Decentralized Exchanges (DEXs) have become an important cornerstone of blockchain applications, providing users with the ability to trade assets without permission and without intermediaries. In 2024, the DEX market experienced significant growth, with trading volume nearly doubling compared to 2023. For example, the Raydium platform's average daily trading volume in the third quarter reached $785 million, a year-on-year increase of over 100 times.

Source: the 6th annual @ElectricCapital Developer Report

In the Monad ecosystem, the leading L1 public chain of the new generation of parallel EVMs, a batch of powerful native DEX projects have emerged, utilizing Monad's next-generation performance to provide more powerful functions and better user experiences. These platforms aim to solve the existing challenges in decentralized trading, such as capital efficiency, pricing accuracy, and user engagement.

This article begins by introducing the native DEX/Perp projects in the Monad ecosystem as of the end of 2024. By building on Monad's high throughput and low latency infrastructure, these Monad-native DEXs are poised to redefine the decentralized trading landscape, providing solutions that combine the advantages of centralized exchanges with the security and composability of decentralized platforms. As Monad's public testnet is about to launch, we have the opportunity to personally experience the performance of these DEXs:

1. Kuru

Kuru is the first fully on-chain central limit order book (CLOB) DEX in the Monad ecosystem. By leveraging Monad's high throughput and low latency, Kuru aims to combine the advantages of centralized exchanges with the composability and self-custody of decentralized trading.

I. Why choose CLOB?

Advantages over Automated Market Makers (AMMs)

Capital efficiency: CLOB allows market makers to actively quote prices, thereby providing tighter bid-ask spreads and reducing slippage. Unlike the passive allocation of liquidity in AMMs, CLOB concentrates liquidity at the best price points.

Pricing accuracy: Real-time order updates provide accurate price discovery. This helps better align with global market prices.

Flexibility for market makers: Market makers can dynamically adjust their buy and sell quotes based on market conditions without incurring significant gas fees.

II. Kuru's Unique Capabilities

Monad's features enhance Kuru's performance

Throughput: Approximately 10,000 transactions per second (TPS).

Low latency: 1-second block finality.

Cost-efficiency: Low gas fees allow frequent order updates without a significant cost burden.

By building on Monad, Kuru leverages these advanced features to enhance its platform performance:

Optimized smart contracts: Designed for market makers to place/cancel limit orders at low and constant gas fees.

Seamless integration: Supports high-liquidity and long-tail assets, providing a wide range of trading opportunities.

User-centric design: Integrates discovery, research, and trading into a single interface.

Passive liquidity solutions: Developing mechanisms to allow users to passively provide liquidity to the order book.

In July 2024, Kuru announced the successful completion of a $2 million seed round led by Electric Capital, with participation from Brevan Howard Digital, CMS Holdings, Pivot Global, Breed, Velocity Capital, Purple, and renowned angel investors Keone Hon (CEO and co-founder of Monad), Jarry Xiao, and Eugene Chen.

Kuru uniquely combines the efficiency of centralized systems with the decentralization of blockchain, aiming to revolutionize on-chain trading. By leveraging Monad's infrastructure, Kuru has the potential to become the primary liquidity hub for the next generation of DeFi projects. With a clear roadmap, strong technology, and a community-centric focus, Kuru is poised to redefine the new era.

2. Composite

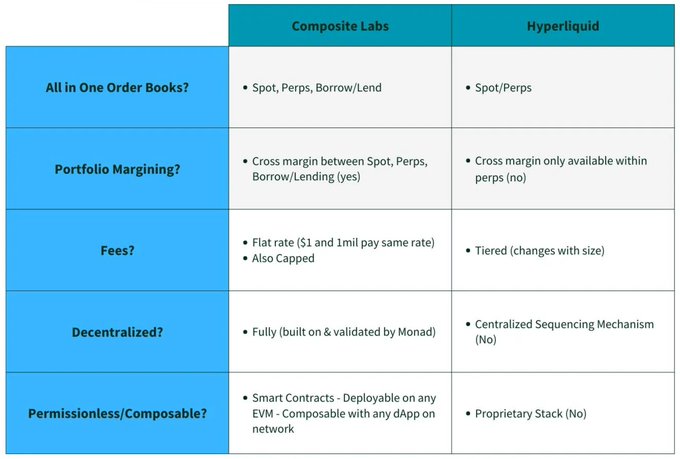

Composite Labs is building a fully on-chain central limit order book (CLOB) DEX in the Monad ecosystem. As a next-generation trading infrastructure, Composite integrates innovative features for both spot and derivatives markets (including real-world assets). The project leverages Monad's high-performance blockchain to address long-standing challenges in DeFi and capture emerging opportunities in the space.

