Consumer-Oriented DeFi

As interest rates decline, the yields of decentralized finance (DeFi) are becoming more attractive. Increased volatility will bring more users, more yields, and higher leverage. Combined with more sustainable yields from real-world assets (RWA), building consumer-facing crypto finance applications suddenly becomes easier.

When we combine these macro trends with innovations around chain abstraction, smart accounts/wallets, and a shift towards mobile, we can clearly see the opportunities to build DeFi experiences for consumers.

Over the past few years, some of the most successful crypto finance applications have emerged at the intersection of improving user experience and speculative demand:

- Trading bots (e.g., Telegram) - providing trading functionality within users' instant messaging and social experiences

- Better crypto wallets (e.g., Phantom) - improving the user experience of existing wallets and providing better experiences across multiple chains

- New terminals, portfolio trackers, and discovery layers (e.g., Photon, Azura, Dexscreener, etc.) - providing advanced features for power users, allowing them to use DeFi through CeFi-like interfaces

- "Robinhood" for meme coins (e.g., Vector, Moonshot, Hype, etc.) - so far, the crypto industry has been predominantly desktop-oriented, but mobile-first experiences will dominate the future of trading applications

- Token Launchpads (e.g., Pump, Virtuals, etc.) - providing permissionless token issuance channels for anyone, regardless of their technical capabilities

As more consumer-oriented DeFi applications are launched, they will exhibit similar standard user experiences to traditional fintech applications, while aggregating and providing "opinionated" experiences to DeFi protocols on the backend. These applications will have their own characteristics in terms of the discovery process and the products they offer (e.g., different types of yields), provide convenient features for power users (e.g., multi-collateral leverage), and abstract the complexity of on-chain interactions overall.

The RWA Flywheel: Endogenous Growth and Exogenous Growth

Since 2022, high interest rates have driven a significant influx of real-world assets (RWA) onto the chain. Now, as large asset managers like BlackRock realize the substantive benefits of issuing RWA on-chain, the transition from off-chain finance to on-chain finance is accelerating. These benefits include programmable financial assets, lower issuance and maintenance costs, and higher asset accessibility. These benefits are about 10x the improvement compared to the current financial environment, just like stablecoins.

According to data from RWA.xzy and , RWA accounts for 21%-22% of Ethereum's assets. These RWAs are primarily US Treasury bills (backed by the US eagle or high-quality assets). Their growth has been largely driven by high interest rates, as it is easier for investors to long the Federal Reserve than to long . While the macro trend is shifting, making Treasury bills less attractive, the "Trojan horse" of on-chain asset tokenization has already infiltrated Wall Street, opening the floodgates for more RWA to come on-chain.

