Bitcoin Rebounds Strongly: From Gloom to Dawn

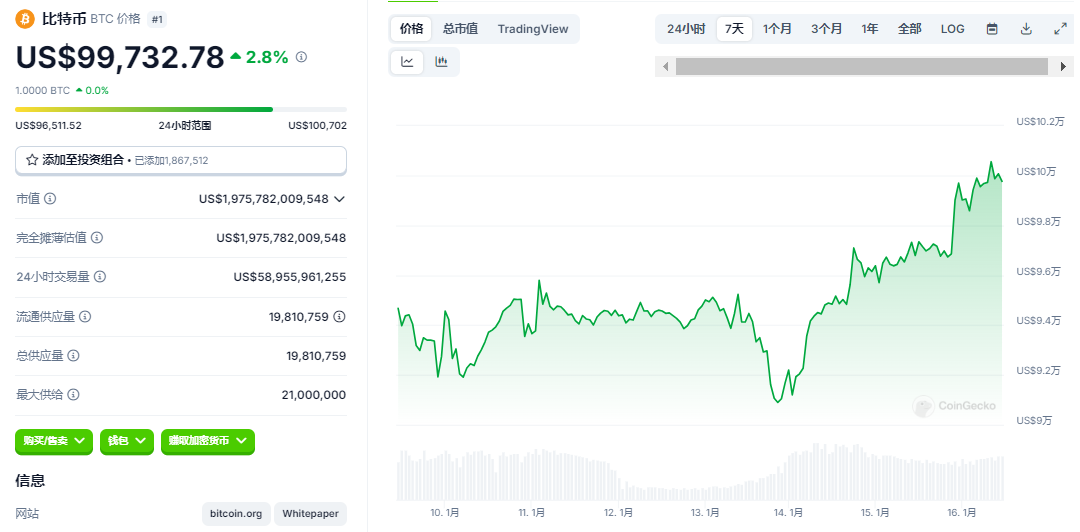

The price of Bitcoin (BTC) has been in a continuous downward trend since December 17, and the market has been in a state of despair on several occasions. At the lowest point, BTC once fell below the critical support level of $90,000, and most investors have accepted the psychological expectation that it may further explore the bottom of $85,000. However, just as the pessimistic sentiment was pervasive, Bitcoin firmly stood at $89,000 and rebounded strongly to above $100,000 in the early morning of January 16, completely reversing the short-term downturn in the market.

The core factor driving this counterattack is the latest release of the US Consumer Price Index (CPI) data. The data showed that the year-on-year core CPI in December was 3.2%, lower than the market expectation of 3.3%. Although this result shows that inflationary pressure still exists, it has alleviated investors' concerns about further interest rate hikes by the Federal Reserve, becoming a catalyst for the market's confidence to rebound.

The famous trader Daan Crypto Trades said on the X platform: "The CPI data performed well, which helps to temporarily calm the panic about inflation." As risk assets collectively rebounded, the price of Bitcoin also rose accordingly, gradually breaking away from the previous downward channel.

Ethereum and AI Agents Dance Together: Another Glimmer of Hope for the Market

Keeping pace with Bitcoin, Ethereum (ETH) has also seen a significant rebound. ETH, which previously fell below $3,000, has soared from the trough to above $3,400, reigniting investors' enthusiasm. SOL also did not lag behind, rebounding from the previous fall below $170 to above $200, showing strong resilience.

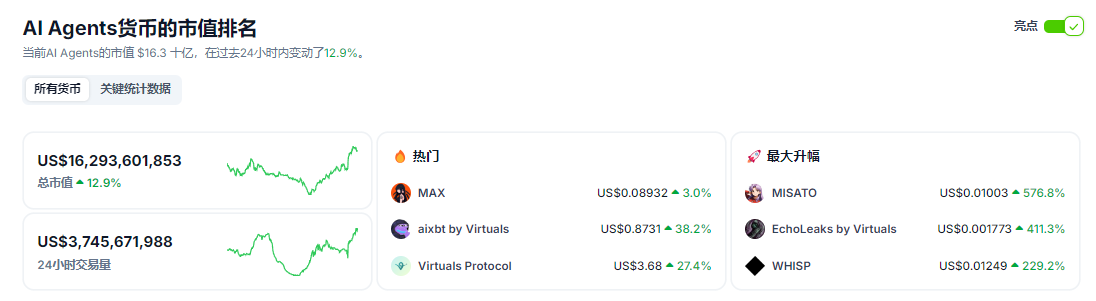

More eye-catching is the performance of the Altcoin sector. In the past 24 hours, the gains of most Altcoins have been between 5% and 10%, especially the AI sector, which has performed brilliantly.

According to CoinGecko data, the total market capitalization of AI Agents tokens has increased from $10 billion to $16.3 billion, with an average gain of 63%.

Star projects such as LMT and AIXBT have all set new historical highs, with AIXBT breaking through $0.9, becoming a benchmark for the market rebound.

Macroeconomic Background: Dual Positives from CPI Data and Capital Inflows

The stable performance of the CPI data has provided important support for the rebound of Bitcoin, and has also attracted more capital to the cryptocurrency market.

