2024 was a milestone when cryptocurrencies broke out of their niche role and became an important driver in the global technology and finance sectors. Unprecedented political support, the rise of AI, RWA, and fierce competition in blockchain have shaped the past year, paving the way for investors' hopes for a positively growing 2025.

In the context of rampant inflation, the Bit price has surged strongly after a 50% drop in April 2024. This surge was driven not only by retail investors and Michael Saylor, but also by the participation of the biggest players on Wall Street through immediate-delivery Bit ETFs. This momentum has also spread to Washington, D.C., where President-elect Donald Trump and many lawmakers have publicly declared their support for cryptocurrencies.

Meanwhile, the smart contract platforms are entering a competition to gain an advantage, with Ethereum's lackluster performance in the face of competition from rivals. In the Web3 space, new trends have emerged, with AI and RWA-related Tokens becoming the biggest winners of the year.

## Bit heading for new price highs

In 2024, Bit repeated the standard model after halving, rising 126% thanks to recognition from traditional finance and politicians.

The new immediate-delivery Bit ETFs have transformed the Bit market by attracting new capital from investors and companies wishing to easily access BTC.

In January 2024, nine asset managers, including BlackRock, launched the first immediate-delivery Bit ETF. Over the year, their total assets under management (AUM) increased from $27 billion (from the existing Grayscale conversion) to $109 billion.

The ability to form a strategic Bit reserve could also provide a boost to the Bit price in 2025. Long-time U.S. Senator Cynthia Lummis, a Bit supporter, has introduced the BITCOIN Act, a legislatively approved plan that would lead the U.S. to purchase an additional 1 million BTC to "establish a supplementary store of value asset to strengthen the U.S. government's balance sheet."

Whether this bold idea will receive Congressional support remains to be seen. However, the November elections have improved its chances of success. Backed by the Fairshake PAC, which according to OpenSecrets spent $172 million in the 2024 election cycle, many pro-cryptocurrency candidates have won seats in the Senate and House, sometimes ousting anti-cryptocurrency incumbents. Data from StandWithCrypto shows that more than 247 pro-cryptocurrency candidates were elected to the House and 15 to the Senate. This is quite impressive, given that only 33 Senate seats were up for election in 2024.

## Increased competition in smart contract platforms

While investors often focus on Bit's role as a currency, most other Blocks serve as smart contract platforms, enabling DApp development. In 2024, these Blocks have quietly improved their technology. Notably, Solana released the Firedancer client to increase scalability, and Ethereum deployed the Dencun upgrade to reduce transaction fees on its Second-Layer Solutions.

The market is becoming increasingly saturated, and it is crucial for Blocks to develop in order to attract users and developers. Last year showed that even Ethereum with its many Second-Layer Solutions is at risk of losing its dominance, as faster and cheaper L1 Blocks like Solana are gradually narrowing the gap.

From a financial perspective, this uncertainty has led to a modest 65% increase in the price of Ether (ETH) and lukewarm interest in immediate-delivery Ether ETFs.

2025 will bring the Pectra upgrade to the Ethereum network, allowing external Account owners to directly execute smart contracts. This will bring Ethereum closer to complete account abstraction, improving flexibility and user experience. Ultimately, the value of Ethereum and any Block will depend on the industry's ability to deploy genuinely useful real-world applications.

## AI and RWA driving Web3 growth

The main promise of Web3 - a decentralized internet - has yet to be realized. However, 2024 has seen many developments contributing to this goal.

