This article is from: Thor Hartvigsen

Compiled by: Azuma (@azuma_eth), Odaily

Background

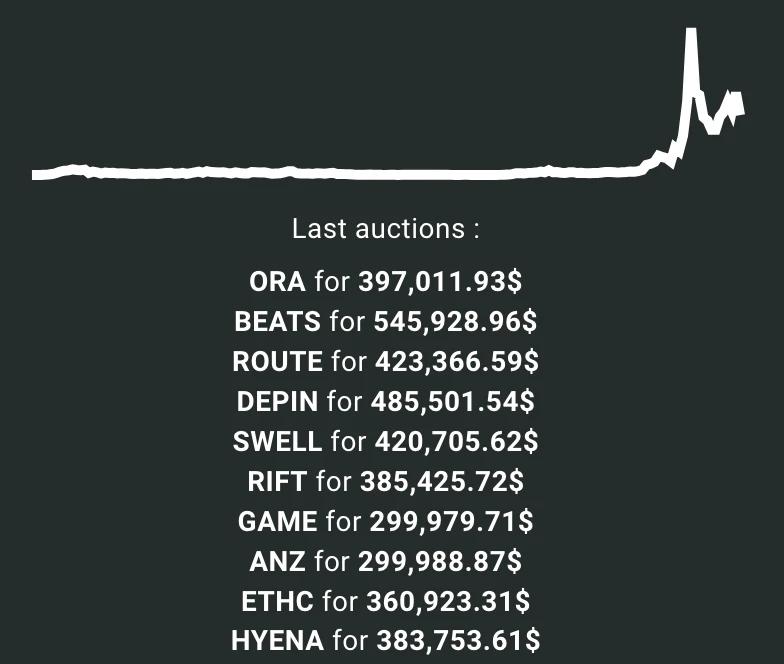

Since the launch of HYPE, Hyperliquid's trading volume and revenue have seen significant growth.

HYPE was officially launched on November 29, with an opening price of around $2, and experienced a significant increase in December, until it has recently declined (down about 34% from its all-time high).

What's next for HYPE and Hyperliquid?

This article will delve into the fundamentals of Hyperliquid and HYPE, explore the upside potential of HYPE, and analyze the potential valuation based on the projected growth in trading volume and revenue by 2025.

