Author: Frank, PANews

When one becomes famous, there are often controversies. As the current Layer 1 public chain with the highest market attention, Hyperliquid's token market capitalization has exceeded $11 billion after the airdrop, and its total circulating market capitalization once approached $35 billion, with exponential growth in ecosystem data. While the market is extremely optimistic, it has also sparked a lot of controversy recently.

These controversies mainly revolve around the fact that Hyperliquid, as a Layer 1 chain, has performed poorly in terms of decentralized governance and attracting more developers. Especially in terms of node participation, it seems to be full of a closed atmosphere, which once again confirms the impression of many skeptics about Hyperliquid's single-machine chain. The official has also basically acknowledged the existence of these problems in the network in its response, but will gradually solve them.

An open letter sparks governance controversy

On January 8, Kam, an employee of node operator Chorus One, published an open letter on social media, pointing out that Hyperliquid currently has many problems such as closed-source code, a black market for testnet tokens, and limited decentralization. This statement quickly sparked a lot of discussion in the community about Hyperliquid's governance.

In the open letter, Kam mentioned that it is difficult to operate testnet nodes, with problems such as closed-source, lack of documentation, and over-reliance on centralized APIs. The incentive mechanism of the testnet has design problems, resulting in a black market for testnet tokens. The main network validators are overly concentrated, with an insufficient degree of decentralization.

From the content of this open letter, the focus is directly on the low degree of decentralization in Hyperliquid's governance, with the official and the foundation having absolute dominance over nodes and staking. Secondly, the technical and operational information is not transparent, which is a major problem for expanding the ecosystem. Thirdly, the economic incentive mechanism is not sound, and it is difficult for external nodes to maintain costs. Fourthly, the communication between the official and the nodes is not smooth, and the nodes cannot timely obtain guidance from the official on node operation, and the nodes also lack channels to provide feedback on problems.

The above are also basically the main problems that the industry has criticized Hyperliquid for. The well-known asset management firm VanEck also pointed out in a crypto research report released in December that Hyperliquid's valuation is about $28 billion, but it has not attracted a large number of developer communities to join. If the growth expectations of the developer community cannot be realized, it may be difficult for the HYPE token price to be maintained. Research firm Messari also published an article on New Year's Day saying that Hyperliquid's outstanding performance may have come to an end.

After Kam's open letter was published, many industry figures joined the discussion about Hyperliquid. Charles d'Haussy, CEO of the dYdX Foundation, a competitor in the same track, commented, "Closed-source code + limited number of validators + most of the voting power under 1 entity + lack of clarity and security in multi-sig bridge setup. The token price trend should not be ignored by so many people."

Some also believe that "I don't think the black market hype on the testnet is a big problem, because we've seen this kind of thing on many other protocols."

The official acknowledges the problems, and the road to governance is still long

However, the majority opinion is still to question this phenomenon of excessive centralization. Facing these questions, Hyperliquid also quickly responded on the same day, focusing on the following 6 points: 1. All validators have obtained qualifications based on their performance on the testnet, and cannot obtain seats by purchasing. As the blockchain matures, the validator set will gradually expand. 2. Will further promote the decentralization of the network. 3. Anyone can run an API server pointing to any node, and the example client code sends requests to a specific API server, but this is not a basic requirement of the network. 4. The testnet HYPE black market is unacceptable, and efforts will continue to improve the entry process for the testnet. 5. The node code is currently closed-source; open-sourcing is important, and the project will open-source after the development enters a stable state; Hyperliquid's development speed is several orders of magnitude faster than most projects, and its scope is also several orders of magnitude larger than most projects; the code will be open-sourced in a secure manner. 6. There is currently only one binary file. Even for a network as mature as Solana, the vast majority of validators also run a single client.

