Author: 0xJeff, Steak Studio; Translator: Jinse Finance xiaozou

Last year, when the number of L1/L2 public chains became too many to count on our fingers, fragmentation of liquidity became a major challenge. Subsequently, Bitcoin L2 entered the market, causing the number of L2 to surge.

This has led to the fragmentation of liquidity, attention, and experience across countless ecosystems. Many of the L2s and dApps in these ecosystems have struggled to gain any meaningful traction. Capital has only flowed into a few top ecosystems - those with outstanding communities, great products, high-quality teams, and sufficient funding to attract builders.

Now, the field of AI agents is also facing the same challenge. While still in the early stages, the sheer number of individual agents, tokens, and new agent tokens makes it difficult to distinguish them.

The industry is facing an increasingly serious problem of agent fragmentation. Liquidity and attention are too dispersed and thin.

1. Two Common Trajectories of AI Agents

Most AI agents are progressing along two trajectories:

(1) Transitioning from Agent to Framework

Some agents demonstrate their value by constantly engaging users in real-time on platforms like Crypto Twitter (or other channels). Once these agents achieve product-market fit (PMF) and gain sufficient attention, other teams often want to replicate what they have built.

What's the logical next step? Open-sourcing the agent. This allows the agent to evolve into a framework - making it easier for others to experiment, integrate, and build on top of it. This move can break the valuation ceiling that constrains the agent and position it more like an L1 blockchain.

We see this trend in the following agents:

Zerebro

Dolos

AVA

Freysa

Rei

This approach allows these agents to scale by reducing barriers and letting others join their ecosystem.

(2) Continuing to Refine the Product as Independent Agents

Not all agents can immediately find PMF. Some agents must constantly iterate and evolve until they discover the right use case. Even so, some teams still prefer to keep their technology proprietary rather than opening it up to others.

For those agents that do find PMF and perform well, there is no need to transition into a framework - they can continue to be independent agents.

Examples of this approach include:

Aixbt

Griffain

So, what should we do?

For builders: Focus on understanding the gaps in the market and building products that truly provide value to users. Remember, agents should serve as a channel to bring users into the ecosystem. In such a saturated market, standing out will only become increasingly difficult.

For investors: Focus on the leaders or top projects in each category. Doubling down during the lows may be the best way to consolidate attention in this fragmented space.

2. Current Categories, Narratives, and Notable Projects

(1) Alpha-Centric KOL Agents

These agents are dominant in outputting alpha (insights, data synthesis, and analysis). Aixbt leads in mindshare. While this is not a winner-take-all market, the leaders will garner disproportionate attention.

Notable tokens to watch: AIXBT, REI, TRISIG, TRUST, AGENCY, KWANT

(2) Investment DAOs

These DAOs focus on strategic investing. The winners in this space are typically those that can effectively execute strategies and provide strong PnL.

Examples include:

VADER, AIXCB, AIMONICA, SEKOIA, WAI, AROK

Other platforms in this space include Virtuals, ai16z, daos.world, and daos.fun.

(3) Agent Virtual Worlds/Game x AI

This is a young field with immense potential. Realis pioneered this trend, but Hyperfy is now the leading infrastructure for world-building. Smol and Arc Agent are exploring AI-based games and gamified mechanisms with reinforcement learning.

Key tokens include:

HYPER, REALIS, SMOL, NRN

(4) DeFAI/Abstraction Layer

This is a competitive space with multiple players vying for dominance. Wayfinder's token launch is expected to be a game-changer.

Tokens to watch include:

GRIFFAIN, ANON, GRIFT, NEUR

(5) Autonomous Trading Agents

This narrative is still in the early stages but has immense potential. Multiple competitors have emerged, each agent striving to generate outsized returns.

Tokens to watch include:

ASYM, PPCOIN, GEKKO, TONY

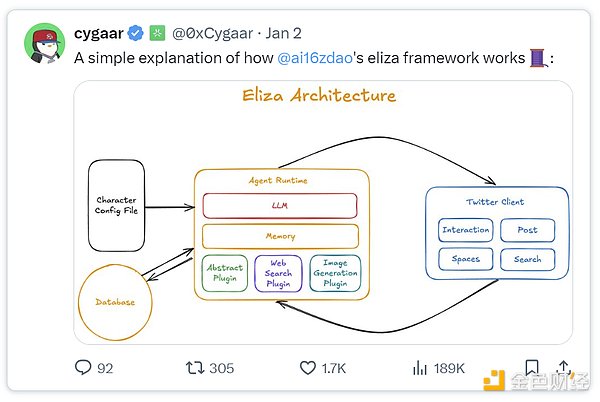

(6) Frameworks

Popular framework tokens enhance agents by providing open-source solutions. AI16Z/Eliza is the largest open-source framework, but there are other models as well.

