Author: HelloLydia¹³

2024 is undoubtedly the first year of chain abstraction, and we have witnessed the narrative go from non-existent to product implementation. After 12 months of effort, experience has proven to us that both the theory of chain abstraction being useless and the theory of chain abstraction achieving a quick victory are incorrect. The transformation of the on-chain transaction paradigm is inevitably a protracted battle.

My Story: From Chain Abstraction Researcher to Builder

My interest in chain abstraction originated from a conversation with @coin_casanova in July, when I was a researcher at Mint Ventures and had gained a small following with a few research reports.

One day, casa suggested that I research $ACX (the token of Across Protocol, which was listed on Binance in the last month of 2024). At first glance, it seemed like just another cross-chain bridge, a relic from the previous cycle. But upon closer inspection, I found that Across used an "intent-based architecture" and had truly achieved faster speeds and lower prices than other cross-chain solutions. The Across team had also collaborated with Uniswap to launch the cross-chain intent standard ERC-7683.

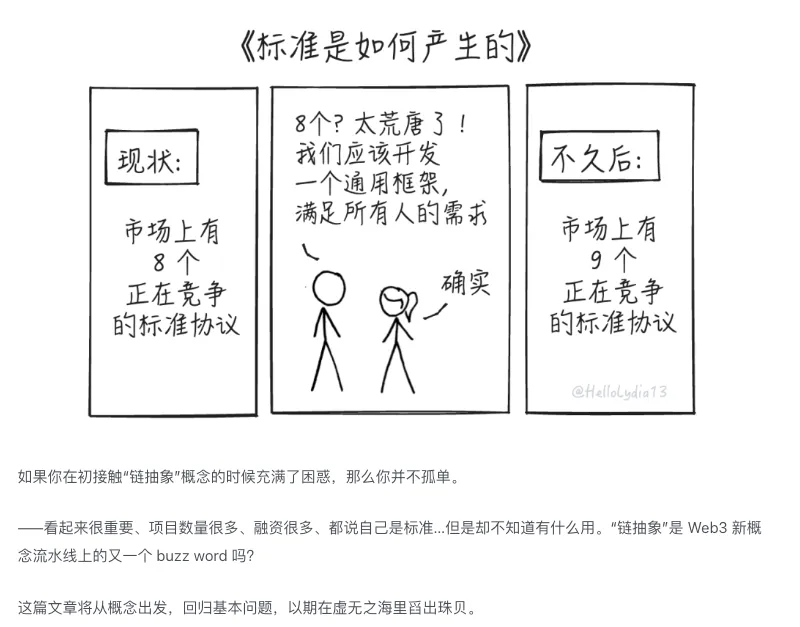

As my research on $ACX deepened, I found myself falling into a rabbit hole of new concepts: cross-chain bridges, cross-chain communication, interoperability, intent, chain abstraction... it was all very confusing. As a researcher, I am very particular about the choice and use of concepts, but at the time, I couldn't find any articles in either the Chinese or English-speaking areas that could help me clarify the relationships between these concepts. So I decided to take matters into my own hands and wrote a piece called Understanding Chain Abstraction by Problem Framing.

