The AVL Token of Avalon Labs is expected to drive the growth of the Bitcoin DeFi ecosystem, with various utilities such as governance, staking, and user incentives.

Avalon Labs is preparing for the AVL token TGE, airdropping 20% of the total supply to users

Avalon Labs is preparing for the AVL token TGE, airdropping 20% of the total supply to users

Avalon Labs, the prominent Bitcoin DeFi (BTC-Fi) protocol, recently introduced the AVL governance token, marking an important milestone in its mission to build the leading on-chain financial center for the BTC-Fi ecosystem.

The project team stated that the AVL token not only serves to engage the user community and open up new opportunities for Avalon, but also as a way to drive the growth of the entire BTC-Fi ecosystem.

To welcome the launch of the AVL token, Avalon Labs announced that the project is officially entering the TGE phase and will allocate 20% of the total supply for an airdrop to reward loyal users/supporters. The airdrop registration will soon be opened, providing an opportunity to participate in the next stage of Avalon's development.

Avalon TGE is Coming.

— Avalon Labs 🎩🔮 (@avalonfinance_) January 9, 2025

The Ticker is $AVL. pic.twitter.com/vEhjufpilb

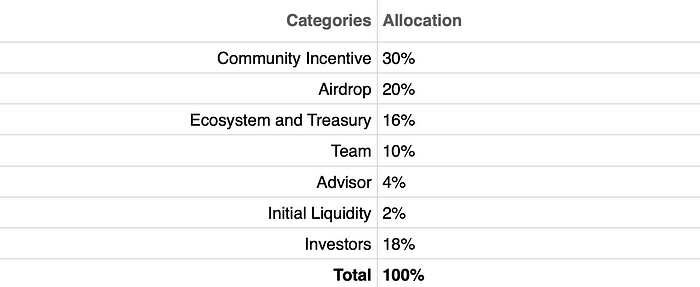

Specifically, the total supply of AVL is capped at 1 billion tokens and will be allocated according to strategic factors to ensure alignment with the growth of the platform and the expansion of the ecosystem as follows:

- 30% of the total supply - Allocated for community incentives: To drive participation in Avalon's DeFi products, marketing activities, support for community development initiatives, and product development.

- 20% - Airdrop.

- 18% - Distribution to investment funds/investors.

- 16% - Ecosystem and protocol treasury: AVL will be used to attract partners and expand the ecosystem.

- 10% - Allocated to the project team.

- 4% - Allocated to the advisory group.

- 2% - Used for liquidity upon initial listing.

Tokenomics of the AVL token for the Bitcoin DeFi (BTCFi) protocol Avalon Labs

Tokenomics of the AVL token for the Bitcoin DeFi (BTCFi) protocol Avalon Labs

In addition to governance utilities and fee discounts when using Avalon's DeFi products like USDa or CeDeFi, users who participate in staking will receive sAVL, which provides the following additional benefits:

- Receive additional AVL token rewards.

- Governance rights: sAVL holders have the right to vote on new products, features, and protocol parameter adjustments.

- Emission control: sAVL holders can vote on the distribution of AVL emissions to different pools, creating additional yield through "bribes" markets.

- Exclusive fee discounts on Avalon products: Staking sAVL will help reduce costs when using Avalon's DeFi products, especially the lending platform and USDa.

- Support long-term growth: Staking sAVL not only provides individual benefits but also drives the sustainable development of Avalon, ensuring long-term benefits for the entire community.

Additionally, users can also farm additional AVL tokens through activities within the Avalon ecosystem:

- Holding USDa or sUSDa.

- Utilizing DeFi lending: Participate in Avalon's lending platform to earn rewards, which can then be converted to AVL during the TGE event.

- Interacting with whitelisted protocols: Using USDa or sUSDa on supported platforms to expand the opportunities to earn AVL rewards.

Avalon Labs is building a fully-featured ecosystem to unlock greater financial potential for Bitcoin, thereby accelerating the development of BTC-based DeFi. Through the USDa stablecoin, Avalon aims to transform Bitcoin from a store of value asset into a more active financial tool that can serve various purposes. Users can leverage the value of BTC by collateralizing it to borrow the USDa stablecoin, or earn yield through savings accounts and Bitcoin-backed credit cards.

The project has raised a total of $11.5 million across two funding rounds, Seed ($1.5 million) and Series A ($10 million), with participation from a host of reputable investment funds and crypto individuals, including Framework Ventures, Kenetic Capital, SNZ Holding, GeekCartel, Taiko, Summer Ventures, Comma3 Ventures, MARBLEX, and Domo (the creator of the BRC-20 token standard).

Compiled by Coin68