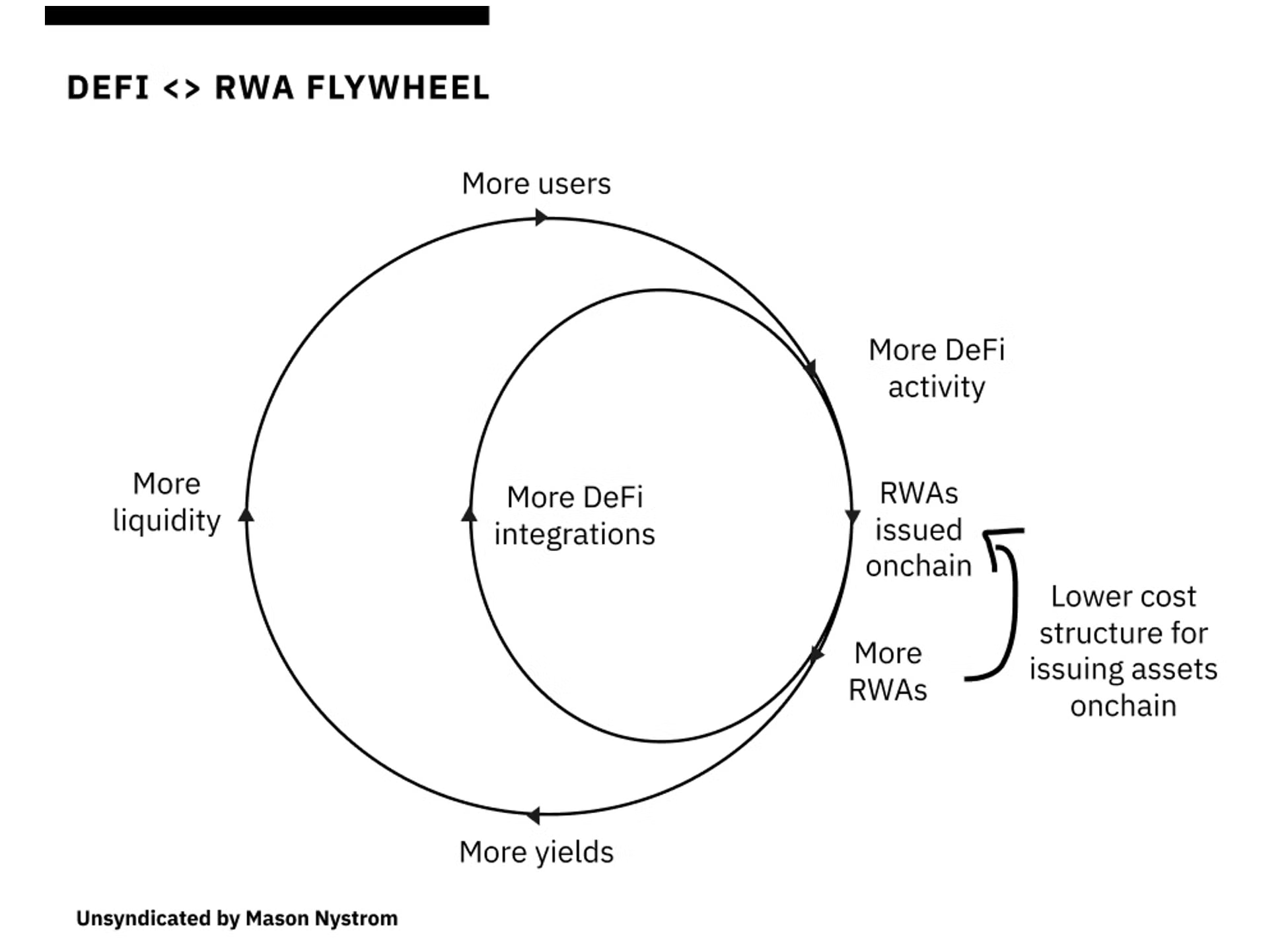

As more traditional assets move on-chain, this will trigger a compounding flywheel effect, gradually integrating and even replacing the traditional finance track with protocols.

Why is this important? The development of the crypto industry comes down to the distinction between exogenous capital and endogenous capital.

is largely endogenous - primarily self-circulating within the ecosystem, with the ability to self-grow. However, it has historically been quite "reflexive": going up, coming down, and then back to the starting point. But over time, new things steadily expand the scale of .

- On-chain lending protocols like , , and have expanded the use cases of by providing leverage using crypto-native collateral.

- Decentralized exchanges (especially automated market makers, AMMs) have expanded the range of tradable tokens and laid the foundation for on-chain liquidity.

But can only expand its own market to a certain extent. While endogenous capital (e.g., speculation on on-chain assets) has already propelled the crypto market to a relatively mature asset class, exogenous capital - capital outside the on-chain economy - is the driving force for the next wave of growth.

RWA represents a massive potential source of exogenous capital. RWA - commodities, equities, private credit, forex, etc. - opens up a huge opportunity for beyond the circular capital between retail investors and traders. Just as the stablecoin market needs to grow through more off-chain use cases rather than just on-chain financial speculation, other activities (e.g., trading, lending, etc.) are similarly situated.

The future of lies in migrating all financial activities onto the blockchain. will continue to expand in two parallel directions: maintaining similar endogenous expansion to conduct more on-chain native activities, and gaining exogenous growth from on-chaining real-world assets.

The Platformization of DeFi

"The power of platforms comes from their ability to connect third-party suppliers and end users."

-- Ben Thompson

Crypto protocols are about to enter their platform moment.