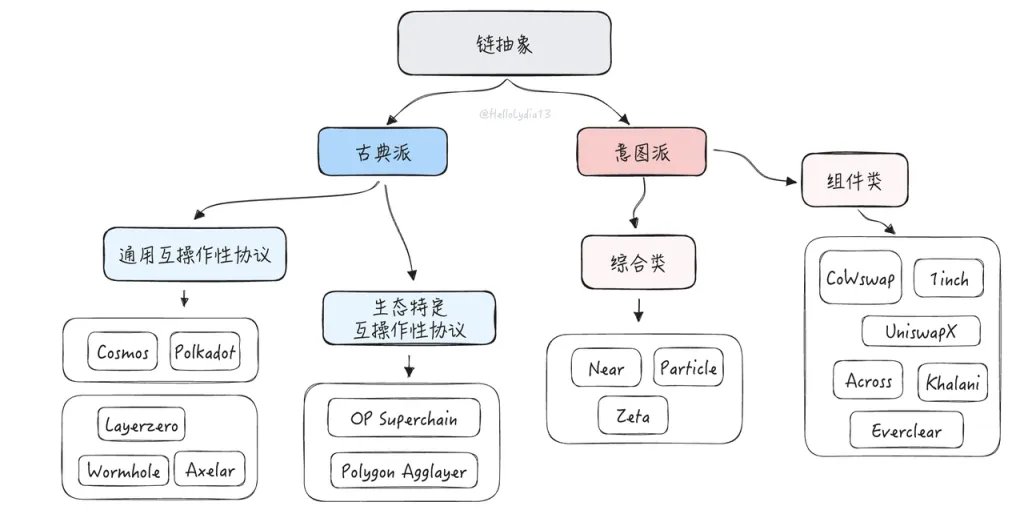

The reason I chose "chain abstraction" rather than cross-chain or interoperability as the research object is that in my classification, chain abstraction is a very high-dimensional narrative that encompasses many specific technical paths, so I included cross-chain and interoperability within chain abstraction. And in this research report, I expressed my optimism about the adoption of intent architecture and user-facing chain abstraction solutions - following the clues, you can trace upwards to Across Protocol and downwards to the newly launched UniversalX@UseUniversalX.

Interestingly, during the writing of this research report, I noticed that the Particle Network Blog (@CarlosCanCab, @TABASCOweb3) covered a lot of very professional chain abstraction research, and combined with the Li.Fi Blog (@arjunnchand), it basically helped me fill in the basic knowledge from the most classical cross-chain bridges to the latest emerging chain abstraction. I was also happy to include Particle Network in my chain abstraction project diagram.

One day in October, the CEO of Particle Network, @0xpengyu, contacted me through a mutual friend, and after a series of substantive and unconventional brainstorming sessions, my passion for the chain abstraction cause had swelled to the point where I felt the need to get involved immediately. The gears of fate turned into place, and that's how I joined Particle Network, taking on the role of researcher while also responsible for the overall construction of the Chinese community.

Two Rebuttals: The Theory of Chain Abstraction Being Useless is Incorrect, and the Theory of Quick Victory is Also Incorrect

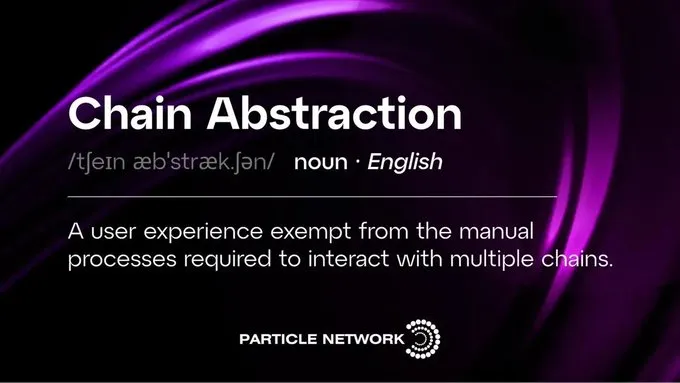

My research journey at Particle Network began with a "misconception clarification" series. This is because although chain abstraction has already formed a mature system in the West, a large amount of research content has not been systematically disseminated to the Chinese-speaking area, which has led to a number of misunderstandings derived from the literal meaning. To address this, I wrote 4 consecutive articles, laying out the nine major misconceptions about chain abstraction (vs. cross-chain bridges, intent, multi-chain wallets, etc.) and providing an official definition.

Refuting the "Chain Abstraction is Useless" Theory

These articles later became the catalyst and driving force for me to open up and participate in chain abstraction discussions. As expected, in the context of the market's overall indifference to the narrative, pushing the new chain abstraction narrative immediately invited a wave of "chain abstraction is useless" naysayers. Their views were essentially the same as what I summarized and analyzed in the three articles on common misconceptions: I understand chain abstraction, it's just xxx... old wine in new bottles... no need for it...