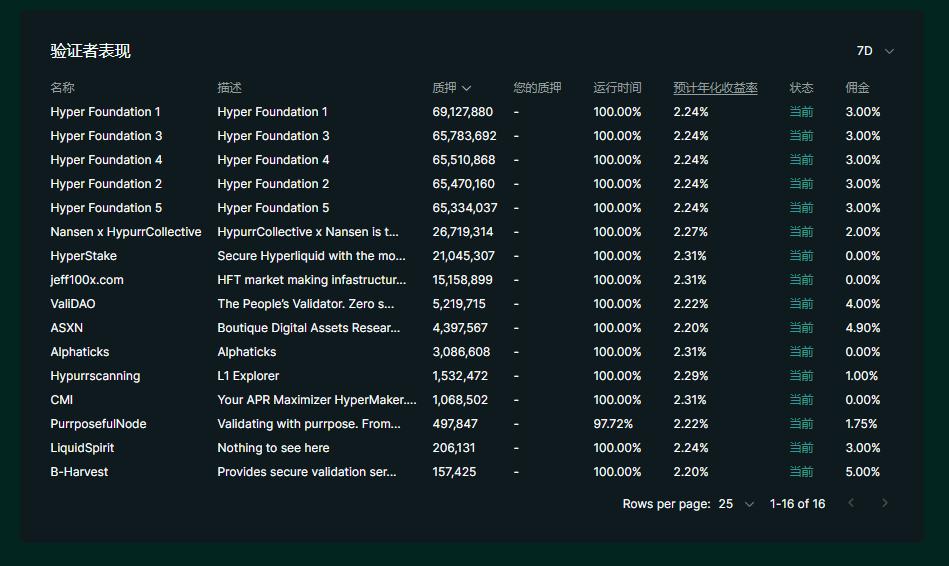

In summary, Hyperliquid's response did not deny the problems raised by Kam in his criticism, but basically acknowledged the existence of these problems in the network, and will gradually solve them. From the current Hyperliquid validator data, the top five nodes by staking amount are all self-operated by the official, and the staking tokens of these five nodes alone account for 330 million, exceeding the total staking amount of all other nodes. In addition, although the official has launched a foundation, it has not yet introduced governance voting and other related channels. From these perspectives, Hyperliquid's open governance still has a long way to go.

