Author: AJC, Research Manager at Messari; Translated by: Jinse Finance xiaozou

1. Key Highlights

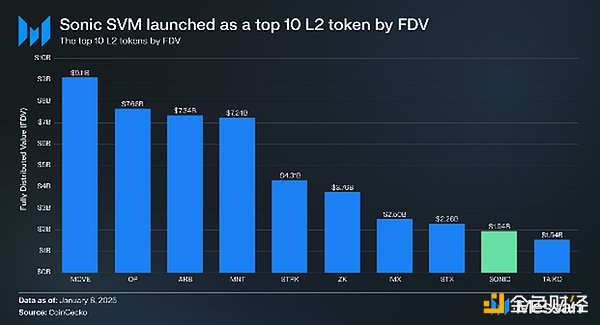

The SONIC token has completed its TGE (Token Generation Event). SONIC's fully diluted valuation (FDV) is $2.14 billion, making it the 9th largest L2 token by FDV and the first active L2 token based on Solana.

Sonic SVM's first TikTok game, SonicX, is a blockchain-based "tap-to-earn" game. It requires users to register a TikTok account and has already attracted over 2 million registered users.

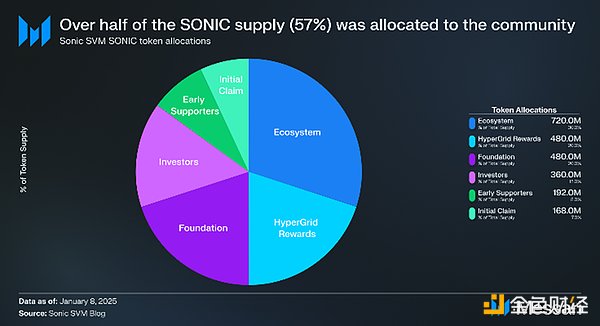

The total supply of SONIC tokens is 2.4 billion, strategically allocated to support ecosystem growth, validator rewards, and community participation. The initial circulating supply at TGE is 15% of the total supply, with 57% allocated to the community.

Sonic SVM has outlined a clear three-phase roadmap, with milestones including the HyperGrid shared state network in Phase 1, the mainnet Alpha release (with key services like bridges and oracles) in Phase 2, and ecosystem expansion (additional SVMs and enhanced staking mechanisms) in Phase 3.

2. Introduction to Sonic SVM

Sonic SVM (Sonic) is an atomic Layer-2 (L2) scaling solution on Solana, aiming to improve the efficiency and interoperability of blockchain gaming platforms by providing dedicated block space and optimized tools for developers and players. Sonic SVM was first announced in March 2024, leveraging its innovative HyperGrid scaling mechanism to seamlessly integrate with Solana and provide high-performance gaming and efficient transaction rollups. Key features include atomic interoperability, the HyperGrid framework for Optimistic Rollup deployment on Solana, and the Rush ECS framework to simplify on-chain gaming and autonomous world-building. Sonic provides monetization tools for payments, settlements, and user acquisition for games and applications. SonicX is one such application, a blockchain "tap-to-earn" gaming platform built on the Solana Sonic SVM.

Sonic SVM was created by Mirror World Labs, with a founding team consisting of CEO Chris Zhu, COO Alan Zhu, and CTO Jonathan Bakebwa. In June 2024, the project announced a $12 million Series A funding round, following a $4 million seed round. Investors include BITKRAFT, Galaxy Interactive, Big Brain Holdings, Sky9 Capital, OKX Ventures, and others.

3. SONIC Token Economics

The SONIC token was launched on December 31, 2024, as the primary utility token for the Sonic SVM ecosystem. It is designed to support applications within the Sonic SVM ecosystem and other SVMs leveraging the HyperGrid framework. The total supply of SONIC tokens is set at 2.4 billion, with the allocation specifically aimed at supporting ecosystem development and encouraging sustained participation.

(1) Allocation

Ecosystem and Community (30%): 720 million tokens are allocated to measures promoting ecosystem development and community participation. These tokens will be gradually distributed to foster long-term engagement and innovation within the Sonic SVM ecosystem, including funding for game studios and dApp developers building within the ecosystem.