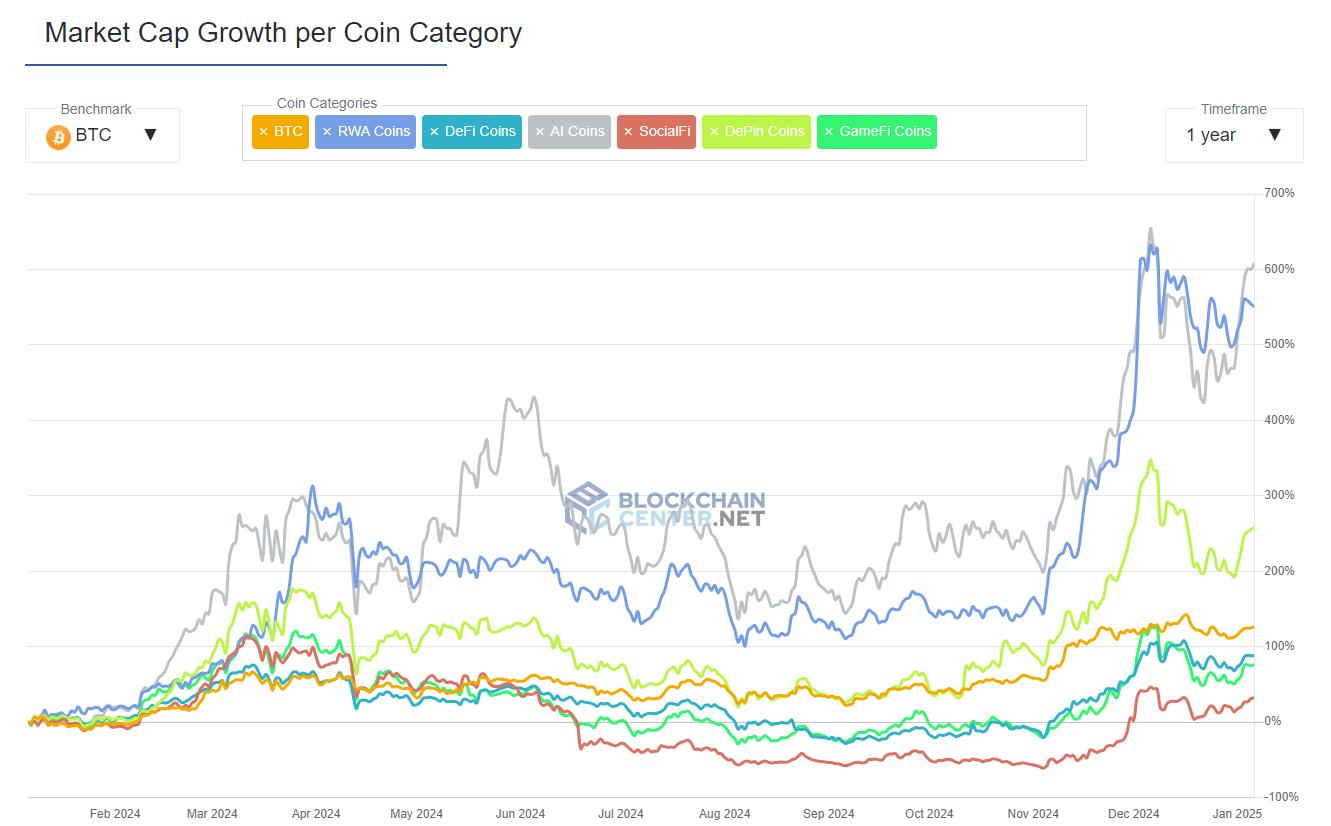

The biggest Web3 trend of 2024 was, unsurprisingly, progress in AI. Top projects include the Render Protocol (RENDER +125%), the Bittensor machine learning network (TAO +135%), and the Virtuals AI agent protocol, which have seen tremendous growth (VIRTUAL +33,000%). Overall, according to BlockchainCenter data, AI Tokens have increased by 630% in 2024.

2024 was a milestone when cryptocurrencies broke out of their niche role and became an important driver in the global technology and finance sectors. Unprecedented political support, the rise of AI, RWA, and fierce competition in blockchain have shaped the past year, paving the way for investors' hopes for a positively growing 2025.

In the context of rampant inflation, the Bit price has surged strongly after a 50% drop in April 2024. This surge was driven not only by retail investors and Michael Saylor, but also by the participation of the biggest players on Wall Street through immediate-delivery Bit ETFs. This momentum has also spread to Washington, D.C., where President-elect Donald Trump and many lawmakers have publicly declared their support for cryptocurrencies.

Meanwhile, the smart contract platforms are entering a competition to gain an advantage, with Ethereum's lackluster performance in the face of competition from rivals. In the Web3 space, new trends have emerged, with AI and RWA-related Tokens becoming the biggest winners of the year.

## Bit heading for new price highs

In 2024, Bit repeated the standard model after halving, rising 126% thanks to recognition from traditional finance and politicians.

The new immediate-delivery Bit ETFs have transformed the Bit market by attracting new capital from investors and companies wishing to easily access BTC.

In January 2024, nine asset managers, including BlackRock, launched the first immediate-delivery Bit ETF. Over the year, their total assets under management (AUM) increased from $27 billion (from the existing Grayscale conversion) to $109 billion.