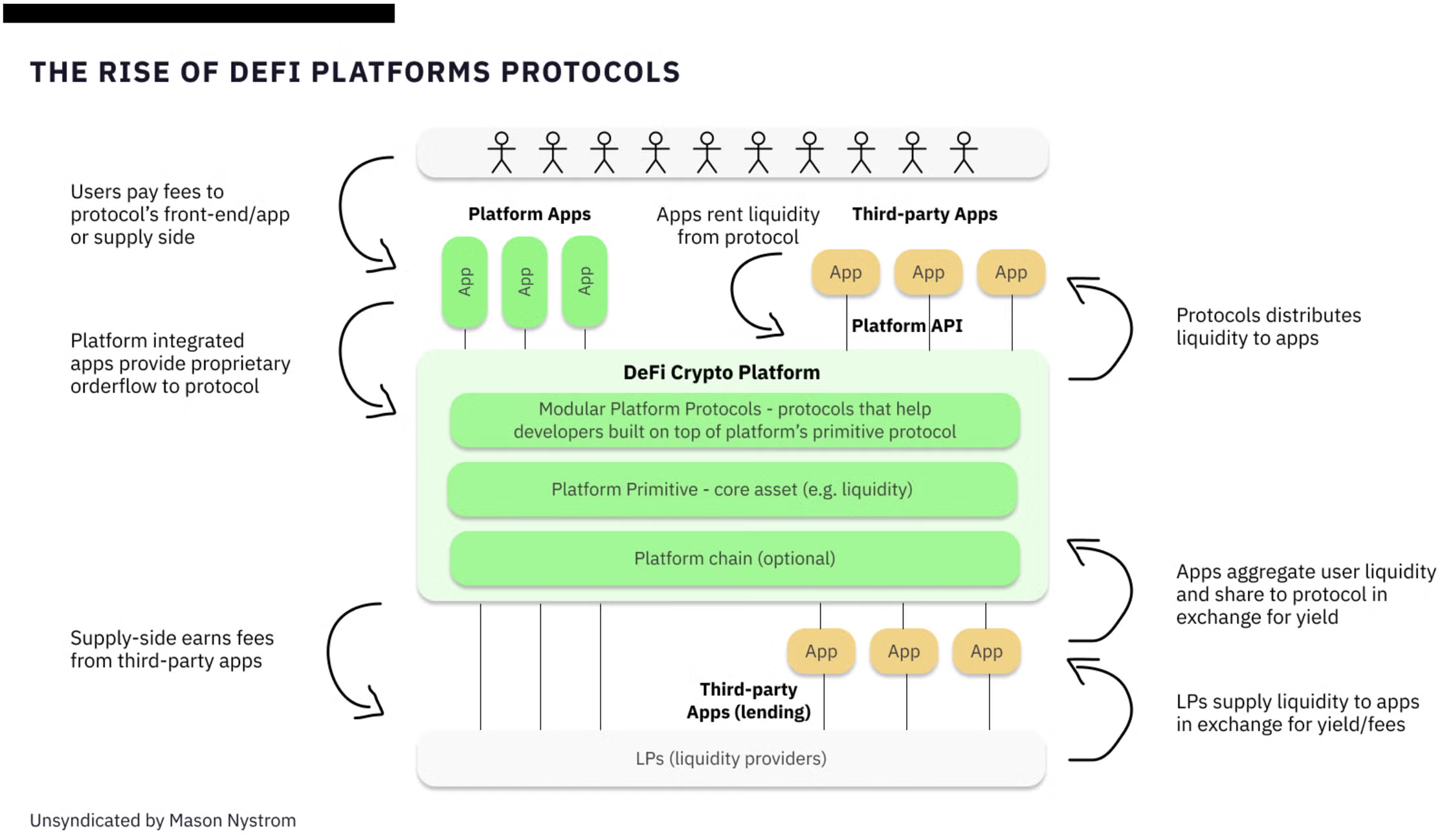

applications are evolving towards the same business model, gradually transitioning from a single application-protocol form to a comprehensive platform-protocol form.

