Author: Foxi (DeFi / AI)

Compiled by: TechFlow

"Agents are not just here for your Twitter feed - they are reshaping the entire digital economy."

This article will delve into how to discover the next leading AI agent (Alpha) by understanding the methodology. Remember: Once everyone sees it, it has already lost its lead advantage. The key is to be two steps ahead, and by applying this methodology, you can seize the opportunity and succeed.

Special thanks to the AI report from Delphi_Digital and the contributions of other pioneering researchers.

The Golden Rule: Consensus

In the market, everyone tries to sell their assets to others at a higher price. Your goal is to exit at the right time, not to be overly attached to any asset. To successfully exit, you need to find a project with "consensus." This means that most people in the market recognize the value of the project, providing liquidity support for you. Building consensus is a complex topic, which we will not delve into today.

How to Make Money?

Predict an emerging trend (consensus) and hold a firm belief (knowledge is needed to support your judgment).

Invest in potential projects that are innovative and legitimate.

Sell your assets when the market forms a consensus.

This article will focus on the most challenging step: prediction. If you don't have a clear understanding or belief in the trend, it's difficult to independently judge the value of potential projects. In this case, you either rely entirely on luck or wait for others' cues, ultimately becoming the object of others' profits. Let's get started.

Part 1: The Three Waves of Agent Evolution

The AI field in 2024 was marked by OpenAI's o1 system and a valuation of billions of dollars, while 2025 is considered a pivotal year for the financialization of artificial intelligence. However, to find true value in this rapidly evolving field, we need to go beyond the hype of "AI agents" and delve into the fundamental changes behind them.