Sonic HyperGrid Rewards (20%): 480 million tokens are allocated to incentivize validator participation. Half of these are distributed to validators securing the Sonic SVM network, and the other half to observer nodes monitoring the network.

Foundation (20%): The foundation retains 480 million tokens to support the project's ongoing development, partnerships, and strategic growth initiatives, including the team members and advisors.

Investors (15%): 360 million tokens are distributed to investors as part of the funding rounds, in recognition of their financial support for the project.

Early Supporters (8%): 192 million tokens are allocated to contributors and supporters who were instrumental during the early stages of the project development.

Initial Debt (7%): 168 million tokens are allocated for early distribution to stakeholders and contributors, ensuring initial liquidity and participation. This includes Sonic AVS delegators, HyperFuse Node holders, Odyssey participants, SonicX users, World Store point holders, and Mirror NFT holders.

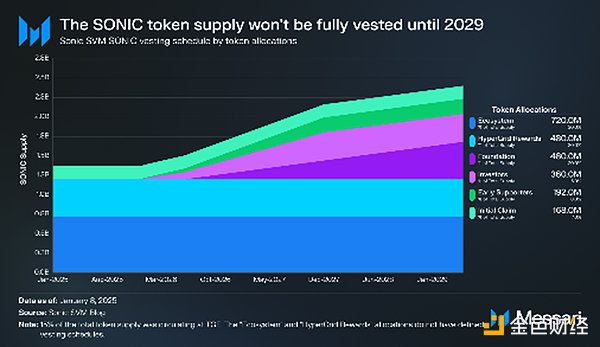

The initial circulating supply at TGE is 15% of the total supply, coming from the "Initial Debt" and "Ecosystem" allocations. The "Investors" and "Early Supporters" allocations have a 12-month cliff, followed by a 24-month linear vesting period. Another vested allocation is the "Foundation" distribution, with an 18-month cliff and a 36-month linear vesting period. The "Ecosystem" and "HyperGrid Rewards" allocations do not have explicit vesting periods, but as of the time of writing, these two allocations have not been fully distributed.

(2) Utility

The SONIC token has several core functionalities, providing utility for token holders:

Medium of Exchange

SONIC is the primary transaction currency within the Sonic SVM ecosystem, supporting payments for in-game assets, services, and other applications, ensuring seamless economic activity across the platform.

Staking

Token holders can stake SONIC to contribute to the ecosystem. Through staking, users can gain eligibility to participate in upcoming activities and earn rewards. As of the time of writing, approximately 21.1 million SONIC are staked, with a maximum APR of 21.27%. Additionally, once the Sonic SVM network is live, users will be able to stake Sonic to support network validation, with stakers able to delegate their tokens to validators and earn rewards.

Staking Rewards

Stakers will receive SONIC rewards for participating in securing the network, incentivizing long-term token holding and active engagement in the ecosystem.

Governance

SONIC holders have the ability to participate in governance decisions, allowing them to vote on protocol upgrades, allocation changes, and other key proposals.

4. Token Generation Event (TGE)

The SONIC token was launched on January 7, 2025. Prior to this, on January 3, users could check if they were eligible for the initial debt distribution. Eligible users included Sonic AVS delegators, node holders, Odyssey participants, SonicX users, World Store point holders, and Mirror NFT holders. Qualified users had two options:

Claim the full airdrop immediately.

Claim 60% now and the remaining 140% over the next 6 months (starting 6 months after TGE).

Additionally, on the same day, the SONIC Alpha Vault was announced. This collaborative initiative by Sonic SVM, Live Bonk, and Meteora ensured fair and proportional token distribution, without any front-running. The vault provided 4.5 million SONIC tokens through a pro-rata allocation model, with no vesting requirements. The Alpha Vault opened on January 5 and allowed eligible participants to participate, concluding with the TGE.