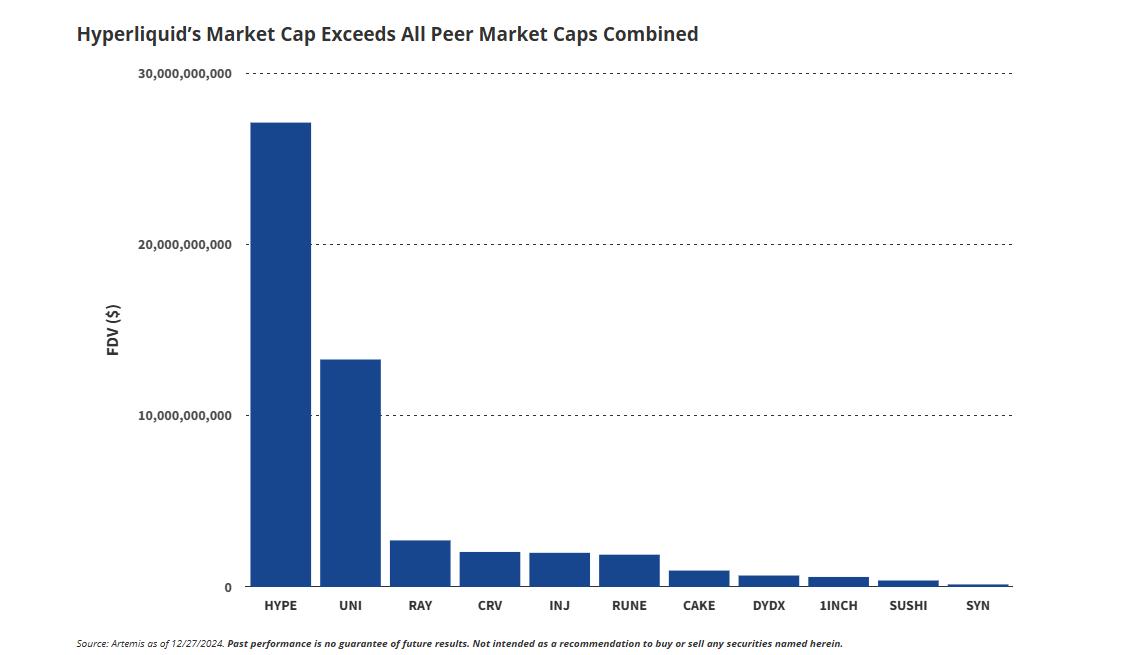

Valuation game, using the Layer 1 narrative to outperform all DEXes

Since the Hyperliquid airdrop, the data of the Hyperliquid ecosystem has seen a significant increase. As of January 8, the cumulative number of users has reached 300,000, with an increase of 100,000 new users in just over a month. Additionally, the TVL data reached a high of $2.8 billion in December, a 14-fold increase in a single month. According to VanEck's research report, Hyperliquid's main competitor dYdX had a TVL of less than $600 million in the 15 months since its creation, and its token market capitalization has surpassed the total market capitalization of all its peers.

Hyperliquid's outstanding market performance is closely related to its dual attributes as a Layer 1 and a DEX. As of now, Hyperliquid's attributes as a Layer 1 are not complete. On the one hand, its decentralized open governance is still far behind the mainstream Layer 1s. On the other hand, the richness of the Hyperliquid ecosystem also needs to be improved, and the current ecosystem applications are mainly dominated by the official team.

As a DEX, Hyperliquid has the advantage of 100,000-level TPS performance and the user experience brought by an independent public chain.

Therefore, if Hyperliquid is positioned as a DEX, it is clearly successful. But if it is positioned as a Layer 1, it still has a long way to go.

Positioning may be an important factor in future market pricing

It is also worth mentioning that many people believe that Hyperliquid may be another gold rush site after Solana. However, PANews found in the analysis of Hyperliquid's on-chain data that the overall profit curve of Hyperliquid's traders has been in the negative territory for a long time, and as the trading heat has increased, the total amount of losses has continued to expand. As of January 7, 2025, the cumulative loss of traders has reached $51.3 million, which has expanded by nearly 25 times compared to the same period a year ago. The cumulative liquidation amount has also reached $6.69 billion, and the number of open contracts has also reached $3.78 billion. From this perspective, Hyperliquid is more like a new on-chain casino.

On January 6, Hyperliquid announced a partnership with Router Protocol to launch a new cross-chain bridge, starting to support cross-chain deposits for more than 30 networks including Solana, Sui, TRON, Base, and Ethereum. Compared to the current ability to only transfer funds through Arbitrium, this collaboration can bring more flexible channels for capital flow to Hyperliquid.

Overall, the controversies surrounding Hyperliquid and the reasons why many people are optimistic about it stem from the same source. As a DEX-led exchange, the Layer 1 currently seems more like a supporting infrastructure for this exchange. The critics believe that Hyperliquid as a Layer 1 lacks transparency and a decentralized governance framework. The supporters believe that Hyperliquid is the only DEX equipped with a Layer 1. For Hyperliquid's own development, the situation it may face in the future may also always revolve around the contradictions between these two roles.

If the main development is for Layer 1, then Hyperliquid's valuation still has a lot of room for growth, and there are also many issues to be addressed. If it is only positioned as a high-performance DEX, then the valuation that far exceeds its peers will also raise suspicions of market overestimation. Moreover, with the continued opening of the ecosystem, HYPE entering more market trading, and getting rid of the doubts about being a single-machine coin, it will also face more market uncertainty changes. These issues are a test of the art of balance for the Hyperliquid team, and for investors who are paying attention, it is an issue that requires meticulous scrutiny.