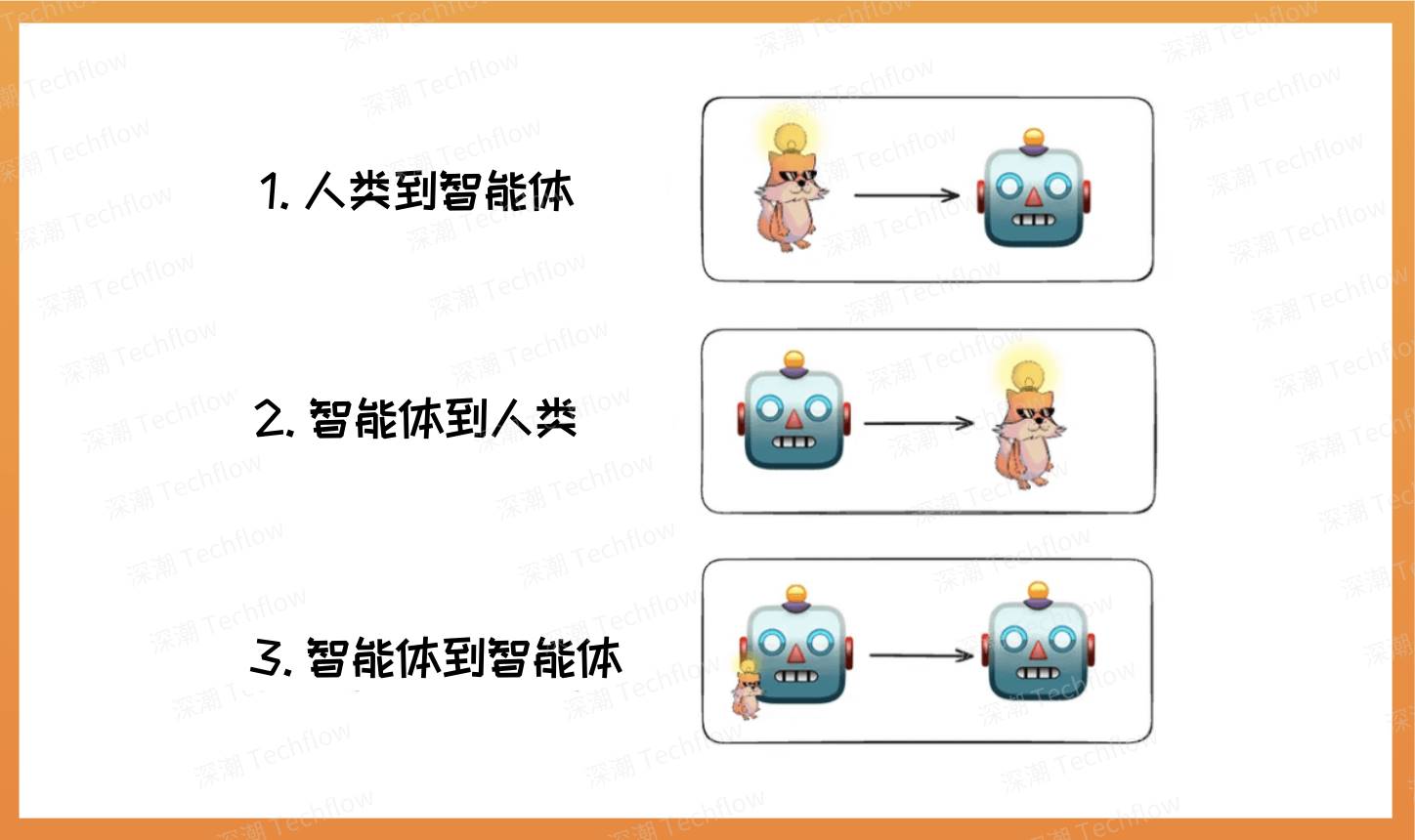

Understanding which stage of the technology adoption cycle we are currently in is crucial for seizing opportunities. The development of the agent economy can be divided into three stages:

Image by Foxi (DeFi / AI), compiled by TechFlow

Wave 1: Human to Agent (Current Stage)

We are currently in this stage, with typical examples being simple chatbots on X (@aixbt_agent). These agents primarily serve as research assistants or execution tools for humans, helping to complete simple tasks. Although they have some value, they do not require disruptive infrastructure reforms. Most current agents are similar to a customized ChatGPT, helping users with simple research tasks, but with limited autonomy. They cannot independently manage resources, take on risks, or pay service fees.

Wave 2: Agent to Human (Emerging)

Agents in this stage are beginning to truly demonstrate their potential. They can independently complete daily tasks, such as running trading strategies, optimizing home energy use, and even negotiating and paying bills. These tasks no longer require frequent user intervention. Tools like Stripe's Agent SDK already cover some scenarios, revealing a trend: the traditional fixed monthly or annual fee model will gradually be replaced by a pay-as-you-go pricing model.

As agents take on more responsibilities, they need to pay for computing resources, API query fees, model inference costs, and more - these expenses may be real-time and on-demand. However, the limitations of existing payment systems are exposed in these scenarios, as they were not designed for real-time micro-payments. Cryptocurrencies have shown advantages in this area, providing faster settlement speeds, lower transaction costs, and more flexible payment methods to better meet these new needs.

Some on-chain use cases include:

Automated trading systems

Yield optimization tools

Portfolio rebalancing mechanisms

Wave 3: Agent to Agent / Collaboration (Future)

This is the most promising stage of the agent economy. We have already seen some early experiments in agent-to-agent commerce, such as projects like Terminal of Truth and Zerebro. However, the true potential of these explorations goes far beyond the applications of social media tokens:

Resource Markets: Computing agents can negotiate with storage agents to optimize data storage locations, improving resource allocation.

Service Optimization: Database agents can negotiate with computing agents to optimize query services, improving efficiency.

Financial Services: Risk assessment agents can trade with insurance coverage agents to provide smarter protection plans for users.