Trading Volume Data

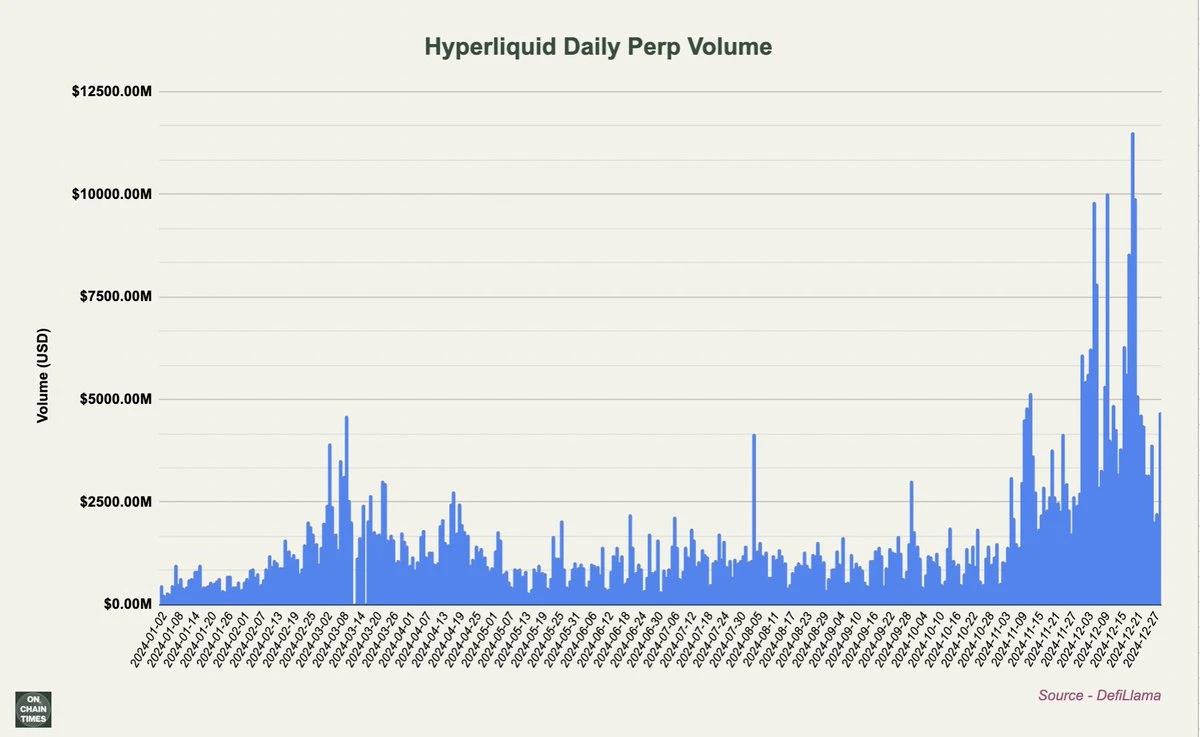

Although some expected the trading volume on Hyperliquid to decline after the HYPE airdrop (as seen in the past with other derivative exchanges), the opposite has happened. Since then, Hyperliquid's trading volume has increased significantly, repeatedly setting new daily highs of over $10 billion.

The HYPE airdrop accounts for 31% of the total supply. An estimated 42.81% of the supply is available for future distribution and community rewards. While a portion of the remaining supply can be expected to be used for staking incentives and HyperEVM Layer1 ecosystem incentives, the possibility of traders and HYPE holders receiving some form of reward unbeknownst to them in the future is not zero.

At a price of $25, the 42.81% HYPE supply is equivalent to around $11 billion.

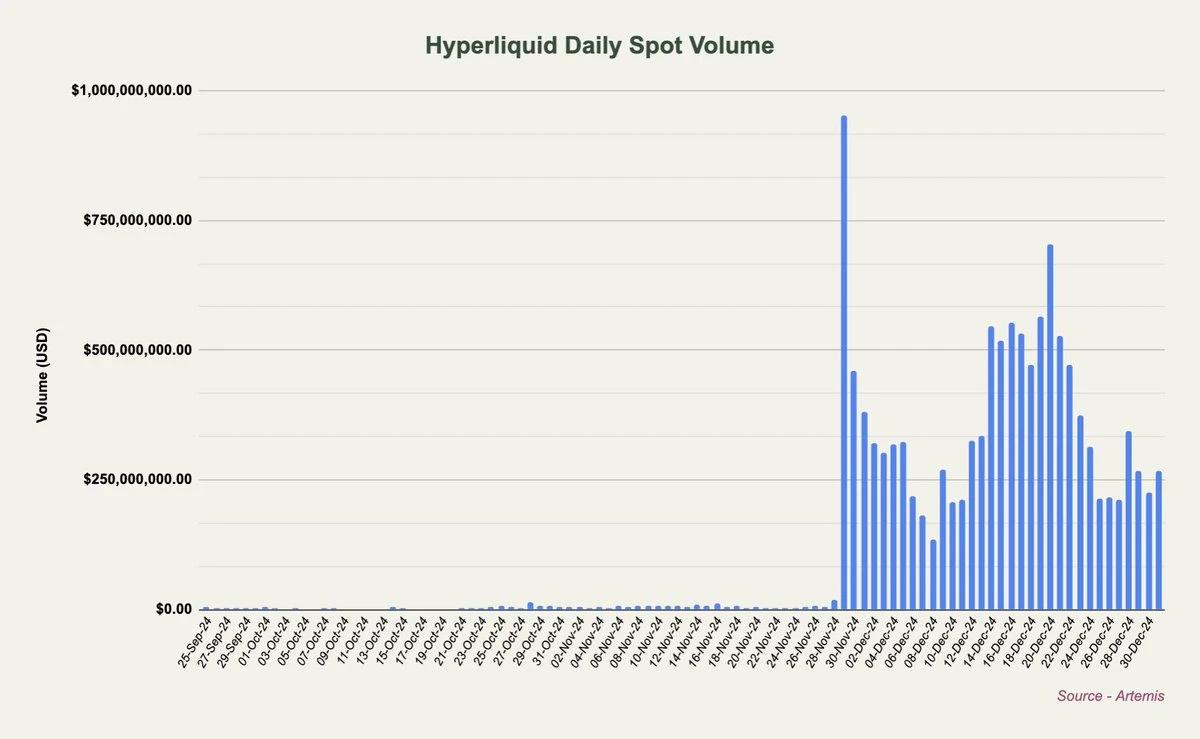

Since the launch of HYPE, in addition to the contract trading volume, Hyperliquid's spot trading volume has also increased significantly, with most trading days seeing $250-500 million in volume.

