Author: Nancy, PANews

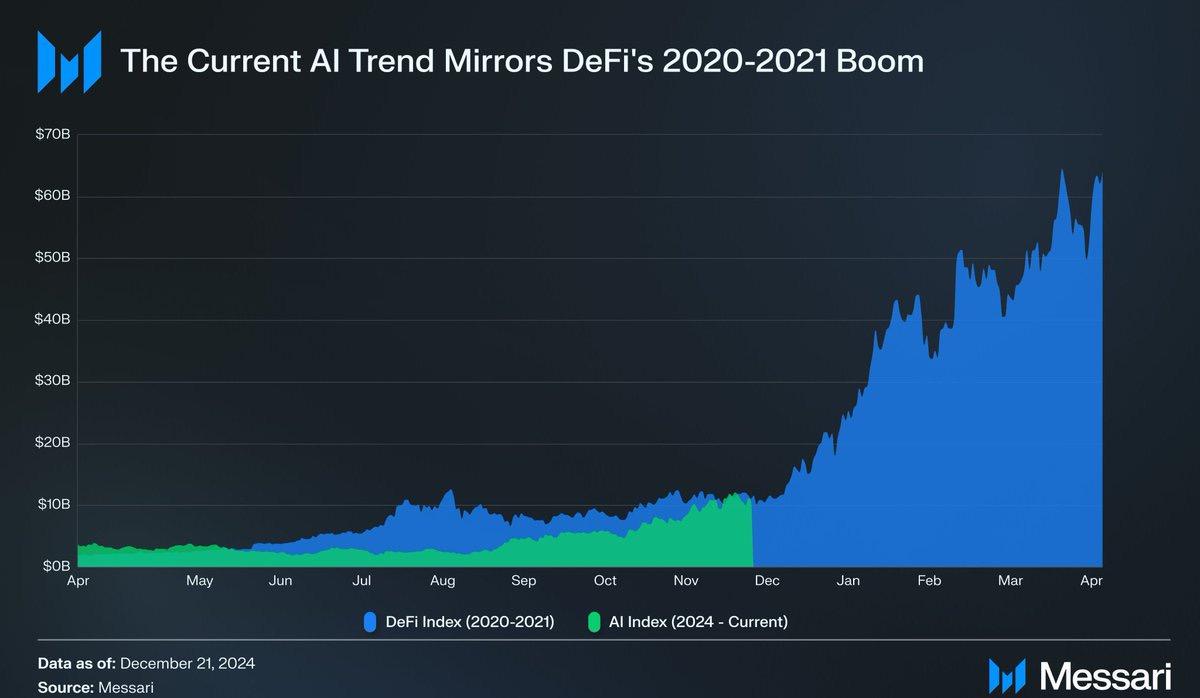

Each crypto cycle gives rise to a dominant narrative, and AI+ is undoubtedly one of the biggest themes of this bull market, especially as the AI Agent craze is occupying the vast majority of on-chain liquidity. The market discussion on whether Crypto AI is in a similar DeFi Summer cycle is increasing. This article by PANews will compare the market development scale of Crypto AI and DeFi, and discuss the similarities and differences in the development of these two fields.

A market cap of $48 billion exceeds the DeFi Summer period, but whether it can replicate DeFi's success is controversial