The reason why the "chain abstraction is useless" theory is wrong is that they approach the understanding of chain abstraction from a partial, mechanical, and static perspective. They simply equate chain abstraction to things they have seen and are familiar with before, and in the absence of understanding the evolution of the track, they refuse to see the innovative points and progressive significance of chain abstraction.

This can be further divided into two types of errors:

One is a fundamental error, implying a systemic bias and blindness, the most representative of which is the belief that the future of Web3 will only have one or two chains. The response to this type of error is simple - you cannot build the entire Web3 on a single state machine. But correcting this type of view is very difficult, because it fundamentally rejects the possibility of anything beyond its own position.

The other is an occasional error, such as confusing chain abstraction with multi-chain wallets, cross-chain bridges, and intent. This type of error can basically be solved by reading my articles, which is also the main significance of our continuous popularization of chain abstraction.

Refuting the "Chain Abstraction Quick Victory" Theory

As the chain abstraction narrative progressed, and with the delivery progress of chain abstraction products from leading projects like Near, Uniswap, Safe, and Particle Network, chain abstraction successfully attracted more attention from CEXes and CEX users, and triggered a wave of chain abstraction heat at the end of 2024. Overnight, the notion that chain abstraction is the future seemed to become a consensus, but we saw another crisis beneath the hype - the "chain abstraction quick victory" theory.

Specifically, some people underestimate the objective technical difficulty of realizing chain abstraction, and ignore the fact that chain abstraction is a complex, systemic engineering project involving the re-architecture and optimization of infrastructure, middleware, and application layers. Essentially, they still hold the backward notion that "chain abstraction is just a repackaging of xxx", so they have unrealistic optimism about the speed of chain abstraction's popularization - xxx project can also do it, they just haven't done it yet, and it will be very fast once they start.

There is also a group of people who acknowledge that chain abstraction is a high-threshold track, but they are overly pessimistic about the current players in the market, so they turn to hope that the wallet teams of the exchanges will "come out" and "strike down from a higher dimension" to quickly unify the market. They do not understand that chain abstraction has never been an isolated new infra narrative, nor is it simply a feature stack, but a track that has been maturing with the brewing and maturation of underlying infrastructures such as AA, modularity, solver networks, AltVM, and Appchain.

In summary, the problems are:

Is chain abstraction useless? - No. This idea is a myopic mistake, a case of being unable to see the forest for the trees. Chain abstraction will eventually be realized.

Can chain abstraction achieve a quick victory? - No. This idea has also fallen into the error of farsightedness, thinking too highly of itself. The paradigm shift in on-chain transactions represented by chain abstraction is a protracted battle.

Stage Analysis: Why is the paradigm shift in on-chain transactions a protracted battle?

The universality and particularity of contradictions

Let's start by analyzing the universality of contradictions. Like all forms of old and new alternation, the penetration of chain abstraction applications and the migration of on-chain transaction paradigms require time. In this process, we will see that the old, fragmented multi-chain ecology can hardly continue, and the applications built on it face increasingly obvious bottleneck problems, while more and more dApps adopting the chain abstraction architecture will gradually emerge, and chain abstraction will become the standard configuration for almost all on-chain scenarios, and there will certainly be a scenario where the potential of chain abstraction + dApp will be fully unleashed.

After discussing the universality, let's talk about the particularity of chain abstraction + on-chain transactions. Why do we believe that the transaction scenario is the opportunity for the explosion of chain abstraction? Because this scenario is just like the porn industry in Web2, the first landing point for all emerging technologies (VR, AR, mobile internet, AI). The reconstruction of the Web3 transaction scenario is the most anticipated native narrative in 2025, and the biggest opportunity here is the possibility of a full-chain CEX brought by chain abstraction. DEX asset non-permissioned + self-custodial account + CEX-level liquidity experience = the next-generation on-chain trading platform. All three requirements are indispensable.

The basis and stages of the protracted battle

Then someone may ask, how long will the protracted battle last? The logic of chain abstraction is so smooth, when will it explode? - No one can give an accurate prediction here, but we can analyze the multiple parties involved and observe the changes in their strength.

