At the beginning of 2025, Bit returned to $100,000, and the market seems to be gradually warming up after the fluctuating adjustment. On the evening of January 6th, BTC broke through the $100,000 mark, and as of the time of writing, it has stabilized at around $102,000, with a 24-hour increase of about 4%. Not only Bit, but also mainstream cryptocurrencies such as Ethereum and Solana have seen a general increase. Behind the market warming, multiple factors are driving the price upward.

The market sentiment is warming up, and the activity of futures and options is significantly increased

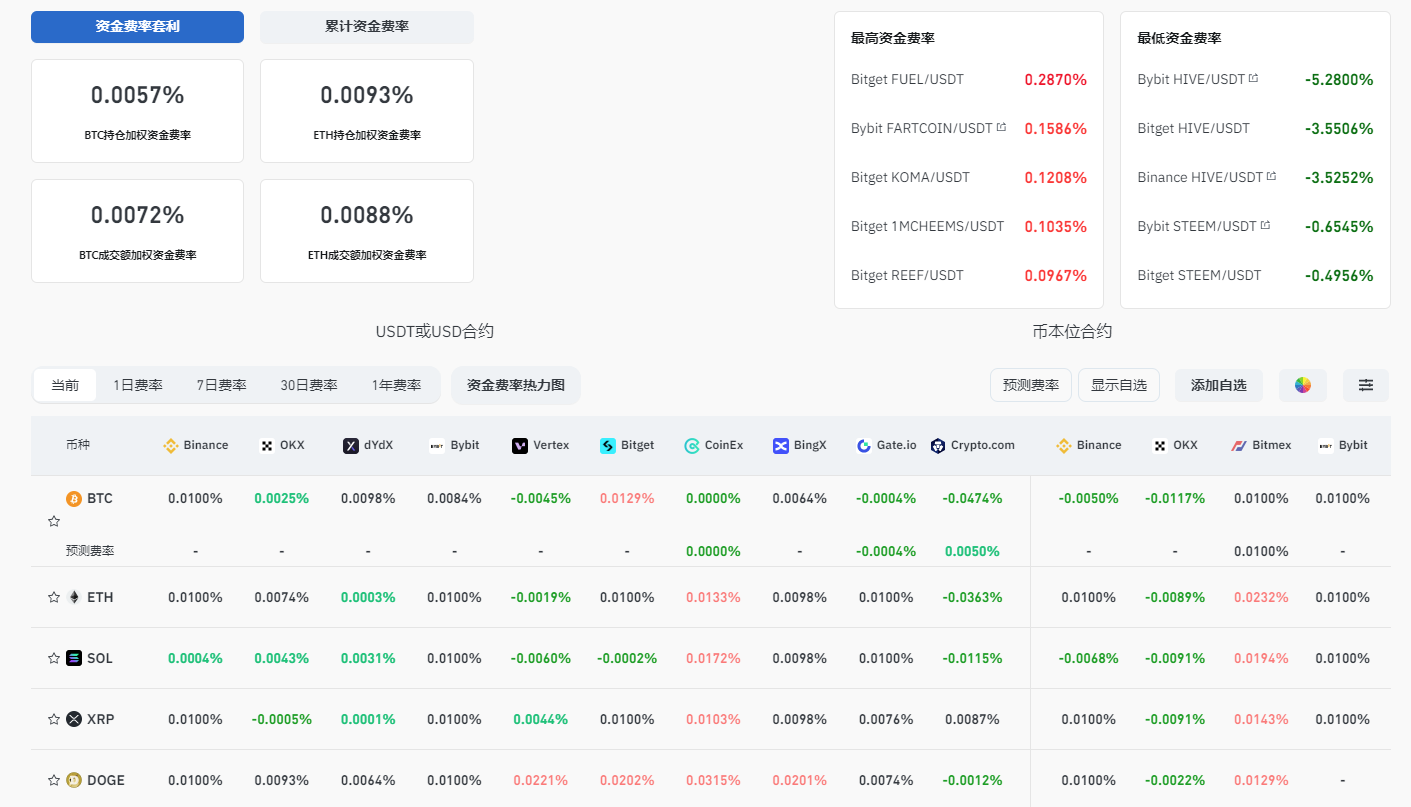

The perpetual futures funding rate has risen, and the derivatives indicators are healthy