Hyperliquid vs CEX

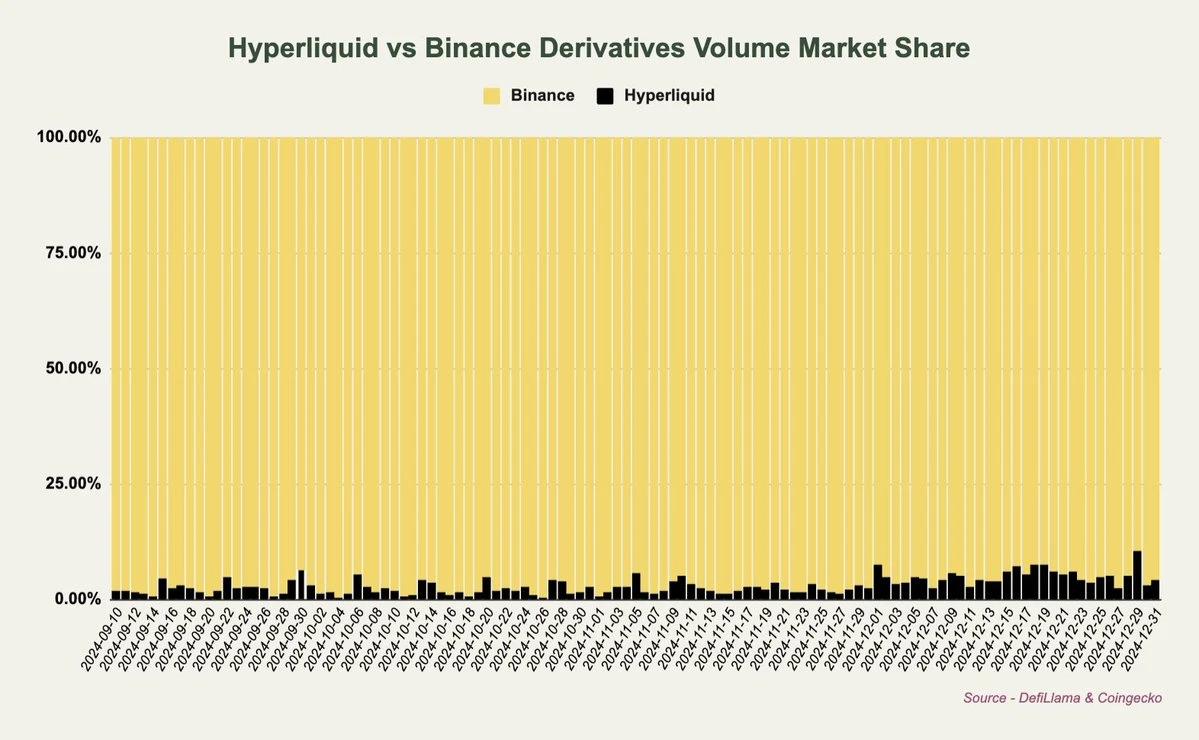

For a long time, I have been tracking the trading volume comparison between Hyperliquid and centralized exchanges (CEXs) like Binance.

Over time, more users and trading volume have started to shift to the on-chain, which has implications for Hyperliquid's growth potential in market share. Compared to Binance, Hyperliquid still has a long way to go. However, as shown in the chart below, Hyperliquid's market share has seen a noticeable upward trend in December. Over the past two weeks, Hyperliquid's relative market share has been around 5-8%.

According to Coingecko data, Binance's recent daily derivative trading volume has been in the range of $60-150 billion. However, these volume figures cannot be verified from the CEX side, so they should be treated with caution.