First, we have to admit that the transformation of the on-chain transaction paradigm depends on the continuous prosperity of new on-chain assets and new users. Since the outbreak of Pump.fun this cycle, on-chain assets have exploded, Meme and AI agents have provided enough hype points and opportunities for profit, and users have begun to migrate from CEX to on-chain. At this point, the main contradiction has become the contradiction between the significant growth in trading demand driven by the explosion of assets and the "curated" listing model of centralized exchanges that cannot cover the hotspots in a large and timely manner. In terms of the attractiveness of the spot business, Trading Bots, DEX aggregators, and in-wallet trading functions have all taken a share from the Tier 1 and below centralized exchanges.

But it would be premature to write off the exchanges and believe that DEX will completely replace CEX. Tier 1 exchanges still enjoy listing credit and deep liquidity for their spot business, and perp is also an important source of revenue for most CEXs. Obviously, Binance Plaza users don't need to all turn into P-small investors to make money, that's one point.

And as fat applications gradually replace fat protocols, more and more applications will choose Appchain or App Rollup to launch in the future, and the multi-chain future is a foregone conclusion. But the currently fragmented multi-chain environment greatly hinders users' exploration and management of multi-chain assets, and although there has been progress in AA and inter-operability protocols within each ecosystem, user education, developer education, and product adoption are not achieved overnight, that's the second point.

So, although on-chain assets are greatly enriched, users are migrating to the chain, and the direction of the multi-chain future is certain, the situation in the process is constantly changing. However, as long as we analyze the trend, we can clearly find the foundation of chain abstraction products - seamlessly connecting and tapping the potential of the multi-chain world, including liquidity, users and developers. For example, the fundamental competitive advantage of UniversalX lies in the liquidity layer, grasping this point, we can lock in the most potential multi-chain trading user group, and convert them into the most loyal users of UniversalX (guess how many times I've heard user feedback like "I can't go back after using UniversalX").

The chain abstraction exchange as the ultimate

Now let's talk about why time will ultimately be on the side of the chain abstraction exchanges represented by UniversalX? Why not multi-chain wallets, Trading Bots and aggregators?

First is the non-custodial attribute, which is relative to the custodial wallets of Trading Bots. We are not saying that custodial wallets should not exist or will disappear, but that they cannot exist alone. Users will ultimately have to transfer their assets to a non-custodial wallet. As on-chain security awareness increases, we believe that products that adhere to the non-custodial attribute will become more and more.

