The price of Pengu (PENGU) has fallen by more than 9% in the last 24 hours. It briefly held the position of the largest meme coin on Solana, but has now been surpassed by BONK and ai16z.

The recent decline has occurred amid a decrease in momentum as shown by key technical indicators such as RSI and DMI.

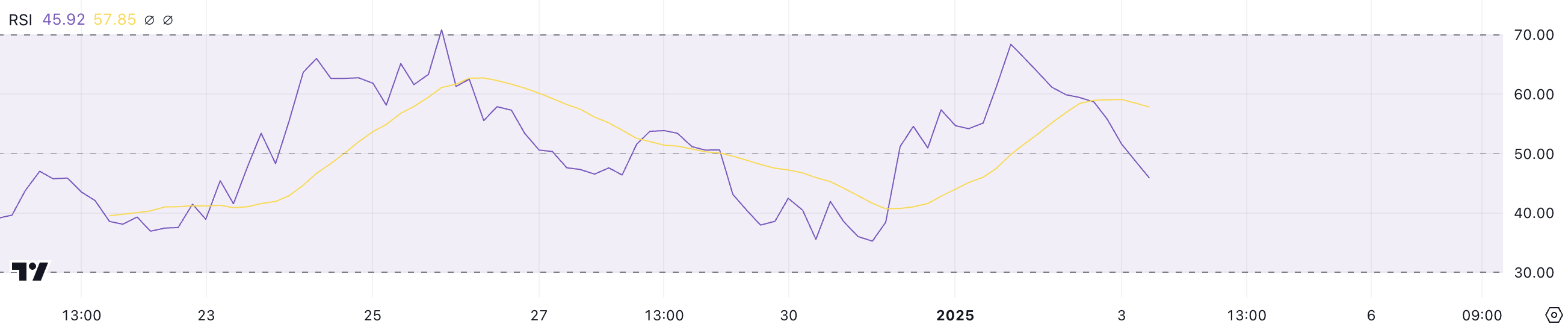

PENGU RSI, Entering Correction

The PENGU Relative Strength Index (RSI) has dropped significantly from 68.3 recorded on January 1st to 45.9 currently. This decline indicates that buying pressure has weakened and the momentum that had been driving the recent price increase has faded.

The current RSI level suggests that PENGU is in neutral territory, indicating a balance between buyers and sellers.

RSI is a widely used momentum indicator that measures the speed and magnitude of price movements on a scale of 0 to 100. Readings above 70 indicate overbought conditions and often suggest the possibility of a price correction, while values below 30 indicate oversold conditions and the potential for a rebound.

With PENGU's RSI currently at 45.9, the indicator suggests that the asset is in a corrective phase, neither overbought nor oversold. In the short term, this level may indicate limited price movements unless there is a significant change in market sentiment.

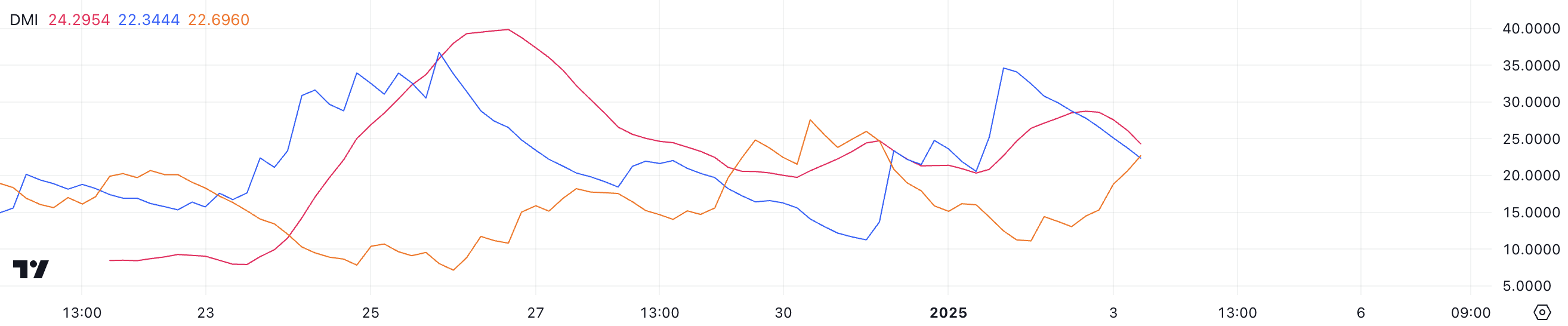

PENGU Downtrend Strengthens

PENGU's DMI chart shows the ADX currently at 24.2, indicating a moderately strong trend. The ADX, which ranges from 0 to 100, measures the strength of a trend, suggesting that there is notable momentum in the market, but it is not yet decisively strong.

The +DI (Directional Indicator) has decreased from 34.6 two days ago to 22.3, indicating a reduction in buying pressure, while the -DI has increased from 11.2 to 22.6, reflecting an increase in selling pressure. This suggests that PENGU may lose its position as the third-largest meme coin on Solana to WIF.

These changes in the Directional Indicators suggest that the bearish momentum is starting to gain strength, with the -DI slightly overtaking the +DI. The close values of +DI and -DI indicate that the market is in a transitional phase, with neither buyers nor sellers clearly dominating.

For PENGU's price, this could mean that the correction may continue, or the +DI may regain strength and the ADX may rise above 25, confirming a strong trend, otherwise, the downside may prevail.

PENGU Price Forecast, 27.6% Correction Possible

PENGU's EMA lines are showing the potential for a death cross, which is a bearish signal where the short-term EMA crosses below the long-term EMA.

If this occurs, it could reinforce the current downtrend and push the PENGU price towards the nearest support at $0.0296. Failure to hold this level could lead to further declines, with the next support at $0.025 representing a significant 27.6% correction.

Conversely, if the trend reverses and bullish momentum takes over, the PENGU price could retest the $0.0409 resistance level. Breaking above this resistance could open the door for further gains, with the potential to reach $0.0439, representing a 26.5% increase and potentially regaining the position as the largest Solana meme coin, as it was last week.