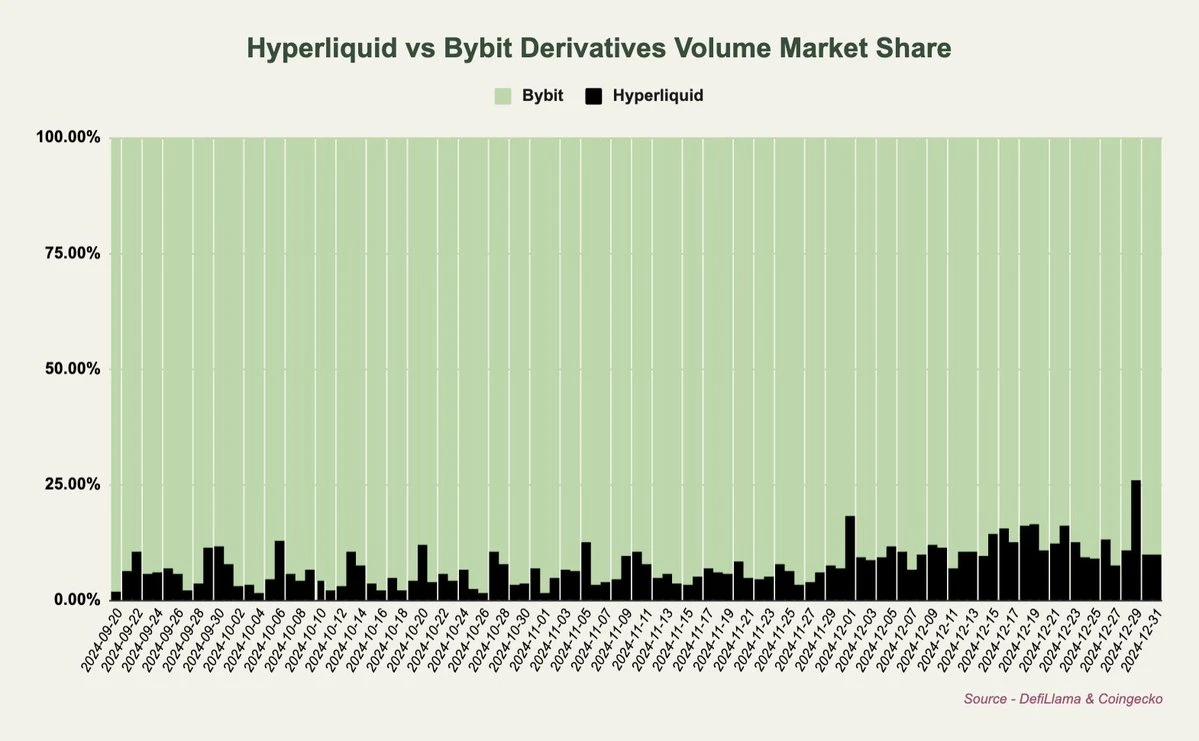

Compared to Bybit, Hyperliquid's market share has recently reached up to 25% of the former (peak data).

Fees and Revenue

Contract Trading

The fees on Hyperliquid are paid by the trading users on the platform. Compared to other exchanges like Binance, Hyperliquid's fees are lower, with the aim of incentivizing more trading activity. For perpetual contract trading, the fee for market orders is 0.035% for most users, and 0.01% for limit orders. The higher the trading volume, the lower the fees.

These fees are collected by the HLP market making vault, insurance fund, assistance fund (mainly for buybacks), and other miscellaneous addresses on Hyperliquid. The Hyperliquid team has not publicly disclosed the specific allocation of the platform's trading fees, making it difficult to accurately estimate the HYPE buyback data.

Spot Trading

The fees paid by users in the spot market are used to purchase and burn the specific tokens being traded. Unsurprisingly, HYPE currently accounts for a large portion of Hyperliquid's spot trading volume. So far, the spot trading fees for HYPE have exceeded 10,000 HYPE (worth over $2 million at the current price).

Overall, this has not had a significant impact on the HYPE supply (at least not yet) compared to the buybacks by the assistance fund.

Spot Auctions

Hyperliquid also generates significant revenue from spot auctions. Assuming $500,000 per auction, Hyperliquid could potentially generate an additional $141.29 million in revenue per year.

