Original | Odaily (@OdailyChina)

Author | Asher (@Asher_0210)

As you can see, a16z has seen its market value surge 100-fold in just two months, and the Eliza framework ranked first on the trend list in December last year, accumulating a total of 9,703 stars.

I first bought a16z in late October last year, when the price was in the range of $0.02 to $0.025, and in the following days I gradually transferred SOL from exchanges to various wallets to invest in a16z. (By the way, the current price of a16z is $1.77, and I'm glad I'm still on board.)

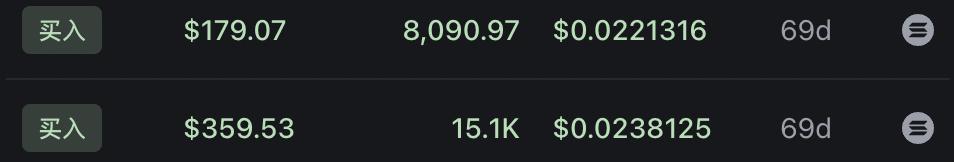

Some records of a16z holdings

Act One: A Beautiful Misidentification

To be honest, my initial choice and investment in a16z was a "mistaken acquaintance". Before November 2024, my main focus was on chain games and the meme board, manually farming Pixels to earn tokens, earning RP points from Mocaverse's collaboration projects, and earning rubies from Heroes of Mavia, but none of them met my expected returns.

During this period, I discovered through X that the earning effect on the chain was significant, especially in the Meme sector, and after GOAT, the AI Meme-related concepts on the chain exploded, with many "get-rich-quick myths" emerging, making me realize that my research focus should shift, and I started buying SOL on exchanges and transferring it to my wallet to look for quality AI Meme projects.

One day, I accidentally discovered a project called a16z, which was "endorsed" by Marc Andreessen, the founder of a16z. Marc posted on his Official Twitter, retweeting a16z's concept image and the official Twitter link. I thought: "An official project of a16z, isn't it a potential stock?" So I decided to buy a16z.

Act Two: A Lucky Hit?

As my position continued to increase, my research on a16z also deepened, and as expected, I found that the a16z project has no connection with a16z at all. This discovery caught me off guard, but I didn't sell immediately, but decided to continue observing. At the time, a16z's market value was only fluctuating in the range of $20-30 million. Although a16z and a16z have no connection, I decided to "take a chance" (maybe the latecomers haven't discovered it yet).

On the one hand, from the project's fundamentals, a16z belongs to the AI concept. The AI concept has always been a hot topic in both Web2 and Web3, and its founder Shaw interacts frequently on X, giving a sense of being good at "stirring things up". On the other hand, from the capital data analysis, I found that there are many early whitelist addresses that have purchased at extremely low costs and have not sold at the high point after the opening, and I also found that multiple GOAT whales are constantly adjusting their positions to a16z, with new wallets buying a16z worth tens of thousands of dollars.

Sure enough, the market's enthusiasm has really come to the AI sector, and in one week, a16z's market value has risen from less than $30 million to over $500 million. As a16z rose, I believed that the projects in the ELIZA ecosystem would also be increasingly recognized by the market, so I started to reduce my position in a16z and shift to the two projects mentioned most by Shaw, degenai and ELIZA.

degenai is the first AI agent developed by the a16z team, which will share alpha information on Twitter and trade autonomously based on it. degenai is a whitelist project of the a16z DAO (never to be sold) and 8% of the profits are used to repurchase degenai. ELIZA is an AI Agent supported by the a16z team. At the end of last year, Shaw, the founder of a16z, joined the Eliza project as an advisor. At the same time, the director of Eliza Studios, Jeff, the creative director of a16z, Ropirito, a researcher at Nous Research, and Matthew, the founder of Ryze Labs, also announced that they have become advisors to the Eliza project. In simple terms, if degenai can succeed, it will be a "AIXBT with built-in trading function". ELIZA can be understood as the totem of the ELIZA framework.

Act Three: To Switch or Not to Switch?

However, the development of the a16z project has not been smooth sailing. With the heat of the AI agent sector, many new challengers have emerged, the most notable of which is Swarm. The core founder of Swarm, Kye Gomez, is hailed as a "child prodigy" in the field of artificial intelligence. Although he dropped out of high school, he developed a multi-agent coordination framework Swarm and successfully ran 45 million AI agents in just three years.

But due to Shaw's criticism of Kye's code plagiarism, Swarm's market value plummeted from a high of $25 million to below $13 million on the same day. I felt that regardless of whether Kye was suspected of plagiarizing the code, Swarm itself is an AI framework with great imagination space, so I continued to buy in the midst of the FUD sentiment.

I met Shaw offline and chatting with him was very comfortable, he is not a "network troll". At the end of last December, when I learned that Shaw was coming to Shanghai to attend an offline Dev Meetup and the company arranged for me to interview him, I was very excited, as I could finally directly ask the project party about the latest situation of the three a16z-related projects I held in large positions.

This face-to-face communication completely dispelled any doubts I had about him and the a16z team. Shaw is not the "high and mighty" figure I imagined, on the contrary, he is very amiable and friendly, seemingly fully committed to building the a16z DAO into an even more powerful platform. In the communication process, I felt his passion and determination for the ELIZA framework, and I am also confident that the positions I hold will bring even more generous returns.

Therefore, I sold Swarm and increased my positions in ELIZA and degenai. (Click here to view the interview transcript with Shaw《Full Interview with a16z Founder Shaw: Eliza Framework, DAO Innovation and How AI Will Reshape the Future of Web3》.)

Act Four: Believe and Hold - Buckle Up and Wait for Takeoff

I believe that the prices of the a16z-related projects will reach a new high after the update of the a16z token economics. Around January 1st, the a16z team initiated a token economics update proposal, the key content of which is the Launchpad stage in the first quarter of 2025, through the acquisition of projects with mature technology and teams, focusing on Eliza framework innovation, including multi-chain integration, increasing launch fees, staking and other value capture mechanisms. With the construction of the Launchpad platform, it can be imagined that there will be a massive influx of projects into the a16z ecosystem in the first quarter of 2025, and the demand for a16z tokens will increase significantly.

Since last weekend, seeing Swarm's continued surge, I couldn't help but feel some fluctuations, but I still believe in the a16z system, believe that ELIZA and degenai are still waiting for value discovery. Currently, over 80% of my on-chain positions are in the three a16z-related projects, with ELIZA accounting for 50%, degenai accounting for 20%, and a16z accounting for 10%. I look forward to the token economics update of ELIZA on January 10th and its subsequent diversified development; I look forward to the upcoming launch of the degenai AI agent surpassing AIXBT; I look forward to the adjustment of the a16z token economic model, the launch of the Launchpad, and even the launch of its own L1 blockchain.

Finally, I'm bullish on the Eliza framework and embrace the a16z system.