The recent price action of Solana shows a continuous battle to ensure $200 is a stable support level. This cryptocurrency is fluctuating around this important price threshold, reflecting the instability of the broader market.

However, the changing market conditions indicate the possibility of a reversal, paving the way for an uptrend.

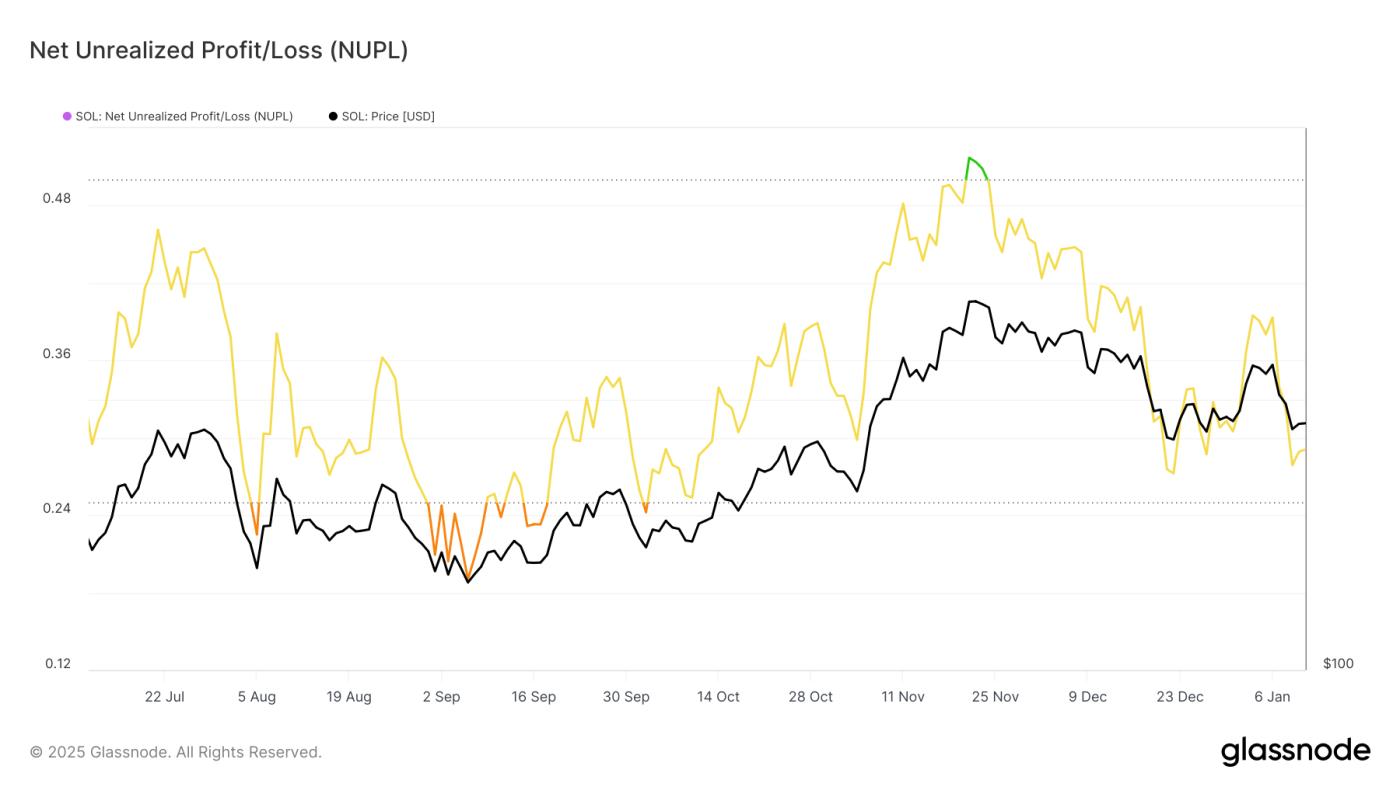

Solana Investor Profits Decline

Solana's Net Unrealized Profit/Loss (NUPL) metric is approaching the Fear Zone, signaling cautious sentiment from investors. Historically, when this index drops into this zone, prices tend to recover as the market begins to stabilize. This trend suggests that Solana may experience a similar rebound if the unrealized profits continue to decline.

Investor sentiment still plays a crucial role in determining the next phase of Solana's price movement. If NUPL enters the Fear Zone, it could create opportunities for new buying activity, fueling optimism. This could be the necessary catalyst to push the cryptocurrency back into an upward trend.

The macroeconomic growth momentum of Solana is showing signs of recovery. The Relative Strength Index (RSI) has recently rebounded after approaching oversold territory last month. Although the RSI has not yet established a neutral 50.0 support level, it is trending upward, suggesting the potential for stronger price appreciation in the coming days.

The improving RSI aligns with market indicators, pointing to the possibility of a reversal. If Solana continues to strengthen, this could reinforce investor confidence and lay the foundation for a sustainable recovery above key price levels.

SOL Price Forecast: Reclaiming the Support Level

Solana's price temporarily breached the $201 resistance level in early January but subsequently declined by 15%, returning to the $183 support level. This pullback reflects the ongoing volatility in the market but also creates a foundation for a potential recovery if the key conditions improve.

If the aforementioned factors continue to strengthen, Solana may return to the $200 support level. Sustained momentum could push the price up to $221, recouping recent losses and signaling the start of a stronger uptrend.

However, if it fails to break above the $201 resistance, it could lead to a prolonged consolidation above $183. If the cryptocurrency loses this support level, it risks further decline to $169, weakening the upward momentum and delaying the recovery efforts. This scenario would highlight the challenges Solana faces in establishing a stable uptrend.