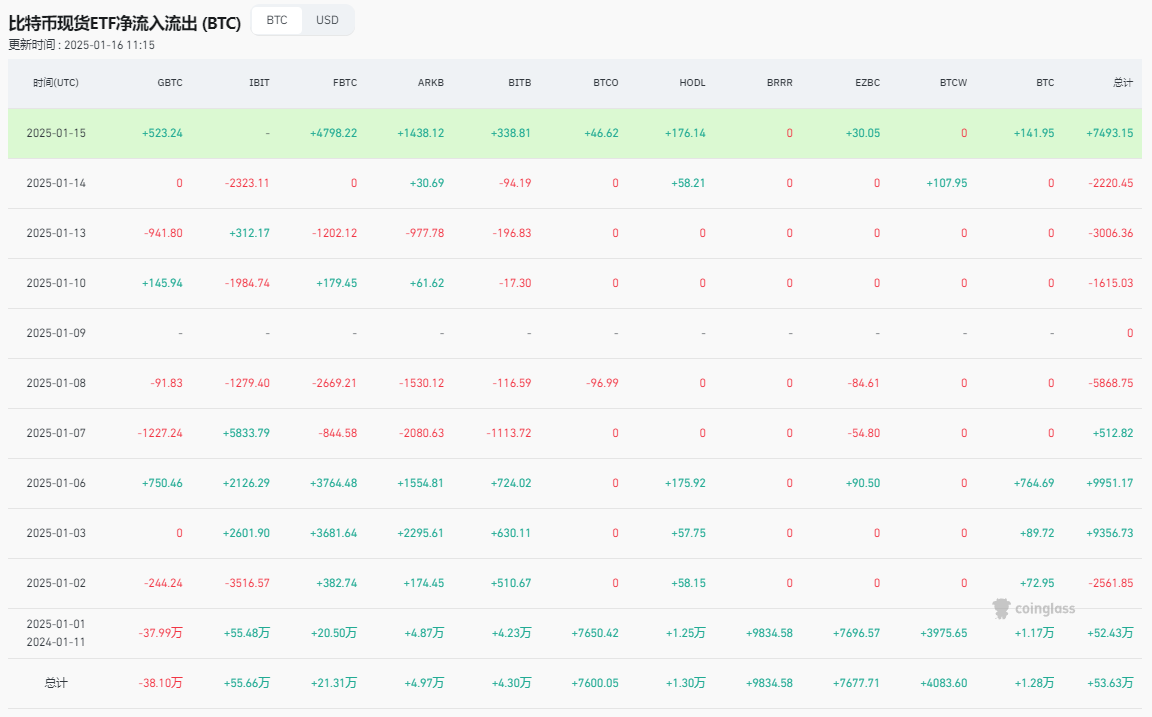

Data shows that the US Bitcoin spot ETF saw a net inflow of $754.79 million yesterday, ending a five-day outflow trend. Similarly, the Ethereum spot ETF also received a net inflow of $59.12 million, injecting a "cardiac stimulant" into the market.

In its daily market update, trading company QCP Capital reminded investors: "Although the short-term market sentiment has warmed up, the $90,000 Bitcoin support level still needs to be watched, and a break below it may trigger a larger correction." In addition, Bollinger Band volatility analysis shows that Bitcoin's volatility is at the lowest level in a year, which may indicate that the market is about to experience violent fluctuations.

Trump's Imminent Inauguration: Policy Reform Expectations Ignite Market Enthusiasm

Changes in US policy have also become an important driver for the rebound of the cryptocurrency market. With only 4 days left before Trump's formal inauguration, the market is closely watching the policy direction after his administration takes office. Reuters reported that Trump's team has begun reviewing the SEC's cryptocurrency enforcement cases, planning to suspend some lawsuits that do not involve fraud allegations, and clarify which assets constitute securities. Affected by this news, XRP rose more than 17% on the day.

In addition, MicroStrategy founder Michael Saylor has stepped in again to inject confidence into the market. He said at the Orlando Investor Conference that the company will issue perpetual preferred shares to provide investors with a new leveraged investment tool with a return of 1.5 times that of Bitcoin. Saylor's firm buy-in stance not only eased the selling pressure in the market, but also provided strong support for the Bitcoin price.

Market Outlook: A Future of Volatility and Opportunities

Looking ahead, Placeholder partner Chris said that a supportive policy environment will make the growth of the cryptocurrency market more stable in the next few years, without the parabolic surges and plunges seen in the past. He pointed out: "The spot ETFs for BTC and ETH have changed the structure of capital flows in the market, and may also drive more mainstream assets to enter a stable growth track in the future."

However, market volatility still needs to be watched. Technical indicators such as the Bollinger Band show that Bitcoin may experience violent fluctuations in the coming weeks, and the $90,000 support level is still crucial. At the same time, the global macroeconomic environment and policy direction will also largely determine the next direction of the cryptocurrency market.

Conclusion: Rise with the Wind, Proceed with Caution

From the strong rebound of Bitcoin to the overall recovery of the Altcoin sector, this round of market correction has demonstrated the resilience of cryptocurrency assets. However, the uncertainty of macroeconomic and policy factors may still bring volatility risks. For investors, reasonable risk management and keen market insight will be important weapons to navigate the volatility.