Hyperliquid airdropped 28% of the total HYPE token supply to early users in November, making it the most valuable crypto airdrop in history, with a total market value of over $7 billion.

This feat has been hailed by the industry as the most successful and lucrative airdrop in crypto history, also thanks to the decentralized exchange (DEX) platform's high emphasis on community participation and rejection of venture capitalists (VCs). However, experts warn that other projects trying to replicate Hyperliquid's airdrop strategy may not achieve the same level of success.

Excluding VCs, creating "artificial demand" in the short term

Jae Sik Choi, an analyst at Greythorn Asset Management, said in an interview with Cointelegraph that Hyperliquid's exclusion of VCs and focus on community participation not only boosted the token price performance of HYPE after the airdrop, but also created a unique "cult-like" following for HYPE on social media.

"One of the key reasons for Hyperliquid's success is that in the short term, they created 'artificial demand' by not allowing VCs to participate - VCs can only buy the tokens after they are listed, just like everyone else."

—Jae Sik Choi

Choi emphasized that Hyperliquid has returned to the "fair distribution" idea of the early days of crypto. "As long as the project itself is not bad, and the distribution is fair - no matter what, the token price can almost always get a short-term boost."

Choi also pointed out that another key factor supporting HYPE's price performance is an entity called the "HYPE Assistance Fund", which uses the protocol's revenue to repurchase HYPE in the market every day, creating sustained buying demand. "And now it's the Trump era, so I don't think there will be any regulatory issues."

Source: Steven.hl

Source: Steven.hl

"Providing sustained buying demand with real revenue every day is great. Although technically this is still 'artificial demand', the FOMO effect can also trigger 'organic demand' in the secondary market."

However, he also warned that the buybacks cannot be sustained indefinitely.

"It can only last for a while, like the 'Ouroboros' effect."

"Egalitarian" airdrop and perfect timing

Kain Warwick, founder of Synthetix, said in an interview with Cointelegraph that much of Hyperliquid's success stems from its "egalitarian" rewarding of each early loyal user - regardless of investment size - and the perfect timing of the market.

"Hyperliquid gained enough attention and awareness during the bear market. For teams trying to launch new projects now, it will be more difficult to replicate that airdrop effect. The market noise is much louder than it was back then."

—Kain Warwick

Warwick recently used a similar approach when fundraising for his new platform Infinex: using a patronage model to sell Patron NFTs at the same price to both the general market and VCs, ultimately raising $68 million. He explained that this model can attract a more sticky community and avoid VCs from dumping during the fully diluted valuation (FDV), thereby undermining the long-term development of the project.

"The core of this idea is: no more of those 'low liquidity, high FDV, VC-dominated' fundraising practices. By rewarding early and sustained actual users, you can get more real people involved."

Hyperliquid's HYPE token officially launched on November 29th, airdropping 27.5% of the total supply to around 94,000 users. Initially, the HYPE airdrop was worth around $100 million, but as of the time of this writing, it has quickly ballooned to over $7.5 billion, making it the largest crypto airdrop in history.

