Source: Grayscale; Compiled by Tong Deng, Jinse Finance

Summary

Cryptocurrency valuations declined in December after rising earlier in the year. The pullback may reflect more hawkish signals from the Federal Reserve. Similar-sized declines have occurred during the two most recent Bitcoin bull markets.

Spot Bitcoin and Ethereum exchange-traded products (ETPs) are set to launch in the U.S. market in 2024. Cumulative inflows have now reached $38 billion. [1] Bitcoin and Ethereum declined 3% and 10% respectively during the month. [2]

The financial cryptocurrency sector performed well in December. Grayscale Research believes this sub-sector may benefit from regulatory changes and/or new legislation under the incoming U.S. administration, and has included several DeFi-related assets in its updated Top 20 list. The Top 20 also features assets related to decentralized AI technology, which remains a focus of market attention.

In early January, the Senate will consider the President-elect's nominees for Treasury Secretary, Commerce Secretary, SEC Chair, and CFTC Chair.

In December 2024, the cryptocurrency market took a breather, with major stock indices retreating and bond yields rising. Grayscale Research believes many of the market changes can be attributed to the more hawkish signals from the Federal Reserve in its mid-December meeting. Despite the setback last month, Bitcoin was still up 121% by the end of 2024. [3]

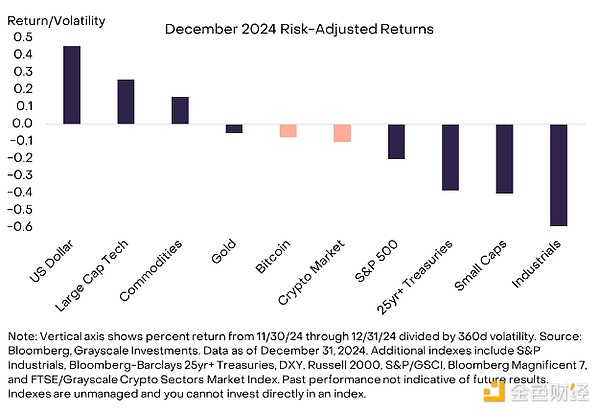

Traditional markets had a mixed performance at year-end (Figure 1). The U.S. dollar rose in December, and yields on the yield curve increased. The Fed's guidance to slow the pace of rate hikes in 2025 may have fueled the moves in currency and bond markets. Broad equity indices declined, led by cyclical market sectors. Large-cap tech stocks (represented by the Bloomberg 7 Majors index) were an exception, rising in December and posting strong full-year returns. Bitcoin saw a modest decline, with risk-adjusted (i.e., accounting for the volatility of each asset) returns in the middle of the pack. The FTSE/Grayscale Crypto Industry Market Index (CSMI) fell 6% in December, giving back around 15% of its gains since November 2024.

Figure 1: Crypto returns are in the middle of the pack on a risk-adjusted basis

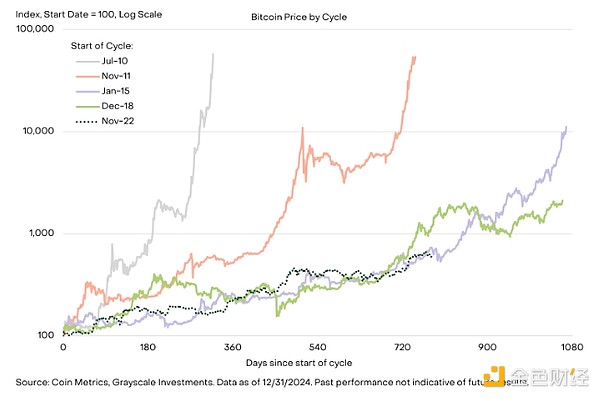

Short-term declines are a common feature of crypto bull markets. For example, during the latest appreciation phase of the crypto market cycle (from December 2018 to November 2021), Bitcoin's price rose by around 21x. However, during this period, Bitcoin's price declined by at least 10% a total of 11 times, including two drawdowns of around 50%. During the prior appreciation phase of the crypto market cycle (from January 2015 to December 2017), Bitcoin's price declined by at least 20% a total of 11 times. [4] We still believe we are in the mid-stage of the current Bitcoin bull market, and there is further upside potential in 2025 and beyond as long as the market remains supported by fundamentals (Figure 2).