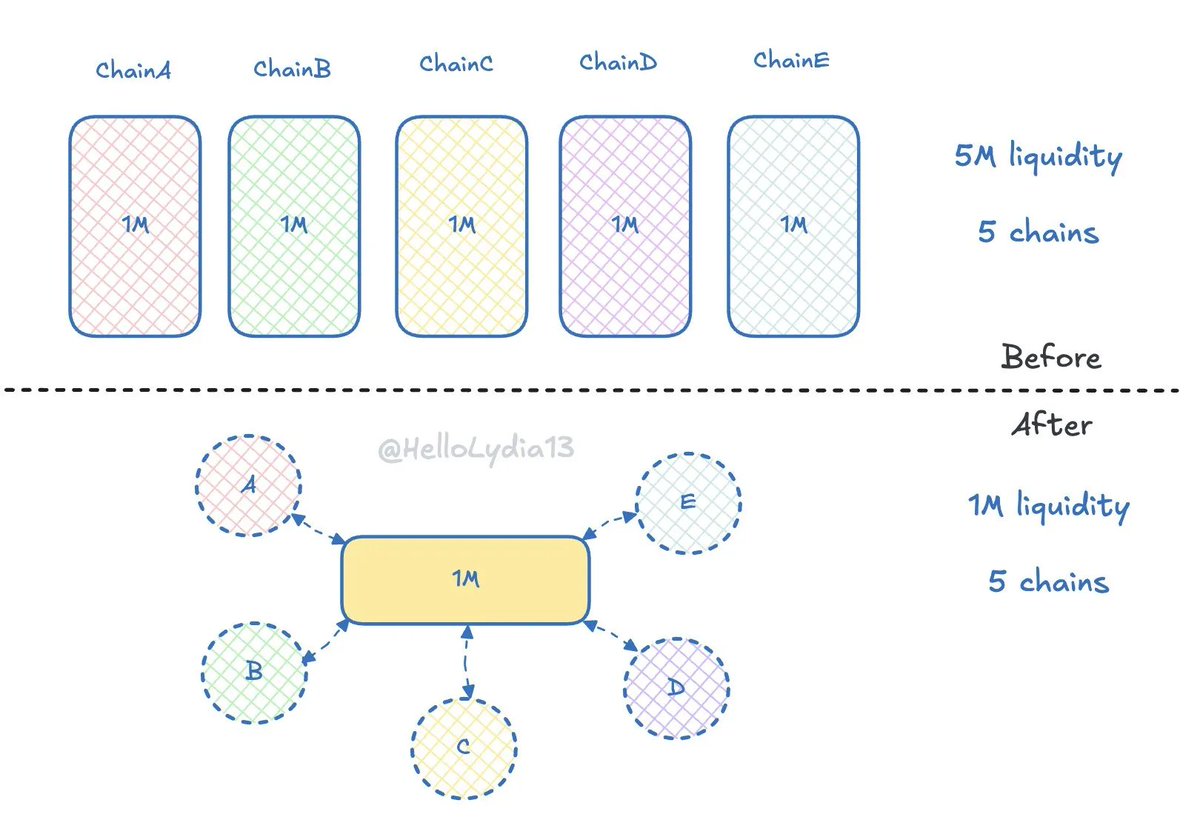

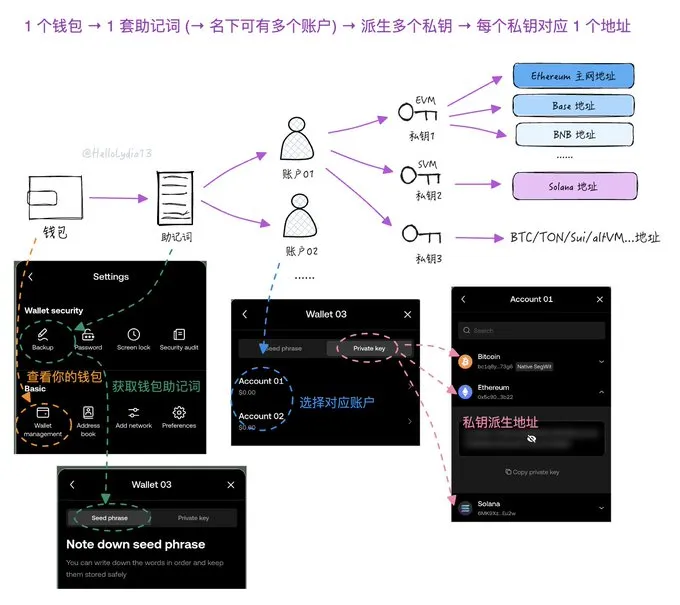

Secondly, it is the chain abstraction attribute, which is relative to multi-chain wallets and aggregators. The current multi-chain wallets only "access" multiple chains, playing an aggregation role. Although some wallets have also launched some optimizations on gas payment, the essence is that the user's assets are still scattered on different chains without being connected, and in the process of use, they still need to manually switch between different chains and bridge assets. But we can't expect every user to be familiar with the knowledge from private key management to new chain bridging, I've done a popular science on a multi-chain wallet before, and the complexity is quite headache-inducing even for me, a self-proclaimed professional user. As for the aggregators, most of them only support single-chain, and a few support multi-chain, but the range of assets covered is also far from reaching the effect of "connecting multiple chains".

Finally, to the specific competition. The on-chain trading product market will most likely repeat a three-stage pattern: 1) demand competition; 2) fee competition; 3) business model competition.

The emergence of countless new tools and products now proves that we are still in the first stage of demand competition, but specific product features like smart money, address monitoring, and chip analysis have already shown signs of commercialization. When the user demand is more or less satisfied by the products on the market, it will enter the second stage, i.e. the stage of fee competition. To grab the market, the products will wage a "price war" until a relatively stable state is reached. The last stage, which is also the most demanding for the project's long-term operation capability, is the business model competition.