Source: Kain Warwick

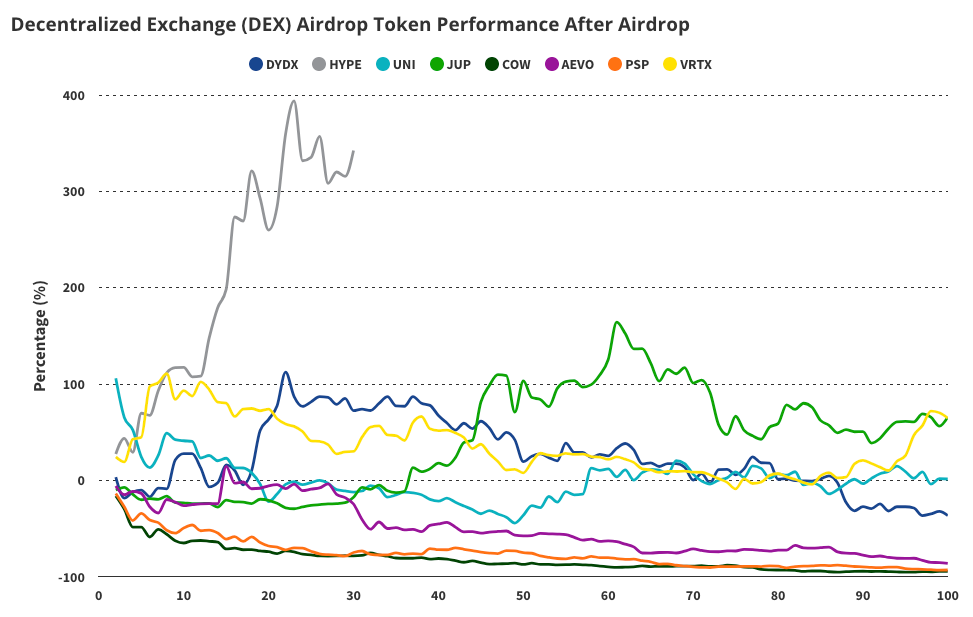

Warwick previously stated that Hyperliquid may be able to "break" the "curse" of decentralized perpetual contract exchanges gradually being forgotten by the market after launching their tokens. The reason is that many DEXs lack the incentive to continue attracting large-scale user adoption after launching their tokens. But so far, HYPE's performance has far exceeded other airdrop-based exchange tokens, such as the Ethereum DEX Uniswap (UNI), the perpetual contract DEX dYdX, the Solana aggregator exchange Jupiter (JUP), and Aevo (AEVO).

Price performance of major DEX tokens after airdrop. Source: VanECK

Choi compared HYPE to the token TIA of the data availability protocol Celestia, which was controversial for alleged OTC insider trading and providing extremely high FDV returns to early investors.

"In retrospect, the reason TIA went up was that the Celestia Foundation was selling tokens to OTC buyers behind the scenes. Once the real TGE started, the early investors got a 70% discount. They then short-sold to lock in their profits once the token price reached $10 on the open market."

"But for Hyperliquid, this kind of play doesn't work, they can only buy the tokens in the market first, and then wait for the price to reach a suitable level before they can short."

Success is difficult to replicate

Although Hyperliquid's "generous" token distribution strategy has won widespread praise from airdrop recipients, Warwick also warned that other protocols trying to airdrop large amounts of tokens to users must be very cautious.

"This is not an experience that all projects can learn from. We've seen many projects do airdrops of over 30%, and the results are not good. If your project itself hasn't built up a lot of hype and awareness, this kind of airdrop will only trigger a downward spiral in token prices."

Asset management firm VanECK noted in a report on January 6th that Hyperliquid's market share in the perpetual contract DEX ecosystem has soared from 10% to 70% within a year, without any significant "pump and dump" or other abnormalities.

Choi believes that Hyperliquid's true highlight is its excellent product experience: deep liquidity, high throughput, and more competitive fee structure compared to market leaders.

"In terms of user experience, Hyperliquid feels like using Binance, but without KYC or AML, and with higher leverage and more functionality."

At the product level, Hyperliquid has focused on throughput as a key metric, quickly outperforming decentralized perpetual exchanges like GMX, Vertex Protocol, and dYdX. According to VanECK data, Hyperliquid can process 100,000 orders per second, while competitors like GMX and Vertex are orders of magnitude behind. At the same time, Hyperliquid's fees are also lower than its competitors.

"Hyperliquid uses an order book model, so it doesn't have issues like slippage and 'toxic flow' that AMMs have. Market makers have to think twice before trying to manipulate the market."

Security shadow from North Korean hackers

Despite Hyperliquid's outstanding performance in profitability and user enthusiasm, it also encountered controversy at the end of December. MetaMask security researcher Tay Monahan said that hackers associated with North Korea have been "testing the waters" on the Hyperliquid platform since October 2024.

North Korean hacker groups (such as the Lazarus Group) stole $1.3 billion worth of crypto assets in 2024, doubling from 2023. Monahan and others also criticized Hyperliquid for being too centralized, with only about 16 validator nodes currently, which may make it more vulnerable to hackers or other powerful attackers. While centralization is concerning from a security standpoint, Choi jokingly said it also brings unrecognized benefits to the user experience.

"Sometimes centralization actually brings better user experience."