The price of XRP has been adjusting over the past month, recording a slight 2.2% increase over the past 30 days. It formed a golden cross at the beginning of the month, suggesting potential upward momentum, but whale activity indicates a lack of accumulation, which could put pressure on further price increases.

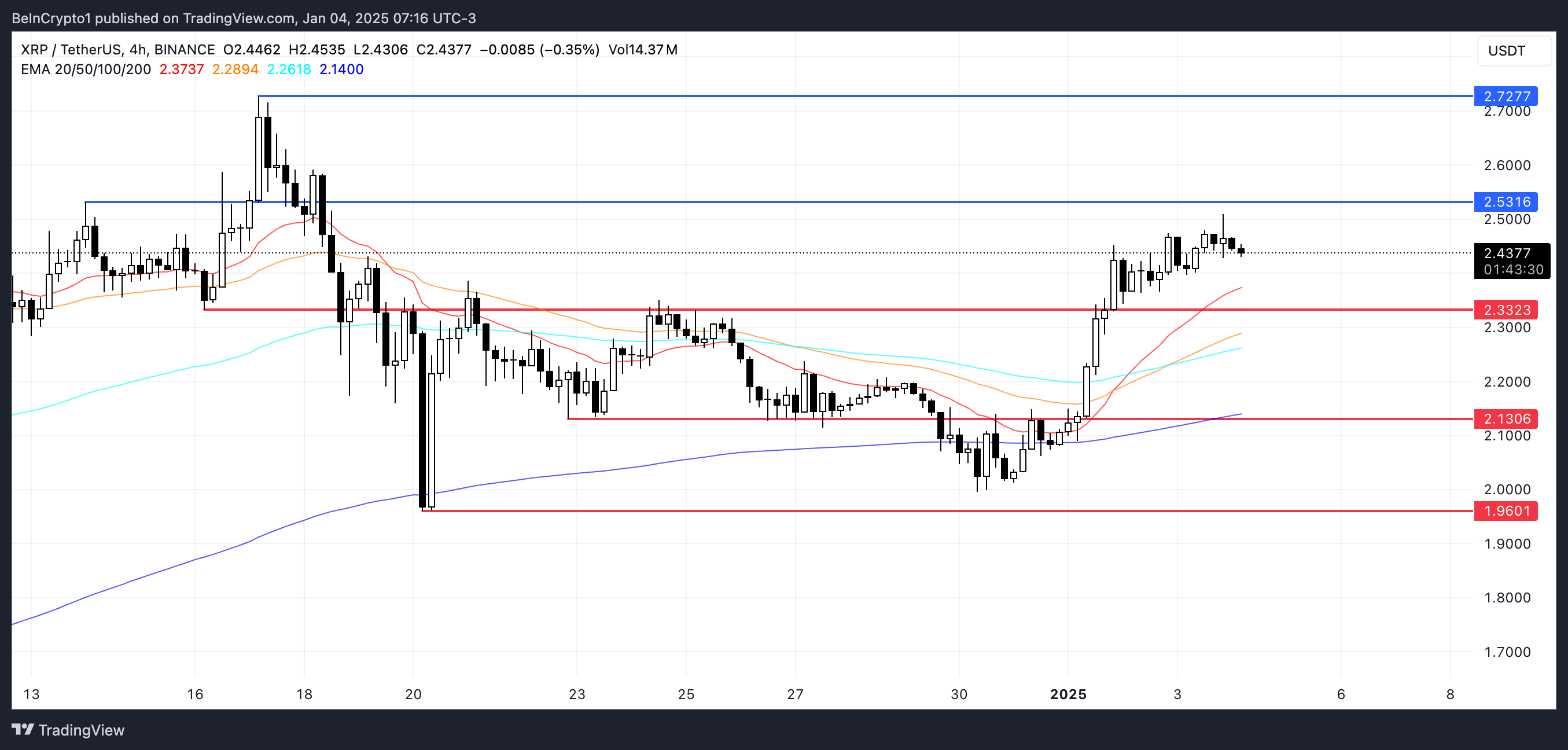

XRP's Chaikin Money Flow (CMF) is positive and emphasizes persistent buying pressure. However, the indicator has cooled slightly from recent highs. These factors suggest that XRP's next move will largely depend on whether it breaks through the $2.53 resistance or succumbs to downward pressure near the $2.33 support level.