Assistance Fund and HYPE Buybacks

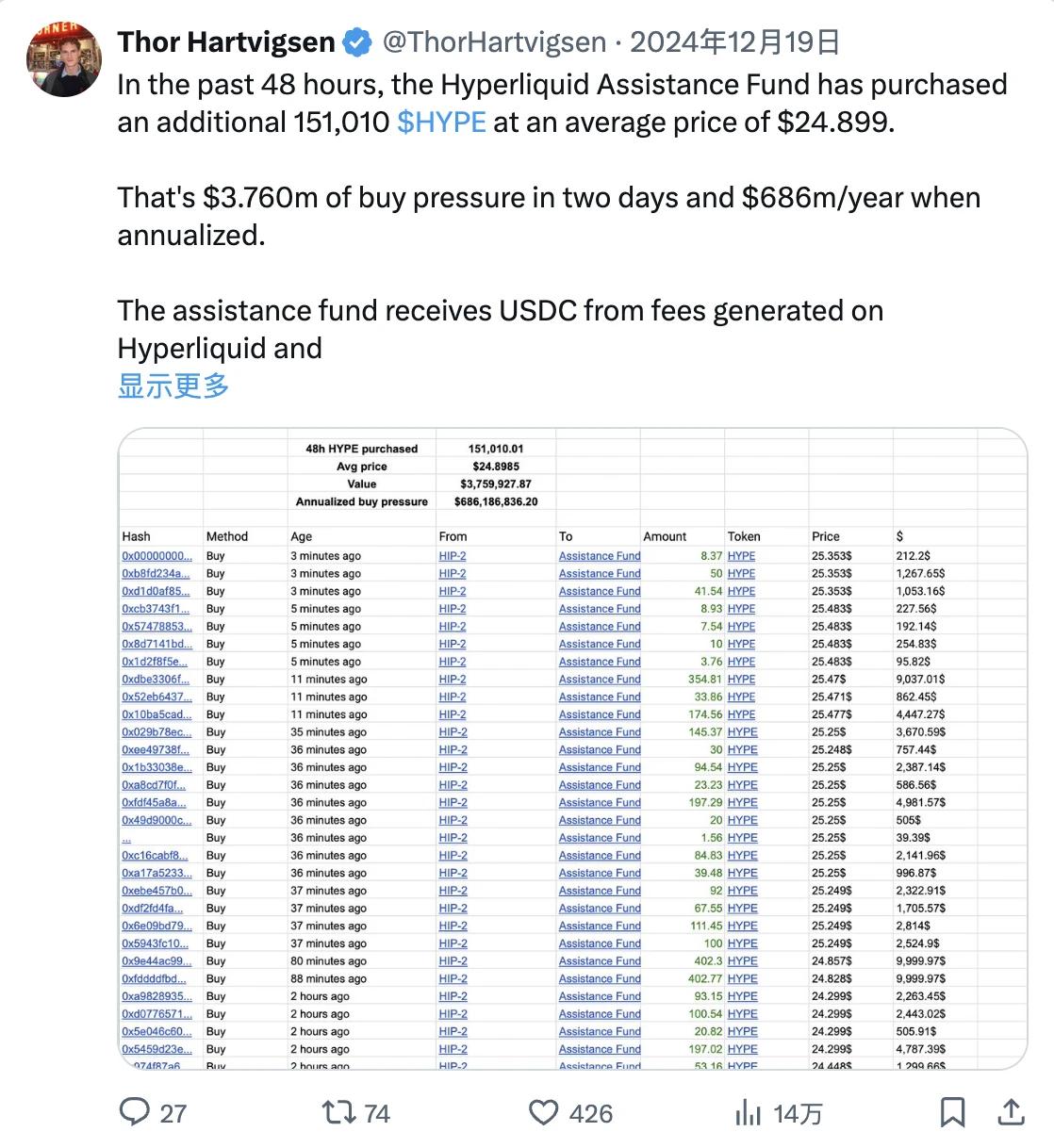

Although the details of the revenue allocation from spot auctions and contract trading are not clear, we can gauge the daily HYPE buyback data through the assistance fund.

