James Seyffart, a Bloomberg Intelligence ETF analyst, said that Canary Capital has amended its S-1 filing for a Litecoin ETF, suggesting increased engagement from the U.S. Securities and Exchange Commission (SEC).

Recent developments around the proposed Litecoin ETF have sparked optimism in the market.

Litecoin, the Next Cryptocurrency ETF to be Approved by the SEC?

Seyffart mentioned that while he "can't guarantee it," the amended filing could indicate that the SEC has started to scrutinize the proposal more closely.

"Canary Fund has amended and refiled their S-1 for a Litecoin ETF. Can't guarantee it, but this could signal SEC engagement. The 19b-4 filing hasn't been made yet (that's what actually starts the approval/denial clock)," Seyffart tweeted on January 16.

For context, the S-1 filing is a crucial step in the SEC's approval process for a new investment product. The amendment itself does not guarantee approval, but it suggests the SEC is paying attention to the proposal.

However, as Seyffart pointed out, the 19b-4 filing has not yet been submitted. This is the formal request to list and trade the ETF on a national securities exchange.

This filing is essential to start the official clock for the SEC's potential approval or rejection of the ETF, meaning the process may still take time.

Canary Capital filed for a Litecoin ETF last October, just a month after filing for an XRP ETF.

Another Bloomberg analyst, Eric Balchunas, further supported the idea that the SEC has started engaging with the Litecoin ETF filing. Balchunas cited "rumors" that the SEC has provided feedback on the S-1, which he believes strengthens the possibility of Litecoin being the next cryptocurrency to receive ETF approval.

Both Balchunas and Seyffart believe the approval of a Litecoin ETF may be imminent, but they warn that the appointment of a new SEC chair could impact the timeline. So far, the SEC has been cautious in its approach to cryptocurrency ETF approvals, with notable reviews of Bitcoin and Ethereum ETFs.

