The price of Solana (SOL) has risen 9% over the past 7 days, with its market capitalization exceeding $103 billion again. However, SOL's trading volume has decreased by 34% over the past 24 hours to $2.4 billion.

The positive indicator CMF and the recent golden cross support the upward momentum. However, whether SOL can maintain its upward trend or enter a correction depends on whether it can maintain the important $211 support level.

Solana CMF still high... Decreased from the highest level

Solana's Chaikin Money Flow (CMF) is currently at 0.23, reflecting positive capital inflows into the asset. CMF measures the flow of funds into an asset over a certain period based on price and trading volume. A value above 0 indicates net buying pressure, while a value below 0 indicates net selling pressure.

The SOL CMF has surged from near 0 on January 1 to 0.33 yesterday, indicating strong buying momentum has entered this period.

At 0.23, the SOL CMF is still in positive territory, indicating that buying interest continues with slightly decreased intensity compared to the recent peak. The decrease from 0.33 may suggest that buying pressure has eased slightly, and could imply the possibility of the price consolidating a bottom or the upward momentum slowing down.

For SOL to maintain its upward trend, the CMF needs to stabilize or rise again to restore investor confidence. However, if it continues to decline, the weakening demand could increase the likelihood of a short-term price correction.

Profit-taking movements in SOL also increasing

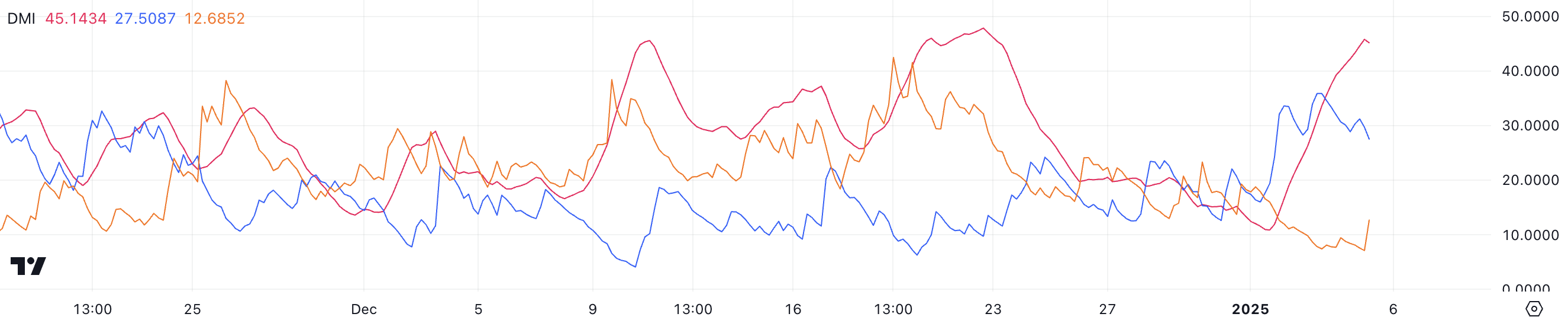

The Average Directional Index (ADX) of SOL has surged to 45, rapidly rising from 10.8 four days ago, indicating the formation of a strong trend. ADX measures the strength of a trend on a scale of 0 to 100, with values above 25 indicating a strong trend and values below 20 indicating a weak or absent momentum.

This rapid ADX increase confirms that SOL is currently in a strong uptrend, reflecting confidence in market activity and price direction.

The directional indicators provide additional insights into the current trend. The +DI, which represents buying pressure, is at 27.5, down from 35.8 yesterday, indicating a slight decrease in upward momentum. Meanwhile, the -DI, which represents selling pressure, has increased from 8.6 to 12.6, showing a slight increase in bearish activity.

Despite these changes, the +DI is still significantly higher than the -DI, and the strong ADX continues to support the uptrend. However, the decreasing +DI suggests that Solana's upward momentum is stabilizing, and the market may consolidate a bottom unless buying pressure increases again.

SOL Price Prediction: $211 Support Holds, Next Target $229

The movement of the Solana price depends on whether the crucial $211 support level can be maintained. If this support is broken, SOL could enter a downtrend, and the next key level of $203 should be watched.

If it fails to hold above $203, the decline could accelerate, with the price potentially falling back to $185, reflecting a significant shift in market sentiment.

On the other hand, the EMA (Exponential Moving Average) lines are still maintaining an upward trend, signaling optimism about potential upward movements. The golden cross formed two days ago further strengthens the possibility of sustained momentum.

If the $211 support is maintained, the SOL price could challenge the $221 resistance. Breaking through this level could open the way for an additional rise to $229. If the upward momentum is strengthened, the Solana price could target $246, a 16% increase from the current level.