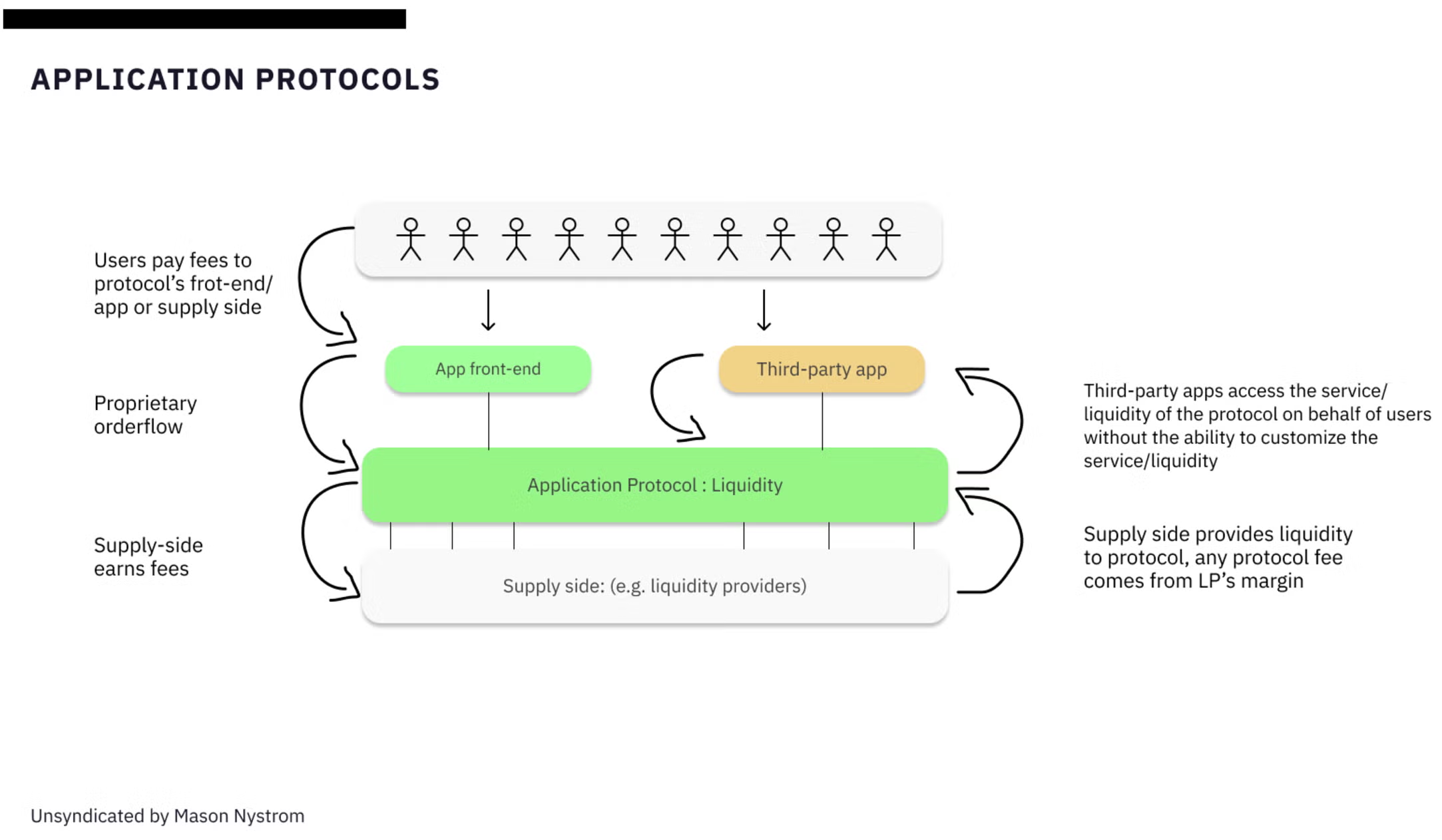

But how exactly are these applications becoming platforms? Today, most protocols are relatively rigid, providing a "one-size-fits-all" service to the applications that want to interact with them.

In many cases, applications are simply "paying" the protocol in the form of regular users to access its core assets (e.g., liquidity), without the opportunity to build differentiated experiences or programmatic logic directly within the protocol.

