The TOP10 leading cryptocurrencies in the market over the past 10 years have undergone significant changes. This reflects the continuously changing interests of investors, as well as the constant evolution of the crypto market with new ideas.

Here are the observations from BeInCrypto about the major changes in the TOP10 as well as the bold predictions from industry leaders.

How has the TOP10 leading cryptocurrencies changed?

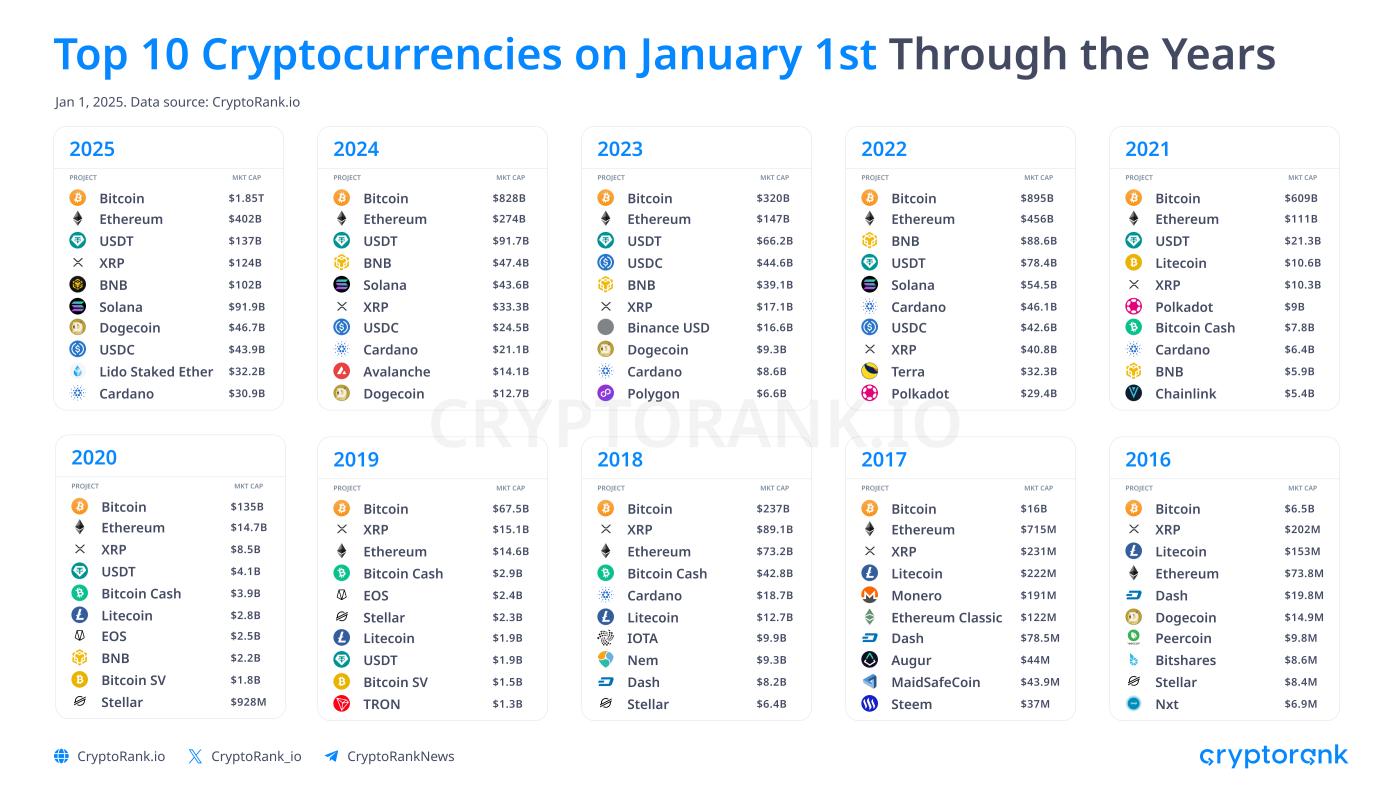

The recent "The Year 2024: A Historic Milestone for Cryptocurrency" report from Cryptorank has listed the TOP10 leading projects by market capitalization from 2016 to the present. During this period, the market capitalization has increased from $6 Billion to over $3,000 Billion, a 500-fold increase in 10 years.

