Author: Ana Paula Pereira, CoinTelegraph; Translator: Tong Deng, Jinse Finance

2024 will be remembered as a landmark year in the history of cryptocurrencies. From the surge in mainstream demand for Bitcoin-based financial products to the White House's crypto-friendly expectations, the Web3 industry has made significant progress despite facing significant challenges along the way.

As its resilience is finally rewarded, and with the hope of regulatory clarity combined with years of innovation and development, the industry is now looking towards another promising year.

Experts are closely watching emerging trends that not only have the potential to redefine the cryptocurrency landscape, but will also impact the world.

RWA: Use Cases to Watch in 2025

If you've never heard of it, make a note of this word: tokenization. It refers to the art of converting traditional assets into tokens, making them tradable, even in small fractions.

In 2024, developers, investors, and companies from across industries have been captivated by the tokenization of real-world assets (RWA) craze, as it unlocks liquidity for traditionally illiquid assets (such as real estate) and allows people around the world to access investments that small investors don't always have access to.

"RWA is a use case to watch in 2025. The value of tokenized assets will double this year," Interop Labs CEO and Axelar Network co-founder Sergey Gorbunov predicts.

Venture capital firm a16z also echoes Gorbunov's view. The VC firm stated in its annual report on crypto and blockchain industry trends that "tokenizing unconventional assets could redefine revenue sources in the digital age."

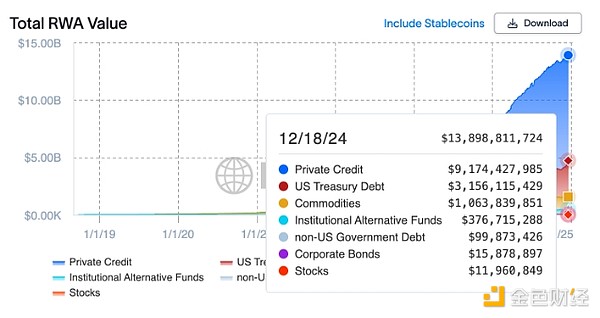

According to data from RWA.xyz, the total value of tokenized assets is currently close to $13.9 billion, up 67% from $8.3 billion in January.

On-chain real-world assets are currently worth over $13.8 billion. Source: RWA.xyz

Financial institutions are currently studying the risk framework for tokenized assets. In other words, they want to ensure compliance with legal requirements and address security risks and market volatility. According to Gurbunov, "Several major financial institutions will develop the risk framework required to issue RWAs that can move across interconnected public blockchains."

Identity Verification via AI Agents

Over the past few years, several protocols have been exploring how to provide identity verification on-chain.

One advancement in this field is undoubtedly the emergence of zero-knowledge (ZK) proofs, a technology that allows humans to prove themselves without revealing any personal information. Startups developing this technology include Worldcoin, ONCHAINID, and RisedID.

Looking ahead, on-chain biometric verification is expected to be increasingly supported by artificial intelligence. In other words, AI will automatically check your identity on-chain. This may sound like a scene from a sci-fi movie, but it's just one example of the convergence of AI and blockchain.

"We expect automated biometric identification and/or government ID checks to become the norm, not the exception," said Civic CEO Chris Hart. He continued:

"As AI agents increasingly act on behalf of users, robust identity verification and authorization frameworks are critical to controlling what these agents can do and for how long - especially in financial transactions."

DePIN Set to Take Off

Through decentralized physical infrastructure networks (DePIN), community-driven energy services, online storage, and internet connectivity have become a reality.

DePIN allows users to become stakeholders in the network, meaning they can own a portion of the infrastructure they use, creating new opportunities for financial inclusion.

Borderless Capital is a venture capital firm that has invested millions of dollars in DePIN protocols, claiming the industry has the "most compelling opportunities" in Web3.

Borderless partner Álvaro Gracia points out: "It's the only Web3 vertical industry that can generate revenue and fundamentals, completely uncorrelated to the crypto markets, that can deliver real-world value."

According to data compiled by DePIN.Ninja, the market capitalization of DePIN protocols has exceeded $50 billion.

Bitcoin Brings More Rewards

Finally, it's impossible to discuss 2025 without mentioning Bitcoin. Bitcoin was once a disreputable asset, but has made significant strides over the past decade, gaining widespread recognition on Wall Street and cementing its position in the financial realm.

While developers are still working to upgrade the network, which now has more stakeholders than ever before, startups are exploring other ways to unlock rewards for holders.

"This is a native demand for holders, including retail and institutions. This is a native demand for holders," said Kevin He of Bitlayer, a Bitcoin Layer 2 protocol backed by asset manager Franklin Templeton.

According to He, not only investors, but also major BTC holders like MicroStrategy are seeking additional income sources through the integration of Bitcoin and decentralized finance.

He said Bitcoin holders could soon see annual returns of up to 40% from their holdings.