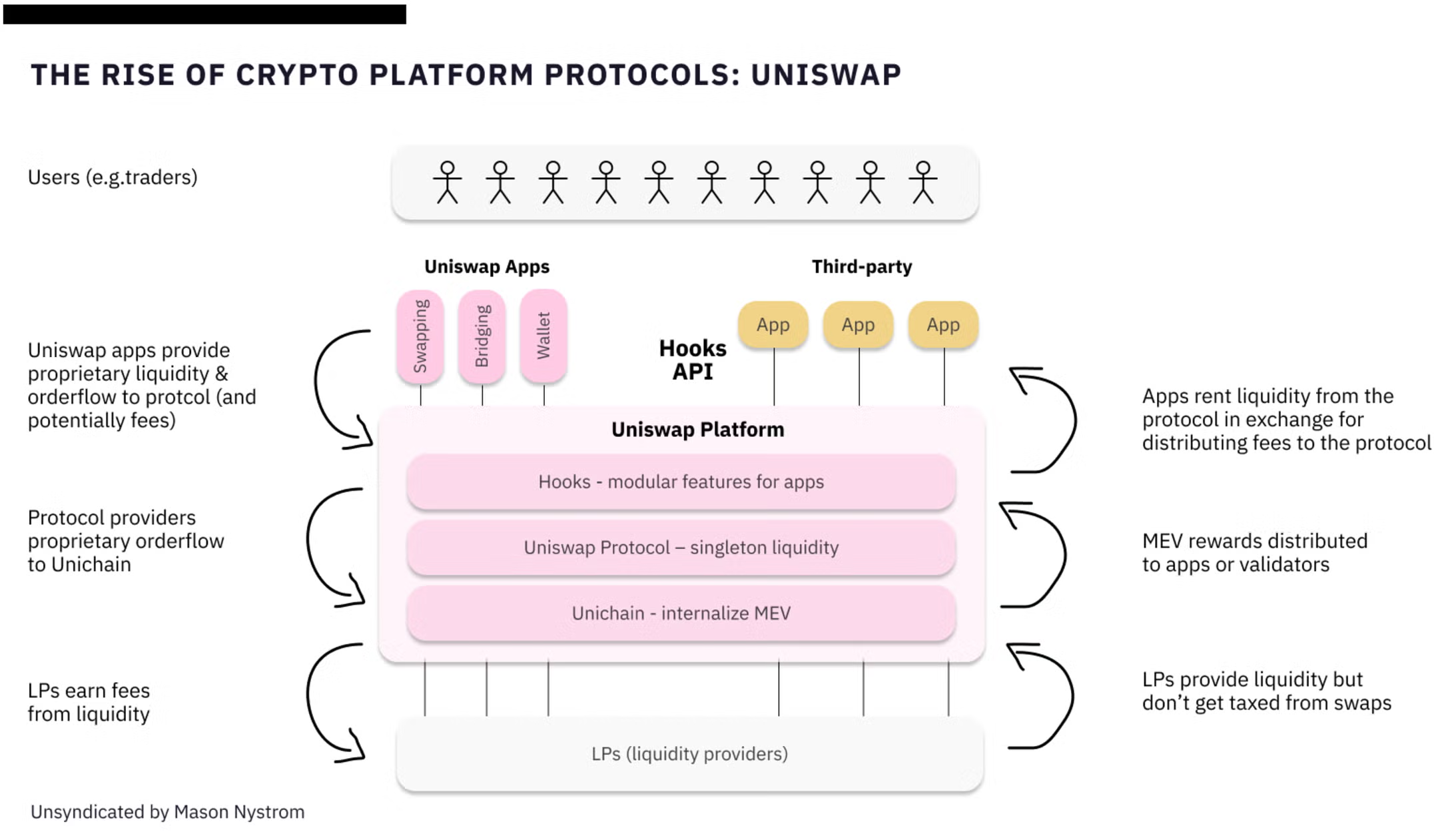

Most platforms start this way: solving a core problem for a single use case. initially provided a payment API, allowing individual merchants (e.g., online stores) to accept payments on their own websites, but this was only effective for individual merchants. When launched "Uniswap Connect", it could help merchants process payments on behalf of multiple sellers or service providers, making a platform today. It then further expanded its integration options for developers, expanding its network effects. Similarly, platforms like are now transitioning from a single decentralized exchange (e.g., an application for swap trading) to a platform that allows any developer or application to build their own specialized DEX based on its liquidity.

The key driver of the platform transformation is the shift in business models and the evolution of singleton liquidity primitives.

"Singleton Liquidity Primitives" - such as , , - will aggregate liquidity for protocols, allowing two composable links in the value chain (e.g., liquidity providers and applications/users) to plug in. For liquidity providers, the experience is simpler, just allocating capital to a single protocol, rather than navigating between differentiated capital pools or isolated vaults. For applications, they can "rent" liquidity from the platform, without needing to just aggregate the core services (like decentralized trading, lending, etc.).

Here are some examples of emerging platform protocols:

- V4 is driving a singleton liquidity model, where applications (like hooks) can "rent" liquidity from the V4 protocol, rather than just routing liquidity through the protocol like in V2 and V3.

