Author: jk, Odaily

On January 2, local time in the United States, the former founder of Terra, and the co-founder of Terraform Labs, Do Kwon, officially appeared in the public view of the U.S. court. At the hearing in the U.S. District Court for the Southern District of New York, Do Kwon pleaded not guilty, and the case will formally enter the trial process.

Odaily previously reported that on Tuesday, the Prime Minister of Montenegro, Milojko Spajic, stated that Montenegro has completed the procedures to extradite Terraform Labs co-founder Do Kwon to the United States. Spajic posted on the X platform: "This extradition demonstrates our unwavering commitment to international justice and the rule of law."

Do Kwon is facing charges in New York and Seoul due to the $40 billion collapse of the TerraUSD stablecoin in 2022. Last year, he was arrested in Montenegro for traveling with a forged passport. In April this year, after a civil trial against the allegations of the U.S. Securities and Exchange Commission (SEC), Terraform and its founder Do Kwon were found guilty of fraud. Terraform has agreed to pay $4.5 billion to settle with the SEC.

Background: The Collapse of Terra, Extradition, and the Upcoming Trial of Do Kwon

The Collapse of Terra

In May 2022, the Terra ecosystem experienced a collapse unprecedented in the history of cryptocurrencies, with the core cryptocurrencies TerraUSD (UST) and LUNA plummeting in value to nearly zero, resulting in a loss of about $40 billion.

UST was the leading representative of algorithmic stablecoins that year, maintaining a 1:1 peg to the U.S. dollar through algorithms and market incentive mechanisms, while LUNA was the governance token supporting the stability of UST. However, in early May, as Terra's protocol was upgraded and funds fled, UST lost its peg to the U.S. dollar, and its price plummeted rapidly, triggering market panic. To address this crisis, Terraform Labs tried to support the UST price through reserve funds, but failed. At the same time, the dual-coin mechanism of the Terra protocol led to the minting of a large number of new LUNA, further depressing the price of LUNA, forming a vicious cycle.

Ultimately, the price of LUNA plummeted from a high of around $119 to nearly zero, and the entire ecosystem collapsed. The collapse of Terra also triggered a chain reaction in the market, affecting other cryptocurrencies such as Bitcoin, and resulted in the complete evaporation of the funds of hundreds of millions of investors. Subsequently, algorithmic stablecoins have almost disappeared from the market, directly leading to the subsequent blowups of firms like 3AC.

Extradition to the U.S. or South Korea?

Do Kwon was embroiled in a tug-of-war earlier this year, with both the U.S. and South Korea wanting to try Do Kwon on their home soil. In March, there were rumors that Do Kwon would ultimately be extradited to South Korea, but this decision was postponed by Montenegro's Supreme Court, and it was finally confirmed in December that he would be extradited to the U.S.

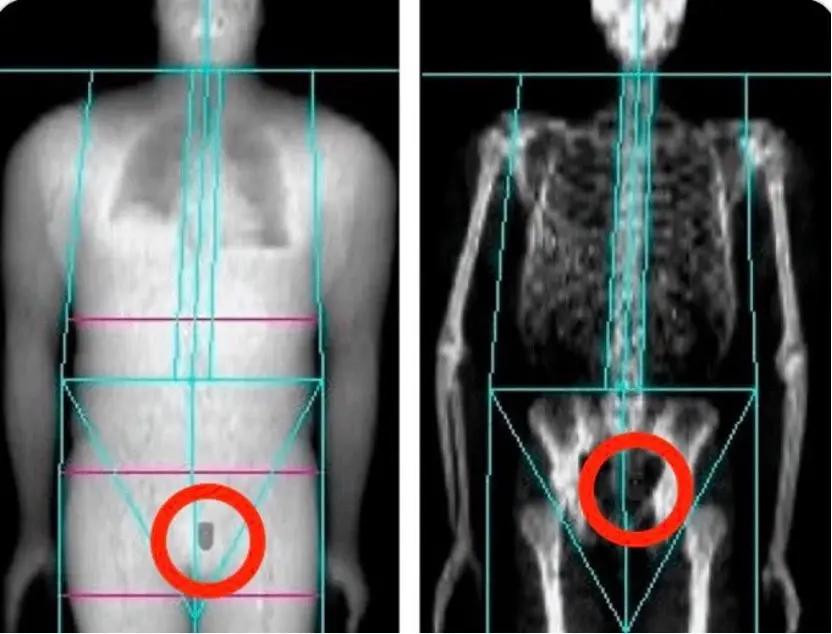

Previously, there were market rumors that when Do Kwon was arrested by the Montenegrin police, a Trezor hardware cold wallet containing over 10,000 Bitcoins was found in his rectum. These Bitcoins are now worth over $1 billion.