I. Why Composite?

Composite stands out in DeFi for its innovative approach to decentralized trading. The following are the unique and critical core reasons for Composite:

Integrated order book: Composite integrates lending, spot trading, and perpetual contract trading into a single CLOB-based platform. This integration simplifies the user experience and operational efficiency, meeting users' demand for cross-platform capabilities.

Portfolio margin: Composite provides traders with a top-tier capital-efficient experience through portfolio margin. Traders can use existing assets (e.g., ETH) as collateral to open positions without additional margin. For example, selling perpetual contracts to generate yield does not require additional collateral.

Cost-efficiency: Composite charges a uniform low fee for all trade sizes. Whether the trade amount is $1,000 or $100,000, users pay the same minimal fee, improving their cost efficiency.

II. Composite's Key Performance Enabled by Monad:

Scalability and performance: Monad's high throughput and low latency allow Composite to efficiently process a large number of transactions, providing users with a seamless trading experience.

Cost-efficiency: Optimized execution and storage mechanisms reduce operating costs, enabling Composite to offer extremely low trading fees for users.

Security and decentralization: Monad's robust consensus mechanism and fully on-chain operations ensure Composite maintains a high level of security and decentralization, aligning with its commitment to transparency and trustlessness.

By combining advanced financial engineering with Monad's cutting-edge blockchain capabilities, Composite is poised to become the cornerstone of the Monad ecosystem and lead the next wave of DeFi innovation. Composite Labs brings together state-of-the-art financial engineering and Monad's frontier blockchain features to create a fully on-chain, high-performance trading platform.

3. Zaros

Zaros is an innovative perpetual contract decentralized exchange (Perp DEX) that combines liquidity-staking tokens (LSTs and LRTs) with the perpetual futures market, aiming to provide a user experience on par with centralized exchanges (CEXs) while maintaining the advantages of decentralization.

Why choose Zaros?

Diversified market coverage: Traders can trade 30-40 perpetual contracts covering cryptocurrencies, forex, and commodities on a single platform. This diversity supports traders in implementing comprehensive multi-asset class trading strategies.

Innovative market-making mechanism: Zaros introduces a new market-making engine that allows anyone to participate by locking up yield-generating assets as collateral. This democratizes market making, and liquidity providers earn the ETH fees paid by traders by lending their collateral to generate Zaros liquidity.

Impermanent Loss Enhancement: By connecting LSTs and LRTs with perpetual futures, Zaros allows liquidity providers to increase their yields through the ZLP vault. The ZLP vault is a single contract that locks the underlying collateral provided by liquidity providers to increase the liquidity cap of the Zaros perpetual futures market. This integration promotes the generation of actual yields and capital efficiency, enabling LST and LRT holders to lend out their liquidity.

In May 2024, Zaros successfully completed a $1.8 million funding round. The round was led by SNZ Holdings, with participation from Seven Capital, Cogitent Ventures, DCI Capital, and renowned angel investors Antony Sassano, Fernando Martinelli, Kieran Warwick, Andy Chen, and Kevin Lu.

By building on Monad, Zaros leverages Monad's core features to provide an efficient, cost-effective, scalable, and user-friendly trading platform. Monad's high throughput and low latency ensure that traders experience minimal delays even during peak trading periods. Cost efficiency translates to lower trading fees for users, making transactions more accessible. Furthermore, Monad's EVM compatibility ensures that Zaros can seamlessly integrate with other Ethereum-based applications, enhancing the platform's composability and the overall DeFi ecosystem.

Supported by Monad, Zaros offers a powerful and user-centric perpetual futures trading platform that combines the best features of centralized and decentralized exchanges, creating a superior trading experience for traders.

Drake Exchange is a fully on-chain perpetual contract decentralized exchange (Perp DEX) that aims to provide a trading experience on par with centralized exchanges (CEXs) while maintaining the transparency and security of DeFi. Leveraging Monad's high-performance infrastructure, Drake offers advanced trading features, deep liquidity, and efficient execution, positioning it as the leading perpetual contract DEX in the Monad ecosystem.

Why choose Drake?

- Hybrid Liquidity Model: Drake combines a fully on-chain limit order book (LOB) with an automated market maker (AMM) backstop. This dual-layer approach ensures optimal price discovery, minimal slippage, and the ability to quickly capture market opportunities without the need for immediate market making.

- Advanced Trading Capabilities: Traders can use up to 50x leverage on major assets like ETH and BTC, utilizing cross margin and isolated margin accounts. Features like internal collateral swaps and automated vaults (including a funding rate vault for generating non-directional yields) enhance users' trading strategies and risk management capabilities.