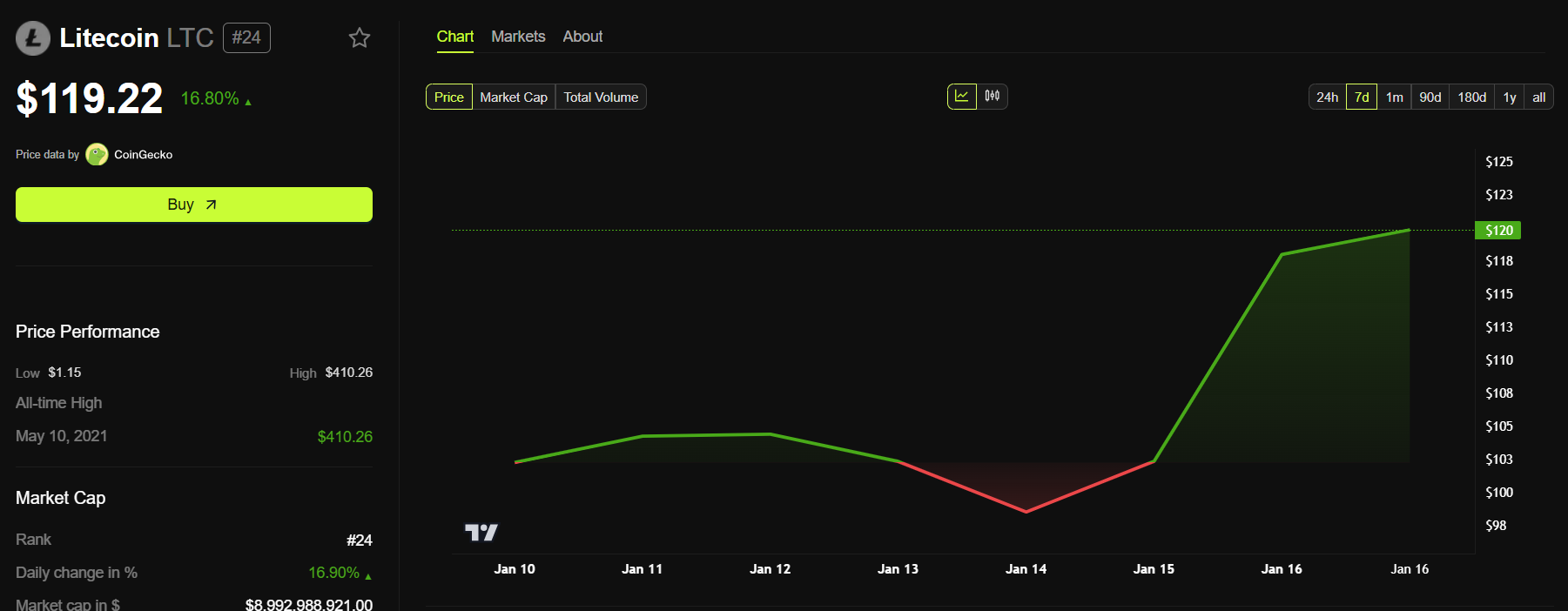

The ETF news has boosted Litecoin's price. At the time of reporting, LTC was trading at $119.22. The cryptocurrency's price has increased by 16.8% over the past 24 hours.

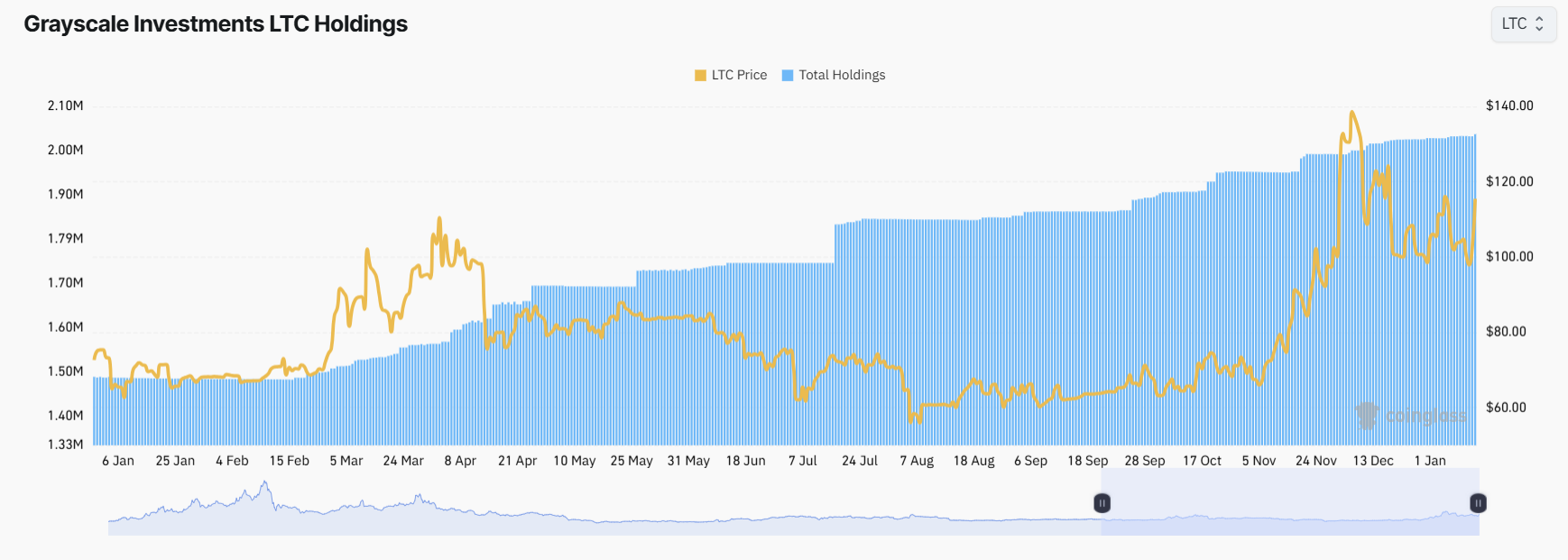

Additionally, Grayscale's Litecoin Investment Trust has already been providing U.S. investors with exposure to LTC. Grayscale's trust appears to have quietly accumulated over 500,000 LTC by 2024.

According to CoinGlass data, the trust held less than 1.5 million LTC coins in January 2024. A year later, the investment giant's holdings had increased to over 2 million. Grayscale's moves suggest the company anticipates strong investor interest in Litecoin.