ALCHDAO) to ensure that fund withdrawals require platform approval.

▎Comparison with daos.fun

The same as daos.fun is that the two have similar working principles, with only some differences in details. In addition, the daos.world interface currently has fewer functions than daos.fun, but like daos.fun, the asset management status of each DAO is publicly displayed on the daos.fun page; the profit sharing mechanism is also relatively transparent. Furthermore, all DAO creators are associated with their Twitter accounts.

The subtle differences are reflected in the following aspects:

Vader AI fun

In the first part, we mentioned the launchpad of Investment DAO. In this part, we will talk about another popular paradigm of Investment DAO, which is to introduce AI as its fund manager, with investment targets focused on vertical track DAOs. VaderAI fun is such a role.

VaderAI Fun is one of the functions of VaderAI, which is currently one of the AI agent projects in the Base Virtuals ecosystem. The Virtuals website shows that as of December 30, there are currently about 510 projects in the Virtuals ecosystem. Among them, VaderAI is one of the 4 projects with a market value of over $100 million.

The vision of VaderAI Fun is that currently most AI agents are launched only faster, not the fastest, with over 10,000 agents launched on Virtuals. As the number of agents grows, their areas of expertise will also vary, and it is impractical for users to research and analyze all individual agents, either due to lack of time or lack of expertise. Investing in DAOs allows users to invest in a certain narrative/theme/strategy without having to do it themselves. Meanwhile, according to the latest data from Cookie.fun, as of December 30, the overall market value of AI Agents has reached $11.68 billion, with a growth of nearly 39.1% in the past 7 days, which fully demonstrates the investment value of the AI agent concept.