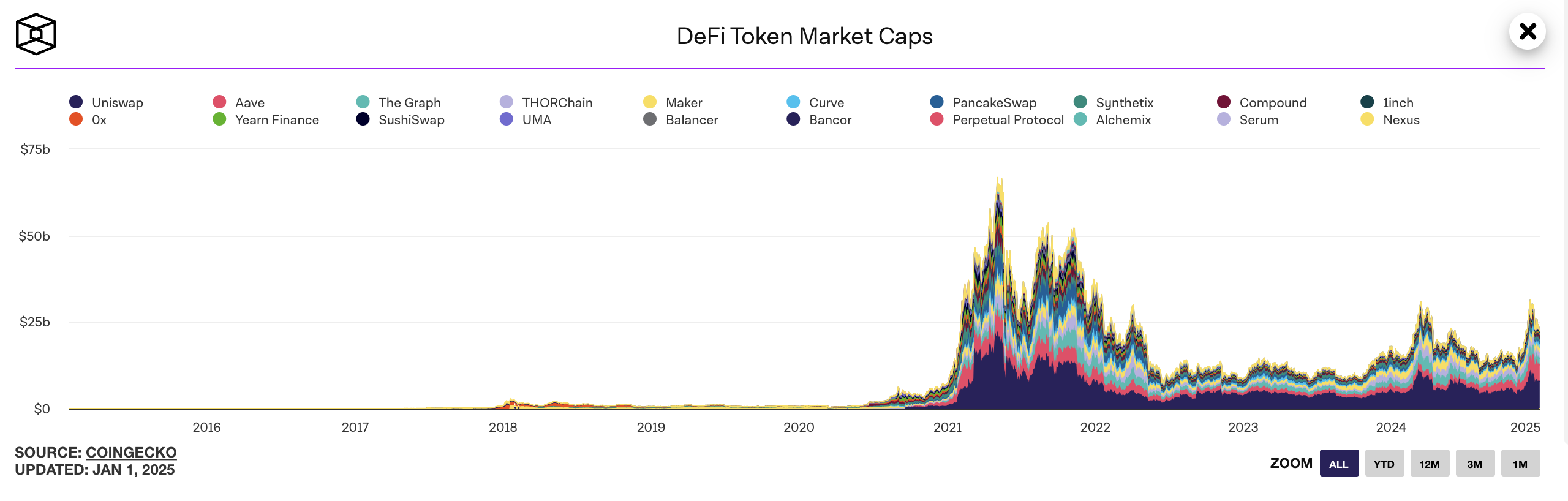

According to CoinGecko data, as of January 2, the market cap of the Crypto AI field has reached $48.8 billion, far exceeding the market cap of DeFi during the "DeFi Summer" period. According to The Block data, after the explosive growth phase in 2020, the DeFi market cap reached a high of $6.04 billion, and it was not until mid-April 2021 that it broke through the $50 billion mark, by which time the market had gradually matured and diversified. This comparison shows that the explosive power of Crypto AI has surpassed the early development stage of DeFi, and it has shown stronger advantages in market appeal and growth potential.

Particularly, the AI Agent sub-sector has been continuously exploding during this period. CoinGecko data shows that as of January 2, the market cap of AI Agents has reached $16.93 billion, accounting for 34.7% of the entire Crypto AI track, which is equivalent to the total market cap of DeFi protocols in January 2021. Taking the leading projects Virtuals Protocol ($5.02 billion) and ai16z ($2.7 billion) as examples, the sum of their market caps has already exceeded the market cap of all DeFi protocols at the end of 2020, further highlighting the rapid development of the AI track. The market caps of the leading DeFi projects Uniswap and Aave reached a peak of $22.05 billion and $6.58 billion respectively in the previous bull market.

In terms of capital investment, DeFi has attracted a large amount of venture capital after its rapid development, and Crypto AI is also in a similar stage, with more and more funds flowing into the AI field, and investment around Crypto AI has surged. According to the 2024 financing report compiled by PANews, the DeFi field received $1.69 billion in 296 investment and financing events in 2024, while AI projects, as an emerging category, have seen rapid growth this year, with nearly 100 disclosed financing events, 15.2% of which received funding in the tens of millions of dollars range, with a total funding scale of around $600 million.

Although the data performance of the Crypto AI track looks impressive, the market still has different views on whether its development cycle can be similar to DeFi. For example, Messari's latest report points out that AI Agents will reach their peak in the first quarter of 2025 and will not recover. The reasons are as follows: (1) AI Agent proxies have not yet proven their product adaptability to support market speculation; (2) The success of Alt-L1 is based on the clear demand for block space during the DeFi boom, but AI Agents lack both demand and a clear user base; (3) The launch of AI Agents depends on market speculation, but when the market realizes that they will only be toys in the foreseeable future, this speculative cycle will collapse.