The ability to form a strategic Bit reserve could also provide a boost to the Bit price in 2025. Long-time U.S. Senator Cynthia Lummis, a Bit supporter, has introduced the BITCOIN Act, a legislatively approved plan that would lead the U.S. to purchase an additional 1 million BTC to "establish a supplementary store of value asset to strengthen the U.S. government's balance sheet."

Whether this bold idea will receive Congressional support remains to be seen. However, the November elections have improved its chances of success. Backed by the Fairshake PAC, which according to OpenSecrets spent $172 million in the 2024 election cycle, many pro-cryptocurrency candidates have won seats in the Senate and House, sometimes ousting anti-cryptocurrency incumbents. Data from StandWithCrypto shows that more than 247 pro-cryptocurrency candidates were elected to the House and 15 to the Senate. This is quite impressive, given that only 33 Senate seats were up for election in 2024.

## Increased competition in smart contract platforms

While investors often focus on Bit's role as a currency, most other Blocks serve as smart contract platforms, enabling DApp development. In 2024, these Blocks have quietly improved their technology. Notably, Solana released the Firedancer client to increase scalability, and Ethereum deployed the Dencun upgrade to reduce transaction fees on its Second-Layer Solutions.

The market is becoming increasingly saturated, and it is crucial for Blocks to develop in order to attract users and developers. Last year showed that even Ethereum with its many Second-Layer Solutions is at risk of losing its dominance, as faster and cheaper L1 Blocks like Solana are gradually narrowing the gap.

From a financial perspective, this uncertainty has led to a modest 65% increase in the price of Ether (ETH) and lukewarm interest in immediate-delivery Ether ETFs.

2025 will bring the Pectra upgrade to the Ethereum network, allowing external Account owners to directly execute smart contracts. This will bring Ethereum closer to complete account abstraction, improving flexibility and user experience. Ultimately, the value of Ethereum and any Block will depend on the industry's ability to deploy genuinely useful real-world applications.

## AI and RWA driving Web3 growth

The main promise of Web3 - a decentralized internet - has yet to be realized. However, 2024 has seen many developments contributing to this goal.

The biggest Web3 trend of 2024 was, unsurprisingly, progress in AI. Top projects include the Render Protocol (RENDER +125%), the Bittensor machine learning network (TAO +135%), and the Virtuals AI agent protocol, which have seen tremendous growth (VIRTUAL +33,000%). Overall, according to BlockchainCenter data, AI Tokens have increased by 630% in 2024.The next category is real assets, a trend that includes protocols dependent on the Tokenization of real assets such as securities, debt, real estate, and art. The foundations of structured financial products Ondo Finance (ONDO +705%) and the DeFi lending-borrowing protocol Mantra (OM +6,866%) are leaders in this field. Notably, the leader in stablecoin Tether has joined the trend by launching the Asset Tokenization platform Hadron in November 2024. Overall, Tokens related to RWA have increased by 570%.

Growth in market capitalization by asset category. Source: BlockchainCenter

The long-established Web3 categories are gradually attracting more attention.

With a 270% growth rate year-over-year, Decentralized Physical Infrastructure Tokens (DePIN) are among the leading areas of Web3. Its main promise is to allow users, device owners, and businesses to own and earn from digital infrastructure. Two of the oldest computing markets, Filecoin (FIL) and the live-streaming-focused platform Theta (THETA), are among the prominent representatives of DePIN, along with AI-powered protocols like Render and Bittensor.

DeFi also recorded growth momentum in 2024. In December 2024, the Total Value Locked (TVL) in DeFi nearly reached the all-time high of $250 billion, according to defillama. The most notable launch of the year was EigenLayer, a reset protocol. Launched in April 2024, it quickly climbed to the 3rd position globally, attracting over $17 billion in TVL.

Crypto gaming also continued to grow, ending 2024 with nearly 9 million unique active wallets — a significant increase from 1.3 million in 2023 according to data from DappRadar. Prominent 2024 launches like World of Dypians and Seraph, along with the famous Telegram game Hamster Kombat, have driven this growth.

Looking ahead, the momentum gained in 2024 seems set to continue in 2025, driven by crypto-friendly Trump administration policies, the sustained Bitcoin price rally, and ongoing technological advancements in blockchain.