- Automated Yield Strategies: Through features like the funding rate vault, users can earn non-directional yields on USDC deposits, achieving continuous returns without active management. This dual-layer liquidity system ensures deep liquidity and optimal price execution, even during periods of high volatility or low order book depth.

Monad Madness NYC 2024 Finalist: Drake has been recognized for its innovative features and user-friendly design, highlighting its potential as a native perpetual contract DEX on Monad.

By building on Monad's efficient infrastructure, Drake offers gas-free trading, enhancing the user experience by reducing transaction costs. Leveraging Monad's unique capabilities, Drake's performance and features can rival those of centralized exchanges. Its innovative liquidity model, user-friendly design, and commitment to transparency make it an ideal choice for traders seeking a secure and efficient on-chain perpetual contract DEX.

Bean Exchange is a decentralized exchange (DEX) that offers spot and perpetual trading, featuring low swap fees, zero-price impact trades, and multi-asset liquidity pools that benefit liquidity providers.

Why choose Bean?

- Low Swap Fees and Zero-Price Impact Trades: Bean ensures cost-effective trading by reducing swap fees and eliminating price volatility, achieving zero-price impact trades.

- BLP Tokens: Liquidity providers can participate in the BLP pool, earning yields from leveraged trading (including spot and perpetual), lending fees, and swap fees. The fees from leveraged trading and swapping automatically increase the value of the BLP tokens.

- Advanced Position Management: Traders can adjust their positions by adding collateral to the current position, preventing liquidation or fine-tuning their leverage ratios. Additionally, they can modify take-profit and stop-loss levels, among other advanced trading features, even during active trades.

By leveraging Monad's infrastructure, Bean Exchange aims to provide a powerful and user-friendly decentralized trading experience, catering to DeFi traders seeking efficiency and reliability.

Ammalgam is an innovative DeFi protocol that integrates lending and trading functionalities into a single platform, becoming a decentralized lending and exchange (DLEX). This integrated innovation enhances capital efficiency and provides users with a superior user experience.

Why choose Ammalgam?

- Permissionless Over-Collateralized Peer-to-Peer Lending: Allows users to engage in over-collateralized lending without the need for intermediaries.

- Decentralized Lending and Exchange (DLEX): Ammalgam combines lending and trading functionalities within a single contract, enabling seamless interaction between these features and improving capital utilization.

- Enhanced Capital Efficiency: By lending out assets typically locked in AMM pools, Ammalgam increases yields for market makers and can provide up to 20% higher returns for liquidity providers.

In September 2024, Ammalgam announced the successful completion of a $2.5 million seed funding round. The round was co-led by Lightspeed Faction and Framework Ventures, with participation from Robot Ventures, Bodhi Ventures, NGC Ventures, DeWhales, Blockchain Founders Fund, and renowned angel investors Kain Warwick (Synthetix founder), Anton Bukov, Spencer Noon, and Jordi Alexander.

Supported by Monad, Ammalgam combines its innovative DLEX model with a blockchain infrastructure designed for speed, efficiency, and compatibility, positioning it as a formidable competitor in the DeFi space.

Monorail is an innovative DEX aggregator that aims to optimize trading by integrating the liquidity of AMMs and CLOBs. Leveraging Monad's high-performance blockchain, Monorail provides users with greater price efficiency and advanced trading features.

Why choose Monorail?

- Exceptional Price Aggregation: By integrating the liquidity of AMMs and CLOBs, Monorail ensures that users trade at the best prices. The platform aims to route large orders from Ethereum and L2 networks to Monad settlement, utilizing Monad's scalability and low fees.

- Advanced Features: Monorail offers limit orders from the start, providing traders with greater control and flexibility compared to traditional DEXs. Its aggregation model optimizes trade execution by combining multiple liquidity sources, reducing slippage and improving trading outcomes.

- Experienced Team: Monorail is developed by a team incubated by Delphi Labs, known for their successful launch of Astroport in the Cosmos ecosystem.

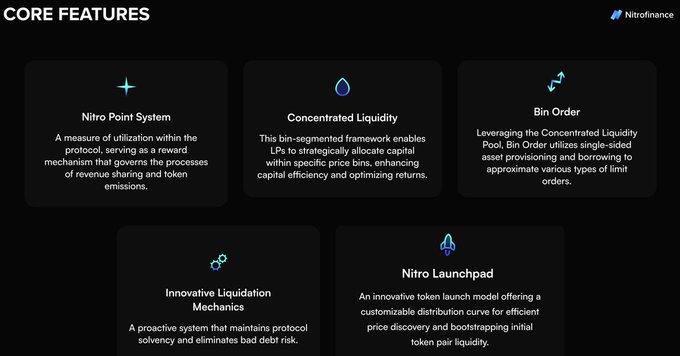

Monad Madness BKK 2024 Finalist: Monorail is the next evolution in aggregation, blending order book efficiency with AMM liquidity into a personalized order book, providing traders with the best trading experience.Price Bin Mechanism: Unlike traditional models, Nitro employs a price bin system, where each asset has multiple price bins. Liquidity providers and borrowers must exhaust one bin before activating the next, providing a structured approach to liquidity provision and utilization.