TOP10 leading cryptocurrencies over the past 10 years. Source: Cryptorank.

TOP10 leading cryptocurrencies over the past 10 years. Source: Cryptorank.From this data, we can draw the following key insights:

1. Bitcoin has maintained the leading position

- Bit (BTC) has firmly held the number 1 position in market capitalization from 2016 to 2025. This demonstrates the dominance and importance of Bit in the crypto ecosystem.

- The market capitalization of Bit has grown significantly over the years, from below $6 Billion (2016) to $1.85 Trillion (2025).

2. Ethereum has maintained an important role but has grown slower than Bit

- Ethereum (ETH) has been stable at the number 2 position in most years, with its market capitalization growing strongly from $715 Million (2017) to $400 Billion (2025).

- Although it has not reached the same level of market capitalization as Bit, Ethereum has affirmed its important role thanks to its smart contracts applications and has now become the chain that accounts for 77% of the RWA assets being tokenized.

3. The rise and fall of many cryptocurrencies

- Early Altcoins like Litecoin, Dash, Monero were once in the TOP 10 (2016-2018), but have gradually been replaced by new Altcoins.

- Changes in trust in cryptocurrencies forked from Bit: Bit forks like Bitcoin Cash, Bitcoin SV once reached high positions (2018-2020) but have gradually declined, reflecting the diminishing trust in Bit Hard Forks.

4. Stablecoins affirm their importance

- Tether (USDT) appeared in 2020 and has continued to grow, reaching the 3rd position by 2025 with a market capitalization of $137 Billion. And to date, Tether's functions have expanded beyond the crypto market, becoming the most profitable business in the crypto industry.

- Other stablecoins like USDC have also emerged, demonstrating the growing demand for using stablecoins in transactions and preserving value.

5. Changes following technological trends

- New Blockchain platforms like Solana (2022), Polkadot (2021), Avalanche (2023) have quickly entered the TOP 10 thanks to their high transaction speeds, low fees, and support for DeFi, NFT, and the creation of Meme coins, AI Agents, and the trust of many investors in "technology coins".

- Solana (SOL) is a special case. Although SOL's development in 2023 was disrupted to the point that it seemed "dead", this ecosystem has had a remarkable revival and now occupies the 5th or 6th position in 2024-2025.

- XRP has maintained a TOP 10 position over the years thanks to its role in cross-border payments within organizations. To date, XRP has received more positive projections due to the promising legal environment in the US in 2025.

6. Changes in market position: In the early period (2016-2018), the market capitalization of the coins in the TOP 10 was still low (only in the Billions of USD). By 2025, the market capitalization of the leading coins has reached hundreds of Billions to Trillions of USD, indicating the strong expansion of the crypto market.