Figure 2: Bitcoin's price behavior prior to the two bull markets

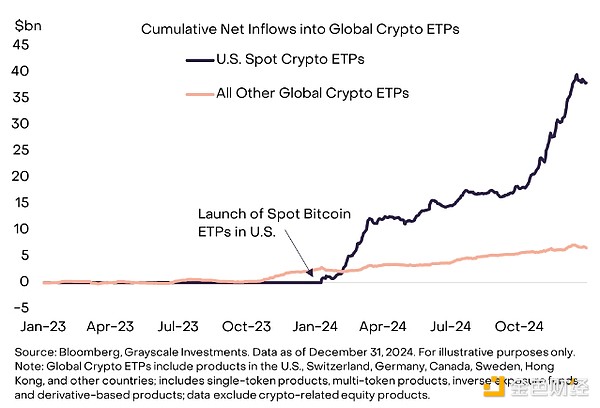

In December, U.S.-listed spot crypto ETPs again became an important source of new demand, with net inflows totaling $4.7 billion for the month. Including the spot Ethereum ETP launched in July, the cumulative net inflows to U.S.-listed spot crypto ETPs have now reached $38 billion. [5] While investor demand for crypto ETPs has also increased in other jurisdictions, the cumulative inflows have been lower and more stable on a month-over-month basis (Figure 3).

Figure 3: Surging demand for U.S.-listed spot crypto ETPs

Another important source of Bitcoin demand in the U.S. market is MicroStrategy, a publicly-traded company that holds Bitcoin on its balance sheet, primarily as a Bitcoin investment vehicle. [6] MicroStrategy was added to the Nasdaq-100 Index in December 2024. [7] In Q4 2024, MicroStrategy purchased 194,180 Bitcoin, worth $18.2 billion at year-end. [8] Thus, MicroStrategy's Bitcoin purchases in Q4 were comparable in size to the net inflows into spot Bitcoin ETPs during the quarter. [9] MicroStrategy has been funding its Bitcoin purchases through equity and debt issuances and has announced plans to continue buying Bitcoin over the next 3 years. [10] Given the quantitative significance of this Bitcoin demand source, crypto investors should monitor MicroStrategy's financial performance metrics, including the gap between the company's market capitalization and the value of its Bitcoin holdings. Generally, if the company's stock trades at a premium to the value of its Bitcoin, it may incentivize further equity issuance and Bitcoin purchases.

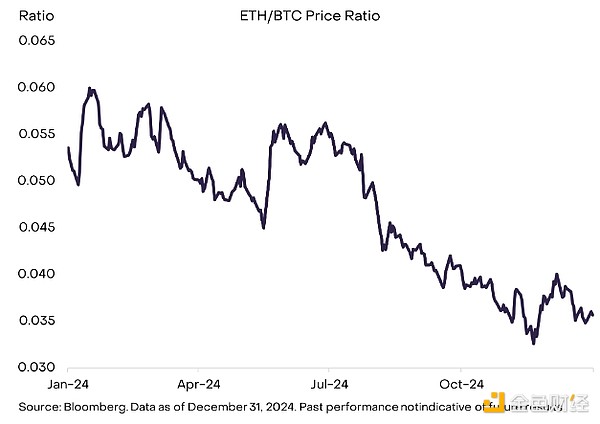

In December, Ethereum (ETH) underperformed Bitcoin (BTC), with the ETH/BTC price ratio consolidating over the past two months (Figure 4). Ethereum is the leading smart contract platform blockchain by market cap, but it faces increasingly intense competition from other projects. [11] In 2024, Ethereum underperformed Solana, the second-largest asset by market cap, [12] as investors have become more focused on alternative Layer 1 networks like Sui and The Open Network (TON). When building infrastructure for application developers, the architects of smart contract blockchains face various design choices that can impact technical characteristics like block times, transaction throughput, and average transaction fees. Regardless of the specific design choices, all smart contract platforms are competing for network fee revenue, which Grayscale Research believes is a key determinant of value accrual.

Figure 4: Ethereum underperformed Bitcoin in December and throughout 2024

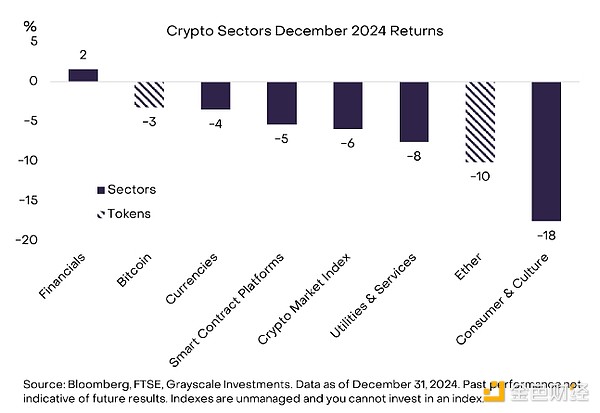

Grayscale's Crypto Industry Framework shows that digital asset valuations broadly declined in December (Figure 5). The worst-performing market segment was the Consumer & Culture crypto industry, primarily due to the price decline of Dogecoin, the largest meme coin by market cap. [13] One exception to the broad decline was the Financial crypto industry, which was primarily supported by the rise of Binance Coin (BNB), the token associated with the Binance exchange and Binance Smart Chain smart contract platform. Grayscale Research believes regulatory changes and new legislation under the incoming U.S. administration may particularly support blockchain-based financial applications. Therefore, we have introduced several DeFi-related assets in our updated Top 20 list.