The needs that UniversalX satisfies, as we have analyzed before - firmly grasping the foundation of multi-chain seamless liquidity, and not affecting the integration of increasingly commercialized advanced data functions.

The more the multi-chain trend is confirmed, the clearer the demand for UniversalX will be; the clearer the demand for UniversalX, the more the multi-chain trend will be confirmed. This positive spiral will give UniversalX a different pricing power from non-chain abstraction products, giving it an advantage in the fee competition stage.

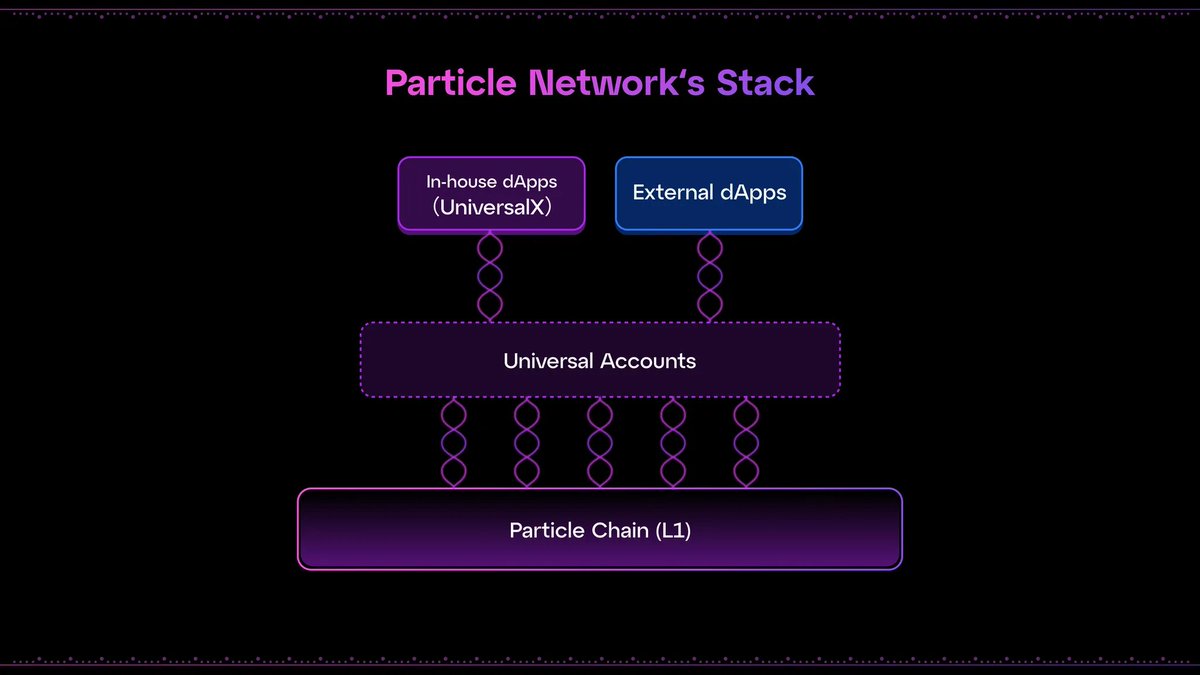

And in the final stage of business model competition, the answer for UniversalX is also very clear - L1 + infrastructure + flagship application. The L1 Particle Chain is the public chain business model, the chain abstraction infrastructure Universal Account is the B2B2C business model, and UniversalX is the typical 2C exchange model, each layer is very clear and mutually supportive.

Conclusion

At this point, my argument is more or less complete. This is a long article but not a puff piece, what I hope to convey is simply two points:

1) As builders, we never lack struggle and doubt, but always choose to believe and move forward.

2) The realization of chain abstraction is a protracted battle, and the transformation of the on-chain transaction paradigm has just begun.

My research and views have their shortcomings, and I hope to receive corrections and supplements from you all. Looking forward to your attention and three-link!