Key tokens include:

AI16Z / ELIZA, GAME (Virtuals), ARC (Rig)

(7) Music

AI agents are entering the music space by releasing albums or supporting music creation. Zerebro leads with an outstanding album, and now more agents are collaborating with world-class DJs to expand into this niche.

Key tokens include:

ZEREBRO, MUSIC, BEATS

(8) 3D Modeling

AVA is undoubtedly the leader in the 3D modeling space. Holoworld AI has been collaborating with various teams to develop and deploy 3D models across different frameworks and ecosystems.

AVA is a token to watch.

(9) AI Idols

This trend started with Luna becoming an AI idol on TikTok and Twitter. While the initial hype wave has subsided, this niche has laid the foundation for agents that can provide more practical services. Luna remains the most relevant AIDOL, now with more personality and capabilities.

Key tokens include:

LUNA, ELIZA, MOE

(10) AI Meme Coins

These meme coins are either issued by AI agents or have some association with AI.

Prominent tokens include:

GOAT, FARTCOIN, ACT

(11) Video/Filmmaking

This is an emerging industry, with Kween leading in the production of high-quality films, although it is currently unclear whether they are agent-driven. Sandy is launching the first AI video agent framework, with untapped potential.

Noteworthy tokens include:

KWEEN, SANDY

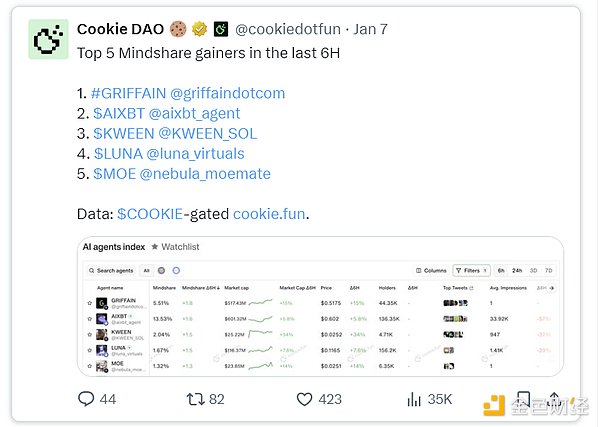

(12) Data

In the field of artificial intelligence, data is the digital key to the development and performance of agents. Cookies are at the forefront of providing data to human and AI agents.

The main tokens are:

COOKIE, NOMAI

(13) AI Application Store

This category focuses on useful AI application ecosystems, including GenAI tools, games, and productivity enhancement tools. Alchemist is currently the top ecosystem, while Myshell focuses on image generation and waifu simulation games, although its token has not yet been released.

The main token in this field is ALCH.

(14) NSFW Agents

This is an emerging niche market, where agents play the role of spicy influencers, attracting users 24/7. Lush, Nectar, and Oh are the biggest competitors, but currently only Lush has a token.

The token to watch is LUSH.

(15) TEE / DeAI Infrastructure

This narrative enables fully autonomous agents to resist human interference, such as hacker attacks or rug pulls.

The main tokens are:

FAI, PHALA, SPORE

(16) Developer-Centric Tools

Key tools for AI security, code analysis, and utilities, which are crucial for the growth of this industry. Soleng is my personal favorite, as it can help non-technical friends on Crypto Twitter analyze code/GitHub directories.

Tokens to watch include:

SOLENG, H4CK, CERTAI, JAIL

(17) Robotics/Embedded AI

This is an exciting and still-developing field. OpenAI's work in embedded AI may attract more attention this year.

The main token is SAM.

(18) Other Projects

There are many more categories that I haven't covered. The trend of agent fragmentation is already out of control. My personal investment view is to focus on narratives that attract the most attention, and also predict narratives that will attract attention in the future.

The main narratives that I believe will continue to gain attention are:

DeFAI

Autonomous Trading Agents

InvestmentDAO

Agent Metaverse

There are also some narratives that I'm bullish on, as I expect them to attract more attention as we enter Q1/Q2 of this year:

NSFW Agents

TEE and other DeAI Infrastructure (opML, zkML, POSP, etc.)

Robotics

Developer-Centric Tools

3. Conclusion

The issue of agent fragmentation highlights the complexity and opportunities in this rapidly evolving field. Builders and investors should not cling to all trends, but rather focus on areas with the potential for integration and long-term growth.

For builders, the focus should be on creating scalable, differentiated products that meet clear user needs. For investors, supporting projects with strong attention and positioning in high-potential narratives will be key to addressing the challenge of fragmentation.

The next wave of innovation will come from projects that simplify the chaos and create ecosystems that integrate liquidity, attention, and value.