There are also views that AI has similar development potential as DeFi. For example, crypto KOL @0xWizard said that 2020 can be called the "Cambrian explosion of DeFi", and 2025 is likely to be the "Cambrian explosion of AI Agents". Various Ai+Crypto applications will emerge in the coming year. Researcher Haotian believes that the arrival of AI Agents is like the DeFi Summer that blockchain welcomed in 2020, and will produce a new "bubble" narrative cycle of Build+Speculation. Although the AI Agent ecosystem does not even have its own dedicated infra conditions yet, in terms of ecosystem plasticity, the industry narrative opportunities brought by AI Agents are much grander than DeFi.

Former Spartan Group member @0xJeff predicted that 2025 will be called the Agentic era, and Agentic-type L1 will reach a market cap of $100 billion, similar to the L1 valuation cycle of 2020-21; DeFi will reach a TVL high of over $200 billion with the help of AI Agents.

Regarding the valuation of AI MEME coin projects, crypto KOL @Rui said that in the early MEME market, the valuation of a project was closely related to whether it could be listed on exchanges, especially top exchanges. But with the rise of AI Agents and market changes, the valuation system based on exchange logic for large-cap MEME projects is no longer valid, and people's valuation expectations for projects are not about which exchanges they will be listed on, but what kind of ecosystem they will create. For projects with existing ecosystems, valuation can be determined based on the proportion of their ecosystems; for single-project or "wild ecosystem" projects, the key to valuation is whether they can break through a $100 million market cap, and below this market cap, they rely more on dissemination, community, and early capital support.

Four major commonalities from cultural influence to capital efficiency

The combination of technology and capital is the core driving force for the development of the crypto industry. In the previous bull market, DeFi reshaped the crypto financial world through decentralized platforms and smart contracts. Now, Crypto AI is changing the way the crypto market operates in a more intelligent and automated way.

Meme culture

As one of the core narratives of the previous crypto bull market, DeFi itself has a spirit of rebelling against traditional finance. Many DeFi projects, while providing real financial functions, attract attention through humorous and parodic naming methods (such as various food series). Initially, the market even more often regarded DeFi as a liquidity game rather than a pure financial tool, but this culture of breaking the "seriousness" of traditional finance unexpectedly sparked reflection and discussion on the traditional financial system, and quickly accumulated a large number of developers and users' participation.

Similar to the meme culture in the early DeFi narrative, the popularization of Crypto AI also relies on the power of MEME culture. The rise of AI Agents not only depends on technological innovation and application value, but also quickly gathers emotions through humorous and playful MEME methods, thereby stimulating the interest and participation of on-chain users, including bringing in new groups such as off-chain developers and researchers in a more relaxed and interactive way.

Technical foundation

Relying on its support in smart contracts, token standards, and developer ecosystems, Ethereum's flexibility provided a strong technical foundation for the rise of DeFi, allowing developers to innovate financial products based on demand, and its decentralization and open-source mechanism also provided users with a fair and transparent financial platform.

The emergence and popularity of the Crypto AI narrative in this cycle is also based on the explosive progress of AI technology, especially the emergence of large language models (such as ChatGPT), which has allowed people to see the huge potential of the combination of artificial intelligence technology and blockchain. At the same time, the rapid improvement of AI large model capabilities has also empowered more intelligent on-chain applications, such as trading strategies, market forecasting, smart contract automation, and data analysis, thereby providing new perspectives and momentum for crypto technology innovation.

Access threshold

Compared to the complex procedures, bank accounts, and credit checks required by traditional financial systems, DeFi provides an open and transparent financial service model without intermediaries through blockchain and smart contracts, requiring only a crypto wallet and a small amount of crypto assets to freely engage in activities such as lending, trading, and liquidity provision, without being limited by region and economic background.