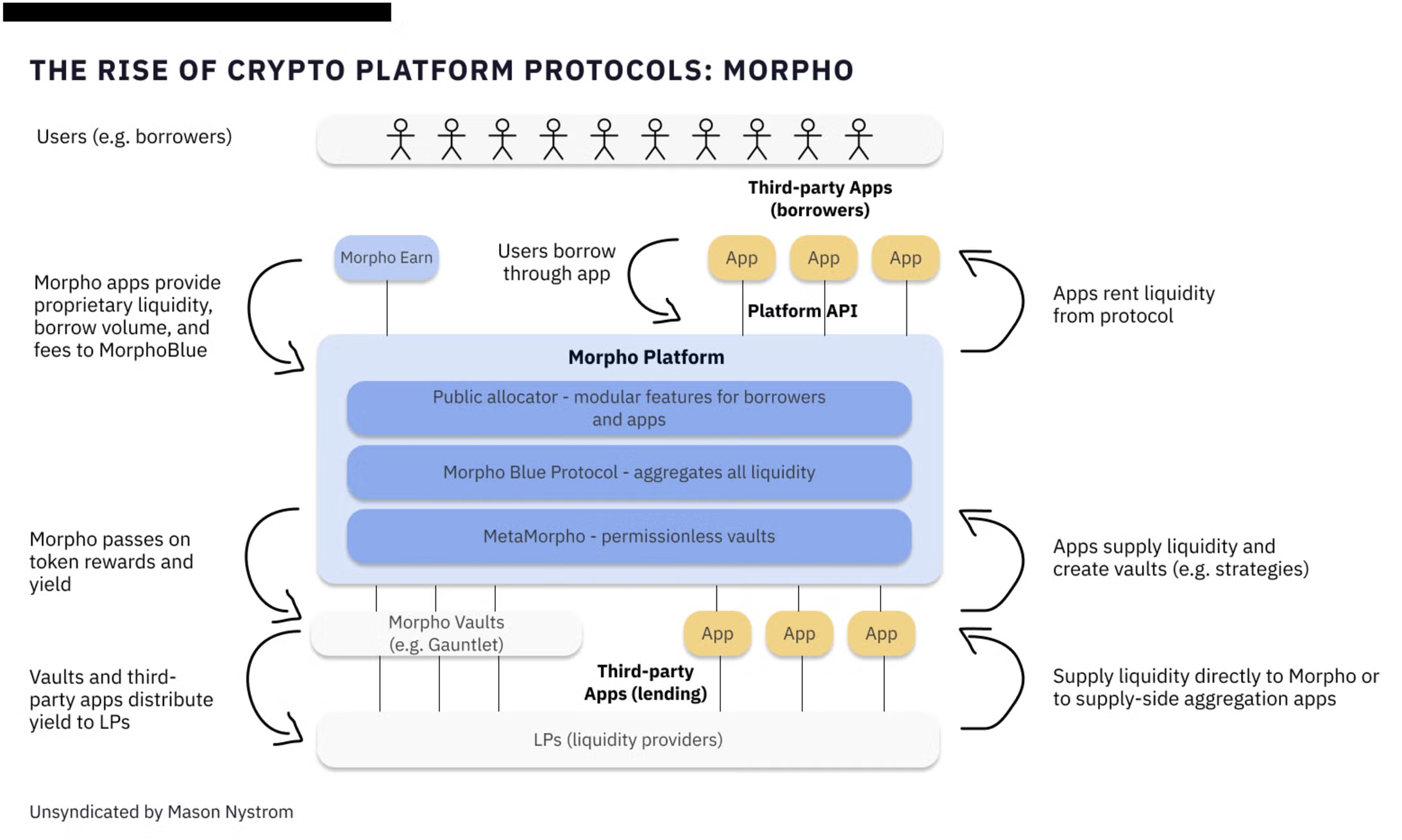

- Morpho has also shifted towards a similar platform model, in which MorphoBlue serves as the core liquidity primitive layer, and anyone can create vaults by building on top of the MetaMorpho protocol, thereby accessing MorphoBlue's liquidity without permission.