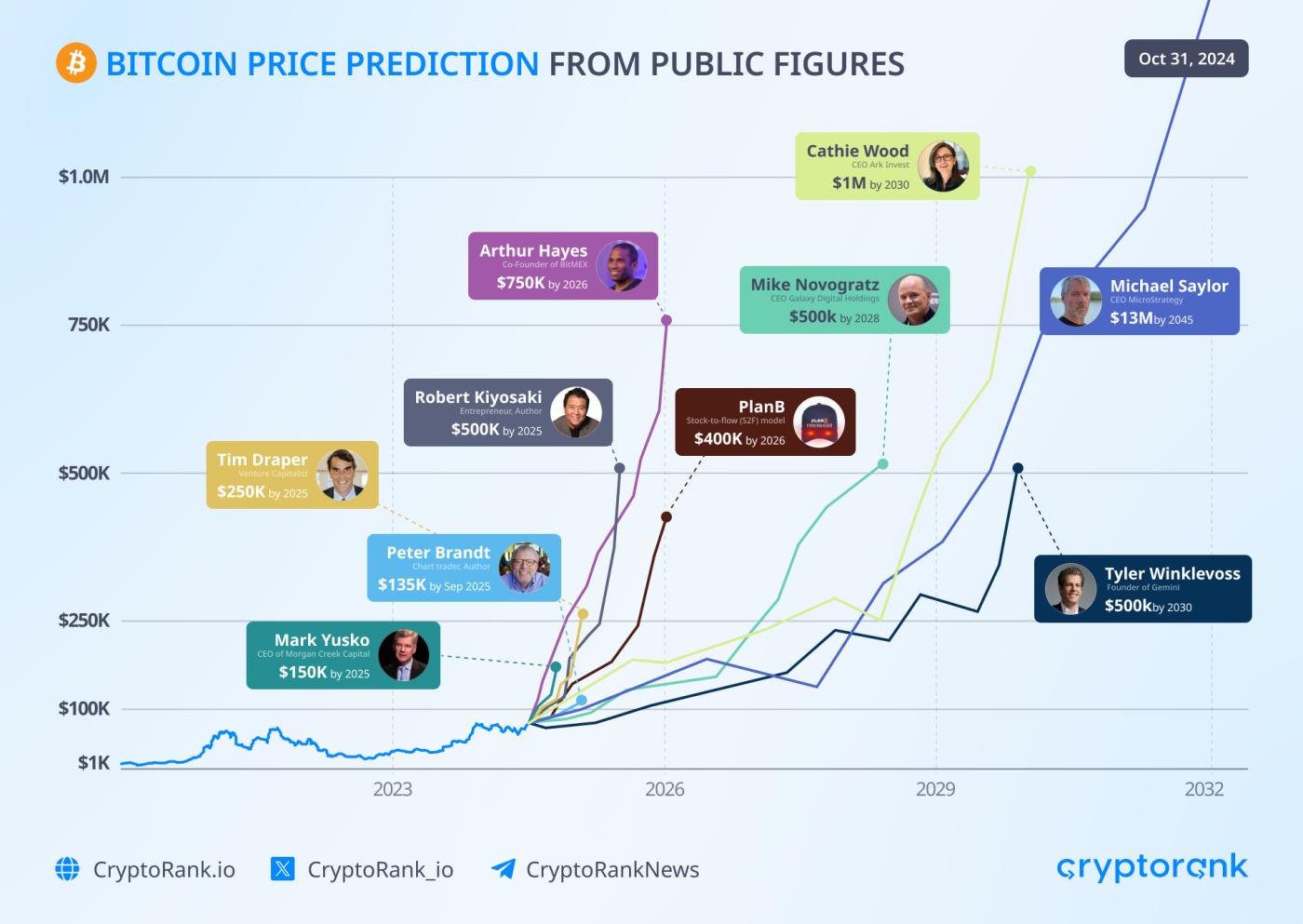

10 Bitcoin price predictions from 10 prominent industry leaders

After 10 years, the expectations for Bit have not stopped. The latest Bit price predictions from industry experts still aim for surprising new highs.

Bit price predictions from industry leaders. Source: Cryptorank.

Bit price predictions from industry leaders. Source: Cryptorank.The statistics show a clear polarization in Bit price predictions. Bit price predictions range from $135,000 (Peter Brandt - 2025) to $13 Million (Michael Saylor - 2045), reflecting significant differences in perspective and time frame. Overall, the chart shows the strong optimism of experts about the long-term growth potential of Bit.

Macroeconomic factors, Blockchain technology, and the level of global adoption will be the determining factors for the actual realization of these predictions.

Join the BeInCrypto Community on Telegram to stay updated on the latest analyses and news about the financial markets in general and cryptocurrencies in particular.