The cryptocurrency community is expecting a strong 2025 after Donald Trump's return to the White House. However, a new report shows that the Trump-led rally may face obstacles.

As 2025 begins, the cryptocurrency trading environment is showing a mixed trend following the Federal Reserve's Open Market Committee (FOMC) meeting in December and the year-end holiday season.

Bitcoin risks losing upward momentum despite the 'Trump effect'

According to 10x Research, the first quarter of 2025 may not see the same level of momentum as seen from late January to March 2024 or late September to mid-December 2024.

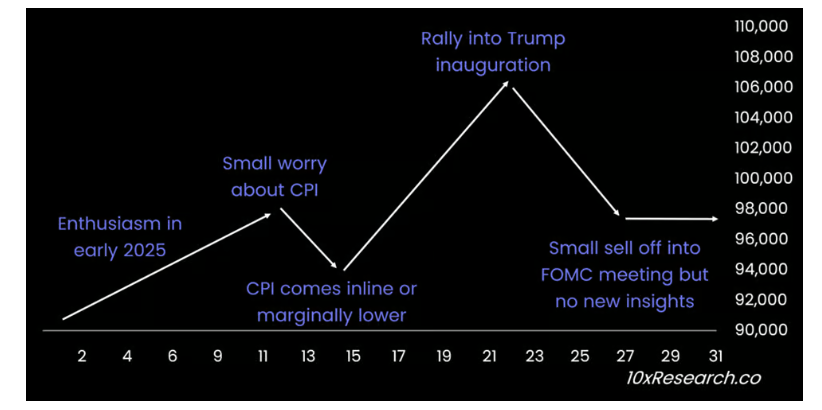

The release of the Consumer Price Index (CPI) data on January 15 is a key event to watch. Adjustments are expected ahead of the CPI data release, and a positive result (CPI figures coming in lower than expected) could lead the market to rebound.

"Positive inflation numbers could reignite optimism and drive a rally leading up to Trump's inauguration on January 20." – Mark Tillery, founder of 10x.

However, the momentum generated by such a rally may be short-lived. Tillery added that the market is likely to retreat ahead of the January 29 FOMC meeting. He expected Bitcoin to be in the range of $96,000 to $98,000 by the end of January.

Bitcoin reached a new all-time high in the fourth quarter of 2024 after the Federal Reserve's 25bp rate cut. The September rate cut was very positive for the cryptocurrency market.

Bitcoin dominance at 57%... needs to decrease for 'alt season' to kick in

Another factor to consider when discussing the Bitcoin price path in 2025 is Bitcoin dominance. According to the 10x report, Bitcoin's market share surged from 50% to 60% from January to mid-November 2024, putting significant pressure on altcoins.

As Bitcoin's dominance increased, many altcoins failed to gain attention, making it difficult for investors to generate substantial profits from investments other than Bitcoin.

There was a brief period of 3 weeks when Bitcoin dominance fell to 53%, which sparked hope for an altcoin season. However, this decline was short-lived, and Bitcoin dominance quickly approached 58%, stabilizing at around 55% by the end of 2024. This adjustment to the 55% level indicates that Bitcoin has a firm grip on the market.

For investors, this emphasizes the importance of closely monitoring Bitcoin's dominance. At the time of reporting, Bitcoin dominance was around 57%, and the price was trading at $99,225.

10x Research's Bitcoin outlook is in line with the prediction made last week by CoinShares research head James Butterfill, who said Bitcoin could see a potential high of $150,000 in 2025 and a correction to $80,000.

Similarly, Bitwise Asset Management expected Bitcoin to reach $200,000 by the end of the year.