This stage requires infrastructure specifically designed for machine-to-machine interactions. Traditional monetary systems are human-centric, emphasizing human verification and control, but lack the flexibility needed in an economy dominated by autonomous agents. Stablecoins, with their programmability, cross-border payment capabilities, fast transaction settlement, and support for micro-payments, have become a key tool in this domain (yes, I'm also very optimistic about the stablecoin space).

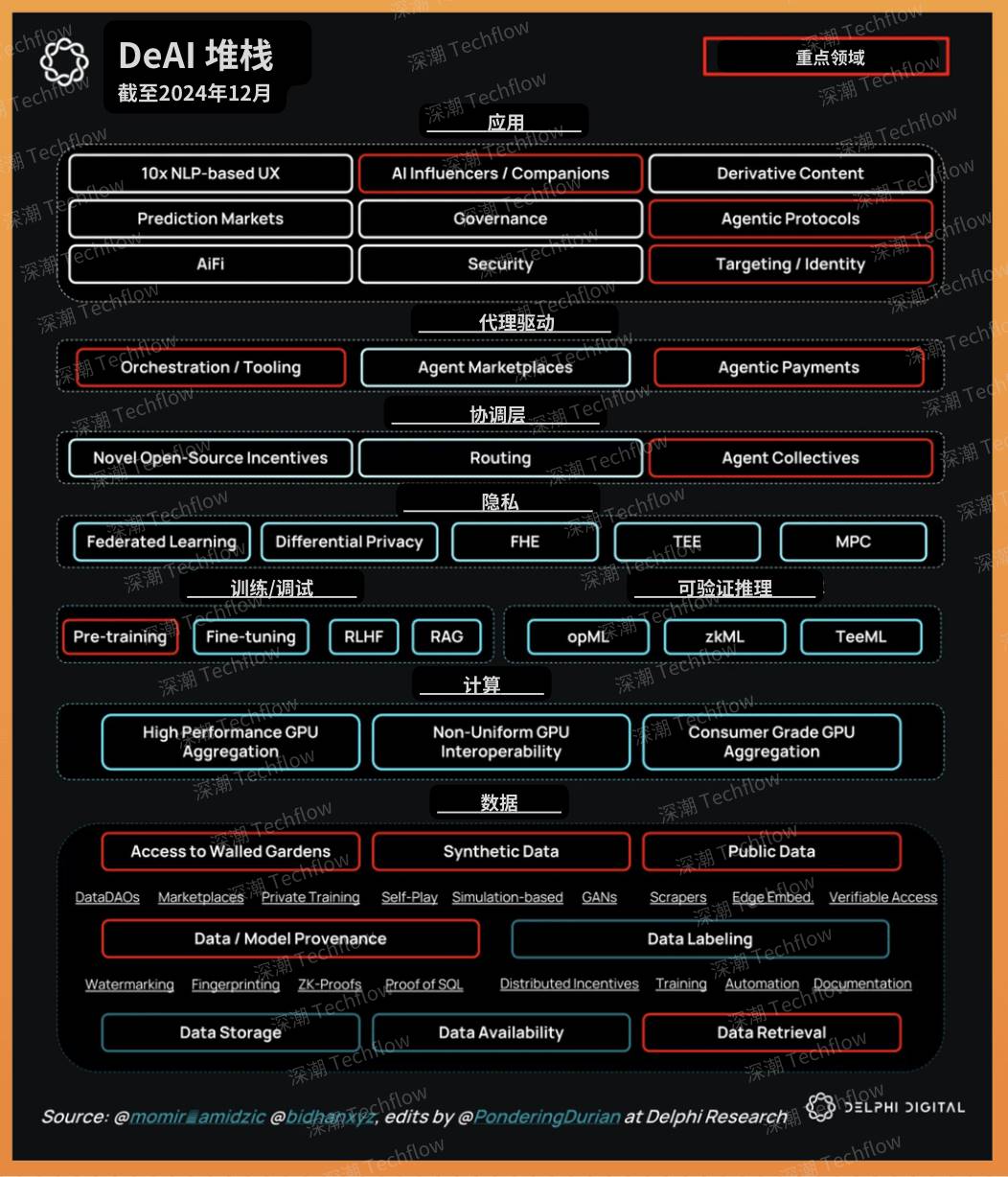

Part 2: Analyzing the AI Stack of Web3

Delphi Digital has proposed a clear "Decentralized AI" stack classification framework. The framework contains 6 key directions (which I believe have great potential), each with several sub-domains that can be viewed as narratives or innovation directions. I believe that in the coming months, there will be a leading project in each sub-domain with a market capitalization of at least $500 million.

6 Key Directions and Their Prominent Examples

Applications - aixbt

Agent Enablement / Coordination - Virtuals Protocol

Privacy Preservation - Phala Network

AI Training / Inference - Ritual

Compute Services - io.net

Data Storage - Arweave

Image by Foxi (DeFi / AI), compiled by TechFlow

Whether you save this article or the image, it can serve as an important reference guide as you explore new narratives.