Reduced Bad Debt: The combination of an automated debt recovery mechanism and fixed debt terms effectively reduces bad debt by absorbing collateral at the borrowing price upon maturity.

Nitro Launchpad: An innovative token issuance model that provides customizable distribution curves for efficient price discovery and initial token-to-liquidity guidance.

Trading Made Simple: Narwhal has launched a gamified copy-trading platform, allowing users to easily follow the strategies of top traders and enjoy the same returns. This feature lowers the entry barrier for novice traders while fostering a community-driven trading environment.

AI-Driven Trading Platform: The Narwhal platform integrates AI-powered trading bots, providing users with advanced tools to optimize their trading strategies and improve their trading performance.

Synthetic Leveraged Trading: Narwhal adopts a synthetic trading model, eliminating the need for traditional order books or independent liquidity requirements for each trading pair. Profit and loss calculations are executed in smart contracts and settled with the platform's liquidity token, NLP, simplifying the trading process.

Multi-Asset Selection: Through the synthetic asset design provided by Pyth, Narwhal offers deep liquidity and minimal slippage, allowing users to trade beyond cryptocurrencies, including stocks, indices, and forex.

Website:https://monad.xyz/

Twitter:https://twitter.com/monad_xyz

Substack:https://monadxyz.substack.com/

Discord:https://discord.gg/monad

Developer Discord:https://discord.gg/monaddev

Monad Chinese Community Twitter:https://x.com/monad_xyz

Monad Chinese TG Group:https://t.me/Chinads

Monad Chinese Developer TG Group:https://t.me/+UE_dh4BNHIxhMjY1

Monorail showcases the high-performance features of Monad, providing a new generation of DEX aggregators that combine the liquidity of AMM and CLOB to achieve optimal trading efficiency. Backed by a strong team, innovative features like limit orders, and strategic partnerships within the Monad ecosystem, Monorail is poised to become a key player in the DEX space.

8. Nitro

Nitro Finance is an innovative DeFi protocol that integrates the functionalities of decentralized exchanges (DEXs) and money markets into a unified platform, aiming to address common challenges such as Impermanent Loss, bad debt, low capital efficiency, and market fragmentation.

Why choose Nitro?

Fused Trade Ledger: Nitro introduces a single asset pool (e.g., ETH/USDC), allowing users to seamlessly swap, lend, and borrow within the same pool. This design enhances capital efficiency and integrates DeFi operations.

By leveraging Monad's advanced blockchain infrastructure, Nitro Finance enhances the platform's performance, security, and user experience, allowing users to swap, lend, and borrow from the same asset pool. This integration improves capital efficiency and reduces the fragmentation issue in the DeFi ecosystem.

9. Narwhal Finance

Narwhal Finance is a decentralized perpetual contract trading platform built on Monad, featuring a combination of AI-driven trading and gamified trading experiences. It allows users to trade a variety of leveraged trading pairs, including cryptocurrencies and forex, without the need for KYC, geographical restrictions, or high centralized exchange fees.

Why choose Narwhal?

In March 2024, Narwhal Finance completed a $1 million seed round led by Animoca Ventures, with participation from top-tier investors and several angel investors.

By building on Monad, Narwhal Finance combines innovative trading features with a powerful and efficient blockchain infrastructure, providing users with a decentralized trading experience on par with traditional centralized exchanges.

Summary

The Monad-native decentralized exchange (DEX) ecosystem is rapidly evolving, leveraging Monad's advanced technology. The aforementioned DEX projects are dedicated to addressing the shortcomings of traditional centralized exchanges (CEXs) and existing DEXs. By emphasizing user experience, capital efficiency, and innovative trading mechanisms or user experiences, these projects are poised to play a crucial role in shaping the future of DeFi. These emerging ecosystem projects may attract traders seeking more efficient, transparent, and secure trading platforms. Continuing to harness Monad's high throughput, low latency, and cost-effectiveness demonstrates Monad's important role in driving innovation in this domain.

This article introduces the native projects built on Monad that have been publicly disclosed as of 2024. We welcome more builders to explore Monad's technological innovations and join our ecosystem. Here are the relevant links and communities for Monad, feel free to reach out to us at any time.

Gmonad

Official Links WebOfficial Links