On the day of release, SONIC's liquidity was supported on decentralized exchanges (Raydium and Meteora) and centralized exchanges (OKX, Bybit, KuCoin, Bitget, Upbit, Gate, Mexc, Backpack, Trubit, Hashkey, BingX, etc.). As of the time of writing, SONIC's fully diluted valuation is $1.94 billion, making it the 9th largest FDV L2 token. Furthermore, SONIC is the only L2 token based on Solana among the top 10 tokens, and it is also the first token to be launched. Additionally, as of the time of writing, there are 42,700 wallets holding SONIC.

5. Roadmap

The Sonic SVM roadmap outlines three progressive development stages, each advancing towards the growth and expansion of its ecosystem. The three-stage development roadmap highlights key milestones from the initial network setup to the expansion of the entire ecosystem, emphasizing the importance of technical development and community engagement.

Stage 1: Network Genesis (Q4 2024 - Q1 2025)

The focus of the Network Genesis stage is to establish the infrastructure of Sonic SVM and initiate key partnerships. In this stage, the HyperGrid shared state network will be launched, supporting the creation of interconnected SVM networks to facilitate seamless interoperability. Additionally, a decentralized node set, named HyperFuse, will be deployed to ensure the security and integrity of the HyperGrid operation. The outcome of this stage is the official birth of the Sonic SVM network.

Stage 2: Mainnet Alpha Release (Q1 2025)

The Mainnet Alpha release marks the transition from the testnet to the mainnet. The Mainnet Alpha deployment will launch key services, including bridges, DEX, oracle, and NFT programs. In this stage, SonicX will also launch Android and iOS applications. Sonic Bridge will also support the transfer of assets such as SOL, sSOL, sonicSOL, and stablecoins like USDC and USDT. Furthermore, all HSSN validators will be activated to effectively protect the network's security and operations.

Stage 3: Ecosystem Expansion (Q2 2025)

The focus of the final stage is to expand the Sonic SVM platform to accommodate a wider range of developer and user needs. This stage includes the integration of new Sonic Virtual Machines (SVM) through the HyperGrid Optimistic Rollup Stack. Sonic Grid V2 will be released on the testnet, followed by mainnet deployment. Additionally, a SONIC staking program will be launched, allowing SONIC holders to stake their tokens and delegate to HSSN validators to earn rewards, with a slashing mechanism to ensure network security. Finally, the RUSH ECS framework will be expanded and support new SDK clients, enabling more on-chain games and use cases.

Collaborative Development of a Smart Proxy Center with Injective

One example of ecosystem expansion is the collaboration between Sonic SVM and Injective. Sonic SVM and Injective have collaborated to develop a cross-chain smart proxy center, enabling automated decentralized trading across multiple blockchain networks. The center leverages Sonic's programmable asset transfer protocol and Injective's infrastructure to achieve interoperability. It will be launched using the HyperGrid framework as the SVM. This collaboration aims to simplify cross-chain operations and improve the efficiency of decentralized AI applications.

6. Conclusion

Sonic SVM is an innovative approach to blockchain scalability and interoperability, tailored for game applications on Solana. Through its innovative HyperGrid scaling mechanism and RUSH ECS framework, Sonic SVM provides developers and users with a high-performance L2 solution, addressing the industry's most pressing challenges, including scalability, transaction costs, and user experience fragmentation.

The SONIC token, as the utility token of the ecosystem, ensures economic functionality and can incentivize participation, with staking, governance, and developer rewards playing a crucial role. The well-thought-out token economics structure, combined with a well-executed TGE, reflects Sonic SVM's strategic considerations in promoting adoption and liquidity. The TGE's token circulation of 15% of the total supply, supported by major decentralized and centralized exchanges, has positioned Sonic SVM as the first Solana-based L2 among the top 10 FDV tokens.

Sonic SVM's three-stage roadmap outlines clear milestones, from the foundation of the network genesis to ecosystem expansion and cross-chain integration. Strategic collaborations, such as the development of a smart proxy center with Injective, further demonstrate its commitment to innovation. Sonic SVM is poised to play a leading role in shaping the future of blockchain gaming and decentralized applications.