Author: Felix Jauvin, Blockworks; Translated by Bai Shui, Jinse Finance

As early as September, the market had predicted one of the most aggressive rate cut cycles I have ever seen, with multiple 50-basis-point rate cuts that would quickly bring the federal funds rate to 3% by 2025. Fast forward to today, the situation is completely different, with a maximum of one to two rate cuts expected by 2025.

Let's delve into the factors driving this change and the expected outcomes.

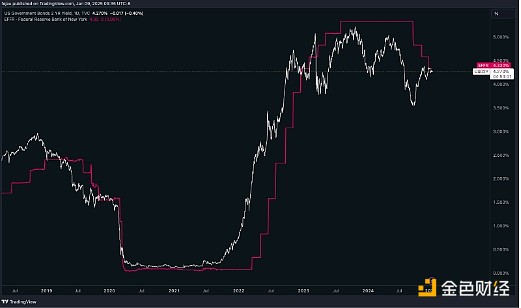

The chart below compares the Effective Federal Funds Rate (EFFR) and the 2-year US Treasury yield.

By comparing these two yields, we can draw some conclusions:

Over the past two years, we have seen many instances where the 2-year yield has already reflected the impending aggressive rate cut cycle (e.g., the 2-year yield falling below the EFFR).

Since the mid-2022, we have seen these two yields converge for the first time. This means the market is digesting a rate cut cycle that is essentially already over, but it also sees no possibility of rate hikes.

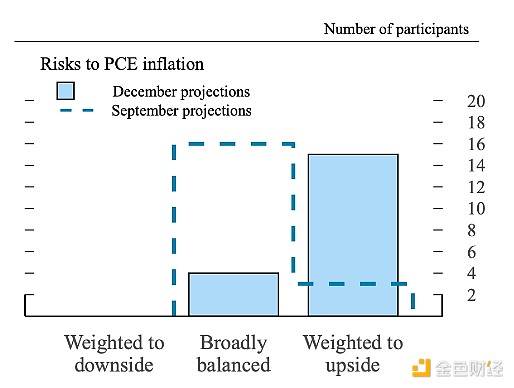

A major driver of this discussion about the rapid end of this brief rate cut cycle is the surprisingly stubborn inflation. As we saw in the December economic projections summary, FOMC members have shifted from a basic balance on inflation to seeing the risks as tilted to the upside.

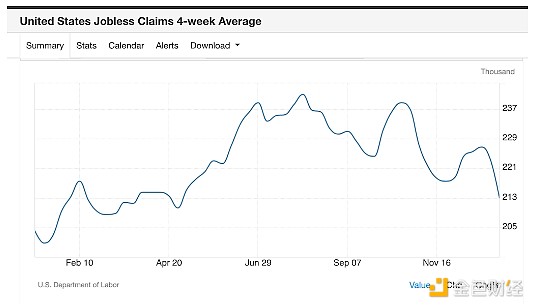

Combined with the fact that the current labor market has proven to be more flexible and robust than when the Federal Open Market Committee began cutting rates in September, these factors are making the possible outcome distribution more skewed towards a hawkish monetary policy response function.

Putting these factors together, it's clear why people are increasingly believing the rate cut cycle has ended.

That said, there are still dovish voices within the FOMC.

Governor Waller mentioned in his speech this week that he still believes there will be rate cuts this year: "So what's my view? If the outlook evolves as I've described here, I would support further reductions in our policy rate in 2025. The pace of rate cuts would depend on the progress we make on inflation, while guarding against labor market weakness."

Just as in the past two years, 2025 will be another extreme year, with the market swinging from aggressive hawkish pricing to aggressive dovish pricing.

Investors will need to quickly decide whether to try to ride these sentiment shifts or to treat them as noise and ignore them.