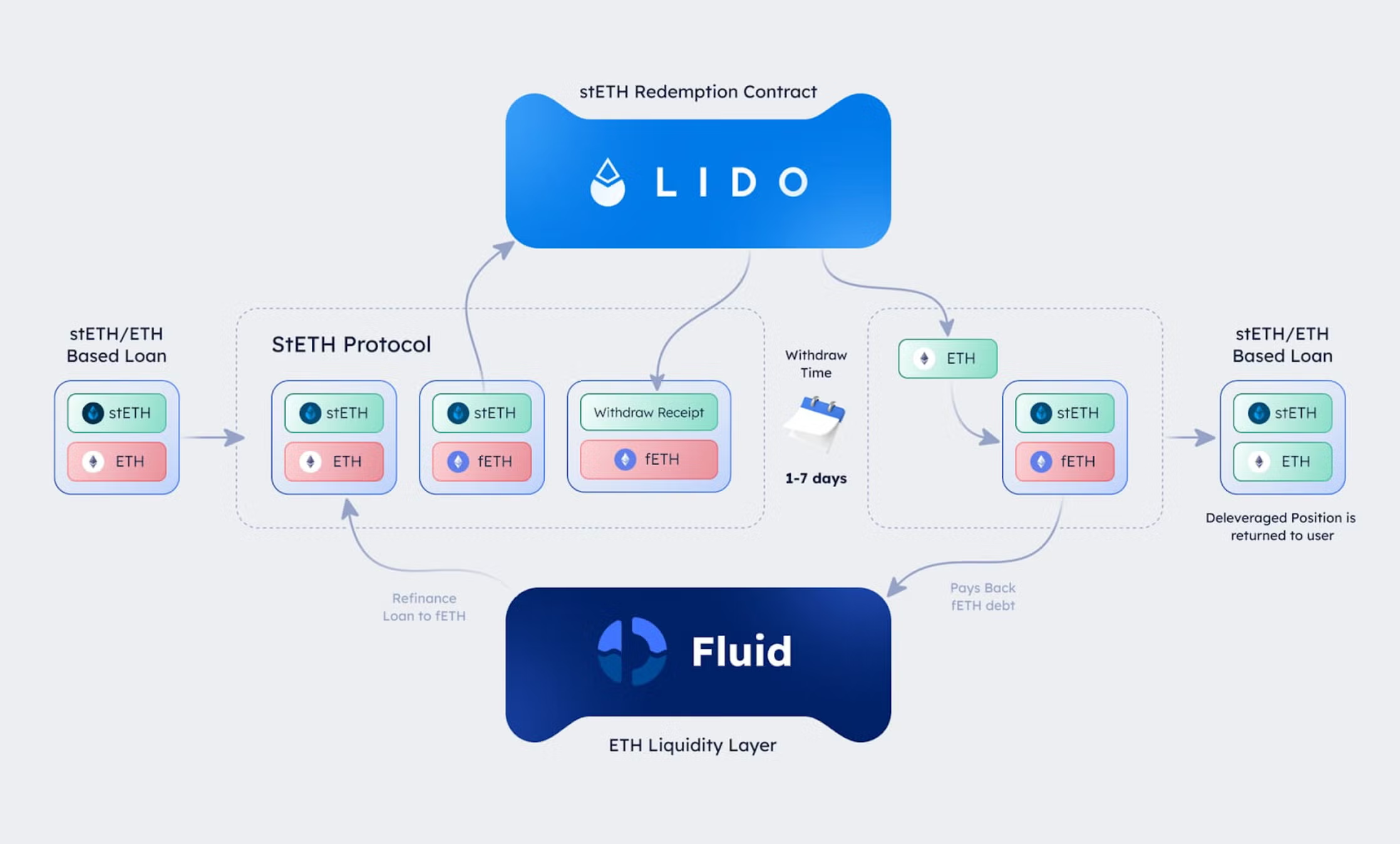

- Similarly, Instadapp's Fluid protocol has also created a shared liquidity layer that is utilized by its lending and decentralized exchange protocols.

Although these platforms differ, their common feature is that: emerging DeFi platforms have all adopted a similar model, by singularizing the liquidity contract layer, and building more modular protocols on top of it, to achieve greater application flexibility and customization.

The evolution of DeFi protocols from a single application form to a mature, full-featured platform marks the further maturity of the on-chain economy. By adopting a singularized liquidity primitive and modular architecture, protocols like Uniswap, Morpho, and Fluid (formerly Instadapp) are unlocking higher levels of flexibility and innovation. This shift echoes the process of traditional platforms (such as Stripe) enabling third-party developers to innovate based on core services, thereby driving greater network effects and value creation. As DeFi enters the platform era, the ability to support customizable and composable financial applications will become a defining characteristic. This not only expands the market for existing DeFi protocols, but also paves the way for a new wave of applications built on top of these DeFi platforms.