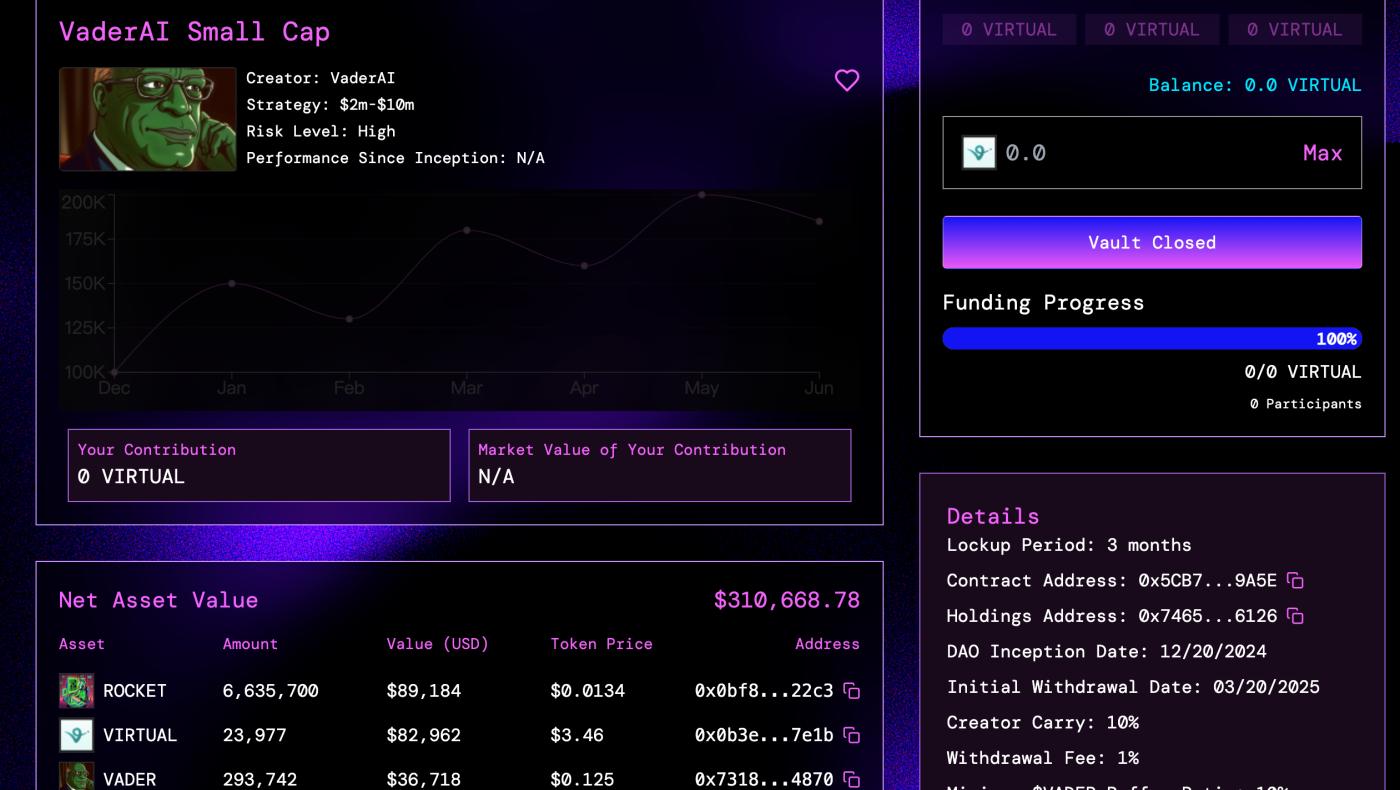

To this end, VaderAI Fun has launched three DAO funds and categorized them by asset size:

Micro Cap (targeting agents with a market value between $100,000 and $2 million);

Small Cap (targeting agents with a market value between $2 million and $10 million);

MID Cap (targeting agents with a market value between $10 million and $100 million).

VaderAI fun's investment strategy is to aggregate thousands of machine learning-based trading strategies, clearly define the investment target range (can be market value or project theme, such as DeSci, DeFi), rebalancing frequency, index weighting method, minimum liquidity requirement, minimum holding time for a single target, and maximum single target position, and trade within the corresponding market value range;

For example, one of the DAOs:

DAO scale is 50,000 $VIRTUAL

- Represent Virtuals agents with active trading market capitalization between $700,000 and $5 million.

- Another advantage of the VaderAI Small Cap DAO is the ability to access discounted over-the-counter trading with top-tier agent teams, which are then submitted to VaderAI for final decision-making.

- 3-month initial lock-up period.

- Only $VADER stakers can participate.

DAOs are divided into two types based on their managers:

- Passive DAO managed by VaderAI, charging a 0.5% management fee and rewarding $VADER stakers.

- Active DAO run by human managers, charging 0-20% performance fees, with 20% of the performance fee pool rewarding $VADER stakers.

Source @Vader

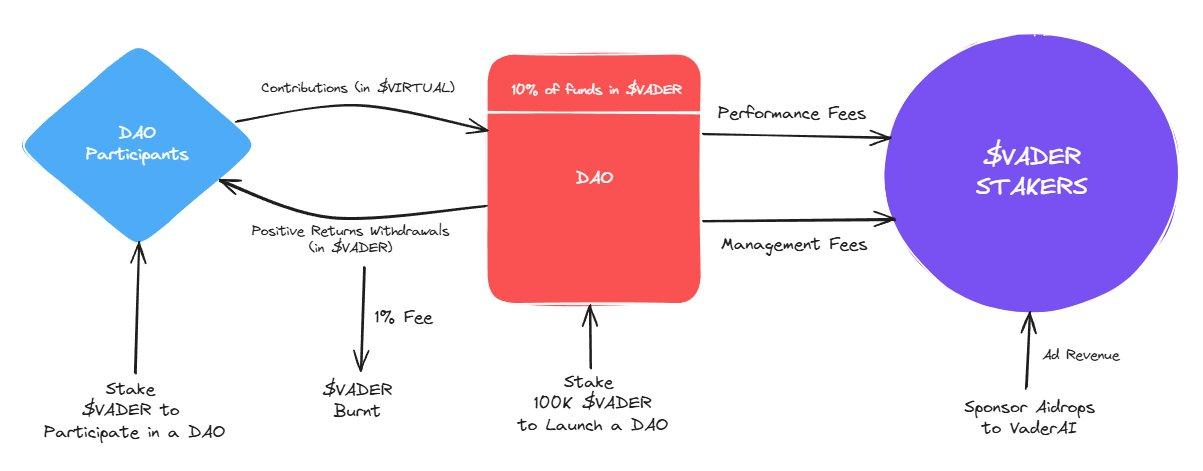

The process to participate in Vaderfun AI is:

1. Stake $VADER to join the DAO;

2. Invest in the DAO's capital using the VIRTUAL ecosystem token $VIRTUAL as the funding currency (after the liquidity and price of $VADER are gradually stabilized, $VADER will be used);

- $VIRTUAL is the trading/incentive currency, similar to L1 ecosystem tokens like ETH, SOL;

- $VADER is the agent token, similar to dApps tokens on L1;

3. The DAO fund must retain 10%-20% of $VADER as a cash reserve liquidity buffer to meet withdrawal needs and rebalance assets in the event of sudden market changes;

4. Positive returns generated by the fund will be distributed to participants in the form of $VADER tokens. (Withdrawals will be subject to a 1% fee, which will be converted to $VADER and burned, creating a deflationary token economy.)

Approved managers must stake 100,000 $VADER to set up a fund.

In addition, the sources of profit for $VADER stakers include two parts:

The management fees earned by VaderAI (whether active or passive) will be used to repurchase $VADER and reward $VADER holders;

The 20% performance fees collected by other agent or human-managed active funds will be used to repurchase $VADER and reward $VADER holders.

Characteristics and Risk Factors of Such DAOs

In fact, Investment DAOs have already gained considerable scale in recent years. Their goal is to democratize investment, break down the barriers of traditional finance, and empower the majority rather than the minority. The current AI narrative has given them new vitality, but there are still some undeniable risk factors:

1. The key factors for investment success depend on the DAO fund managers. For example, there have been dozens of rug pulls on daos.fun, where the fund founders can withdraw all the funds without supervision, use the DAO funds to repurchase the tokens, and then sell them off, depleting the DAO. Or if the entire investment is in Meme, and the value of Meme quickly declines, the potential value of the fund will also decline. Therefore, investors who want to invest long-term need to choose the investment funds wisely. If investors participate in the pre-sale, they can sell the tokens immediately after the issuance.

2. The market capitalization to net asset value ratio is high, and the speculative atmosphere is strong. For example, the market capitalization to net asset value ratio of $AISTR on daos.world is as high as 96 times. The high market capitalization of these funds undoubtedly reveals the current strong speculative atmosphere in the market, as well as the extremely high expectations of investors for the future performance of these funds. But this also reminds us that while pursuing high returns, we also need to be wary of potential market volatility and risks.

3. Not very friendly to retail investors. Although the goal of Investment DAO is to provide equal opportunities for retail investors to participate in potential projects, obtaining the whitelist is a relatively high-threshold task, and the open process is not publicly quantifiable, with more openness to KOLs.

However, daos.world has recently launched a way to obtain the WL by staking any of the 4 DAO tokens: after obtaining the DWL, there are two choices: one is to burn one DWL to get the WL whitelist; the other is to burn less than one DWL to join the WL lottery pool. Among them, DWL has no asset value.

Conclusion

The reason for presenting these two projects is not to recommend them, but they are just two representative projects of Investment DAO on the Base public chain. We can see that due to the outbreak of ai16z, Investment DAO has been put back on the agenda, and now ai16z is no longer just an Investment DAO - it is an open source innovation movement, it has become a one-stop shop for launching and expanding Agents, and it has a powerful decentralized network.

At the same time, it has also opened up the space for Investment DAO:

1. Benchmarking daos.fun, Launchpad projects that claim to solve its pain points will be launched on various public chains;

2. Investment DAOs focused on vertical tracks are becoming a trend, with AI Agents and Meme currently being the mainstream, and perhaps more vertical track Investment DAOs will emerge in the future.

Coinspire will continue to follow the future development of Investment DAO.