Source: X

Preview of the Trial Process

In court, Do Kwon pleaded not guilty to the charges against him. So what will happen next?

Pleading not guilty is the formal statement made by a defendant in a criminal case in the U.S. judicial system, meaning that he denies committing the crimes alleged. This does not mean the defendant is immediately deemed innocent, but rather that the prosecution must provide sufficient evidence to prove the charges, and the case will enter the trial phase, with the court deciding whether the defendant is guilty or not.

The case will be heard again on January 8.

In other words, we will witness a similar courtroom drama to the one involving SBF at the beginning of this year, from witness testimony to the final verdict, and many inside stories of the Terra collapse will be revealed. Odaily will continue to follow and report on this.

He Could Face 130 Years, but He Smiles

Do Kwon is facing multiple charges. According to the news release from the U.S. Department of Justice's Office of Public Affairs, the main charges against Do Kwon are as follows:

False Statements by Do Kwon:

- Stablecoin Misrepresentation: Kwon falsely promoted the effectiveness of the "Terra protocol" system, which he claimed used a computer algorithm to maintain the value of Terraform's so-called "stablecoin" TerraUSD (UST) at $1-1 UST. But Kwon knew that in May 2021, after the Terra protocol failed to restore the $1 peg of UST, he reached an agreement with an executive of a high-frequency trading firm for the firm to purchase large amounts of UST to artificially support the $1 peg.

- LFG Misrepresentation: Kwon falsely promoted the governance of Luna Foundation Guard Ltd. (LFG), claiming that the organization was independently managed and responsible for deploying billions of dollars in financial reserves to defend the UST peg. But Kwon actually controlled LFG and Terraform, and misappropriated hundreds of millions of dollars in LFG assets.

- Mirror Misrepresentation: Kwon falsely promoted the success of the Mirror protocol on the Terraform blockchain, which he claimed allowed users to create, buy, and sell synthetic versions of stocks listed on U.S. stock exchanges. But Kwon and Terraform actually controlled Mirror and manipulated the prices of the synthetic assets through automated trading bots.

- Chai Misrepresentation: Kwon falsely claimed that the Terraform blockchain was used to process billions of dollars in financial transactions for the South Korean payment app Chai, when in fact Chai used traditional financial processing networks.

- Founder Token Misrepresentation: Kwon used the 100 million founder stablecoins intended for reserves for fraudulent trading, including manipulating the prices of Mirror assets.

Daniel M. Gitner, the U.S. Attorney for the Southern District of New York, stated, "As we have alleged, this fraudulent conduct, as well as the collapse of the Terraform cryptocurrencies in May 2022, wiped out over $40 billion in investor assets, causing devastating losses to countless investors in the U.S. and worldwide. Kwon will now face justice in the Manhattan federal court."

However, according to Inner City Press, during the hearing today, "Do Kwon was chatting with one of his lawyers, smiling - apparently in a good mood."

Do Kwon entering the courthouse. Source: Inner City Press

According to The Block, Kwon also faces a civil complaint filed by the U.S. Securities and Exchange Commission (SEC) in February 2023. The litigation between Terraform and the SEC began at the end of March, but he did not participate. In April, a jury found Terraform and Kwon guilty of misleading investors and liable for civil fraud, violating federal securities laws.

Kwon faces two counts of commodity fraud (each with a maximum of 10 years), two counts of securities fraud (each with a maximum of 20 years), two counts of wire fraud (each with a maximum of 20 years), two counts of conspiracy (each with a maximum of 5 years), and one count of money laundering conspiracy (maximum of 20 years). If all charges are upheld, Do Kwon could face a maximum of 130 years in prison, more than five times the potential sentence of SBF.