XRP Whales Have Paused Accumulation

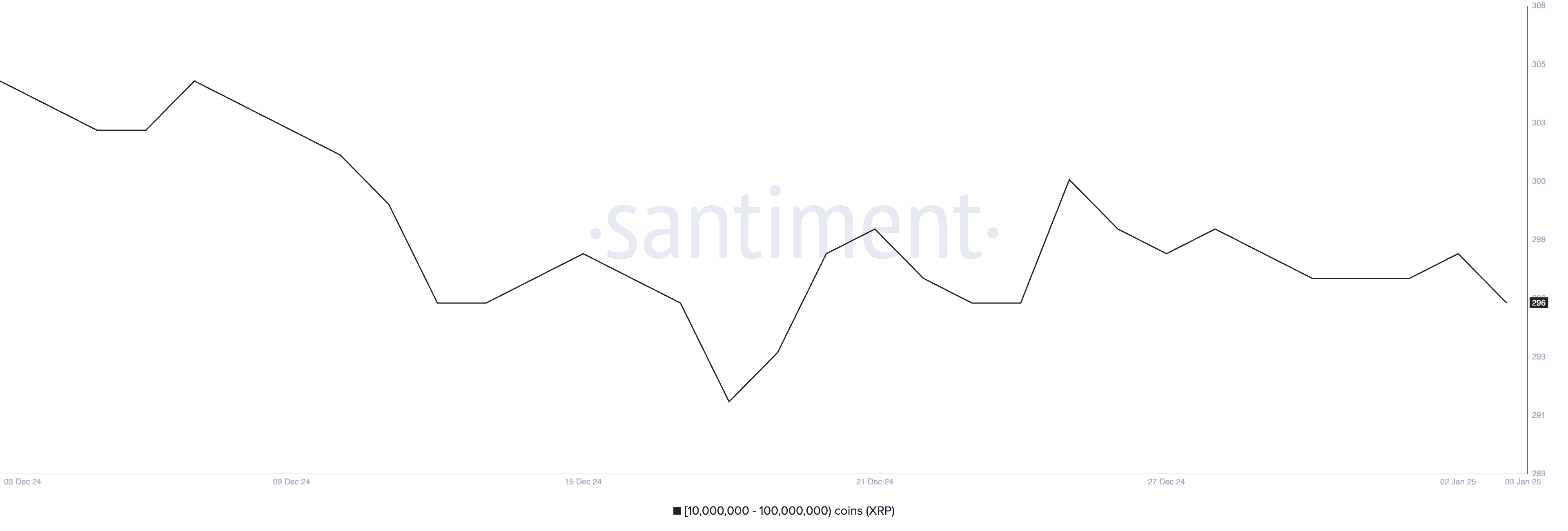

The number of XRP whales holding between 10 million and 100 million XRP has decreased to 296, the lowest level since December 24. After peaking at 301 on December 25, the number of these large holders has steadily declined.

This represents an important change in whale activity, as their numbers had previously reached a one-month high of 305 on December 7, coinciding with XRP's price exceeding $2.50.

Tracking whale activity is important, as these large holders can significantly impact the market. Their accumulation generally indicates confidence in the coin and can drive price increases. Conversely, a decrease in their numbers suggests selling pressure or waning interest.

The recent decline in whale numbers implies a bearish sentiment among major investors, which could put short-term pressure on the XRP price. Unless whale activity stabilizes or reverses towards accumulation, XRP may struggle to regain its upward momentum.

XRP CMF Reaches One-Month High

The XRP Chaikin Money Flow (CMF) is currently at 0.28, maintaining a positive position after being close to 0 on January 1. The CMF has been on an upward trend since the new year, indicating increased capital inflow as buying pressure outweighs selling pressure.

This positive CMF reflects growing investor confidence and suggests that XRP is garnering attention from market participants.

CMF is a momentum indicator that measures the flow of money into an asset based on price and volume. Values above 0 indicate net buying pressure, while values below 0 suggest net selling pressure. The XRP CMF reached a peak of 0.33 a few hours ago and has since slightly declined to 0.28, but it remains in positive territory.

This suggests that the buying momentum may have cooled slightly, but the overall trend still supports additional price stability or a minor short-term increase, as long as the CMF does not continue to decline.

XRP Price Prediction: Potential for Reversal at Any Time

The XRP price is currently trading within a narrow range between the $2.53 resistance and the $2.33 support. The formation of a golden cross on January 1 triggered a recent price surge, suggesting strong upward momentum.

However, indicators such as the decrease in whale accumulation and a slight decline in the CMF suggest that the current uptrend may be losing steam.

If the $2.33 support level is not maintained, the XRP price could drop to $2.13 as selling pressure increases. A break below this level could see the price further decline to $1.96, potentially representing a 19.6% correction.

Conversely, if the uptrend regains strength and the XRP price breaks through the $2.53 resistance, the next target could be $2.72, potentially providing a 10.6% upside.