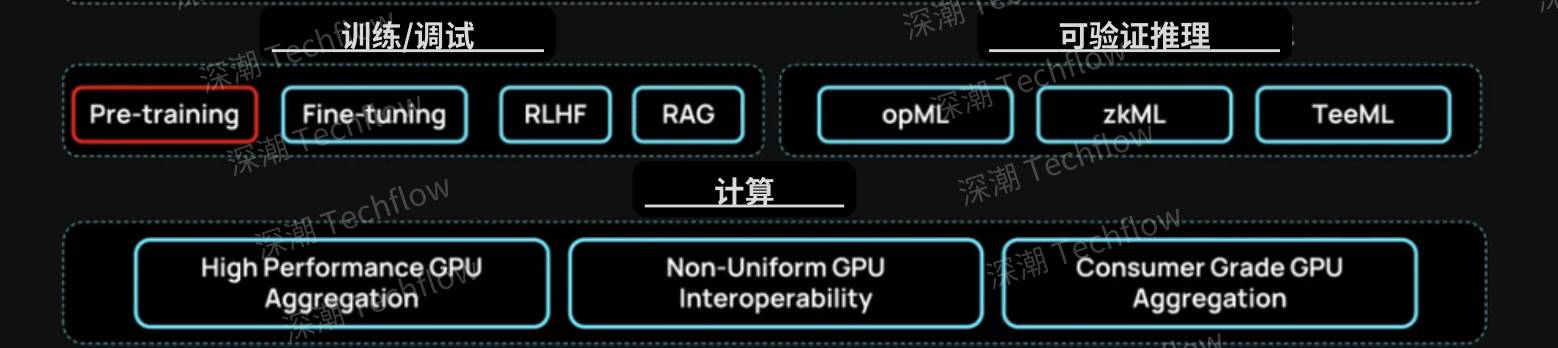

Each direction contains many sub-domains, so this article will not go into them one by one. However, I expect the capital inflow into these directions to follow a certain "order" depending on the market's maturity and development stage. Here is a brief visual illustration:

Image by Foxi (DeFi / AI), compiled by TechFlow

Why choose aixbt? It's just because it's interesting, not because it will become the ultimate champion of the AI industry.

Stage 1:

We can see that a large number of intelligent agents are being launched every day, most of which are just simple encapsulations of chatbots or ChatGPT, with limited practical use, but their meme properties make them interesting. As we know, the marketability of a product is not directly related to its practical utility. Therefore, interesting intelligent agents with sufficient imagination space are often sought after by the market.

In this stage, the intelligent agent enablement platforms (such as Launchpad) become the underlying support layer for the intelligent agents.

Example: Intelligent agents generate revenue through interaction with users, and this revenue is used to repurchase and burn the tokens paired with $Virtual. This mechanism directly links the success of the intelligent agent to the platform value, thereby achieving consistent incentives across the entire ecosystem.

