Author: Sam Bourgi, CoinTelegraph; Translated by Bai Shui, Jinse Finance

The price of BTC experienced violent fluctuations in December after failing to hold above $100,000, but according to data from ARK Invest, the cryptocurrency's performance is not abnormal.

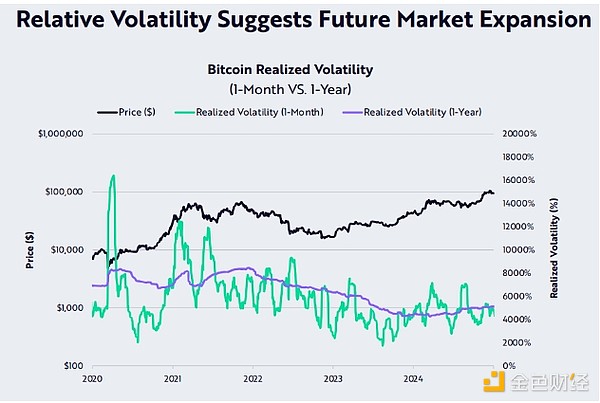

ARK Invest's December "Bitcoin Monthly" report compared BTC's monthly and annual actual volatility - a metric that measures the degree of price fluctuation of an asset over a specific period. The report stated that although bitcoin's volatility spiked at the end of the fourth quarter, it was "not significant from a historical perspective".

In the accompanying chart, ARK showed that bitcoin's monthly volatility in December was relatively low compared to its annual volatility.

Bitcoin's monthly volatility (green line) is relatively mild compared to the annual volatility in the fourth quarter (purple line). Source: ARK Invest

The relatively low volatility suggests that bitcoin has not yet reached the frenzy stage of its cycle, implying further upside potential, especially in a bull market.

"In fact, these data points suggest there is further room for the market to expand by 2025," the ARK report said.

The report cited several other bullish indicators for bitcoin in December, including mining difficulty, holder behavior, and the cost basis of short-term holders.

Regarding the strong holder behavior, ARK's data showed that 62% of the bitcoin supply has not moved in over a year, even as the asset recorded over 100% gains in 2024.

Expectations Intensify Ahead of Trump's Inauguration

After Donald Trump's election, bitcoin's price surged above $100,000 in December as he promised to usher in a new era of cryptocurrencies for America.

During the presidential campaign, Trump vowed to make the U.S. the world capital of bitcoin and cryptocurrencies.

Ahead of the inauguration, the president-elect chose crypto-friendly Paul Atkins to serve as a key U.S. Securities and Exchange Commission chairman. Days later, he appointed David Sacks as his chief cryptocurrency and AI advisor. The crypto community has expressed strong support for these moves.

Pantera Capital expects Trump's presidency to further legitimize bitcoin and cryptocurrencies, and drive prices to new highs in the coming months.

According to The Washington Post, Trump is expected to sign an executive order specifically targeting cryptocurrencies on January 20th, his first day in office. These "Day One" executive orders aim to further clarify the new administration's priorities for cryptocurrencies.