Two weeks ago, I published an analysis on X, which looked at the HYPE buybacks by the assistance fund over a 48-hour period. During that time, approximately 151,000 HYPE were bought back, equivalent to an annual buyback capacity of around $686 million.

On those two days, Hyperliquid's daily trading volume averaged $8 billion.

Valuation Framework

Going into 2025, the upside potential for HYPE is a bet on continued growth in Hyperliquid's trading volume and increasing demand for spot auctions, as this will lead to increased revenue for Hyperliquid, amplifying the HYPE buyback capacity.

A key driver for Hyperliquid's growing trading volume is the fact that Hyperliquid still has billions of dollars available for future rewards, making it a highly profitable trading venue. Other potential catalysts include CEX spot listings and the launch of HyperEVM.

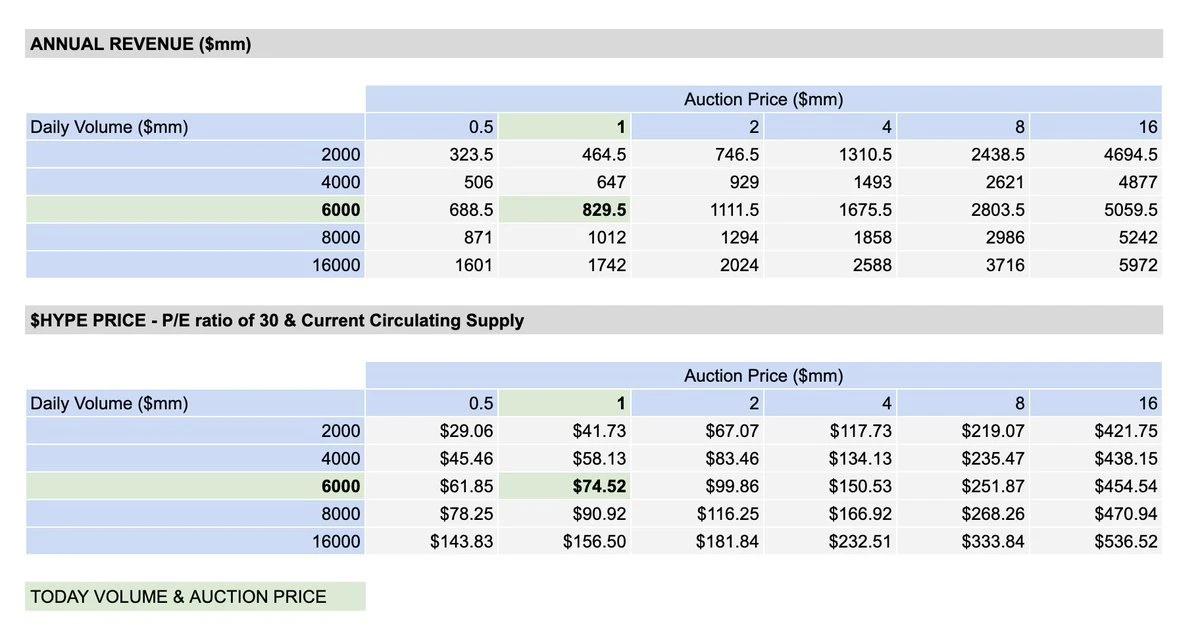

@fmoulin7 has done a good analysis on the potential valuation of HYPE, assuming a P/E ratio of 30, the HYPE price expectations under different levels of contract trading fee revenue and auction revenue are as follows.

Hyperliquid's average daily trading volume over the past 14 days has been around $4.89 billion, with an auction price of around $500,000.

Based on this, we arrive at an expected annual revenue of $587.5 million for Hyperliquid. Assuming a P/E ratio of 30, this implies a HYPE price of $52.78. Note that this calculation is based on the circulating market cap, not the fully diluted valuation, as the future unlocks are mostly related to community incentive measures, not internal group unlocks.

Additionally, it's worth noting that so far, these revenues have been almost entirely used for HYPE buybacks, and an increasing amount of HYPE has been staked (currently around 25%), effectively reducing the circulating supply.

In summary, if you believe Hyperliquid's trading volume and adoption will continue to grow, there are many reasons to be bullish on HYPE in the longer term.