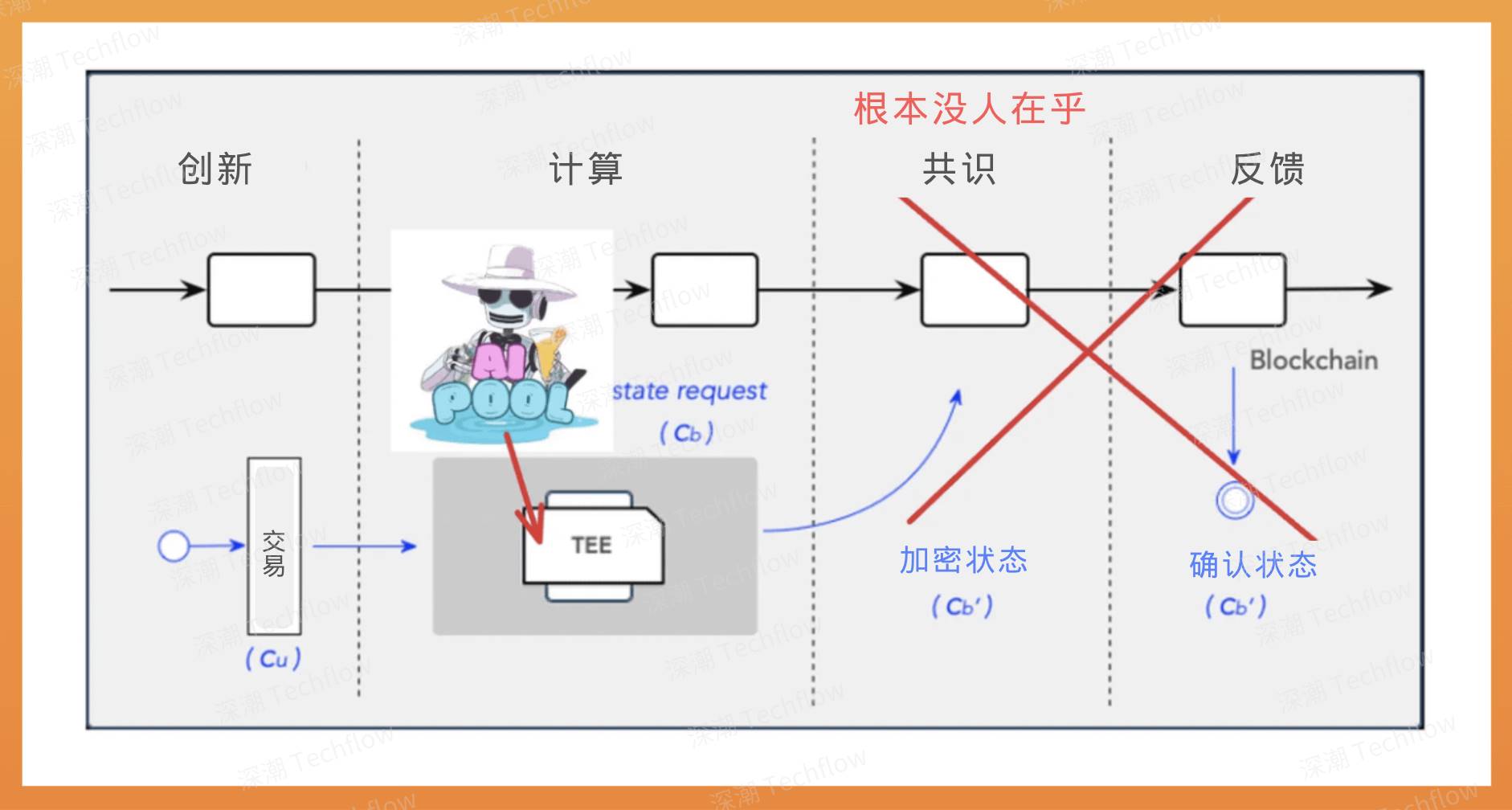

Figure: The current market focus has been highlighted with a red frame

Stage 2:

When Twitter is flooded with "meaningless content" posted by chatbots, this narrative has gradually lost its appeal. Therefore, we are seeing more and more people incorporating the concept of "privacy" into intelligent agent applications (such as @aipool_tee and @sporedotfun). Interestingly, most people do not understand complex technical terms like TEE (Trusted Execution Environment), FHE (Fully Homomorphic Encryption), and ZKP (Zero-Knowledge Proof). This makes the intelligent agent applications appear more innovative, even if they may not have actually implemented these technologies. Nevertheless, the inclusion of these concepts has indeed enhanced the "practicality" of the intelligent agent applications.

The next development direction for intelligent agents is to enter the DeFi and wallet domains. In the future, we will see intelligent agents helping users with token swaps, cross-chain bridge operations, optimizing transaction paths, and reducing transaction fees. These functions will be directly integrated into the user interface of wallets. However, unlike the first stage, these intelligent agents in this stage need to compete on "technical capabilities" rather than relying on "belief hype". Therefore, some tokens (such as $BUZZ and $ACOLYT) are sought after by the market due to the strong AI teams or developers behind them, although the technical level of these teams may still lag behind the Web2 AI experts.

As the intelligent agent economy continues to evolve, the "wealth effect of AI intelligent agents" will attract a large number of top-tier Web2 AI developers to enter the Web3 field in search of new opportunities. This will spawn many powerful AI projects. If you want to seize these opportunities, I suggest you pay more attention to LinkedIn, rather than just staring at Dexscreener.

Stage 3:

Intelligent agents will ultimately mature, and their core value will come from AI reasoning, data processing, and distributed computing. We will see the emergence of the following key infrastructure:

TEE-based secure key management systems

Dedicated data availability (DA) layers for storing and retrieving context for large language models (LLMs)

On-chain Oracles to provide trusted data sources

zkVM frameworks for enabling verifiable computation execution

Chain abstraction solutions to simplify cross-chain interactions

This infrastructure will support large-scale, trustless computational resources, while ensuring the security and verifiability of interactions, data flows, and outputs. At that time, advanced infrastructure like Ritual, io.net, and Story Protocol will evolve from mere speculative objects to become core tools driving the next generation of AI innovation.

Part III: So what should I invest in now?

Based on the current market situation, we are transitioning from Stage 1 to Stage 2.

If intelligent agents can "proactively" provide value to users, rather than just posting on Twitter or analyzing token prices (which GPT can already do), they will be more attractive. I hope intelligent agents can autonomously manage resources and make decisions on behalf of users, and even independently complete transaction settlements. Here are some more complex application directions that I personally would consider investing in:

Automated trading systems

Portfolio rebalancing tools

Virtual reality technologies

AI-driven smart contracts (such as prediction market arbitration)

Other innovative applications

(If you are developing any of these directions, please feel free to message me. I would be happy to support you, but please ensure you have a product that can actually run, not just a whitepaper.)

Of course, the above directions may still be too broad for most people (including myself). Based on the "consensus golden rule", I have observed that the current market consensus is mainly focused on the following areas:

I. Shaw

He is the most influential belief gatherer in the current AI super cycle, just like Murad in the memecoin super cycle. Do not ignore the projects that ai16z and Shaw or other core ai16z members are promoting. Any project they promote is likely to be a buying opportunity.

Note: Be careful of those who claim to be "ai16z partners", as they are sometimes not genuine core members. In fact, I could also randomly call myself a "partner".