Compared to traditional encryption tools and platforms, AI Agent provides a more intelligent and automated way of operation, allowing users to easily get started without the need to deeply understand complex technical details or possess professional trading knowledge and experience. At the same time, high-quality AI Agent projects have also broken down the high thresholds of previous VC and centralized exchange (CEX) platforms through lower participation barriers and convenient operation paths, providing not only more opportunities for individual investors, but also opening up a lower-cost and more decentralized innovation channel for developers and project parties.

By combining with MEME culture, AI Agent has also lowered the cognitive threshold for people to understand encryption AI technology, especially for non-technical users, and has broken the high-threshold image of technical projects, making participation in this field more diversified, easy, and entertaining.

Capital Efficiency

In the DeFi narrative, capital efficiency has always been one of the core driving forces. DeFi can greatly improve capital utilization efficiency through decentralized platforms, utilizing smart contracts and automated mechanisms. These platforms attract a large amount of institutional capital and retail users into the market by providing high APY and capital returns. Due to the absence of intermediaries and traditional banking processing, capital can flow and generate higher returns in a shorter period of time, greatly improving the capital efficiency of the market.

AI Agent, through the automation and intelligence of artificial intelligence technology, can help users achieve more efficient capital operation in the cryptocurrency market. Unlike traditional manual intervention, AI Agent can automatically execute transactions, asset management, and risk control tasks based on real-time market data, helping users seize market opportunities, avoid emotional decision-making and human errors, and significantly improve the efficiency of capital operation. Furthermore, AI Agent projects provide more users with opportunities for benefit redistribution through on-chain execution mechanisms, allowing participants to enjoy the growth dividends of the project under low thresholds.

Four Key Differences from Technology-Driven to User Participation

Although DeFi and Crypto AI have shown similar momentum and potential in driving innovation in the cryptocurrency market, they differ significantly in several key aspects. These differences are reflected not only in the complexity of technology and the breadth of application scenarios, but also in the different ways of market driving forces and user participation.

Application Scope

The main focus of DeFi is on-chain finance, with major innovations concentrated on the construction of decentralized exchanges (DEX), automated market makers (AMM), lending protocols, and other financial instruments. Although these innovations have disrupted the traditional financial system, their application scenarios are relatively concentrated and clear. In comparison, the application scope of Crypto AI is much broader, involving areas such as on-chain finance, AI-generated content (AIGC), Non-Fungible Tokens (NFTs), smart contract automation, and data analysis. While Crypto AI has a higher complexity in terms of technology integration, this also allows it to reach more market and user needs. In the future, with the technological development of large-scale AI models, more cross-domain innovations and applications will be driven.

Technology Driving Force

The technological innovation of DeFi is primarily based on blockchain and smart contracts, driving the innovation of the decentralized finance ecosystem, with the core driving forces coming from decentralized trading, permissionless financial innovation, and smart contract auto-execution. In contrast, the Crypto AI narrative has complex and diverse technological driving forces, ranging from trading strategies and risk management in the financial field to content generation, personalized recommendations, and data analysis in a wider range of applications.

User Groups

The main user group of DeFi is on-chain native users, who typically have strong financial operation experience. In addition to attracting crypto natives, Crypto AI can also gain the participation of a large number of non-technical users, including content creators, developers, and technical researchers, which gives it a significant advantage in terms of popularity and market coverage.

Market Value Drivers

The market value of DeFi projects is mainly determined by factors such as the locked-in amount, the listing on exchanges, and liquidity, which are more directly and transparently related to the frequency of use of the financial instruments and the degree of user participation. In comparison, the market value logic of Crypto AI projects is more complex and has a higher degree of uncertainty. It not only depends on the depth and breadth of technological innovation, but also needs to consider the project's ecosystem influence and the development potential of actual application scenarios. This means that the sustainability of the Crypto AI narrative depends on the combination of technological progress and user demand, and there are higher risks and potentials.