Figure 5: The Financial crypto sector outperformed

The dominant theme in the crypto market in 2024 will be new innovations related to decentralized artificial intelligence technology, and this may again become the dominant theme in the new year. Most of the attention is still focused on developments related to AI "agents"—a type of software that can act independently to pursue a set of complex goals. These AI agents are fundamentally changing the way we interact with blockchain technology, as demonstrated by Luna on the Virtuals protocol. Luna is a female anime-style chatbot whose specific goal is to attract 100,000 fans on X, and notably, she can make financial transactions by paying ("tipping") Luna tokens to users through her own crypto wallet. This integration with blockchain technology is particularly important because it allows AI agents like Luna to directly access and allocate financial resources, going beyond the use cases of previous task-based AI agents.

Since the emergence of AI agent tokens in late October 2024, the leading projects in the industry have achieved extraordinary gains, with Virtuals soaring 49,000% and Ai16z rising 8,700%[14]. Notably, the ai16z project named after the investment firm a16z built the top-ranked AI agent framework on GitHub[15] in December and announced a partnership with Stanford University.[16]

Ultimately, 2024 was a landmark year for the digital asset market: new spot Bitcoin and Ethereum ETPs brought more investors to the crypto ecosystem, the Bitcoin network experienced its fourth halving event, researchers made breakthroughs in new blockchain application technologies, and cryptocurrencies played a prominent role in the US election. While some specific themes may change, we expect crypto investors to remain excited in 2025.

In early January, the US Senate will begin considering candidates for cabinet and government agency leadership positions nominated by the president-elect. For the crypto currency market, we believe the most important confirmations may be the Treasury Secretary (Scott Bessent), Commerce Secretary (Howard Lutnick), SEC Chair (Paul Atkins), and CFTC Chair (not yet announced at the time of writing). The new role of the White House AI and Crypto Czar (David Sacks) does not require Senate confirmation. While Grayscale Research expects the next Congress to pass crypto-related legislation, this may not happen until lawmakers resolve certain tax and other issues. Outside the US, the EU's MiCA regulation fully came into effect on December 30, 2024, imposing stricter rules on stablecoins, leading to the delisting of Tether's unlicensed USDT from exchanges starting in 2025 in favor of compliant alternatives like Circle's USDC.[17]

Beyond political factors, the crypto currency market appears likely to be subject to its usual fundamental drivers: global adoption of Bitcoin as an alternative currency medium, demand for the next generation of decentralized network applications, and macroeconomic factors such as central bank monetary policy changes affecting the valuation of all assets. While the outlook is uncertain, we believe many industry trends look favorable at the start of the new year.

Index Definitions:

The Bloomberg 7 Major Total Return Index (BM7T) is a market-cap-weighted index that tracks the seven most widely traded US companies. The S&P 500 Industrial Index includes companies classified in the GICS Industrial sector within the S&P 500 Index. The Bloomberg Barclays US Treasury Long Index measures the total return of nominal US Treasury bonds with a remaining maturity greater than 25 years. The US Dollar Index (DXY) tracks the strength of the US dollar against a basket of major currencies. The Russell 2000 Index consists of the smallest 2,000 companies in the Russell 3,000 Index, representing approximately 8% of the Russell 3,000 total market capitalization. The S&P GSCI is a composite index of commodity sector returns, representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. The FTSE/Grayscale Digital Assets Index Series measures the price return of digital assets listed on major global exchanges. The Nasdaq-100 Index includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

References:

[1] Source: Bloomberg, Grayscale Investments. Data as of December 31, 2024.

[2] Source: Artemis. Data as of December 31, 2024.

[3] Source: Coin Metrics. Data as of December 31, 2024.

[4] Source: Coin Metrics, Grayscale Investments. Data as of December 31, 2024. Past performance is not indicative of future results.

[5] Source: Bloomberg, Grayscale Investments. Data as of December 31, 2024.

[6] Investopedia, data as of December 23, 2024. Michael Saylor "calls MicroStrategy a Bitcoin operating company."

[7] Markets.com

[8] Source: Bitcointreasuries.net, Bloomberg, Grayscale Investments. Data as of December 31, 2024.

[9] Spot Bitcoin ETPs had net inflows of $16.5 billion in Q4, valued at the time of inflow. The Bitcoin holdings of ETPs increased by $18.6 billion in Q4 based on year-end prices. Source: Bloomberg, Grayscale Investments. Data as of December 31, 2024.

[10] Microstrategy, as of January 3, 2025.

[11] Artemis, FTSE, Grayscale. As of January 6, 2025.

[12] Artemis, FTSE, Grayscale. As of January 6, 2025.

[13] Artemis, FTSE, Grayscale. As of January 6, 2025.

[14] Dexscreener. As of January 2, 2025

[15] Chain Catcher

[16] Blockworks

[17] Ernst & Young, "Monetary Analysis"