According to Coinglass data, the weighted funding rate of perpetual futures on major exchanges has recently risen to 0.0113%, indicating that market sentiment is turning optimistic. QCP Capital pointed out that the current capital level is still in a healthy range, and although it is impossible to expect a large-scale short squeeze, the possibility of a short-term market pullback is not high.

In addition, crypto trader Gordon Grant observed that the Bit options market has become active again in early January. On January 7th, the trading volume of call options with an expiration date and a strike price of $103,000 exceeded 1,000 contracts. The active trading of such short-term call options often indicates the upside potential of the price.

The Coinbase premium has returned to neutral, and the sentiment of institutions and retail investors has warmed up

After the violent sell-off in December, the Bit premium on Coinbase returned to a neutral level on January 4th. CryptoQuant analyst IT Tech believes that this indicates that the sentiment of retail investors in the US market is gradually warming up. However, on-chain data analysis shows that the trading volume of small retail investors below $10,000 continues to decline, and the main driving force of the market is currently from institutional investors and medium and large-sized traders.

Institutions increase their holdings, and the supply and demand of Bit continues to tighten

According to SoSoValue data, since the beginning of January, Bit ETFs have seen net inflows again, and their total net asset value has reached $111.46 billion, with the ETF net asset ratio (market capitalization to total Bit market capitalization) reaching 5.72%, and the cumulative net inflow has reached $35.91 billion.

The strong influx of institutional capital is an important driving force for the recent rebound in Bit prices. MicroStrategy has increased its holdings again, buying 1,070 Bits for $101 million on January 6th, with a total holding of 447,470 BTC worth over $44 billion. At the same time, Bit mining company MARA Digital also announced that it will continue to increase its BTC holdings, with a holding scale approaching 44,000 BTC.

Other global institutions are also taking action:

- Japanese company Metaplanet plans to expand its holdings to 10,000 BTC;

- El Salvador has added 5 more BTC, bringing its total holdings to 6,009;

- US-listed company KULR has added 213 more BTC, with its holdings exceeding 430 BTC.

The continuous inflow of these funds further tightens the circulating supply in the market, providing a basis for the medium-term upward trend of Bit.

The altcoin sector is warming up, and the AI ecosystem is rising

The Trump-concept Memecoin is rising rapidly

On January 7th, Trump was officially confirmed to be re-elected as the President of the United States, and the cryptocurrency tokens related to him have ushered in a new round of increases. The TRUMP token has risen by more than 80% in the past three days, and the MAGA and TRUMPCOIN have even approached 100%. Although these gains have a speculative nature in the short term, the crypto-friendly attitude of the Trump administration has brought broader positive expectations to the market.

AI-concept tokens continue to strengthen

At the CES 2025 conference, AI has become the focus of the technology field again, and AI-concept cryptocurrencies have also strengthened in sync. WLD, RENDER and IOTA have respectively achieved increases of 10%, 8% and 6%. The short-term increase of AI16Z has exceeded 25%, and the price of AIXBT has re-broken through 0.55 USDT. The market is highly concerned about the long-term potential of the combination of crypto technology and artificial intelligence.

Analyst Outlook: Optimism and Concerns about Bit's Performance

Although the market is generally optimistic at the moment, different parties still have different views on the future trend of Bit:

- Optimists: Bitfinex and Bernstein analysts believe that the tight supply and demand of Bit and the reduced selling pressure from miners will drive the medium-term price increase, and the price target for 2025 may reach $160,000 to $200,000.

- Cautious: Both Arthur Hayes and QCP Capital believe that there may not be excessive upward movement in the short term, and the market may see an adjustment in mid-March. They suggest that investors reduce their positions in the late first quarter.