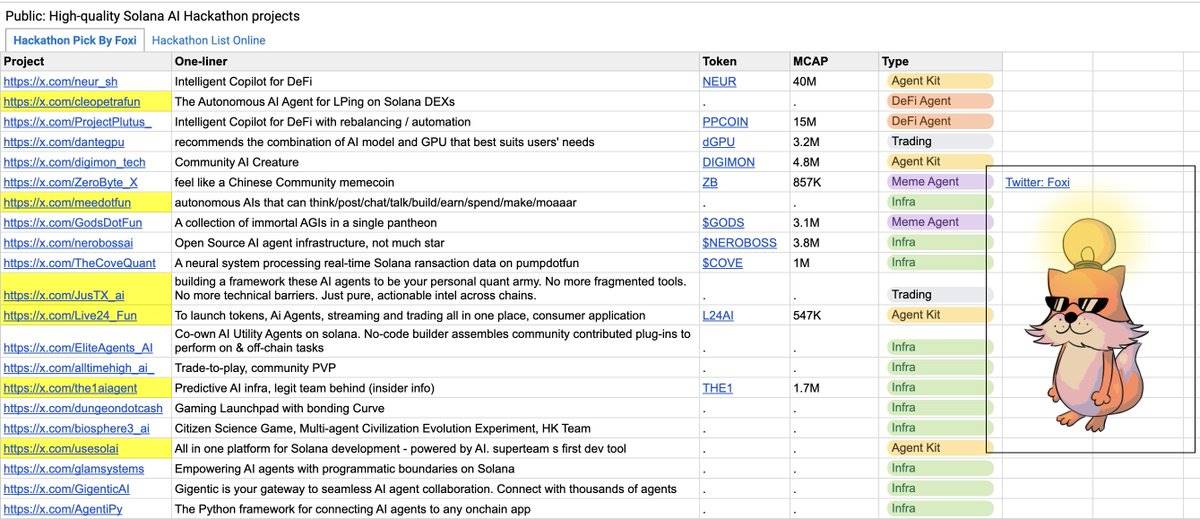

II. Solana Hackathon Award-Winning Projects

The Solana ecosystem is actively promoting the development of some innovative projects. To seize the market opportunities, you need to identify high-quality projects in advance. I have already filtered some projects for you, and you can refer to my posts. Although I am not an insider, I have evaluated these projects based on my personal experience. Of course, you should also conduct your own in-depth research.

Link: Google Sheets Link

To truly profit from these narratives, you need to leverage some tools, or you may miss the best investment opportunities. For example, @AgentiPy is one in my high-quality project list, which initially did not issue any tokens. Once it launched its tokens, the market cap quickly soared to $40 million, but I personally missed the opportunity due to the lack of timely tool support. Therefore, I suggest using tools to monitor the dynamics of projects, such as tracking their Twitter, and being able to intervene immediately when the tool detects the release of a contract address (CA).

III. AI Frameworks

You may have noticed that there are more and more infrastructure projects in the blockchain industry, and even many dApps are starting to transform into Appchains. The reason behind this is simple - infrastructure projects are usually able to obtain higher valuation space. However, not all frameworks have equal value. You can choose the market-leading projects, or delve into the technical documents and GitHub to find infrastructure projects with strong technical capabilities.

If you find these research tasks too complex, a simple strategy is to focus on high-quality tokens like $ai16z or $Virtual, and find the right entry point. Do not invest your SOL or ETH in those AI scam projects without any technical support.

IV. DeFi x AI

As mentioned earlier, I am very optimistic about the prospects of the narrative of the fusion of DeFi and AI (DEFAI). This trend is in line with my prediction for Stage 2, where the interaction mode between intelligent agents and humans is gradually maturing. A good starting point for research is to delve into some DeFi x AI projects and their sub-sectors, understanding their specific application scenarios and technical implementations.

Finally, understanding these market dynamics is crucial to grasping the real opportunities in the intelligent agent economy. Although the current market is still dominated by simple social media intelligent agents, the real value lies in the infrastructure and frameworks that can drive the next generation of autonomous economic activities. I will continue to hold $ai16z and $Virtual, as I believe they have tremendous potential in the future.