The price of Dogecoin (DOGE) has risen 7% in the last 24 hours. This is an attempt to recover a market value of $50 billion. Trading volume has surged to $3 billion during this period.

Key technical indicators such as the Ichimoku Cloud are showing strong bullish momentum. If the current trend continues, DOGE could break through key resistance levels and generate substantial gains in the short term.

DOGE Ichimoku Cloud Bullish Setup

The Ichimoku Cloud chart for Dogecoin shows a bullish configuration. The price has broken above the red cloud, indicating a change in momentum, and buyers have pushed the price higher.

The red cloud formed by Senkou Span A and Senkou Span B previously reflected bearish sentiment, but as DOGE has moved above it, a shift in sentiment has occurred. The upcoming green cloud signals the sustainability of the bullish momentum, further supporting this bullish outlook.

Additionally, the blue Tenkan-sen (conversion line) crossing above the orange Kijun-sen (base line) further confirms the bullish trend. This crossover emphasizes that the short-term price strength has exceeded the long-term baseline. The green Chikou Span (lagging span) also sitting above the price and the cloud indicates that the current bullish trend is in sync with previous price movements.

For the DOGE price to maintain its upward momentum, it needs to stay above the cloud and build on this momentum. However, if it fails to maintain these levels, it could enter a correction or retreat back into the cloud.

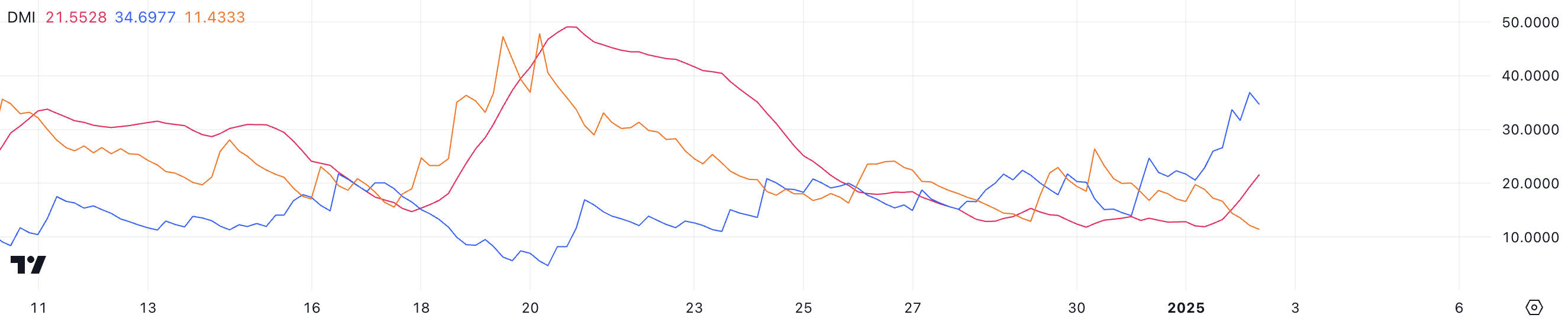

Dogecoin DMI, Potential for Strong Uptrend

The Dogecoin DMI chart shows that the ADX has risen significantly from 11.9 yesterday to the current 21.5, indicating a strengthening trend. The rise in ADX suggests that the uptrend is gaining momentum, reflecting increased market confidence and buying activity.

The +DI (Directional Indicator) has surged from 15 to 34.6 over the past two days, indicating strong buying pressure, while the -DI has decreased from 20 to 11.1, reflecting a significant reduction in selling pressure. This divergence between +DI and -DI reinforces the dominance of bullish momentum in the market.

The Average Directional Index (ADX) measures the strength of a trend on a scale of 0 to 100. Values above 25 indicate a strong trend, while values below 20 suggest a weak or absent trend. With DOGE's ADX at 21.5, the trend is likely to be firmly established. This is further supported by the sharp rise in +DI and the decline in -DI.

In the short term, this configuration suggests a high probability that the DOGE price will continue its upward trend, as buyers are in control. However, for the trend to be sustained, the ADX needs to continue rising and stay above 25 to confirm the strong bullish momentum.

DOGE Price Prediction: Dogecoin Poised for Another Upswing?

The Dogecoin price EMA (Exponential Moving Average) lines are suggesting a potential golden cross formation. This is a bullish indicator where the short-term EMA crosses above the long-term EMA. This potential crossover could signal the continuation of the uptrend and allow DOGE to test the $0.36 resistance level.

If this level is breached, the DOGE price could target higher resistance levels at $0.387 and $0.415, potentially representing a 22.7% price increase.

Conversely, if the uptrend loses momentum and the market reverses, the DOGE price could test the immediate support at $0.30. Failure to hold this level could lead to a deeper decline towards the next strong support at $0.26.

For DOGE to maintain its bullish momentum, the golden cross needs to materialize, and buyers need to push the price through the critical resistance levels.